|

-- Posted Friday, 9 June 2006 | Digg This Article

The world is full of people with little or no real estate experience (okay, like me) who still claim to know the business well enough to predict a crash. It’s also full of real estate industry pros who, deep in denial, seem to expect a soft landing followed by another long, glorious boom.

So when an actual real estate expert crosses over to the dark side, it’s news. This morning I’m reading through a 31-page report compiled for internal use by Colorado Santa Fe Real Estate, a company founded by a serial entrepreneur named Marcel Arsenault, one of the rising stars of the commercial real estate business. Back in the late 1980s, Marcel was a hippy/entrepreneur in the Ben & Jerry mold who had spent the previous decade mixing up vats of Mountain High yogurt, eventually turning the brand into one of the most popular in the West and selling it Beatrice Foods for a nice profit. He then started buying up Colorado real estate. “I couldn’t have picked a worse time,” he says now. The junk bond implosion was metastasizing into the S&L collapse, and the value of office buildings and shopping malls was plunging. But he held on, and in a couple of years was rewarded with the mother of all fire sales. The government began liquidating the assets it had acquired from failed thrifts, and prime properties were suddenly available for pennies on the dollar. Marcel loaded up on empty office buildings and leased them out for a fraction of the going rate—possible because of the low purchase price. The buildings filled up, their values rose, and he leveraged their cash flow to buy more offices, shopping malls and condos. As western real estate values soared, so did Colorado Santa Fe’s portfolio. It now manages upwards of $350 million of property and is sitting on well over $100 million of unrealized capital gains. In other words, this is a guy who has prospered in both good and bad real estate markets, which makes his current take worth noting. And right now he’s excited—about the prospect of another 1990-style crash. Below are some excerpts from the previously mentioned report. The capitalized headings and italicized comments are mine, the rest is Marcel’s. As your read this, keep in mind that it’s the analysis of someone who for the past fifteen years has been very successfully LONG real estate. | THE BIG PICTURE

We believe that the apparent ‘irrational exuberance’ in the real estate market is, in reality, an asset bubble that has been inflated by a flood of capital attracted to real estate. The effect of this flood has been to drive down yields and push up prices. We believe this value trend is unsustainable and that we are at a crucial inflection point. Based on the analysis detailed below, we believe that cap rates will inevitably rise back to trend (and possibly overshoot), thus driving values down dramatically. HOW WE GOT HERE

Phase I: Stimulus through Monetary Easing. Following the recession and 9-11, the U.S. Federal Reserve implemented monetary easing to a degree not seen in almost 50 years. Cheap money and credit flooded the U.S. economy in an effort to prevent a serious recession (which had the risk of turning deflationary like Japan’s). The lax monetary policy had the intended effect of stimulating consumer spending (particularly on assets like homes and real estate). Phase II: Illusion Becomes Reality. By 2003, prices of real estate began rising faster than the rate of inflation. In effect, investors began noticing how “profitable” it was to accumulate real assets. Rising prices created a “virtuous cycle” whereby more and more buyers participated in the equation of purchasing real estate. While admittedly rising prices were driving down yields, few cared about yield because the Fed was not rewarding saving. The preferred game was appreciation. Phase III: Lenders “Pile In” (the final period of play). Given a few years of rising prices, real estate began looking very safe; low rates made the cost of debt very manageable, justifying higher prices and larger loans. By 2005 real estate lending was extraordinarily competitive, (after all, default rates were at historic lows). By 2006, cheap and easy mortgages had grown to epic proportions throughout the real estate industry. “No money down” became the way to purchase a home. Foreign and hedge fund capital poured into mortgage markets chasing yields of the “risky” tranches of mortgage paper (why settle for the 5% yield of “A tranche” if the risky “B tranche” yielded at 8-10%?) With rising property values, the “B tranches” were soon re-rated to “A”, rewarding the buyers with phenomenal appreciation in their mortgage paper. Mortgages become more plentiful and the tide of easy money rises into uncharted territory, and bringing real estate values even closer to rocky shores hidden beneath a tidal flood. Phase IV: Inflection Point Achieved (the cost of money rises). Satisfied that it had prevented a serious deflationary recession, by June 2004 the Federal Reserve begins to slowly increase rates. By 2006, the Fed Rate had increased from 1% to 4.5% (the “neutral rate” – not deemed excessively simulative by economists). With yields this high, it again makes sense to hold cash at the bank. By 2006, the cost of mortgage debt is returning to the long term average.

THE NEXT FEW YEARS

Phase V: - The Future: Look Out Below. The problem becomes obvious and virulent when real estate values begin to fall. With debt service costs rising, real estate begins to flounder, and more risky real estate ends up on the rocks. As default rates rise, mortgages slowly become more expensive and difficult to obtain (“real estate becomes a four letter word” in the parlance of an old banker). Only brave and knowledgeable entrepreneurs venture onto the scene of real estate wreckage at the lowest tide. Only a “foolhardy lender” would venture between the rocks of the now quiet ebb tide.

The “virtuous cycle” has completed its turn into the “vicious cycle.” HOUSING AND CONSUMER SPENDING

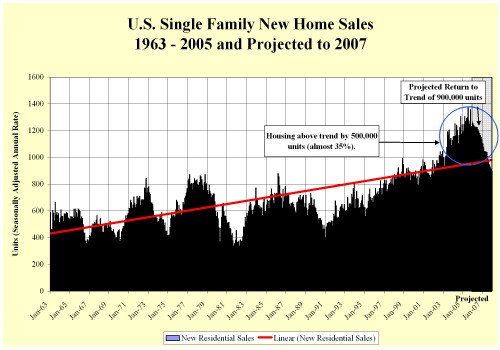

It is our view that the “irrational exuberance” has transferred from stocks to housing, setting up conditions for a “housing deflation.” We expect a serious fall-off of home construction, sales and values, starting in 2006, and becoming very pronounced by 2007. A glut of new houses will accumulate in the next 12-24 months, causing a drop in price and construction of new units, and setting up a serious risk of price decline (similar to the “tech wreck” in the stock market).

With the costs of debt service so low, buyers have been able to pay ever higher prices while maintaining low monthly mortgage payments. In a “virtuous cycle,” this has helped continue to push up housing demand beyond supply for several years (2002 through 2005). As a result, prices surged higher, and contributed to a pervasive “wealth effect.” Booming housing prices (and sales) have created a boom in allied industries, including mortgage brokerage, retail sales for furniture, appliances and home improvements, magnifying the boom throughout the economy. This spending, in turn, has put off any serious recession. More importantly, the cocktail of low interest rates and rising home values has dramatically stimulated retail consumer spending. However, with interest rates now rising, households are left with an almost unprecedented negative savings rate, and dangerously high debt levels and debt service costs. The economy hinges on housing.

Implication: Based on the speculative excess we have observed, we believe this housing boom will almost certainly be followed by a long and painful housing bust. We expect that a continued rise in interest rate spreads and decline in housing sales and prices will push the U.S. in recession by late 2006, and this recession will deepen in 2007, as the housing “wealth effect” turns into a “poverty effect.” As defaults accelerate, lenders’ underwriting will tighten significantly, leading to a precipitous drop in new home sales. Builders have slowly accumulated large positions in land (2-5 years of inventory), and will be anxious to turn land into cash (even at a loss). Earnings for the home builder industry will go negative, along with earnings in many allied industries (mortgage brokers, title companies, lenders, construction companies, etc.) This housing downturn will ripple through the economy, creating a loss of 2-4 million jobs (10-20% of the employment in construction and housing-related industries). On the heels of the housing downturn will come a downturn in consumer spending, particularly in housing-related retail sectors (home improvement items, furniture and appliances, etc.). This will happen because variable mortgage rates are rising, fuel costs stay high, and the “wealth effect” of the last 10 years quickly turns into a “poverty effect,” forcing the personal savings rate quickly back up to at least the U.S. long term trend of 7.1%. With stocks and housing giving back the “asset bubble” appreciation, the

consumer has no choice but to resort to savings (as they have in the past and as they do in all other countries once the “asset bubble” turns into an “asset bust”). As savings returns to trendline, our projections show a drop of 3.7% in consumer spending by the end of 2007 in real dollars. The US economy will, along with the drop in residential investment, shrink real GDP by 3.1% (a fairly serious recession). With housing and consumer spending both going down, business investment spending may also contract, causing declines in the stock market, possibly driving the economy deeper into recession (until the imbalances are corrected). The resulting recession will be longer and deeper than most, likely lasting 3 years. The rising federal deficit, economic recession, lower interest rates, and declines in real estate will all lead to substantial downward pressure on the US dollar. Falling U.S interest rates will chase out investors, weakening relative demand for the dollar. If the economy experiences an asset deflation recession, the dollar could sink for a period of 3-5 years, reaching new lows year after year. COLORADO SANTA FE’S ACTION PLAN

There is virtually no upside left, and instead, tremendous downside risk. There will be a significant “flight to quality” by lenders and investors. The risk of remaining heavily invested in real estate is extremely high. Values are far more likely to fall precipitously than to rise modestly. Most real estate should therefore be sold and the extraordinary profits harvested. If our projections are wrong, we have avoided risk and locked in small returns from holding cash. If our projections are correct, we will need cash in 2007 and 2008 for the considerable buying opportunities that may be available at the bottom of the cycle. 2006 and 2007: Sell most existing properties:

• Quickly liquidate condo conversions ($75 million)

• Liquidate most retail and industrial properties ($200 million)

• Short stocks of retail REITs, homebuilders, real estate companies, mortgage insurance companies, and suppliers (construction, copper).

2008-2010: Return to Real Estate (at Cycle Bottom):

• Raise equity pool of $250 million and buy distressed property on a massive scale ($1 billion). | | |

Now here’s what makes this really interesting: Instead of just taking some well-earned profits, Colorado Santa Fe is both lightening up and going short. In effect, it’s morphing from a real estate developer (which buys and operates, always on the long side), into a hedge fund, capable of going both long and short with outside investors' money. That’s a very big change in mindset, hard to pull off but exactly the right approach for what’s coming. “I’m an adept buyer,” says Marcel. “Now it’s time to become an adept seller.”

Copyright © 2006 http://www.dollarcollapse.com/

-- Posted Friday, 9 June 2006 | Digg This Article

Previous Articles by John Rubino, Dollar Collapse

|