|

-- Posted Friday, 14 September 2007 | Digg This Article | Source: GoldSeek.com | Source: GoldSeek.com

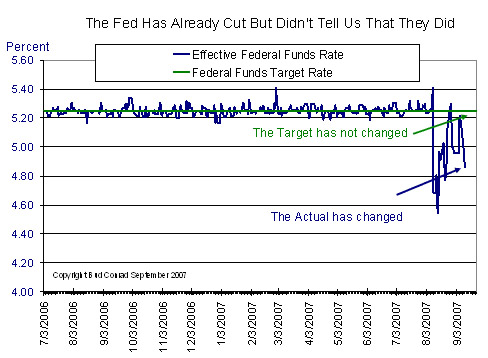

The Fed has already cut rates, it just hasn’t told anyone, says Bud Conrad, chief economist of Casey Research September 11, 2007-- Stowe, VT -- According to Casey Research Chief Economist Bud Conrad, there is a disconnect between the official Fed pronouncements and official action. Further, Mr. Conrad believes that the Fed has already effectively cut the Fed Funds rate. “After the August FOMC meeting, Bernanke announced that the Fed was still focused on fighting inflation, indicating no cuts in interest rates,” said Mr. Conrad. “Further, St. Louis Fed Governor William Poole said they wouldn’t cut the Fed Funds rate before the next FOMC meeting on September 18 unless there were a ‘calamity.’” Yet, according to Mr. Conrad, while economists debate whether or not there will be a cut, and how much of a cut might be made, as shown in the chart that follows, since August 8, 2007, the Fed has allowed the Fed Funds rate to average 32 basis points below the targeted 5.25% rate, and has let it fall by as much as 71 basis points below that number.

Fed’s Stealth Rate Cut continued… “The official target for the Fed Funds rate – the number you hear – is a benchmark used by the New York Fed which buys and sells securities during the day to keep the rate on actual Fed Funds transactions close to the target rate, which is currently 5.25%. They are usually able to keep within a very tight range around the targeted rate,” explained Mr. Conrad. “Since August 8, when the Fed added a big infusion of $24 billion and then $38 billion, the actual Fed Funds rate has averaged below 5%. In other words, they have already cut the rate, they just haven’t announced it,” he added. Mr. Conrad then went on to draw two conclusions. “First, watch what the Fed does, and not what they say. While talking about holding the line against inflation, they have already gone ahead and made a cut in the Fed Funds rate. It is our opinion their rate cutting has only begun,” said Mr. Conrad. “Second, investors need to understand that further cuts in the Fed Funds rate, which effectively bail out the bankers by interjecting money into the system, risk triggering an exodus from the dollar and causing a knock-on currency crisis. That is the scenario investors want to be preparing for.” For additional information about Casey Research or to arrange an interview with Bud Conrad or any other Casey analyst, contact Veronica Charette at 802-253-8767, ext. 104, or by email to press@caseyresearch.com. More information and risk-free trial subscriptions to various Casey Research publications are available at www.caseyresearch.com. About Bud Conrad and Casey Research, LLC: Casey Research, LLC was founded by Douglas Casey, the best-selling author of Crisis Investing (HarperCollins, 1980) and Strategic Investing (Simon & Schuster, 1982). For over 27 years, Mr. Casey and his team have published research for high net worth individuals and institutions on contrarian opportunities to earn above-average returns. Bud Conrad, chief economist, holds a Bachelor of Engineering degree from Yale and an MBA from Harvard. He has held positions with IBM, CDC, Amdahl, and Tandem. Currently, he serves as a local board member of the National Association of Business Economics and teaches graduate courses in investing at Golden Gate University. Bud Conrad has been a futures investor for 25 years and a full-time investor for a decade. A popular speaker, Mr. Conrad delivered the keynote speech at the "Commodities Week MENA 2007" conference in Dubai this spring.

-- Posted Friday, 14 September 2007 | Digg This Article | Source: GoldSeek.com | Source: GoldSeek.com

Previous Articles by Doug Casey

|