-- Posted Thursday, 8 June 2006 | Digg This Article

WARNING: The Information in this article could be Dangerous to your Financial Health! Read at your own risk!

Every Sunday I listen to financial Commentary on the previous weeks trading. Iíve learnt which commentators I like and which I donít.

I especially enjoy listening to Frank Barbera a well known Market Technician. I find Frankís analysis solid, well-grounded and convincing. It was therefore with great interest that I heard him discuss the Yen Carry Trade (YCT).

The YCT took over where the Fed left off

The Fed has been lifting short term interest rates a ľ point at a time since early 2004. We are told this is to Slow a BOOMING economy before inflation gets out of control. Umm yeah right!

So whilst the Fed plays White Knight worried about how far our Dollar goes, the Bank of Japan (BoJ) has been playing Bad Cop via the Back Door.

The truth is credit expansion has not moderated at all. In fact itís continued growing at ALARMING proportions - even after the Fed started tightening.

Where has all the money come from?

The YCT is a name used to describe a trading strategy. Hereís how it works.

- A trader / institution borrows money in Japan at Unbelievably Low interest rates (I believe the term Free Money has been used).

- Those newly borrowed Yen Notes and are then used to buy Something. Anything. Anything at all that will yield something higher than the ridiculous Borrowing Rate of 0 to 1%..

- Banks are borrowing and buying Bonds, Real estate, Stocks, Emerging Markets, Commodities etc. etc. When assets are bought outside Japan the hurdle rate is slightly higher. You need to cover the ridiculous interest payment + the move in the Yen exchange rate.

When you hear about a liquidity driven market this is it!

The BoJ is giving money away. Hell, after 10+ years of being in the Doldrums, even the Japanese Stock Exchange has been floating higher. Iíll show you later why I say Floating...

For those of us that trade Forex itís not hard to see the YCT in action.

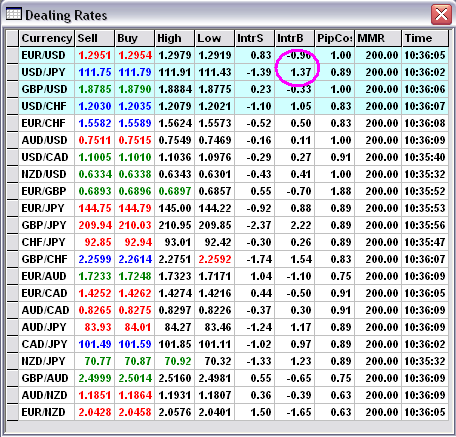

Chart 1 - Forex Trading on Trade Station

Get this. For $200 margin deposit, you can SELL •1Million for USD$8,900 at the prevailing exchange rate. The interest rate differential between the Yen and the USD is such that everyday you earn US$1.37 in interest (purple circle).

What youíre really doing is borrowing Yen and investing it into an overnight US Dollar deposit at the prevailing exchange rate. It so happens that the difference between what you pay on the loan and what you earn on the deposit is $1.37 in YOUR FAVOR.

Maybe you donít just want overnight Dollar deposits? Perhaps youíd prefer Bonds Or maybe Gold Stocks?

Easy!

Take the $1.37 that drops into your account everyday and use it to pay the interest on a short term loan. Use the proceeds of the loan to buy anything your heart desires!

Sounds crazy?

Itís exactly what the Banks are doing. But they ainít making $1.37 per day!

The CATCH: The •:$ exchange rate fluctuates daily and can wipe out that days interest.

Hereís a BIG problem!

Chart 2 - Yen is looking very BULLISH

The Yen has formed a massive right angle triangle formation.

Over an 8 year period the floor on the Yen has steadily risen and now stands at 85. The ceiling has remained around 100.

Whoops!

This POWERFUL chart suggests the Yen is more likely to rise than fall over time.

The drop from roughly 2004 to 2006 (red rectangle) accounts for the MASSSIVE Yen trade we are talking about. Hardly a Free Fall!

The recent Global Stock Market Wobble, courtesy of a rising Yen can be seen in the blue rectangle. Can you imagine what would happen if the Yen really took off?

Remember, the YCT requires 2 things:

- The Yen to fall or remain flat against the USD$ - which according to Chart 2 may already be coming to an end and

- The BoJ to maintain infinitesimally small interest rates

BoJ interest rates

Unfortunately, the laws of economics apply equally in the Land of the Rising Sun as they do everywhere else.

Chart 3 - Gold in Yen. A screaming Uptrend.

I like to think of interest rates as the rate that will keep me interested in holding Junk paper instead of an Ounce of Gold.

If people are SWAPPING their pieces of paper for Gold I imagine theyíd need more interest to hold those pieces of paper.

Thatís exactly what the Yen Gold chart is saying. The Yen is being unfashionably DUMPED in favour of Gold.

As sure as night follows day, the above chart tells me that interest rates WILL need to rise in Japan to induce people away from Gold and into holding Junk Yen Paper.

Ok Greg, Iíll bite.

The Yen trade may unravel and soon.

What should we do?

My first instinct would be to sell everything that has been rising (because of YCT) and buy Yen. And whilst I am a holder of Japanese Yen I certainly wouldnít bet the house on another Fiat Currency.

The story is the same wherever you look. The Asset Price Explosion weíve seen since 2003 is almost entirely a Monetary phenomenon.

Even the Nikkei with its nominal stellar performance of over 50% in 2005 looks like itís still STUCK in a Secular Bear market against Gold.

Chart 4 - Nikkei gone nowhere vs Gold (green line) but up in Nominal terms (red line)

A reversal of the YCT will be ETREMLEY deflationary. Asset classes that were beneficiaries of the trade will fall. As the Yen short position UNWINDS, asset prices will Evaporate at an ALARMING rate. Giving rise to an UNPRECEDENTED level of FEAR. As is well known, FEAR and Gold are the best of friends.

BUY GOLD!

Caveat: Physical Gold may perform better than Gold Stocks as people trade leverage for safety.

Further Caveat: I donít speculate on the Yen Carry Trade and donít recommend you do so either. The leverage is a Killer.

More commentary and stock picks follow for subscribersÖ

---

Greg Silberman CA(SA), CFA

goldandoil@yahoo.com

I am an investor and newsletter writer specializing in Junior Mining and Energy Stocks.

Please visit my website for more free articles and analysis

Click here: http://goldandoil.blogspot.com/

This article is intended solely for information purposes. The opinions are those of the author only. Please conduct further research and consult your financial advisor before making any investment/trading decision. No responsibility can be accepted for losses that may result as a consequence of trading on the basis of this analysis.

-- Posted Thursday, 8 June 2006 | Digg This Article