-- Posted Tuesday, 7 October 2008 | Digg This Article | Source: GoldSeek.com

| Source: GoldSeek.com

By: Tom Szabo

THIS ESSAY HAS BEEN UPDATED ON OCTOBER 6 WITH SOME IMPORTANT CORRECTIONS AND CLARIFICATIONS. THE NEXT INSTALLMENT IS COMING SOON IN WHICH I EXPLAIN PRECISELY HOW THE HELICOPTER HAS BEEN LOADED AND IDENTIFY THE FIRST MONETARY DROP TARGETS. I WILL FOLLOW THIS SORRY SAGA TO ITS FINAL CONCLUSION IN MORE DETAIL AS PART OF THE METAL AUGMENTOR (WWW.METALAUGMENTOR.COM) SERVICE LAUNCHING SOON. YOU CAN SIGN UP NOW TO BEGIN RECEIVING OUR PERIODIC REPORTS AND DISPATCHES.

This might be the most important monetary discussion of the past few decades, and Ed Bugos should get a lot of credit for starting it with the excellent Who’s Bailing out Whom? I agree with Mr. Bugos wholeheartedly although I believe the situation might be even more precarious than he states. I urge all of my readers to at least read the piece by Ed Bugos and as much of the below discussion as you can stomach. Also, I would ask that you forward this to as many people as you know so they too will have a chance to understand the truth before it smacks the U.S. and the rest of the world in the face.

- The Federal Reserve is bankrupt. The U.S. Treasury Department quietly rescued — actually, took over — the world’s largest Central Bank on September 17.

- The idea that Federal Reserve Chairman Bernanke could fly his helicopter was a fraud; the Fed simply didn’t have any helicopter fuel.

- The U.S. Treasury Department, on the other hand, has copious amounts of helicopter fuel in the form of undiscounted government debt, and this fuel has now been made available to Mr. Bernanke. The more fuel the Treasury provides, the closer the U.S. dollar will get to its death.

- Just released Fed data confirms that initial test flights of Ben’s helicopter have been spectacularly successful. Up to $150 billion has been loaded on the helicopter so far and may already be fluttering down into the Monetary Base as I write this. The inflation of “high power” money by more than 15% in the course of 2 weeks (an annual rate of 300% or more) is unprecedented.

- Inflation of the Monetary Base is leveraged by fractional reserve lending. Should the banks actually start to lend again, we could very well see hyperinflation in the U.S. over the next 18 months.

- This is obviously bullish for gold and silver and bearish for the dollar, although it could take the markets a while to realize it (by which time an even more incredible sequence of events could overshadow this one, although I doubt it). I think the markets might need 2-3 weeks more to absorb what just happened.

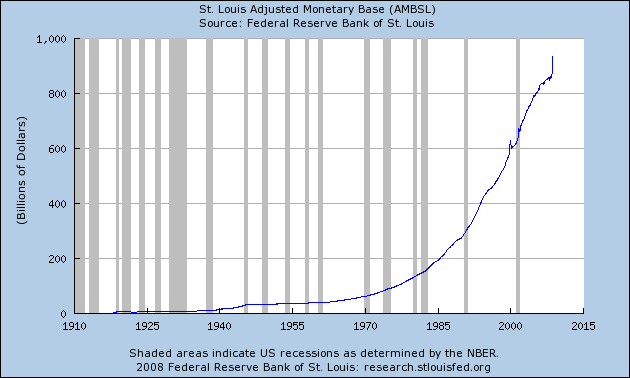

I wrote last Thursday’s post about the Federal Reserve’s bankruptcy right before the new Factors Affecting Reserve Balances report came out with data as of October 1, which confirmed my statement that the Federal Reserve is a dead man walking. The Reserve Balances report supports what Ed Bugos and several of my readers pointed out on Friday: a massive jump in the Adjusted Monetary Base during the second half of September. Here is a chart of this data:

Notice the vertical line at the end of the chart. That’s a $75 billion increase in the past two weeks. Given the parabolic rise of the Adjusted Monetary Base since 1970, perhaps you might think that $75 billion is not particularly special, but the just-released Factors Affecting Reserve Balances report indicates that the size of the vertical line could more than double to $150 billion when this chart is updated next week. See the Ed Bugos article for more charts with vertical lines.

Monetary Base Set to Explode

To get an idea of what is in store, let’s examine the latest Factors Affecting Reserve Balances report a bit more closely. The relevant number we need to look for in this report is called “Reserve balances with Federal Reserve Banks”. Reserve Balances are claims by the banking system on cash held in the vaults of the Federal Reserve Banks. The most important thing about Reserve Balances for our purpose is that the Monetary Base includes these Reserve Balances as well as cash in circulation (including coins and Federal Reserve Notes in bank vaults and in the hands of the public). The Monetary Base, as the name implies, is the first layer of the fractional reserve banking system. Generally speaking, an increase in the Monetary Base is multiplied several times as it propagates through the money supply.

Here are the figures for “Reserve balances with Federal Reserve Banks” since the beginning of September:

September 3, 2008: $3.8 billion

September 10, 2008: $25.0 billion

September 17, 2008: $81.7 billion

September 24, 2008: $87.9 billion

October 1, 2008: $171.5 billion

We can see from this data that around $63 billion of the $75 billion increase in Adjusted Monetary Base as of the two weeks ended September 24 was the result of a rise in Reserve Balances. Let me note that another $7 billion was apparently the result of an increase in Federal Reserve Notes in circulation while much of the remainder was the result of the Adjusted Monetary Base being a weekly average (not end of period) calculation.

Indeed, if we look at another important Fed report, Aggregate Reserves of Depository Institutions and the Monetary Base, we can confirm the leap in the Adjusted Monetary Base figures. There are some differences in accounting and averaging that make the actual amounts of Reserve Balances included in the Monetary Base and the Adjusted Monetary Base somewhat different from report to report, but what matters is the rate of change between periods. To wit, there has been an increase in the Monetary Base of $65 billion for the two weeks ended September 24 according to the latest Aggregate Reserves of Depository Institutions and the Monetary Base report.

We can also see from the data I provided above that Reserve Balances almost doubled this past week (after September 24), rising by $83.6 billion to $171.5 billion. Thus, we should expect both the Monetary Base and the Adjusted Monetary Base to rise by a very substantial amount when new Monetary Base data is published this next week.

The Dam Broke Two Weeks Ago

Up until two weeks ago when the $700 billion bailout package came out of virtually nowhere, the Federal Reserve seemed content to continue swapping its liquid Treasury securities portfolio for the illiquid assets of banks, slowly destroying the Fed’s balance sheet in the process. But the impending failure of AIG and the actual failure of Lehman Brothers apparently did some serious damage to the Fed’s plans, because the most important monetary decision of this entire crisis was made in a big hurry, with virtually no fanfare. I suspect the Fed finally started looking more than a few days ahead and suddenly realized that it might quickly and completely run out of Treasury securities (see below).

So, the Fed and Treasury announced a seemingly innocuous Supplementary Financing Program on September 17. In reality, it was nothing less than a clandestine federal bailout, a de facto government takeover of the Federal Reserve that will officially materialize as such only at a later date. This radical “program”, which is by far the most extreme of all the Fed and Treasury actions in terms of monetary consequences, has received very little coverage so far in the media, on Wall Street, on Main Street, in the Capitol, or on the Internet. But I suspect this could soon change now that the $700 billion bailout package has been penned into law. Indeed, the Treasury bailout legislation seems to be the fuel for the Supplementary Financing Program, which is nothing less than the biggest monetary helicopter lift since the Weimar experiment with the printing press.

Supplementary Financing: An Unprecedented “Program”

Here is how the Supplementary Financing Program is alleged to work. The U.S. Treasury Department sells Treasury securities in a public auction and deposits the cash proceeds with the Federal Reserve. The Federal Reserve thus has “cash for use in the Federal Reserve initiatives”.

Sounds simple enough, but do not be fooled! That is only a part of the story. If the Treasury securities were merely sold into the market and the proceeds were loaned to the Federal Reserve, there would be no impact on Reserve Balances or the Monetary Base. Or as Ed Bugos likes to say, the liquidity would be “sterilized”. In other words, the operation would merely represent a shift of existing money supply within the financial system, not an injection of new cash. Yet what we have witnessed in the past few weeks is a massive increase in Reserve Balances to the tune of over $160 billion.

And that can only mean one thing: the Fed is now monetizing bank assets, or at least is preparing to do so, on behalf of the Treasury. This is a bona fide helicopter operation, the first of its kind during the current credit crisis and certainly the largest in the history of First World central banking since the Great Depression. What we don’t know is if these Reserve Balances will turn into Federal Reserve Notes and get stuffed under the mattress as panicked depositors continue to withdraw cash from the banking system or if these Reserve Balances will get loaned out by the banks whose assets are being monetized. If the former, the hyperinflation will be delayed until the cash is taken back out from under the mattress, which will happen once the bank runs have abated. If the latter, hyperinflation could come fast and furious.

In effect, what’s really happening is that the Treasury is borrowing money into existence at the Monetary Base level. This is exactly the same thing that Weimar Germany did. What the Germans (and the Argentinians, Zimbabweans, etc.) found out, and what our “benevolent” leaders will also soon discover, is that the printing press is a slippery slope to oblivion. The worst-case outcome of giving into this temptation is almost unfathomable.

And here we all thought the $700 billion bailout package had to actually be approved by the elected representatives of the people before the Fed and Treasury could commence their bailout plan. Silly us! In fact, it looks like the Fed and Treasury have been preparing to go forward via the back door regardless of what our legislators decided. I suppose this is why Secretary Paulson insisted that passage of the bailout was necessary to restore confidence to the credit markets, but no specifics were provided about how exactly the process would work. Now we know why. The bailout was the equivalent of putting lipstick on a pig, and the pig is the Supplementary Financing Program through which the Fed can already monetize bank assets. Legislative approval was essentially a rubber stamp, a mere formality. The Executive branch under Bush Jr. has once again usurped powers not granted to it under the U.S. Constitution.

If the above is not crystal clear to you, perhaps the hard numbers will put things in perspective. The Treasury has provided over $150 billion of Reserve Balances so far under the Supplementary Financing Program (out of $344 billion in special auctions) whereas the initial Treasury authority to purchase troubled bank assets under the Congressional bailout legislation is $250 billion. In other words, most of the initial authority has already been loaded on the helicopter in the past couple of weeks and is ready to be dropped from the sky.

Here is the thing that bothers me the most. The idea that the Treasury would buy distressed bank assets using taxpayer money is hugely unpopular with Americans, but the unpopularity itself became the blindfold that kept everybody from asking exactly how the Treasury would actually do this. In fact, several hundred economists (all of them apparently Keynesians) have written letters to Congress urging them not to vote for the bailout because it would not work, mainly on the grounds that banks will need to be recapitalized with banking reserves instead of just having bad assets taken off their books. Well, guess what? Recapitalization of banking reserves was apparently the plan all along!

I find it curious that some members of Congress have said of the bailout, as a way of expressing that there is much work left to do, that it is the end of the beginning and not the beginning of the end. My two cents is that Thursday, September 24, 2008 could in fact mark the beginning of the end: the end of the U.S. Dollar as a liability of the Federal Reserve system. I suspect we will look back on this as a day of infamy, the day we found out that Ben’s helicopter is fueled up, ready to fly and itching to drop piles of money from the sky.

Helicopter in Action

The helicopter is why, out of nowhere, the Reserve Balances and the Adjusted Monetary Base jumped by $75 billion or so in the past two weeks. And the helicopter is why these amounts have jumped and will jump by another $75 billion or more by next week. As you consider the situation, please realize that up until this September, the Monetary Base had barely changed since the beginning of the credit crisis last year. That proves more than anything that the helicopter was grounded until now.

Indeed, all the credit facilities created by the Fed from the Term Auction Facility to the Term Securities Lending Facility to the Primary Dealer Credit Facility to the Bear Stearns Maiden Lane facility and to the AIG credit facility have had no actual effect on the Monetary Base or money supply. This is because the credit facilities are essentially just swaps of assets, not money creation. The banks simply obtained assets they could sell (Treasury securities) in exchange for assets they could not sell (loans, MBS, CDO, etc.) This is the reason some observers are confused about why the Federal Reserve has not been inflating money supply in the face of a credit crisis that has deepened every month since last August.

So why exactly has Ben’s famous helicopter not flown, much less made money drops, until the past two weeks? There are several reasons. For one, even Mr. Bernanke recognizes the inflationary implications of a helicopter drop and he was willing to use it only as a last resort. But there is a more fundamental reason. You see, the helicopter didn’t have a stable fuel supply. What fuel there was in the form of Open Market operations or purchases of bank assets was simply too unstable and would probably cause the helicopter to crash. Furthermore, it turns out the Fed cannot monetize bank assets effectively without assistance from the U.S. Treasury Department. See the Appendix to this essay for a detailed explanation.

What I’m saying is that the idea — as suggested by the Fed Chairman himself — that the Fed is capable of flying the helicopter all by itself is fraudulent. Moreover, anybody claiming that the Fed had already flown the helicopter before September is simply wrong. The various Federal Reserve reports that I reference in this commentary back me up on this. For example, the Aggregate Reserves of Depository Institutions and the Monetary Base shows that as recently as September 10, when the total borrowings by banks under the various Fed credit facilities stood at $170 billion:

- The Reserve Balances with Federal Reserve Banks was still under $10 billion (as it had been throughout the crisis since early 2007);

- The Monetary Base was still around $850 billion (up only $20 billion since August 2007); and

- Federal Reserve Notes outstanding were still around $800 billion (also up a corresponding $20 billion since August 2007).

I would note that the $20 billion increase is approximately 2.5% per year, well below the trend of the past few years. By contrast, just three weeks after September 10, the Reserve Balances now stand at $170 billion and the Monetary Base is perhaps pushing $1 trillion (each up a staggering $150 billion in two weeks). If and when the Fed and Treasury really start to ramp up their bailout operation, we will likely see these numbers rise even more. What a difference a couple of weeks can make!

It took the Treasury coming into the picture and starting to issue new federal debt under the Supplementary Financing Program — ostensibly to provide cash for the Federal Reserve to use in “initiatives” — to get banking reserves and the Monetary Base to “finally” start growing. Why was the Treasury necessary? Because as I explain in the Appendix below, the banking system as a whole is incapable of generating adequate collateral for banking reserves on its own. And the banking system certainly cannot create sustainable banking reserves out of thin air. Stated another way, neither banks nor the Fed can create banking reserves without collateral. It is collateral, and only collateral, that can serve as fuel for the monetary helicopter. And the only collateral that matters is Treasury securities. Once again, this is explained in greater detail in the Appendix.

For those not wishing to delve into the specific details provided in the Appendix below, perhaps I can sufficiently advance the above argument by pointing out that the Federal Reserve cannot simply accept banking assets as collateral for Reserve Balances or Federal Reserve Notes because withdrawal of these banking reserves by the public — accomplished by literally putting Federal Reserve Notes under the mattress — would create a fatal problem for the banking system: not enough money in circulation to repay outstanding bank loans, including the loans used as collateral for the newly created Reserve Balances. We can use the cliche “pushing on a string” to describe the inability of the Fed to effectively monetize bank assets that were created through fractional reserve lending. Cliche or not, it is precisely the act of “pushing on a string” that has forced the Fed to beg the Treasury to borrow money — and thus banking reserves — into existence.

The Secret Death of the Fed

The problem of lacking helicopter fuel aside, the Federal Reserve had another problem a couple of weeks ago that required immediate Treasury intervention. The Fed had bled Treasury securities from its portfolio to the tune of $300 billion by early September with no end in sight. Indeed, as of October 1 the Fed has given away over $500 billion of Treasury securities from a portfolio that held $800 billion just last year. If something wasn’t quickly done, the Fed was in very real danger of exhausting its ammunition for “lender of last resort” duties.

In my estimation, the Fed exhausting its Treasury securities portfolio is tantamount to insolvency — nay, bankruptcy. Indeed, the Fed seems to have become prescient about its impending doom just in the nick of time given that the latest Factors Affecting Reserve Balances report shows as of October 1 that the Fed has acquired $538 billion of banking assets which now support around 67% of the $804 billion of Federal Reserve Notes outstanding. By my calculation, the Fed has as little as $241 billion of Treasury securities left to lend under its credit facilities, which is barely enough to fund the recently-announced $150 billion increase in the Term Auction Facility. That leaves less than $100 billion.

Look, I was an auditor for 8 years and I can tell you what we would have already called this situation in early September: A GOING CONCERN. I have no doubt that the Fed, were it to be a normal business enterprise, would have needed to file for bankruptcy protection this past week if the Treasury had not come to the rescue on September 17. For all intents and purposes other than appearances, that means the Fed is now effectively bankrupt. This is ultimately why Helicopter Ben made the choice to ask the Treasury to give him fuel to fly his helicopter. It was now or never.

I would assume that Mr. Bernanke is pleased with the net result of his helicopter flying so far: a $150 billion increase in the Monetary Base in just a couple of weeks. If the banks do get back into the business of lending and they maintain a reserve requirement of 10% on new loans, that could mean an increase of up to $1.5 trillion in the money supply at the M1 and M2 level. M1 is currently $1.5 trillion ($700 billion excluding currency) whereas M2 is currently $8 trillion, so such an increase would not be a trifling amount. In addition, there is still another $550 billion to go under the bailout package approved by Congress. Should most of it be used as helicopter fuel, that could mean a nearly doubling of the present money supply over the course of a few months as the Monetary Base increases from around $900 billion to perhaps as much as $1.6 trillion. The gentlest way to describe this is hyperinflation.

Conclusion

Sure, there is a chance we could see a delayed reaction from the markets until people start to get what Ed Bugos, I and others have laid out here. There is even a chance that somehow this crisis gets averted (temporarily) so that the massive increases in the Reserve Balances and Monetary Base can be drained back out of the financial system before they become entrenched. At the same time, there is an even better chance that most of the $700 billion bailout just approved by Congress will be used by the U.S. Treasury under the Supplemental Financing Program (or more likely something else that replaces it) to provide fuel for Ben’s helicopter. It seems that given the choice of inflate or die, the decision has been made to inflate.

With the first $150 billion loaded on the helicopter and all systems go, it remains to be seen what people will do with all this new money when it flutters to the ground. Will they stuff it under their mattresses? If so, the hyperinflationary effect of the helicopter drop would be temporarily neutralized. But that would also mean even larger helicopter drops will be needed to stem the growing deflationary tide. If the drops are ultimately successful and the monetary system does not suffer a deflationary collapse, then at some point a true monetary tidal wave will be released and that could very well create a hyperinflationary collapse. How many times have we heard false warnings about monetary tidal waves in the past to the point where now it’s like crying wolf? Well, this time there really is a wolf!

The good news for debtors is that the sudden flood of hyperinflated money into circulation will probably wash away the unmanageable debt burdens in both the public and private sectors. The bad news for creditors is that the monetary flood could destroy all those who have “saved” wealth in fiat form. Whatever happens, the real beneficiaries in the long term will be gold and silver because they provide, as monetary metals, the safest and perhaps only alternative for wealth preservation. But they will also react as the battle between deflation and hyperinflation rages back and forth, so it will be critical to keep a close eye on the Federal Reserve data to determine where the monetary waves seem to be heading.

In conclusion, those who follow my writing closely know that I’ve been talking about this stuff as if it will happen at some point in the far future. Frankly, I didn’t think the deflation-hyperinflation battle would happen so soon. Sure, I’m a bit surprised. But I’m also prepared. Are you? It’s about to happen right here, right now.

APPENDIX

What Is the Monetary Base?

The Monetary Base consists of currency in circulation (coins and Federal Reserve Notes), cash held in bank vaults, and cash held by banks at the Federal Reserve’s vaults in the form of Reserve Balances. Reserve Balances can be converted to coin or Federal Reserve Notes to be delivered to the bank’s vault at any time. In addition, the U.S. Treasury Department can hold Reserve Balances at the Fed. Treasury Reserve Balances are created when the Treasury sells Treasury securities directly to the Fed. This is the equivalent of “running the printing press” whereby the Fed uses the Treasury securities as collateral for the issuance of Reserve Balances to the Treasury. The Treasury would then spend the Reserve Balances into the economy, thus placing the newly printed money into circulation. If and when Treasury Reserve Balances are converted to Federal Reserve Notes, the Treasury securities issued to the Fed would serve as collateral for those as well. This is what is meant by “borrowing money into existence”.

There is an important distinction, however, between borrowing money at the Monetary Base level and at the fractional reserve level. Essentially, the Monetary Base is the money that banks “start out with” and then sequentially loan out under the fractional reserve lending system. Fractional reserve lending expands the money supply (checking accounts, savings accounts, money market accounts, etc.) with the Monetary Base serving as, well, the base. For this reason and others, a change in the Monetary Base is probably the most sensitive indicator of both monetary and price inflation. It is “high power” money.

The Monetary Base is also the only component of the money supply that the Federal Reserve can directly act upon. By raising reserve requirements, for example, the Fed can force banks to keep more cash in their vaults (or the Fed’s vaults) and therefore to reduce lending. Lowering reserve requirements, on the other hand, allows banks to use excess reserves to make new loans. Not only that, the reserve requirement affects the size of the money multiplier (see below), which ultimately determines the total amount of money that can be created through bank lending activities.

The periodic adjusting of reserve requirements by the Fed is what creates the Adjusted Monetary Base that is shown in the chart at the beginning of this essay. I’m not going to get any more specific about this because for our purposes we can substitute Adjusted Monetary Base for Monetary Base and vice versa.

How Does the Monetary Base Relate to Money Supply?

Please allow me to provide an example to illustrate how reserve requirements and the multiplier effect work in relation to the money supply. For the sake of simplicity, I’ll ignore complications like the fact that certain bank deposits have no reserve requirements and that a portion of the Monetary Base has been permanently withdrawn from the domestic economy in the form of Federal Reserve Notes hoarded (under a mattress) or held offshore.

Let’s assume the Fed requires 10% of bank deposits to be held in the form of reserves. The theoretical limit on money creation in this instance would be 10 times the Monetary Base (or 900% increase). This is because only 90% of the balance can be loaned out each time. So, if we start with $100 Monetary Base, a bank can loan $90 on that, then $81 (90% of $90), then $72.90 (90% of $81), etc. Don’t worry if you’re having difficulty picturing this because I will dive into even more excruciating detail below. For now, what’s important to recognize is that each time the diminishing loan proceeds are deposited in a bank — it doesn’t matter if it is the same bank that issued the loan or another bank — there is a reserve requirement that reduces the amount that can be subsequently loaned out. The sum of the diminishing loan balances with a 10% reserve requirement is equal to $1,000. But if the Fed lowers the reserve requirement to 5%, the theoretical limit on money creation becomes 20 times (a 1900% increase of) the Monetary Base, or $2,000 using our example of $100 initial Monetary Base. By adjusting the reserve requirement, we can see that the Federal Reserve can directly influence the money supply because banks will lend out more (inflate) or less (deflate) of their banking reserves.

The Federal Reserve, however, has not adjusted the reserve requirement for most deposits since 1992. To do so now would be pointless. Raising the reserve requirement in order to make sure that banks are better protected against loan write-offs would cause the money supply to contract and this would make the deflationary threat even worse. On the other hand, lowering the reserve requirement in order to stimulate the money supply would further expose banks to the risk of insolvency since they would have even lower banking reserves to absorb loan losses.

Why, Specifically Then, Are Banking Reserves Rising?

It turns out that there are other ways that banking reserves can be adjusted. Recall that Reserve Balances represent the claims of the banking system and the U.S. Treasury Department on the cash held in the vaults of the 12 Federal Reserve Banks. A bank can choose to hold cash in physical form in its own vaults or as electronic Reserve Balances representing cash located at the regional vaults of the 12 Federal Reserve Banks. Reserve Balances in the Treasury’s account, meanwhile, are held at the Federal Reserve Bank of New York. Together, vault cash held by the banks and vault cash held at the Fed as Reserve Balances constitute total banking reserves for purposes of the reserve requirement.

Each bank must decide how much cash to hold in the bank vault vs. how much cash to hold in the form of Reserve Balances with the Fed. The decision depends on the amount of demand for cash by depositors (this cash obviously needs to be held in the bank’s branch vaults or in ATMs) as well as the volume of transactions clearing through the Federal Reserve payment system (which requires cash to be held as Reserve Balances at the Fed). Fortunately, the Federal Reserve (still) publishes reports on a weekly and bi-weekly basis that allows us to track changes in how the banking system as a whole maintains its banking reserves. For example, these reports allow us to assess the extent to which depositors are demanding cash, which could indicate whether or not a bank run is occurring).

Over the next few weeks, it will be critical to examine these Federal Reserve reports as they are issued in order to determine if either (1) the recent rise in Reserve Balances is being converted to Federal Reserve Notes or (2) Reserve Balances are being used by banks to make new loans. If the former, that means deflationary risk is growing and it would not be very bullish for gold and silver in the short term. If the latter, that means hyperinflationary risk is growing and it would be very bullish for gold and silver in both the short and the long term.

In any case, since the Federal Reserve must stand ready to convert electronic Reserve Balances to Federal Reserve Notes at any time, the two forms of banking reserves (vault cash and Reserve Balances) are essentially the same thing. The only difference is the location of where the cash is actually being held.

Okay, we’ve talked a lot about Reserve Balances but we are still no closer to explaining why precisely they have grown so much in the past couple of weeks. So let me do that now without further delay. Reserve Balances are growing because the U.S. Treasury Department has made available $344 billion or so of Treasury securities to the Fed over the past couple of weeks (Factors Affecting Reserve Balances) under the Supplementary Financing Program. Of this $344 billion, approximately $180 billion has likely been used in Foreign Exchange Swap Lines involving other central banks and as part of the various credit facilities that the Federal Reserve has made available to the banking system. As explained elsewhere in this essay, these swaps and credit facilities are “money neutral” or “sterilized” in terms of their effect on the Monetary Base and money supply. They represent merely a movement of cash between accounts within the banking system, or between central banks.

But that still leaves approximately $160 billion of funds provided so far by the Treasury under the Supplementary Financing Program. And it is these funds that have been surreptitiously used to boost the banking reserves of the Federal Reserve system and its constituent banks through the direct creation of Reserve Balances (printing money) in the Treasury’s account. While it is not clear that these Reserve Balances have made their way down to the individual accounts of the banks themselves, the funds are certainly available for that purpose. Under the $700 billion bailout plan, the Treasury is supposed to have control over these Reserve Balance, not the Fed, but my guess is that it is Ben Bernanke who will actually be flying the helicopter. If not, he will at least be the co-pilot.

In any case, the signing of the bailout plan into law last Friday means that the Fed and Treasury are now in a position to determine how and where these new banking reserves will be used. By “used”, I mean the actual step of monetizing certain bank assets by dropping money from the helicopter on specific targets. The net result will be the transfer of Reserve Balances from the Treasury’s Fed account to the Reserve Balances account of whichever bank is “lucky” enough to be targeted. From there, the Reserve Balances will either be used to make new loans or to pay out depositors in the form of Federal Reserve Notes.

Banking Reserves and Shareholder Equity

It will perhaps help some of you to think of banking reserves as shareholder equity. The two concepts aren’t exactly interchangeable since a bank’s shareholder equity is actually called its capital, which must meet certain minimum requirements apart from reserves. In fact, a bank’s capital is calculated as a percentage of bank assets while a bank’s reserves are calculated as a percentage of bank liabilities. But there are enough similarities that we can use the analogy for illustrative purposes especially if we look at the shareholder equity of the banking system as a whole and not just that of an individual bank.

In a corporation, there are essentially two ways to increase shareholder equity and two ways to decrease shareholder equity. Equity can be raised by generating earnings or by shareholder infusions of capital. Equity can be reduced by generating losses or by paying dividends (or less frequently, by repurchasing and retiring stock). It is for the most part the same in the banking system when viewed as a whole.

An individual bank may elect to maintain its “shareholder equity” in the from of banking reserves (vault cash and Reserve Balances), or to lend it out at interest, as long as it maintains the minimum banking reserves specified by the Fed. The opportunity to lend at interest is the obvious reason why banks do not maintain Reserve Balances very much in excess of the required amount. Even holding low-yielding U.S. Treasury Bills is typically a better option than holding a bunch of non-yielding cash in the vault. From a practical standpoint, however, it is usually easier for banks to lend excess Reserve Balances to other banks on an overnight basis at the so-called Fed Funds Rate (this is accomplished with a simple book entry at the Fed that transfers Reserve Balances from one bank to another). Banks can also use Reserve Balances to buy assets from other banks. In effect, this is what the Treasury appears ready to do now with its newly-created Reserve Balances.

An Even Closer, More Painful, Look at Banking Reserves

I will now explain why banks themselves cannot increase banking reserves and therefore why Treasury intervention is required. To continue the analogy above, banking reserves have a direct relationship to shareholder equity. This means that the banking system cannot increase shareholder equity by simply refusing to lend funds and hoarding cash. Doing so may increase banking reserves at some banks, but it will come at the cost of decreasing banking reserves at other banks. Such changes in banking reserves net out at the system level. In other words, the banking system as a whole — as historical Fed reports demonstrate — is not able to generate banking reserves through its own lending and deposit-taking activities. Over time, banking reserves can certainly be built up as a result of earning the interest differential between loans and deposits, but this is a gradual process. Simply put, the banking system did not generate $160 billion in earnings during the past two weeks.

Indeed, when we look at the banking system up close, we find that every dollar of banking liability (such as a checking deposit) actually represents a dollar of fractional reserve money supply. Converting that dollar from electronic form (deposits) to paper form (vault cash and banking reserves) means that it is no longer available to the banking system. Thus, attempting to turn money supply into banking reserves is sort of like a hamster running inside a suspended wheel: the hamster is running, but it isn’t getting anywhere. Moreover, due to the fractional reserve multiplier effect, removing one dollar from the fractional reserve money supply and holding it as excess banking reserves in the form of vault cash will actually reduce money supply by several multiples (up to $5 decrease in the case of a 20% reserve requirement and up to $20 decrease in the case of a 5% reserve requirement).

Strictly speaking, the decision by one bank to increase its banking reserves by one dollar means other banks will have to reduce their banking reserves by one dollar. At the same time, there would also be a decrease in the overall money supply. To understand this more clearly, let’s look back at the concept of reserve requirements I discussed above. If the Federal Reserve were to increase the reserve requirement from 10% of deposits to 20%, what the banks would do is reduce the amount of loans. This would cause banking reserves to increase but only as a percentage of bank deposits, not as an absolute amount. The reason for this is the multiplier effect of fractional reserve lending. Recall that each dollar loaned out of banking reserves will eventually result in several dollars of growth in money supply (deposits). This necessarily means that a dollar added back into banking reserves will result in several dollars of reduction in money supply. It is the reduction in money supply (deposits), not a change in the gross banking reserves, that accomplishes the increase in banking reserves from 10% to 20%. In other words, total banking reserves stay the same while deposits are reduced by one-half.

I understand this might seem pretty confusing, so let me take it a step further and provide a detailed example. Let’s go back to the 10% reserve requirement and start out with Bank A having $100 Monetary Base in the form of Reserve Balances. Further, let’s assume Bank A has no loans and just one deposit account with a balance of $100. The $100 deposit balance represents a depositor who opened an account with $100 in Federal Reserve Notes. Bank A, when it received the $100 in Federal Reserve Notes, delivered this cash to its regional Federal Reserve branch so now the $100 in Federal Reserve Notes is held at the Fed’s vault and Bank A has $100 in Reserve Balances. Now, let’s assume Bank A makes a loan. Given the 10% reserve requirement, it can only lend $90 of its $100 Reserve Balances. So Bank A makes a $90 loan to Joe, who has a checking account at Bank B. What do we have after the loan is disbursed?

Bank A: $100 Deposit, $90 Loan, $10 Reserve Balances (10% reserve)

Bank B: $90 Deposit, $90 Reserve Balances (100% reserve)

Total Deposits: $190

Total Reserve Balances: $100

System-wide Banking Reserve: 52.6% ($100/$190)

Now, let’s assume Bank B loans out the $90 deposit in Joe’s checking account to Bob, whose account is with Bank C. Remember, Bank B can only loan out $81 because it needs to keep a 10% reserve level. Here is how it looks now:

Bank A: $100 Deposit, $90 Loan, $10 Reserve Balances (10% reserve)

Bank B: $90 Deposit, $81 Loan, $9 Reserve Balances (10% reserve)

Bank C: $81 Deposit, $81 Reserve Balances

Total Deposits Bank A+B+C: $271

Total Loans Bank A+B: $171

Total Reserve Balances: $100

System-wide Banking Reserve: 36.9% ($100/$271)

This can continue with Bank D, E, F, etc. until the total deposits reach $1,000, total loans reach $900, and the system-wide banking reserve decreases to the 10% reserve requirement. This is the multiplier effect in action. Note, however, that the banking reserve itself has not decreased, only the banking reserve as a percentage of deposits has decreased. In other words, the Reserve Balances never changed from $100. It has merely been redistributed between the banks that have received deposits as a result of fractional reserve loans being made throughout the banking system.

If you work the above example in reverse you will see that an individual bank can boost its own banking reserves only by shrinking the overall money supply (deposits). Yet there would be absolutely no change in the reserves of the banking system as a whole.

The above means that Reserve Balances are not — in fact, cannot — be created by the banking system itself. In addition, it also means that individual banks are not increasing their banking reserves despite fears expressed by the Treasury Secretary, Federal Reserve Chairman and so many pundits that banks are hoarding cash and no longer lending to each other. They might not be lending, but they are also not hoarding cash as indicated by the latest Money Stock Measures report issued by the Federal Reserve, which indicates that money supply has in fact been stable to growing in all deposit categories up to and including the past two weeks.

Once again, this leaves the Treasury as the only source of the recent massive increase in banking reserves. Moreover, when you truly understand how the Federal Reserve and U.S. banking system actually work as described above, you will recognize that the recent increase in banking reserves is a form of capital infusion by the Treasury. In effect, this is the same thing as the temporary recapitalization of the banking sector by the Treasury that many Keynesian economists have been arguing for. The trick is that instead of making an equity investment as a shareholder, the U.S. government will create equity by purchasing bank assets at book value instead of realizable value. The result is exactly the same: an increase in the bank’s shareholder equity (capital) and reserves. The difference is that existing shareholders get to keep their full equity stake under the Treasury proposal and the banking system is not nationalized.

How to Capitalize a Bank Without Getting the Upside of Equity

Despite the Treasury’s odd approach, the conventional method to inject capital into the banking system is the same as it is for any other corporation: funds provided by common or preferred shareholders. For example, foreign investors including sovereign wealth funds were making direct investments in some U.S. banks earlier this year. Alas, they have consistently said “no” in the recent past.

When lacking outside or inside investment — by inside, I mean a government investment that results in partial or complete nationalization — there is really only one other way to increase banking reserves under a currency regime where both the fractional reserve money supply (deposits) and the Monetary Base (Federal Reserve Notes, Reserve Balances) are created through borrowings. You guessed it, by borrowing! And since banking reserves are a component of the Monetary Base, it is the Monetary Base that has to be borrowed into existence.

Although you will find this in papers and textbooks written about the Federal Reserve system, it turns out there is no point trying to increase banking reserves by making loans and then attempting to pledge them as collateral to the Federal Reserve in exchange for Reserve Balances. Yes, theoretically an individual bank should be able to pledge any eligible loan to the Fed as collateral in order to obtain banking reserves, but there is a critical consideration that blows the theory into smithereens. It is the fact that the Federal Reserve is required to discount loans and other bank assets that it receives as collateral. By contrast, the Federal Reserve is not required to discount Treasury securities. As a result, the only form of liquidity injection into the banking system that will work both in large amounts and on a permanent basis is the acquisition of Treasury securities by the Fed.

Before getting to Treasury securities, let’s take a closer look at the alternative described above: sales or pledges of bank assets to the Fed in exchange for reserves. A bank presumably needs to increase banking reserves because it is anticipating withdrawals by depositors or it needs to replace capital lost due to loan defaults or bad investments. Typically, however, a bank does not need help from the Fed to do this. The bank could simply sell loans to other banks or stop making loans in order to increase its reserves as long the anticipated withdrawals or losses are gradual enough. There is no need for Fed liquidity injections in this case.

If, however, withdrawn cash is not deposited at another bank but rather placed under the mattress, total banking reserves will necessarily decrease over time and the money supply will necessarily shrink by a multiple of the withdrawn cash as the fractional reserve lending process operates in reverse as described above. Still, while this would be deflationary, there is nothing wrong with the sequence of events from the perspective of the banks themselves because deposits and loans would remain in balance and the banking system would remain solvent. Should the deflationary risk to the economy exceed comfort level, however, the Fed could conduct temporary or permanent Open Market operations to boost banking reserves by acquiring Treasury securities and issuing newly printed Federal Reserve Notes. The result is replacement of the liquidity that was lost when the cash was withdrawn from circulation. As a result, loan balances need not be reduced. And although there are inflationary implications to the creation of new money, they will not manifest themselves until the cash that has been placed under a mattress is brought back into circulation. At that time, the Fed could presumably reverse its Open Market operation and drain excess liquidity back out of the banking system, but of course that doesn’t ever seem to happen.

Alternatively, let’s see what happens if the bank tries to sell loans to the Federal Reserve in exchange for Reserves Balances. This, by the way, is the textbook explanation of how money is initially created. It is how the creation of Federal Reserve Notes is described by the Fed and Treasury in their own websites and by their own staff. It is also how academic papers describe base money creation. Yet despite all the expert nods, money creation through loan purchases by the Federal Reserve doesn’t actually work. Why not? Let’s go back to the bank’s need for the banking reserves in the first place. The bank clearly doesn’t need the banking reserves for lending purposes if it already has perfectly good (performing) loans on its books. Why then would the bank take performing loans (the only type the Federal Reserve is allowed to accept) and offer them to the Fed at a discount? It is either because the bank needs to increase banking reserves to make up for losses that have drained its capital or to make up for deposit withdrawals that have reduced the banking reserves themselves.

In all cases except a complete withdrawal of cash from the banking system, however, all that has occurred is that the banking reserves has shifted from one bank to another. It’s harder to see this in case of a loan loss, but just consider that the loan proceeds had to go somewhere and unless they were withdrawn from the banking system, these loan proceeds are still sitting in a bank account somewhere. That means another bank now has excess reserves while the bank with the loan or deposit losses has inadequate reserves. Once again, however, banking reserves across the banking system as a whole have not changed.

Therefore, the issue isn’t inadequate reserves in the banking system but the issue is rather how the reserves can be redistributed in the most efficient manner from banks with excess reserves to banks with inadequate reserves. In other words, the bank with the losses will either have to attract new deposits or it will have to sell assets. And this is precisely where selling assets to the Federal Reserve will almost never make sense. Why not? Again, it has to do with the fact that all assets other than Treasury securities must be discounted by the Fed. That means the selling bank will receive cents on the dollar for its assets. Acquiring Reserve Balances from the Fed in exchange for discounted assets will definitely boost the bank’s cash reserves, but this will also generate additional losses for the bank. For example, if the bank pledges or sells a $100 loan to the Fed, it will receive $90 or less in exchange even though the loan is perfectly good. Even if the loan is to Bill Gates (unless the loan is commercial paper or a mortgage loan on his house).

The Fed’s collateral discounting is required by the Federal Reserve Act, the legislation that created the third American central bank in 1913, and necessarily results in a decreasing amount of banking reserves, shareholder equity and capital ratios. If repeated enough, it is a sure path to insolvency for any individual bank and the banking system as a whole.

In fact, the “dirty secret” of the current Federal Reserve credit facilities program is rooted in the very concept of discounting. You see, banks and dealers that swap assets under the Term Auction Facility or any of the other Fed credit facilities are allowed to keep these swapped assets on their books at full value even though the Fed only gives them a discounted collateral value in exchange. For example, Fed advances under credit facilities maturing in more than 28 days “cannot exceed 75 percent of the lendable value of its available collateral”. I would note here that the “lendable” value is already a discounted collateral value. As the Fed’s margin table [PDF] shows, bank assets without a market value are generally discounted to 90% with only a few exceptions (95% for commercial paper, 93% for Agency guaranteed loans and 91% for 1-4 family residential loans). By contrast, if the Fed were instead to buy outright such bank assets without market values (and therefore without markets), that would generate an immediate loss of 5%, 7%, 9% or more. Such a move would probably wipe out shareholder equity and capital considering many banks have capital ratios under 10% to start with.

It gets even worse if a cash withdrawal is headed for a mattress. In this case, the banking system has actually lost reserves as a whole. The proper corrective action would be to liquidate loans (or not issue new ones) across the banking system until banking reserves are restored to an adequate level. In the alternative, the Fed should conduct temporary Open Market operations by acquiring Treasury securities in the open market on an undiscounted basis. The Open Market operation should be reversed as soon as the cash is returned to circulation from under the mattress.

If, instead, banking reserves are created by selling discounted loans to the Fed that could otherwise have been liquidated (or paid back) at full undiscounted value at some point in the future, a rather serious monetary imbalance is created. Because of discounting, the newly issued money would not be sufficient to repay loan balances outstanding across the banking system including the loans that were sold at a discount to the Fed. A condition where outstanding loans cannot be repaid with existing money in circulation means that the banking system is essentially underwriting a loss equal to the discount whereas the Fed (and ultimately the government) is guaranteeing that the default rate will not exceed the discount rate. This arguably would work under a gold standard and perhaps even under a monetary standard that allows only short term commercial paper to be discounted, but otherwise it is a recipe for major disaster.

Aside from the horrid consequences for interest rates, the creation of a Federal Reserve Note that is then placed under the mattress means that the Federal Reserve Note is no longer available to repay any loan, including the loan that was pledged in order to bring that particular Federal Reserve Note into existence. As a result, more and more new loans will be required to repay existing loans regardless of the economic circumstances. At the same time, if Federal Reserve Notes were continually removed from circulation and kept under a mattress, as would likely happen given the highly unstable banks that would exist under such a monetary scheme, there would be less and less money in circulation to repay loans. The net result would be hyperinflation of prices amid a collapse of economic activity. In other words, precisely the crisis we now face.

The bottom line is that only entities that can borrow at zero discount (for default and repayment risk) are able to provide the dollar-for-dollar credit necessary to increase the Monetary Base on a permanent basis. In the case of the U.S. dollar, this is the Treasury Department of the U.S. government.

It seems the effects of discounting are being overlooked by most monetary commentators and experts as they seek to understand the current credit crisis. This is not surprising to me given that none of them apparently have realized the true reason why there has been so much monetary inflation in the U.S. up to this point. Simply put, the Monetary Base has been gradually removed from the U.S. economy over time as Federal Reserve Notes are exported offshore or literally placed under the mattress. The movement to a “cashless” economy of debit and credit cards has largely obscured the ugly truth but the current crisis may very well expose it.

Ultimately, Only Government Can Borrow a Fiat Monetary Base Into Existence

I hope that I’ve been able to convince you that only government borrowing — via the direct issuance of Treasury or other securities that the Federal Reserve can hold as collateral at full par value for new issuances of Federal Reserve Notes — can reliably increase the fiat Monetary Base while providing an unlimited amount of collateral to the banking system regardless of what happens to each newly-created Federal Reserve Note. Any other approach (that does not involve constant currency controls and market interventions) would result in the monetary system collapsing back on itself or being hyperinflated away. I suppose this is the key to the Federal Reserve’s relative longevity and also probably the reason why the U.S. dollar is still the world’s reserve currency despite the mess that it is. But that looks to change soon now that the ugly truths are popping up all over the place.

It hasn’t always been this way. When the Federal Reserve was founded, its Notes were intended to circulate only when rediscounted (the discount being split by the lending bank and the Federal Reserve) commercial paper was available to be pledged as collateral. This was a nod to the Real Bills doctrine as advocated by Professor Antal Fekete, even though the Federal Reserve provided a fiat backing of only 40% gold. The effect was to increase the Monetary Base while the commercial paper was outstanding and to reduce the Monetary Base when the commercial paper was repaid. The creation of money under this classic Federal Reserve system was clearly temporary in nature. It was a system that could actually have worked if given a chance. But the temptation of the government — not the bankers themselves — to get something for nothing was too great and so this early version of the Federal Reserve was soon bastardized.

In its modern incarnation, the Fed uses Open Market operations to increase or decrease the Monetary Base ((e.g. during the holidays). Moreover, the Fed has used Open Market operations almost exclusively in the past several decades to permanently increase the Monetary Base as shown in the chart at the beginning of this article. Basically, this involves the Fed buying Treasury securities from Wall Street dealers and paying for the securities with newly issued Federal Reserve Notes (which are credited to the seller’s bank in the form of Reserve Balances). This has the effect of immediately boosting the Monetary Base. Moreover, none of this growth in Monetary Base would have been possible without an increasing amount of Treasury securities available to serve as collateral for the Fed’s issuance of Reserve Balances and Federal Reserve Notes.

The bottom line is that it is ultimately the growth in government debt that has supported the increase in the U.S. dollar Monetary Base and vice versa. And the need for the growth in government debt resulted, at least in part, from the exporting of Federal Reserve Notes offshore.

Why the Federal Reserve Is (Was) a Fraud

Yet if Open Market operations have worked so “well” in the past, you’d think the Fed would have used them all along to deal with the current banking crisis in order to boost the Monetary Base and to increase liquidity. Well, you’d be wrong. One reason for this is the Fed does not want to be blamed for creating hyperinflation, assuming it can still be avoided. It is perfectly willing, however, to let the Treasury and the U.S. government take the blame. This is precisely what seems to be happening given that Treasury Secretary Hank Paulson is considered to be the author of the $700 billion bailout plan. But make no mistake, even if the Treasury is providing the fuel, it is the Federal Reserve that will be flying the helicopter (or at least co-piloting it).

Another reason for prior Fed reluctance to fly the helicopter is that purchasing tens or hundreds of billions of dollars of eligible collateral on the open market would have influenced interest rates to the possible detriment of the Fed’s stated policy goals. In effect, increased Fed demand for Treasuries might drive credit yields below Fed interest rate targets and actually reduce the banking system’s appetite to lend. That is not what you want when liquidity is already tight. At the same time, Fed Open Market operations could also serve to remove some of the highest quality debt securities from the credit markets. This ironically might result in a net reduction, not increase, in liquidity.

So, the Fed has opted, at least until 2 weeks ago, to fight the credit crisis using so-called credit facilities which have consisted of the Fed exchanging its liquid assets (U.S. Treasury securities) for banks’ illiquid assets (various agency and non-agency debt securities for which demand has shrunk to almost nothing as a result of reduced appetite for risk in the markets). These illiquid bank assets have in turn been used to collateralize existing Federal Reserve Notes that were previously collateralized by (relatively) risk-free Treasury securities. Of course, the financial institutions the Fed has been bailing out with these “facilities” sell the Treasury securities into the market as soon as they receive them in order to obtain cash to meet liquidity needs. The added benefit of the “facility-based” approach has been that the sale of Treasury securities into the market (vs. their purchase as part of Open Market operations) boosted overall market liquidity.

Conclusion (The Final One, I Promise)

As preferable as the credit facilities have been compared to helicopter flights, the Federal Reserve essentially destroyed its own balance sheet during the past two weeks, which is why the Fed reached out to the ultimate lender of last resort, the U.S. government. Yet it might be too late for a cure. We’ll find out in a few weeks whether or not the Fed’s ill condition has deteriorated beyond the point of no return. If so, the U.S. dollar as a Federal Reserve liability will shrivel up and die as more and more people discover the truth. Sooner or later the Treasury will have to provide an acceptable monetary alternative because formally nationalizing the Fed will accomplish nothing if the Fed has already been effectively nationalized as of September 17, 2008. Under the circumstances, there is a good chance that gold and silver in the hands of the public will rise to the occasion. My next essay on this subject will describe the most likely approach that the Treasury will take to move back toward a Market-Based Monetary Standard (hint: I think it will involve gold.)

By: Tom Szabo, Silver Axis

-- Posted Tuesday, 7 October 2008 | Digg This Article | Source: GoldSeek.com

| Source: GoldSeek.com