|

-- Posted Monday, 13 October 2008 | Digg This Article | Source: GoldSeek.com | Source: GoldSeek.com

You have no idea how pleased I am that NFTRH’s first week in existence happened to coincide with historic market and economic events. Downside events. If it was easy anybody could do it, right? Some subscribers have noted that my writing tends to give them confidence in their positions, in their beliefs, when things get rough. But I do not give pep talks. All I can do is state the fundamentals as I see them and if they sound bullish, then so be it. Up to this point you may have known me as a chart guy and that is still the case, but over the last several weeks you will note that the charting has taken a back seat to what is really important now; secular (big picture) fundamentals. Technical analysis may win some short term battles, and would have preserved capital to a greater degree, but I am no longer interested in short term battles. I am interested in winning the war. This is a war of misperceptions and misdirection. It is the struggle to remain true to the big picture as the great global casino empties in the face of deflation. It is important, even for someone like myself who knew the deflation event was coming, to remember the key nugget in the investment stance; a deflation impulse – possibly extreme – is needed as a lever (think of it as a lever to a trap door) that implodes the global inflation party that got whooped up compliments of Mr. Greenspan’s previous panic policy. As I recall there was a lot of pressure on the maestro to ‘do something’, to re-liquefy the economy. Well, he did and that liquidity, which had to go somewhere, did; straight into a credit and mal-investment bubble that was directly responsible for the bubbles in housing, certain stock market segments and yes, commodities. That is all being unwound in the face of Armageddon, 2008. The most recent ISM report was dismal and is likely to show further erosion from September’s PMI of 43.5 upon release of the next report.

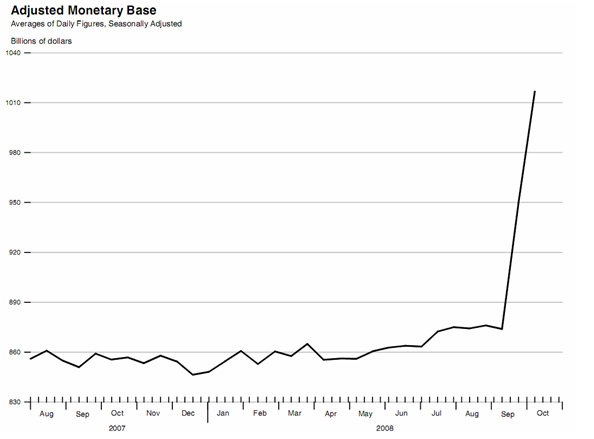

Employment data are degenerating, prices are dropping and inflation is the last thing on anyone’s mind, including a now rate cutting Fed that pretended to be concerned as recently as its last FOMC meeting. What a difference a few weeks makes. From the Fed itself on 10/8/08: Joint Statement by Central Banks Throughout the current financial crisis, central banks have engaged in continuous close consultation and have cooperated in unprecedented joint actions such as the provision of liquidity to reduce strains in financial markets. Inflationary pressures have started to moderate in a number of countries, partly reflecting a marked decline in energy and other commodity prices. Inflation expectations are diminishing and remain anchored to price stability. The recent intensification of the financial crisis has augmented the downside risks to growth and thus has diminished further the upside risks to price stability. Some easing of global monetary conditions is therefore warranted. Accordingly, the Bank of Canada, the Bank of England, the European Central Bank, the Federal Reserve, Sveriges Riksbank, and the Swiss National Bank are today announcing reductions in policy interest rates. The Bank of Japan expresses its strong support of these policy actions. The results on the most recently posted money base (10/9/08 courtesy St. Louis Fed) are obvious.

The danger, according to deflationists is that no matter how much ‘money’ global authorities throw at the problem, a black hole created by decades of credit/debt (as the primary macro-economic fundamental) is going to suck it all up with a near infinite appetite to correct the mess made by a system in its death throes. The title of the piece is ‘The Next Bubble?’ and as I see it, there are two primary candidates; a bubble in financial Armageddon as policy makers’ efforts are rendered null and void by the ‘black hole’ and all hope is lost as even the word ‘depression’ will be an understatement. Or a new bubble, in some asset class, as global money supplies shot out of fiscal Howizters reach their intended target, the investment community. I will go with number two, because inflation is the increasing supply of money and with the deflationary backdrop and inflation fears nowhere on radar, policy makers have a free pass, a directive, to print as much ‘money’ as they can as fast as they can. This makes Greenspan look like child’s play. The markets, gripped in fear and panic will take whatever time they need to come around to the new inflation cycle. In fact, they will likely not respond in force until rising prices are evident. But what I am interested in is the first movers in a new inflation cycle – aside from physical gold, a sound holding about which value, not price is key – and those first movers are likely to be the companies that dig gold out of the ground. Given their outrageous undervaluation vs. the metal itself, when they do emerge from the global stock panic, leverage to the price of gold, the asset outperforming nearly everything except the USD of late (just as it should be) is likely to come into play in a forceful manner. Picture an elastic band being stretched to near the breaking point. If it breaks, it is all done. Nice to know ya and thank you for having been a subscriber to NFTRH for a little while but I’ve gotta go now and hunt me some squirrels to serve the family for dinner tonight. But if the policy takes… if the money supplies continue upward, this ‘money’ will have to go somewhere and it will not go back to where it was so unscrupulously abused in the last cycle, like the credit markets or an unregulated Wall Street. No, I have to believe that the current crisis may actually inspire a bubble in sound thinking, at least in the early part of the cycle. The fact is the gold miners are at historic undervaluation vs. the metal and the metal, their product which is first and foremost a monetary and investment safe haven, is outperforming nearly all global assets during the deflationary impulse, including miner cost inputs like energy and industrial commodities along with human hopes for prosperity. Not to sound callous, but a worker who is thankful to have his or her job is more productive and cost effective than one looking over his or her shoulder at the next guy in a ‘I wanna git mine’ inflationary boom. We will look more closely at the sector, along with my technical take and Otto’s full professional fundamental write up of a junior miner later in today’s report. The markets will do what they will, and the results have been painful. But the big picture has not only not changed, it has improved significantly given the combination of rising money supplies and deflationary depression panic. Gary Tanashian http://www.biiwii.com

-- Posted Monday, 13 October 2008 | Digg This Article | Source: GoldSeek.com | Source: GoldSeek.com

Previous Articles

|