-- Posted Monday, 13 October 2008 | Digg This Article | Source: GoldSeek.com

| Source: GoldSeek.com

Howard S. Katz

Investors and traders are probably confused by the action of the past 4 weeks. Here is what is going on.

First, the stock decline is important for gold bugs because traders under pressure from margin calls on their regular stocks are meeting these margin calls by selling their gold stocks. This is why the gold stocks have badly underperformed the metal over the past month. This tells us that things are much brighter than they look, and as soon as the stock market rebounds (which should be very soon), the gold stocks will come back as though out of a sling shot.

Second, the stock market is acting under a panic.. Everyone is running around like chickens with their heads cut off. Indeed, in my 10-6 08 article I tried to insult these people who are running around in panic by calling them Chicken Littles. However, Al Abelson of Barron’s was one up on me. He began his 10-6-08 column by saying, “Chicken Little was right.”

So you see. These people are so stupid that you can’t even insult them.

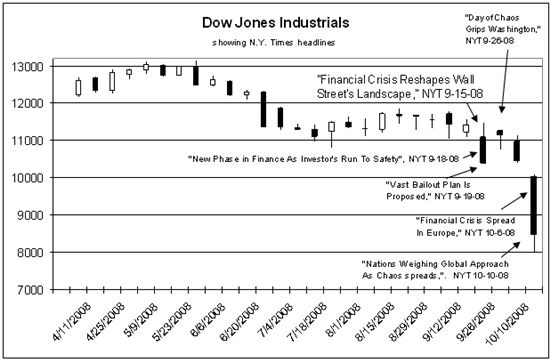

But why has the DJI turned and plunged 2,500 points in the past 2 weeks? The answer is the New York Times. Starting on Sept. 15, 2008 the Times began a series of headlines: big block letters, very unusual for the sedate Times; upper right hand positioning on page 1. Words like “crisis” and “chaos” were used liberally. In the chart above, I show the DJI with some of the Times headlines.

What is not widely known is that a large number of newspapers around the country (and the world) follow the New York Times religiously. The Times puts out an early edition (available on the street at 10:00 pm the night before), and this is flown to other papers in the wee hours of the morning, and these other papers copy the Times’ national and international news substituting only their own local stories instead of the New York stories. If the Times ran a headline that said, “UP IS DOWN,” or “BLACK IS WHITE,” you can be sure that these sentiments would be all over the country the next day, and millions of people would be voicing the Times’ opinions, thinking that these were their own original thoughts.

For example, former Fed chief, Paul Volcker had an op-ed article in the Wall Street Journal on Friday, 10-10-08 in which he said:

“Now, a full-scale recession appears unavoidable.”

Paul Volcker, “We Have the Tools To Manage the Crisis,”

WSJ, 10-10-08, p. A-17.

Volcker was joined this (Monday) morning by 3 other idiots, Bradford DeLong, Kenneth Rogoff and Simon Johnson whose comments in a Bloomberg article, “World May Be Lucky to Escape With Worst Recession in 25 Years,” continued the general panic.

Modern economists made up the concepts of recession and depression because they are the lap dogs of the paper aristocracy (bankers, their loan customers, etc.). What actually goes on in the economy are money/credit expansions and contractions. Since the contractions are good for the vast majority of the people and bad for the bankers, these economists consider them recessions/depressions. But since recessions/depressions are virtually universal declines in wealth, they don’t really exist. When the Fed eases up on the money pedal, prices moderate and the wage earner catches up with the previous price increases, then the majority of the country is better off. So to call such a period a recession is completely inane. That, by the way, is what a degree in economics signifies today. In mid-century, a group of bankers succeeded in getting control of the teaching of economics in America. The real economists were kicked out, and a group of crackpots brought in to replace them. All these people know is, print money, ease credit.

For the past two generations this has been their solution to every problem. Print money and ease credit. On Friday, 3 month T-bills got down to ¼% nominal and negative 5% real.. Consumer prices have not declined since 1955. Since we left the gold standard in 1933 Consumer prices have multiplied by almost 17 times. During this time there have been no “depressions,” few “deflations” and hardly any “recessions.” (Indeed, the current establishment so loves its “recessions,” that, when the most recent one – that of 2000-01 – was revised out of existence, they refused to acknowledge the revision.)

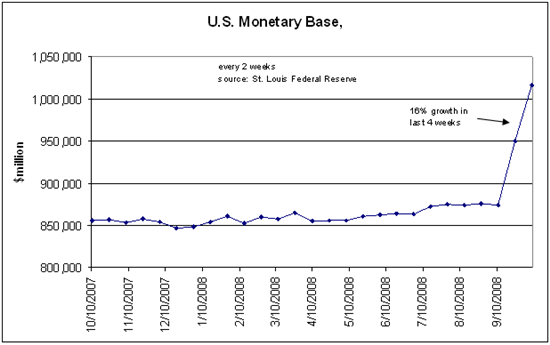

So when one predicts a “recession,” he is calling a long shot because there has to either be a decline in the money supply or at least a decline in its rate of increase. Instead, we have an explosion in the money supply. The 10-3-08 One-handed Economist showed an explosion in Federal Reserve Credit. This has continued and now computes to a 68% increase over the last 4 weeks. Federal Reserve Credit corresponds closely to the Federal Reserve’s portion of the money supply. It has never increased at this rate in history. Below is the U.S. monetary base. It is up 16% over the past 4 weeks.

So, in the words of another establishment economist, “there ain’t gonna be no recession.” And I have confidence in calling Paul Volcker’s bluff because I have a long record of being right

on my economic forecasts, and the establishment has a long record of being wrong. I became a gold bug in 1965 and remained so until 1980. In 1982, I became highly bullish on stocks. In 1987, I predicted Black Monday. And early in 2007 I predicted the end to the 25 year bull market in stocks. In 1955, the year I entered Harvard (DJI at 420), John Kenneth Galbraith predicted another 1929 (i.e., a 90% decline). Instead the DJI went up for the next 11 years and hit 1000. In 1971-72, Henry Ruess, chairman of the House Banking Committee, predicted that the price of gold (then a little above $35) would fall to $6 or $8 per ounce. It never fell below $35. In November 1979, with the price of gold near $600/oz., Martin Mayer wrote in Fortune Magazine that the gold bugs were a “lunatic fringe.”

In 1982, all the nation’s media teamed up to promote Henry Kaufman (aka Dr. Doom) as the great economic wizard. He was bearish with the DJI at 800. In 1997, Morton and Scholes won the Nobel prize in economics. In 1998, their hedge fund went belly up and lost $4 billion. In 1999, the New York Times and Wall Street Journal teamed up to get people to read Glassman and Hassett’s book, “Dow 36,000,” which predicted that the DJI would hit that number by 2004. This was just in time to suck people into the internet bubble, which peaked early in 2000.

So when I go toe to toe with a member of the establishment like Paul Volcker, the odds are on my side. No establishment economist knows anything about his subject because he has been trained and hired to serve as an apologist for the bankers.. This is why his predictions almost always prove wrong. They are intended to panic people into supporting government policies which steal wealth from the people and give it to the paper aristocracy.

In conclusion, the problem that America faces at this point in history is the threat of the printing of too much money and a resulting massive rise in prices. The chances of a “deflation,” “depression” or “recession” are one out of a million. Mr. Volcker’s article should have been entitled, “We Have the Tools To Destroy the Country.” That title would have been true.

Everyone in the establishment is now running around saying that the economy is in terrible danger, that a massive crisis threatens. Well, when a general loses a battle, he gets canned. When an economy collapses into chaos, then the economic manager should get canned. If the people who are in charge of our economy are as smart as they pretend, then how could we be in a crisis? Let’s fire them all and get a new batch in who might do a better job. In “Tragedy and Hope” Carroll Quigley describes the strategy of the establishment as working behind the scenes to make sure that both major parties follow the same policies. Notice the recent Wall Street bailout bill. Both McCain and Obama supported it. So did President Bush and Nancy Pelosi. If you are caught up in the heat of this campaign and think that it is vitally important that one of these candidates be stopped, you have been taken in by the establishment. In this election, you will have two choices on the economy: the Demipublican and the Libertarian. That is reality. All the rest is image.

Interested parties are invited to visit my web site, www.thegoldbug.net which contains my commentary on the Wall Street bailout (no charge). We are starting to add news items not generally available, such as the explosion in the money supply and the House and Senate roll call votes on the bailout bill of Sept. 29, Oct. 1 and Oct. 3. If you want hard core predictions on the price of gold and specific gold stocks, then take a trial subscription to the One-handed Economist ($300 per year, available via the web site).

Thank you for your interest.

Howard S. Katz

-- Posted Monday, 13 October 2008 | Digg This Article | Source: GoldSeek.com

| Source: GoldSeek.com