-- Posted Monday, 9 February 2009 | | Source: GoldSeek.com

By: Howard S. Katz

Well, here we are not quite 5 months since the New York Times declared financial Armageddon and the entire media of the country went into a fit of hysteria truly wondrous to behold. What is the situation?

Gold is now resting above $900. It has recovered 2/3 of its July-to-October decline. This does not seem to me to be the material for a massive recession, depression or deflation as the media are screaming. In previous articles, I have explained the economic reasoning for my position. Today it is time to say that we “inflationists” are looking very good, and all the “deflationists” are looking bad.

However, I am not waiting for them to admit that they were wrong. I have been through that. In 1970, I was one of the small number of gold bugs arguing for a higher gold price. The establishment of the day laughed at gold and recommended “good sound stocks for the long pull.” Over the course of the 1970s, the price of gold rose from $35/oz. to $875/oz. That is, it multiplied by a factor of 25 times. From 1966 to 1982, the “good sound stocks” in the DJI declined over 70% of their value in real terms. Still, they would not admit they had been wrong.

Now we are in a new generation. Who did you decide to learn your economics from Mr. 21st century analyst? Did you choose to learn it from the gold bugs of the 1970s (who were right) or the establishment of the 1970s (which was wrong)? Yes, I know. You learned your economics from the people who were wrong.

And you, Mr. member of the public trying to preserve his capital from the depreciation of the currency, who do you want to learn your economics from? Do you want to learn it from the people who were right, or do you want to learn it from the people who were wrong?

At the beginning of the millennium, I started a Model Conservative Portfolio computing what a trader who began with $100,000 and followed all my advice would have today. It was a bad time to start any portfolio. U.S. Diversified Equity Funds (the average stock mutual fund in the U.S.) is down from a theoretical $100,000 on Jan. 1, 2000 to $77,673 on Jan. 1 2009. (The figures are not out yet, but they probably lost close to another 10% in January.) As of Feb. 6, my Model Conservative Portfolio was up by 49%.

What is wrong with our age is that almost everyone is living in the past. This is particularly true of those who describe themselves as progressives and pride themselves on being modern. They are living in the 1930s and have accepted a number of lies about that period:

- that the economic events of the 1930s were unplanned and came out of nowhere; the fact is that they were a deliberate policy of the Republican Party of the time and were called the policy of the 5¢ cigar; this policy caused a decline in the money supply so that prices fell by 30% from 1930-1933;

- that these economic events constituted a depression; but a depression is a period when the vast majority of the people in the country get poorer (such as WWI or WWII or the period from 1972 to the present); that did not happen in the early ‘30s; it did not happen until FDR came in and started killing pigs and plowing under crops; FDR’s advisors said that killing pigs and plowing under crops would make the country richer, and the media called these advisors “the brain trust.”

Alas, the media were wrong.. There wasn’t a single brain in the whole “brain trust.” In fact, the Republicans were right. Their policy was to restore the value of the nation’s savings, which had been cut in half during WWI. This they succeeded in doing, and all the savers benefited. The Republicans knew that this would cause a period of unemployment, but the unemployed were, at the worst, 25% of the work force. The savers were close to 100% of the people. Further, the unemployment was temporary. All this had happened in the 1870s, and this same policy of restoring the currency had worked beautifully. In the early ‘30s, consumption of meat rose sharply, people switched from margarine to butter and gave more to charity – all proof that the majority of Americans were richer.

The people who were poorer in the early 1930s were Wall Street and the banks. The banks were unable to make loans. The stock market went from DJI 381 in 1929 to 41 in 1932. This was not the catastrophe it is made out to be. Charles Dow’s earliest stock records begin in 1885, and for 40 years the DJI mostly fluctuated between 50 and 100. Lows of 40-50 were common throughout this period. But Wall Street had been spoiled by the “boom” of the late 1920s. They threw a tantrum like a small child. They focused on the unemployed because for all these rich people to complain would have gone over like a lead balloon.

So almost everything you have learned about the “great depression” is a lie, and most of the people from whom you get your information are liars (or in most cases are stupid enough to believe in the liars).

Where are we now? What is the reality of today? The reality is that there is no problem of contracting money supply or declining prices. The last year in which prices declined in America was 1955. All the Republicans have died and been replaced by RINOs (except for a few people like Ron Paul). And the threat we face today is not from an appreciation of the currency (“deflation”) but from a depreciation of the currency (“inflation”).

The form that this takes today I call the commodity pendulum. The government prints money. This makes consumer goods go up, but commodities lag behind – order of magnitude 10-20 years. The two periods when commodities lagged were the 1960s and the 1980s-90s. But after commodities get too far out of line, they correct with a major move to the upside. We had a chance to see this in the 1970s when the CRB index went from 96 to 337. That was the first upswing of the commodity pendulum.

You may have noticed that consumer prices in the ‘80s-‘90s did not rise as rapidly as the money supply (duplicating their action of the 1960s). This was because commodities were declining. This was the second downswing of the commodity pendulum. This downswing ended with a double bottom in the CRB, and starting in 2001 we have been in the second upswing of the commodity pendulum. From 2001 to 2008, the CRB has risen from 184 (Oct. 2001) to 618 (July 2008). (The modern managers of the Commodity Research Bureau changed the name of the CRB to CCI to keep you from discovering this important fact.)

All you have to do is to look at commodity charts which go back to the start of the decade, and you will see, in commodity after commodity, massive uptrends unfolding. The cause of these uptrends is the money created by Volcker and Greenspan in the ‘80s and ‘90s. Whereas that money causes an increase in consumer prices in about 2 years, it takes 1-2 decades to influence commodity prices. That influence is now hitting the commodity markets, and this is (part of) the reason we are now in a gigantic period of massively rising prices, and it is why the fear of “deflation” is absolute garbage.

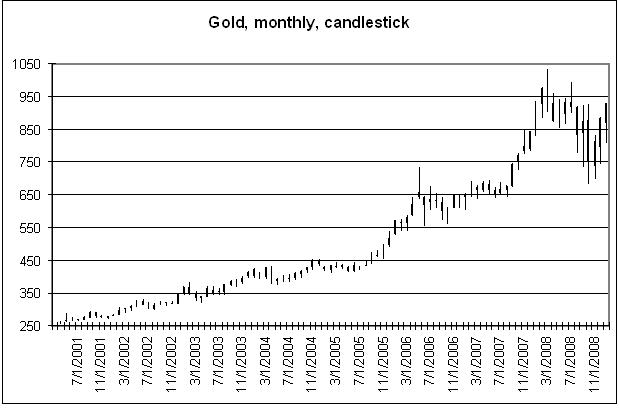

Here is the bull market in gold dating back to 2001. All you have to do is to look at it to

see that what we had in late 2008 was a minor pullback in the context of a grand cycle bull market. Such pull backs are normal in any bull move. THEY ARE OPPORTUNITIES TO BUY! To infer a massive decline in prices that will dominate the economy for the next several years is insanity. Add to this the fact that the Bernanke Fed has gone crazy in the printing of money, and we know that the price of gold will be much higher a few years down the road.

You see, we human beings have a terrible failing. We have an overwhelming desire to have the same opinion as our fellows. This gives the media an enormous power. They can create an opinion, and no matter how absurd everyone will think that this is the opinion of the majority. The desire to agree with the majority will then lead them to agree with the media.

Take the markets of 1982, for example. The media had been saying, for 15 years that everyone should buy good, sound stocks for the long pull. All of a sudden, the media reversed itself and told people to follow Henry Kaufman. Henry Kaufman was Doctor Doom. He was the most bearish man around. At that time, the DJI was 800, and the prime rate was 20%. Henry Kaufman said that the DJI was going lower and the prime rate was going higher.

If you followed Kaufman’s advice, you sold your good, sound stocks at the exact bottom of the greatest bear market of our time. And you were left out of the market for the greatest bull market in history. But on the other hand you were happy because you had the same opinion as the majority. Poor…but happy.

Fast forward to 1990. This time the media were telling us about Ravi Batra and his book, The Great Depression of 1990. Batra used the D word. In 1990, the DJI was at 2700. It rose for the 8 of the following 9 years and finished the decade at DJI 11,000. Poor…but happy.

But right at that time the New York Times Publishing Company published a book by James K. Glassman and Kevin A. Hassett entitled Dow 36,000. They predicted that this would happen between 2002 and 2004. This book, and the media hype, brought millions of people in to buy stocks. It helped push the NASDAQ up to 5,000. After frightening the wits out of people at DJI 800, after threatening them with another 1929 at DJI 1300, here at DJI 11,000 the Times was wildly bullish. The amusing thing is that the Times believed its own propaganda. Today’s paper reports, “The company’s clearest and biggest mistake, analysts say, was spending $2.7 billion to buy back its own stock from 1998 to 2004, despite historic high prices. That figure is more than three times the company’s current market capitalization…” – p. B-7. What followed the turn-of-the-millennium bullishness was the worst bear market since the 1970s. By 2002, the Dow had not hit 36,000. Indeed, in 2002 the Dow hit 7200.. So these people who have been wrong come to us in 2008 screaming “financial crisis” and that you have to sell all your stocks.

I can tell exactly what the majority are thinking about the January market. They are thinking, “This market has to go down.” You heard it yourself. “This past month was the most bearish January ever.” It was down 12%. (Oh, excuse me. They were computing in absolute points, not percent. Somehow that makes it sound worse.) And here I am looking at the fact that the market is up since late November. From Nov. 20 to Dec. 8 the DJI was up by 20%. Believing this nonsense the majority won’t buy. They wait for lower prices. Everyone else agrees with them. Then how come the stock market won’t go lower and the commodity market made its low on Dec. 5? If everybody knows that the markets have to go down, why isn’t everybody selling, and why aren’t the markets going down? Who is doing the buying? I analyze this question in the Feb. 6, 2009 issue of the One-handed Economist. If you are prompt with your subscription, then you can learn the answer to this question in time to profit from it.

What the establishment cannot see is that, one by one, different economic goods are putting in bottoms. Cocoa is right behind gold with a bottom in late October and almost a 2/3 rebound. Corn rallied the second week of December and is holding its gains. Wheat and soybeans are moving with corn. Even the CRB Index (I refuse to call it “Continuous Commodity Index”) bottomed on Dec. 5 and is starting to look like a head and shoulders bottom. Crude oil, and the other energy commodities are gradually forming bottoms.

Also featured in the Feb. 6, 2009 issue of the One-handed Economist is the most recent statement by the Federal Reserve. I will give you a little teaser:

“open market operations…likely to keep the size of the Federal Reserve’s balance sheet at a high level”

That is a bombshell – if you know how to interpret it. And it gives me the answer as to what is going to happen to the financial markets.

Rather than sit around and wait for the establishment to apologize and admit that they are wrong, I would rather look for a few good men who don’t want to be happy. I am looking for the kind of men who will go to a social gathering and get into a big argument with everyone there because they lack this all-too-human trait to have the same opinion as the majority. I am looking for the kind of man who insists on seeing reality as it is.

If you are my kind of man, then check out my web site (free) at www.thegoldbug.net. Here I blog about social issues from an economist’s viewpoint. The current blog is entitled “Peace.” And take a flyer on my newsletter, The One-handed Economist ($300/yr.). Here I stick my neck out and tell you what to buy and how long to hold it. This is what it is all about.

But in any case, thank you for your interest.

# # #

-- Posted Monday, 9 February 2009 | Digg This Article | Source: GoldSeek.com

| Source: GoldSeek.com