-- Posted Sunday, 29 March 2009 | | Source: GoldSeek.com

By: Adrian Douglas

In September of 2008 the CFTC launched an investigation of the COMEX silver market on concerns that it is manipulated. This is being spearheaded by the Enforcement Division. They also undertook to investigate the gold market too. This is the third publicly announced investigation into manipulation of the silver market. The two prior investigations failed to uncover any evidence of manipulation of the silver market. The current investigation has been running for 6 months and according to Commissioner Bart Chilton it is making progress, whatever that might mean. The apparent lack of urgency and an investigation moving at the speed of molasses means that every day mining companies struggle for survival and investors struggle to remain invested, and traders and investors in precious metals are robbed by the Pirates of the COMEX. It is an outrage.

For those of us who observe these markets in real time the signs of manipulation are obvious. If you drive a car everyday you will notice even the slightest vibration or change in engine noise that will alert you that something is not right. To apply the same analogy at the COMEX, somebody has stolen the wheels but after 6 months of looking it doesn’t appear that the expert mechanics have spotted the cause of the excessive vibration!

I have delved into the CFTC’s own published data and it shows that there is clear manipulation of the gold and silver price going on and it also tells us who is doing it.

The CFTC publishes two reports on a regular basis. The first is the Commitment of Traders report [1] which is published weekly and gives the long and short positions of the commodity markets grouped into three categories:

Commercial Traders

Non-Commercial Traders

Non-Reporting Traders

In general terms, the Commercials are the bullion dealers. The non-commercials are the large institutional investors and the non-reporting traders are the small speculators who do not have positions big enough to exceed the threshold to report them.

The CFTC also publishes a Bank Participation Report [2] on a monthly basis. This report gives the long and short positions of Banks who hold positions in commodities grouped as foreign and domestic. They also state how many banks make up the domestic bank holding and the foreign bank holding. In silver there are only two US Banks involved and in Gold there are three.

The position of the banks is also included in the “Commercial” category of the COT. So once per month we can see what share of the commercial trading in gold and silver is performed by these US Banks.

To observe what influence anyone is having on the market we have to determine what “Net Position” they hold. If you were to buy 100 contracts long of silver and sell 100 contracts short at the same time, your influence on the market price will be nil. If however you buy 10 contracts long and you sell short 100 contracts your effect on the market price is a function of the net short position of 100-10=90 contracts.

The commercials collectively are nearly always net short. Their effect on the price is a function of the commercial net short position which is the total commercial short position minus the total commercial long position. To determine how influential the positions of the US bank participation are in the market we need to compute what percentage the net short of the banks represents compared to the total commercial net short position.

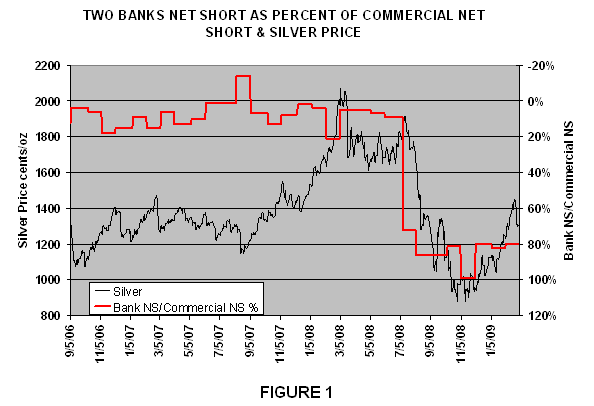

Figure 1 shows the price of silver in black which is tied to the left hand scale while the net short of two US Banks as a percentage of the total commercial net short is on the right-hand scale. I have inverted this scale so that it moves in the same direction as price. An increasing short position means the price will be driven lower. What can be seen very clearly is that from July to November 2008 the two US Banks went from having just 9% of the total commercial net short position to having 99%! The correlation with price is evident. The indisputable conclusion is that these two banks dominated the market to the extent they represented the entire net short position of the commercials and as such they controlled the price of silver, which is illegal. Furthermore, the amount of contracts that were sold short to achieve this represented 25% of the annual global mine production! Could there be any clearer sign of manipulation?

Let’s take a look at gold.

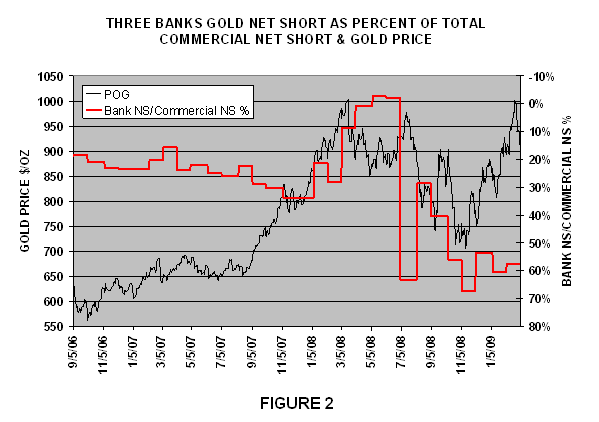

In figure 2 the price of gold is charted in black against the left-hand scale while the net short of three US Banks as a percentage of the total commercial net short is on the right-hand scale. I have again inverted this scale so that it moves in the same direction as price.

This shows very clearly that from July to November 2008 the three US Banks went from having approximately no net short at all to having 67% of the total commercial net short position! The correlation with price is evident. It further appears that they drove the price up from the end of 2007 only to hammer it down in July of 2008. The indisputable conclusion is that these three banks dominated the market to the extent they represented two thirds of the entire net short position of the commercials and as such they controlled the price of gold which is illegal. Furthermore, the amount of contracts that were sold short to achieve this represented 10% of the annual global gold mine production! Could there be any clearer sign of manipulation?

It is a sterile discussion to contemplate whether these banks had this amount of gold or silver to sell. It is irrelevant! Commodity Law does not allow anyone to manipulate the direction of markets even if they have the means to do so…this is exactly why the law exists because otherwise the people with lots of money or lots of gold and silver would always be able to defraud all the small investors. But this is exactly what goes on every day on the COMEX right under the noses of the regulators.

Who are these Pirates of the COMEX? The names of the banks whose positions appear in the CFTC report are not made public. But we can find out who they are. There is another report which issued by the treasury which is the “Bank Derivatives Activities Report” compiled by the Office of the Comptroller of the Currency. In this report they list the top five banks by name who own the most OTC derivatives in the categories of gold derivatives and precious metals derivatives. The report does not spell out what is meant by “Precious Metals” but it excludes gold so we can be fairly sure it is mainly derivatives based on silver, although there are probably some platinum and palladium contracts also.

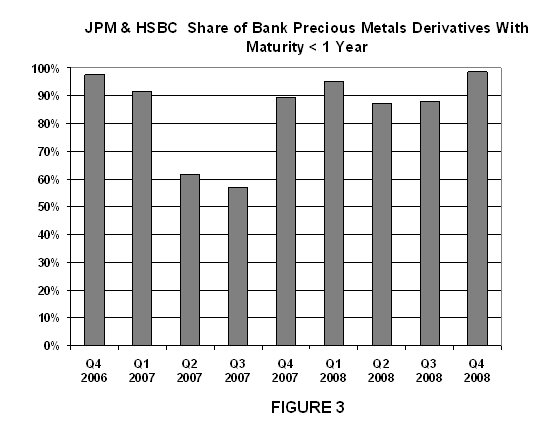

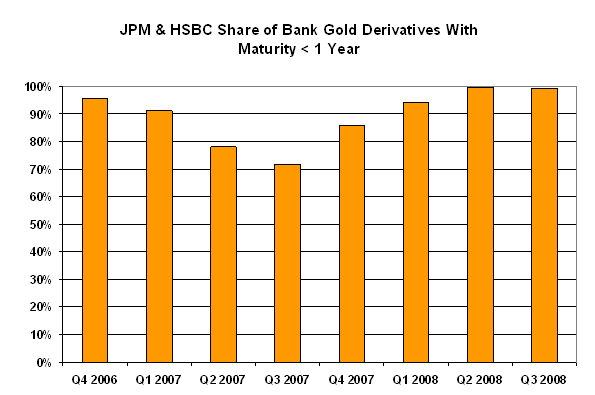

When the derivative positions of the banks are examined it becomes clear that JPMorganChase and HSBC together dominate the market. Figure 3 shows the share these two banks hold in precious metals OTC derivatives as a percentage of the total precious metals OTC derivatives held by all banks. It can be seen that with the exception of Q2 and Q3 of 2007 these two banks hold 85-100% of the banking sector derivatives for precious metals which I suspect is mainly silver.

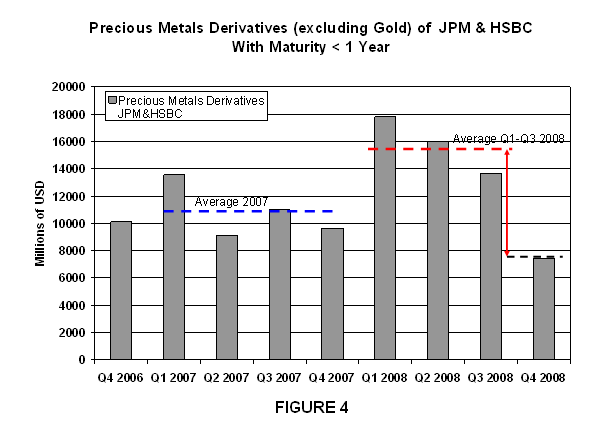

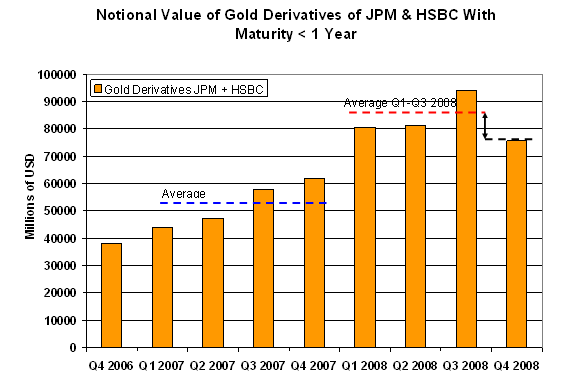

Let’s have a look at Figure 4 that shows the notional dollar value of these positions:

Good grief! The notional value of these derivative holding with maturity of less than 1 year were averaging 10.8 B$ in 2007 and leaped to an average of 15.8B$ in the first three quarters of 2008. All the silver mined in the world each year is only worth 8.8B$ at $13/oz.

So we see two banks holding an outrageously dominant market share position in these instruments of an outrageously large nominal dollar value in 2007 which then jumps to a nominal value that is 40% more outrageously large in the first three quarters of 2008!

Now as the credit markets started to show signs of serious trouble at the end of 2007 and early 2008 one would imagine that customers of JPM and HSBC would want to buy “call” type derivative contracts such that they would be bets that precious metals were going to go higher.

What we have observed is that two unknown banks fraudulently manipulated the COMEX silver market in 2008 with an outrageous 99% ownership of the entire Commercial Net Short position which resulted in the price of silver crashing from $20/oz down to less than $9/oz. That is a real coincidence that two banks on the hook for the equivalent of 140% of all the silver mined in one year in notional value of derivatives should suddenly get lucky that the silver price plummeted such that all those unlucky derivatives customers didn’t get to cash in their calls! Coincidences like this don’t happen. From Q3 to Q4 2008 JPM and HSBC managed to reduce their derivatives in precious metals by 6.6B$ or 43%. This provides a very good reason why two banks in the middle of 2008 suddenly decided they were going to break commodity law by gaining a concentration that represented 100% of the commercial net short of the COMEX market. The most likely reason is these two banks who have manipulated the COMEX market so blatantly are the same two banks who own a monstrous oversized and unregulated derivative position which needed to be reduced.

Let’s take a look at gold.

FIGURE 5

In figure 5 we discover that JPMorganChase and HSBC together dominate the OTC bank derivatives in gold also. Except for Q2 & Q3 of 2007 these two banks control 85-100% of the gold derivatives of less than 1 year maturity held by all banks.

FIGURE 6

Figure 6 shows us that through 2007 these gold derivatives were climbing in notional value but averaging around 52B$. This is equal in value to about 90% of all the gold mined in the world each year! In the first three quarters of 2008 the notional value of the gold derivatives held by these two banks leaped to an average of 85 B$. As with silver it is highly likely that the increase in business would have been dominated by “call” type contracts as the world’s financial system started to go into meltdown. Interestingly we earlier noted that in mid 2008 three US banks had increased their net short position in gold on the COMEX from almost zero to 67% of the commercial net short position and to do so they sold short the equivalent of 10% of the world’s annual gold production in short contracts. Is this another coincidence? I would strongly suspect that positions acquired by the three banks were mainly driven by the positions of only two of them and those two banks are highly likely to be JPMorganChase and HSBC. From Q3 to Q4 2008 JPM and HSBC managed to reduce their derivatives in gold by 22.4B$ or 18%. The combined reduction in gold and precious metals derivatives notional value of 29B$ achieved in a 3 month period is enough to buy 54% of all the gold and silver mined in the world in one year!

These are not the only examples of manipulation of the COMEX gold and silver markets, it happens with other commercials on a daily basis, but this Pirate attack instigated in July of 2008 has them in clear view of everyone, sailing past disgruntled and downtrodden precious metals investors with their Jolly Roger flag flying for all to see….well, for all to see except for the Enforcement Division of the CFTC because apparently after 6 months no one over there has spotted them.

As another amazing coincidence JPMorganChase is the custodian of the silver that is supposedly purchased on behalf of SLV Exchange Traded Fund investors, and HSBC is the custodian of the gold that is supposedly purchased on behalf of GLD Exchange Traded Fund investors. Yet these two banks are seen recklessly gambling more gold and silver paper promises in an unregulated market than they could ever get their hands on. Those are truly bizarre credentials to be in charge of the safe keeping of other people’s precious metals!

All the data I have used for this analysis come directly from government reports. It shows that at least two banks have blatantly and indisputably manipulated the COMEX gold and silver markets. The highly likely link of this activity to virtually the only two bank participants in the OTC derivatives market makes it beyond a reasonable doubt that the Pirates of the COMEX are JPMorganChase and HSBC.

To demonstrate how asleep at the wheel the regulators are here is an extract from the just released Q4 2008 Bank Derivatives Activities report from the OCC

QUOTE

Derivatives activity in the U.S. banking system is dominated by a small group of large financial institutions. Five large commercial banks represent 96% of the total industry notional amount and 81% of industry net current credit exposure. While market or product concentrations are a concern for bank supervisors, there are three important mitigating factors with respect to derivatives activities. First, there are a number of other providers of derivatives products whose activity is not reflected in the data in this report. Second, because the highly specialized business of structuring, trading, and managing derivatives transactions requires sophisticated tools and expertise, derivatives activity is concentrated in those institutions that have the resources needed to be able to operate this business in a safe and sound manner. Third, the OCC has examiners on-site at the largest banks to continuously evaluate the credit, market, operation, reputation and compliance risks of derivatives activities.

END

Even with the world’s financial system on the edge of collapse, the quasi-nationalization of Fannie Mae and Freddie Mac, the collapse of Lehman Brothers, Bear Stearns, and AIG due to derivatives, the regulators say we don’t need to worry about 5 banks “dominating” the derivatives market! But what is absolutely shocking is this is the same paragraph that has appeared in the report since Q3 2006! Apparently the near meltdown of the global financial system and their utter and abject failure as regulators is no reason for revision of this position. JPMorganChase holds a derivatives portfolio of 87 T$ notional value or roughly twice the GDP of the entire world! They have less than 2 T$ of assets (and they are probably very generously valued in that computation!). This is the sort of plot for a James Bond movie where some wayward organization has taken control of the world, except in this real life version the authorities are stirred but not shaken!

Whether regulators stop the activities of the Pirates of the COMEX or not, will not prevent the inevitable from happening. The gold and silver markets have been suppressed for over 15 years in order to maintain low interest rates and a “strong dollar” to allow the US to live beyond its means. The suppression of precious metals meant that the alarm system of the financial world was switched off thereby leaving the average person to wonder how we could have arrived at the abyss of meltdown without any warning.

Lawrence Summers described the blueprint of how to control interest rates by gold price suppression in his paper “Gibson’s Paradox and the Gold Standard”. This was implemented by Robert Rubin in his “strong dollar policy”. It may have seemed a very smart idea by those in power to gain an unfair advantage over all our trading partners and abuse the privileged position of being the custodian of the world’s reserve currency. However, it is time to pay the piper. The abuse of the custodianship of the reserve currency is leading to international pressure to choose something other than the dollar; this inevitable loss of dollar demand together with the desire to print the US out of its troubles will lead to a massive loss of purchasing power of the dollar and a corresponding exponential demand for precious metals. Western Central banks have dishoarded their gold surreptitiously and loaned it to the market to suppress the price. At a time when physical demand is soaring, mine supply is dwindling due to mining being uneconomic at these suppressed prices. As the Central Banks fail to fill the gap between demand and mining supply the price will skyrocket.

To date regulators have failed to rein in any financial fraud before it was too late. Even when regulators were handed all the facts of the Madoff Ponzi scheme they failed to take action. I doubt the suppression of precious metal prices will be any different. The key is to take action yourself and not hold your breath the regulators will stop this fraud. The Pirates prey on investors who are over leveraged. Investors should buy and hold physical gold and silver, and investors on the COMEX should take delivery of their contracts. Those reckless pirates, who have sold promises that they can not deliver upon, will be hoisted on their own petard; the leverage they have used for so long against investors will seal their own demise.

Adrian Douglas

March 27, 2009

www.marketforceanalysis.com

Market Force Analysis is a unique analysis method which provides reliable indications of market turning points and when is a good time to enter, take some profits or exit a market. Subscribers receive bi-weekly bulletins on the markets to which they subscribe.

References:

[1] http://www.cftc.gov/marketreports/commitmentsoftraders/index.htm

[2] http://www.cftc.gov/marketreports/bankparticipation/index.htm

[3] http://www.occ.treas.gov/deriv/deriv.htm

-- Posted Sunday, 29 March 2009 | Digg This Article | Source: GoldSeek.com

| Source: GoldSeek.com