-- Posted Wednesday, 30 December 2009 | | Source: GoldSeek.com

On December 29, 2009 The New York Post [josh.kosman@nypost.com] published an article titled, Deep in derivatives, where scribe Josh Kosman ‘took-a-shot’ at explaining the ABSURDITY of the bind boggling derivatives positions amassed by financial behemoths such as J.P. Morgan Chase and Goldman Sachs. In an attempt to explain how dangerously systemically-interconnected derivatives makes ALL banks, Kosman began;

“The amounts are so large that if the swaps and other derivative contracts the banks broker go bad because the parties on either side of the deal collapse, the banks could be in trouble.”

Kosman then goes on with some very superficial analysis of the latest Office of the Comptroller of the Currency’s, Quarterly Derivatives Report, attempting to scope out the magnitude of the excesses;

“As of Sept. 30, Goldman posted $42 billion in derivatives and had $115 million in assets.

JPMorgan brokered $79 billion in derivatives against $1.7 billion in assets as of Sept. 30.”

Finally, Kosman speaks of ‘a source’ close to Goldman who allegedly said or told him,

“ [the] numbers [in the Quarterly Derivative Report] include only Goldman Sachs [Commercial] Bank, and not the larger holding company Goldman Sachs Group, so the entire firm has less risk than it appears to in the OCC report. Goldman's investment banking is handled outside the federally insured Goldman Sachs Bank.

Factual Inaccuracies

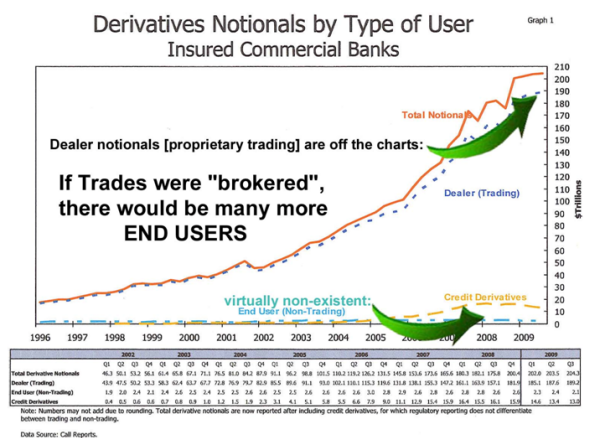

First, Kosman states and characterizes the institutions involved in these derivatives trades as “brokers” when, in fact, they participate as PRINCIPALS. The amount of risk involved when one trades as a principal is materially larger than when one acts as a broker or agent. Of course, if Kosman had bothered to read the rest of the Report, he would have known that these trade COULD NOT HAVE BEEN BROKERED because the report tells us there are empirically NO END USERS FOR THESE PRODUCTS:

source: OCC Quarterly Derivatives Report, Pg. 9 of 33

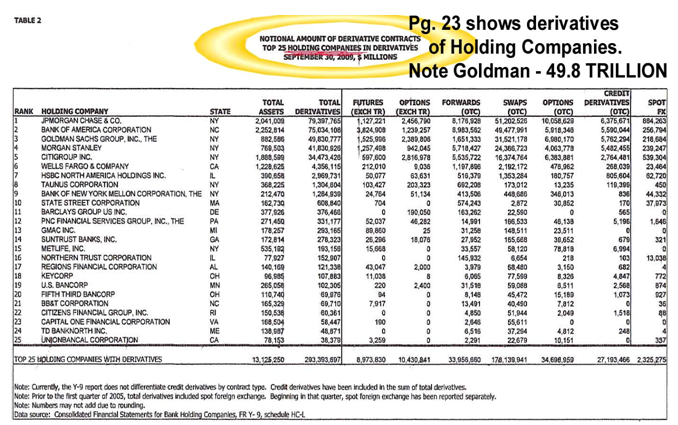

Second, Kosman reports that J.P. Morgan and Goldman Sachs reported their outstanding derivatives positions as 42 and 79 Billion respectively. THIS IS WRONG. The real amounts are measured in TRILLIONS. Maybe Mr. Kosman cannot conceive of the ABSURDITY of these institutions have proprietary positions in the TRILLIONS and thought it was a typo?

And finally, Mr. Kosman reported the derivatives holdings of J.P. Morgan and Goldman Sachs at the Commercial Bank level while citing “a source” close to Goldman who seemingly had knowledge of “larger positions” held at the Holding Company level. Once again, if Mr. Kosman had actually read the OCC Report, he would not have needed to obtain such information from “sources close to Goldman” – he would have spotted the aggregate derivatives reported at the Holding Company level in the same OCC Report on the very next page [Pg. 23]:

source: OCC Quarterly Derivatives Report Pg. 23

Putting aside the notion that Mr. Kosman “missed” the larger point that we actually get some visibility on the constituent parts of the derivatives reported at the Commercial Bank Level and we get ABSOLUTELY ZERO breakout on the TRILLIONS of AGGREGATES presented as a lump-sum at the Holding Company Level - I bring all of this up for another very good reason which seems to have escaped our beloved Mr. Kosman: Namely, the ABSURD amounts of derivatives these financial behemoths are swinging around – absent ANY OBSERVABLE END USERS – are CLEARLY being used for the expressed purpose of controlling / rigging Interest Rates, Currencies as well as Metals and other Commodities Prices – for the simple reason that THERE’S NOTHING ELSE THAT IT COULD BE.

The ABSURDITY of it all is so very clearly demonstrated in Mr. Kosman’s inability to grapple with the scope of the numbers in front of his own eyes – tens and hundreds of TRILLIONS not BILLIONS.

Subscribe here.

Rob Kirby

-- Posted Wednesday, 30 December 2009 | Digg This Article | Source: GoldSeek.com

| Source: GoldSeek.com