-- Posted Monday, 25 April 2011 | | Source: GoldSeek.com

By Scott Silva

Editor, The Gold Speculator

It the price of gold too high? Or gasoline? Are high commodity prices unfair? Are high prices the result of greedy speculation and market manipulation and therefore, unjust?

Many, particularly in government think so, and have set out once again to get to the bottom of market manipulation and criminal speculation. Thursday the president ordered the Department of Justice to investigate price gouging in retail gasoline sales now that the price of gasoline has topped $4.00/gal in many states. In January, the Commodities Futures Trading Commission

(CFCT) put forward new rules aimed at reining in “runaway speculation” in the commodities markets.

Is there a case for government control of commodity prices in the name of justice? What is the just price of a good or service? What does that mean for the current bull market in gold, silver and commodities in general?

Historically, market prices have been considered to include a moral component. One might think the Bible might define the concept of just price, but it does not directly. Although the term “just price” does not appear in Scripture, “just measure” and “just balance” appear several times. The Book of Proverbs states that "a false balance is abomination to the Lord: but a just weight is his delight." It follows that commerce is moral or just absent fraud or deceit in transactions.

But commerce has not always been considered a pious activity, even when conducted honestly.

Plato saw man’s role as subservient to the greater welfare of the collective. Aristotle distained commerce, money-making and especially retail trade, because his concept of fair exchange centered on utility rather than the accumulation of money. The ancient Athenian government set grain prices under law at a level it thought to be just, which inevitably led to severe grain shortages. But the shortages created by the price control laws also created a thriving black market for grains, which ultimately saved thousands from starvation.

Under Roman law, prices were generally determined by the interaction of buyers and sellers. Under the Justinian Code, laissez-faire in transactions was the norm; buyer and seller each expected to buy cheap and sell dear. But there were limits; it was considered immoral to buy and sell for gain, to speculate, or to buy goods to sell for profit without improvements, or sell an item at a higher price for a credit transaction, which implied usury. In AD 301, Diocletian, in an effort to curb inflation, fixed by edict the maximum sales price of beef, grain, eggs, clothing and other articles and prescribed the death penalty for anyone who sold items above the fixed maximum.

As a result, producers quit bringing goods to market, opting instead to supply the black market, which flourished despite the risk of the death penalty. The Edict was later abandoned.

The early Church Fathers saw commerce to be the result of greed. The assumption was all commercial activities involved immoral means. One party's gain in a transaction was thought to only be achieved unfairly by another party's loss. These ideas continued into the Middle Ages.

The concept of the just price is most often attributed to the medieval Roman Catholic philosopher and theologian Thomas Aquinas. In his Summa Theologica, Aquinas discusses the concept of the just price in his "Treatise on Prudence and Justice" called "Of Cheating, Which Is Committed in Buying and Selling."

According to Aquinas, trading is cheating, and therefore a sin. The just price is that price that covers the cost of production and market expenses and allows the producer to maintain his social status. In Aquinas’ view, traders and speculators produce nothing, therefore they cannot profit morally from trading goods or services.

But there is a more enlightened view of just price that accounts for not only the cost of production but also compensation for labor and risk incurred, or the labor theory of value as put forward by Locke, Smith, Ricardo, and Marx. We can see clearly from his arguments, Aquinas fails to recognize the economic value of labor and specialization in day-to-day commerce.

Thanks to Adam Smith, today many have come to know that the invisible hand of the market and the forces of self-interest, competition and supply and demand drive prices and economic activity. Some believe the invisible hand to be a secular force; others see the hand of God in the marketplace.

So what about the recent prices of commodities, in particular gasoline and gold? Are their current prices just? I say yes, and here’s why.

The price of retail gasoline is primarily based on the price of oil, the price of which is based on supply and demand. The market price for oil is high now because buyers fear supply disruptions due to popular revolts in several oil producing countries. Right now there are more buyers than sellers of oil, so prices have been bidding up. Last week, Saudi Arabia cut oil production 800,000 bbl/day, which likely will keep prices high. And demand for oil by China and India is growing along with their economies. China and India will require 8.5 million bbl/day more oil by next year. Should anyone expect prices to fall with growing demand and lower supply? The demand curve doesn’t slope that way. Market prices that accurately reflect supply and demand are just.

But some say it is unjust to buy a futures contract for $108/bbl expecting the price to be higher in three months. Speculators are vilified for “greedily bidding up the price of oil, which has led to $4.00/gal gas”. But there are speculators that have shorted oil, too. And if price controls for oil are implemented in the US today, traders would simply move to other markets to trade. The oil market is global.

Recently a US Senator proposed that the commodities markets such as the CME require 50% margin to trade futures contracts. He reasoned that the additional capital requirement would limit the number of open contacts held by speculators. But changing margin requirements has had little effect on open interest volume in the past. The CFTC adopted position limits on 28 commodity futures and option contracts on exempt and agricultural commodities. It is not clear that position limits will have its intended effect.

Anti-gouging legislation has proved equally ineffective. The federal government can prosecute companies and people for price fixing, that is, conspiring with each other to raise prices, but not for price-gouging. Many states have anti-gouging statutes, but few complaints ever result in charges, fines or trials. Cases are hard to prove, since most businesses tend to raise prices for items important to people. Today’s concern is not new. In 2005 Hurricane Katrina knocked out about 95 percent of oil production in the Gulf; refineries there produce about 25% of US domestic consumption. Gasoline prices spiked 40% to reach just over $3.00/ gal. Government anti-gouging rhetoric filled the media. $3.00/gal gas sounds like a bargain today!

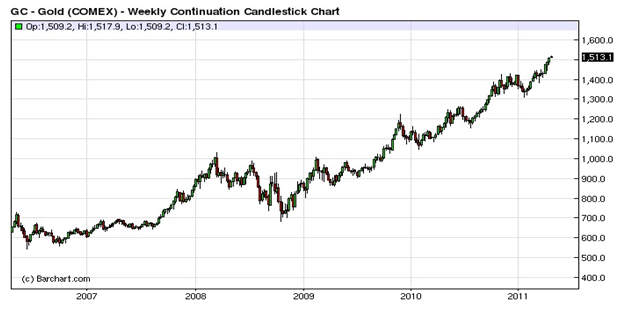

Like oil, gold prices have climbed to new highs over the last several years. Unlike oil, the price of gold is driven primarily by investment demand. Investors are attracted to gold for its intrinsic value and its ability to insure against instability and protect against risk. Since 2009, gold prices have climbed 209%

What price is the just price for gold? The market price at any given time is the just price, because that is the price agreed to by buyer and seller. In the exchange, each party enters into a just bargain; otherwise the trade is not made. For gold, the price includes a risk premium for economic uncertainty, political unrest, war, inflation and the debasement of fiat currencies. The price of gold captures precisely the future outlook without the baggage of earnings-per-share, book value or any other accounting measure of worth. Gold has proved to be an excellent investment for the investor and the speculator for the last several years, and it will continue to preserve wealth for individuals who own gold.

Investors from around the world benefit from timely market analysis on gold and silver and portfolio recommendations contained in The Gold Speculator investment newsletter, which is based on the principles of free markets, private property, sound money and Austrian School economics.

- Scott Silva

Editor, The Gold Speculator