|

-- Posted Thursday, 30 August 2007 | Digg This Article | Source: GoldSeek.com | Source: GoldSeek.com

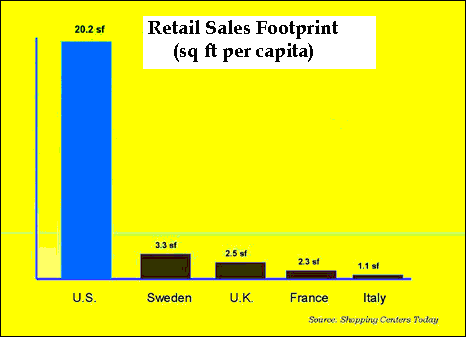

Home: Golden Jackass website Subscribe: Hat Trick Letter Jim Willie CB, editor of the “HAT TRICK LETTER” Use the above link to subscribe to the paid research reports, which include coverage of several smallcap companies positioned to rise during the ongoing panicky attempt to sustain an unsustainable system burdened by numerous imbalances aggravated by global village forces. An historically unprecedented mess has been created by compromised central bankers and inept economic advisors, whose interference has irreversibly altered and damaged the world financial system. Analysis features Gold, Crude Oil, USDollar, Treasury bonds, and inter-market dynamics with the US Economy and US Federal Reserve monetary policy. TRIBUTE TO KURT RICHEBACHER. He was a valued colleague and an inspiration to my newsletter. Our week together in Cannes will forever be etched in my memory. Amusement is my response when other writers call me or my work ‘extremist’ as Claude Cormier recently has. He is a topnotch analyst out of Quebec, whose work is respected and admired. He himself cites extreme events, like comparisons between the United States and Argentina, in the decimation of the middle class amidst prolific inflation and financial sector foul play. Labels are not kind, but my job is to analyze the extreme situation on a host of fronts. To be honest, the label is taken here as an extreme compliment, since it means my perceptions are squarely on target. Additional extreme observations can be detailed, which points to systemic breakdown. The US financial system shows signs of failure, the USEconomy suffering deeply in association. If one were to list the extreme events and factors in the last few years, reaching a climax nowadays, the recitation would flow over into several dozen pages. As an important US holiday approaches (Labor Day), a reflection is in order of the extremely dangerous footing we find our nation in, and the predicament that a nation of laborers finds itself in. Workers find their situation extremely tenuous, especially in light of the corporate sell-out of the American worker in favor of Asians, aided by USGovt incentives and Wall Street cheers. Our workers became accustomed to the betrayal during the 1980 decade with the Pacific Rim powered by the Asian Tigers. Why cannot economists see that a decade of Vietnam War inflation, a Johnson-Kennedy Guns & Butter agenda, and USDollar benefit from high Volcker interest rates (leading to Plaza Accord to bring down the US$), resulted in a colossal cost to the US Middle Class and workers??? They took more blows with the 1990 NAFTA betrayal, as Mexican assembly plants cropped up across the border. The current Chinese and Indian outsource movement is yet another betrayal to the American worker. Outsource the job, enjoy the lower cost to the corporate profit margin, and send the US employees into the street, especially if they are near retirement with pensions. Let us all celebrate Labor Day, marred by a skein of betrayals. What is needed is a national program to put Americans to work. Instead, we fight an endless winless war abroad, in support of private syndicates who profit heavily. How about a national mandate and high priority initiative to rebuild the US bridges, access roads to major cities, tunnels, railroads, sewer pipes, water pipes, natural gas pipes, crude oil pipes, airports, and port facilities? And yes, forbid Halliburton and other connected crooks to participate in any and all bidding? FDRoosevelt initiated numerous plans. Why not now? High speed trains are common in France, Germany, and Japan, soon to China. The US lags badly. In fact, one can conclude that the US is morphing into a bizarre Third World nation with a powerful military and a banking system well equipped to abuse the power extended from printing unbacked money marked as the world reserve currency. Reflection at holiday time brings front and center thoughts of how insistence on placing the Iron Triangle (Pentagon, Defense firms, Lobby firms) in the catbird seat has contributed mightily to the weakening of the USEconomy, the undermine of the American worker, and slow bleed of the US Middle Class. That portion of the federal budget receives almost no debate, no accountability, no prosecution for fraud. WAGES & PENSION DESTRUCTION In the last 30 years, the inflation adjusted wage per adult has fallen by 30% to 35%, inflicting great hardship on the family structure. A household needs to enjoin three wage earners, but such is impractical since most offspring are reckless spenders, not effective workers, and since Uncle Charlie (as in the television show My Three Sons) do not fit the mold anymore. It is next to impossible to put one’s savings to work without engaging in high jinks gambling. Entire pension funds were killed in the 2000 stock bust. Outside of TIAA-CREF, where academic and many institutional pensions are managed, some hefty losses were inflicted. The advent of 1% official Treasury yields enticed many pension managers to take risks which are biting deeply into future retirement income. This all seems wicked and extreme. In fact, the details of the entire national financial and economic landscape seem like out of a futuristic science fiction novel with little basis in sanity. The incredible part of the story seems to be that few smart folks cite the extreme nature of it all. The US financial system, the USEconomy, the global economy, the US$-based banking system, they are all on the brink. Asset-backed bonds have nuked the banking industry. The housing decline puts the USEconomy at grave risk. The global economy leaves Asians and Persian Gulf nations owning enough US$-based debt so as to jeopardize US sovereignty. Call me an extremist. If others do not see the extreme precariousness of the situation, they are compromised, unaware, sleepy, or corrupted. FRAUDULENT STATISTICS AS BASE The 2000 tech telecom stock bust provided an earthquake across both the financial sector and the general economy. An official recession was admitted and acknowledged, late. That means Gross Domestic Product growth fell below minus 5%, since the USGovt gimmicks build in exaggeration by over 4% at least. That fact alone sounds extreme, especially in view of additional distortions, like the Consumer Price Index claimed at 3% when it runs closer to 11%. Extreme gimmicks remove rising components. And then the unemployment rate is claimed at 4% to 5%, when in reality it is more like 9% when those without jobs are counted, using data released by the same spin doctors at the Bureau of Labor Statistics. Productivity would be negative if not for the same gimmicks on hedonic adjustments which assist the GDP. They got caught with bogus statistics last summer, on the relationship between productivity and import prices. You cannot import productivity! Distortions in the compass readings are skewed to the extreme, to such a degree that monetary and economic policy cannot remotely be adequate in response to current conditions. The gulf between official statistics and reality seem extreme. UNFIXABLE UPSIDE DOWN ECONOMY In the wake of the great 2000 stock bust came another even greater extreme. In bizarre yet desperate fashion (hidden), the Greenspan Fed encouraged a housing bubble in order to save its own reputation. The USEconomy could not afford a recession, with all the inherent debt liquidation. So a myth of an Asset Driven Economy was promoted. That seems extreme for any central bank. Imagine proclaiming as healthy, valid, and with firm foundation an economic dependence on assets (housing & stocks) pushed higher by inflation!!! A strong economy would rely upon business investment, production, income growth, and sensible spending, not the lunatic retail mania that we find the USEconomy dependent upon. Almost 30% of all new jobs created since 2002 have been tied to the housing construction bubble. Some call it a boom, but in my view just another absurd bubble. Imagine instilling a dependence for economic growth on a non-producing asset like a house, instead of a manufacturing plant where value can be added with intellectual capital and jobs created. That is a cockeyed extreme. Imagine the extreme structural imbalance of having 70% of the USEconomy derived from consumption, led by retail. Here a graph displays the extreme clutter of retail chains within the US landscape. This 7-fold greater retail footprint of the US consumption over European footprints is absurd. This is a ridiculous extreme.

INDICATORS & PRIORITIES Then we saw a stock market reach new nominal highs, set records, as an economic boom is heralded. All pure extreme nonsense, since the USDollar fell by roughly the same 15% to 20% as the stock market indexes rose. Hence, purchasing power of one Dow share or one S&P500 share has been preserved. That is a wash, not a boom. One might even ask why the S&P stock index is part of the US-based Leading Economic Indicators, when over 30% of profit from such firms is derived from outside the USEconomy. The recent Cisco Systems quarterly report highlighted this effect, strong business abroad, weak at home. The US Federal Reserve in the meantime has made official statements incessantly referring to their fears of price inflation, when what they really mean is the USDollar might fall to such low levels that imported price inflation would threaten the entire USEconomy. They fear a backlash from exported inflation, soon importing it! So the USFed cannot talk about the US$ currency exchange rate directly, yet its policy can easily cause a rout on the USDollar with all its price inflation consequences. That puts the USFed in an extreme box. MUSICAL CHAIRS & HOT POTATOS The aftermaths of extremely incompetent economic guidance and planning, combined with irresponsible heretical banking policy, have led to an utterly unfixable housing crisis and mortgage finance debacle. This mess has years for dust to clear! The entire non-government bond market has fallen into a situation difficult to adequately describe. How about comparisons to a human body suffering from seizures from bubbles in its arteries (from inflation of assets, then deflation) but also beset by constipation from fraudulent asset-backed bonds (like mortgages and associated leveraged CDO bond derivatives)? Sounds about right, but again, quite an extreme situation. With the threat to money market funds, whether insured or not, the entire banking system seems to be at risk of proper function. Musical chairs come to mind, which demand players to find a seat when the music (credit flow) stops. Hot potato comes to mind, much like the Drexel Burnham plight, which demands players not to hold the acidic worthless bonds. My claim is that all subprime mortgage bonds are worth under 25 cents of par value, and ALL Collateralized Debt Obligations with dominant subprime mortgage bonds are totally worthless (as in 100% loss). Actually, the CDO bond losses are much greater than 100%, sure to bite deeply into the value of other assets of good value, like gold and crude oil contracts. To me, the banking situation is on the ropes, an extremely dire picture. WALL STREET JUNK With most Wall Street firms facing junk bond status downgrades according to Credit Default Swaps on their corporate debt, yet enjoying wonderful investment grade debt ratings, we have more extreme corruption in the banker brokerage system. Conversations with foreign analysts strongly indicate a global perception of institutionalized fraud and dishonesty in the US financial sector. In my view it spans almost its entire spectrum. No, not all corporations engage in fraud. But every suite in the US financial sector house contains prevalent fraud. This is utterly extreme, but not surprisingly, as a consequence to the Green Light given to deceit and swindle with the USDollar no longer backed by gold. The end of a fiat currency game is replete with extremes. Gigantic bailouts are part and parcel of the extreme resolutions. GIANT VEILED BAILOUT The size of the mess, from housing and mortgage bond bubbles, is an order of magnitude larger than the lunatic LongTerm Capital Mgmt mess in 1999. Expect a larger bailout, especially since it is denied vigorously. Worse this time though, since confusion will abound. Questions remain unanswered. Did the USFed accept mortgage bonds offered only by Wall Street firms? Or only major banks? Major banks seem listed as big beneficiaries so far. Was the injection of $30 odd billion of funny money, otherwise called counterfeit funds in private sectors, a secret Wall Street bond bailout disguised poorly? Methinks yes. This seems extreme. GLOBALIZATION BACKFIRE

The global economy seems like a rubber band stretched far past its specifications for usage. Labor arbitrage sends jobs to Asia. In return they own vast tracts of US$-based debt securities. The US workers lose their jobs in droves. A giant step backward has taken place on product safety and quality. The end game seems to be trade sanctions, scuffles over currency manipulation, blame game, market ambushes, and lost sovereignty. Globalization sounds good, but in practice it results in dislocation, conflict, and chaos, more extremes. RAMPANT DENIALS OF REALITY Denials have been so broadly uttered by banking and economic and financial market leaders, that your heads should spin. It becomes easier to make sense if you conclude that every denial is wrong, and the louder the denial, the more serious the effect. Now Premier Bank in the Kansas City area is on the ropes, a Fed Reserve Bank. Like with a drunk, why ask if Uncle Jack is a drunk, if his behavior and life does not scream of alcoholism? Contagion of subprime mortgages to other debt securities is evident. Spillover to the real economy is evident, but not total, yet. Borrowing for consumption is impossible anymore. The housing recovery is a mirage. Housing sales and prices are nowhere near the bottom, as July existing home inventory shot up to 9.6 months supply! The denials form an Orwellian backdrop where the system intends to deceive, to lie, and to misguide, so as to retain power and to keep the Middle Class impoverishment process intact. What is missing is the recognition that past denials of important concepts have almost all been incorrect. No learning seems to result in Wall Street, just ongoing compromise and deception. MERGER OF STATE & CORPORATION The diabolic yet accepted merger of state and corporate interests is preached as something beneficial, a movement to keep America strong, to meet foreign competition and even aggression. Nonsense! The merger invites fraud and extreme profiteering, if not roll the carpet to a totalitarian state. What extreme drivel. My experiment has resulted in one person out of 30 adequately citing what fascism is!!! The merger, called the Mussolini Fascist Business Model, is the penultimate in inefficiency and the ultimate framework for colossal theft with near zero prosecution. The Goldman Sachs reduction from 9% to 2% in the gasoline weight of the GSCI commodity index serves as best understandable evidence of such fraud. Did GoldSax short the gasoline futures before the decision to cut the weight by 7%? Of course, since if not, people would lose their jobs for a missed opportunity to profit. LATEST DENIALS ON RECESSION The permitted aristocratic fleecing inside financial markets is unspeakable, and surely extreme. The latest denials have been reformulated into key questions. IS THE USECONOMY HEADING INTO RECESSION ??? IS THE US FEDERAL RESERVE GROSSLY OUT OF TOUCH ??? The answers in my opinion are YES and YES. The USEconomy is furiously addicted to easy credit, which has been curtailed. The home equity easy access wellspring has run dry. What an easy call recession is! Look for more extreme statistical distortion to prevent an official admission of recession. New infusions of liquidity will in all likelihood assist the friends of the powerful groups, not the rank & file, not the run of the mill banks. Recent USFed injections went to the major banks, almost without exception. The US Federal Reserve is led by a university professor who has never run a business, never managed a financial account, never even worked in either, let alone worked in the private sector, but did serve as an apprentice on the Fed Board itself. Such does not instill confidence or adequately prepare for the job of leading the US Politburo of central planner look-alikes. Fortunately, his endless drivel about ‘inflation expectations’ has ended. Reality will pull him at his leg, maybe the short arm. NATIONALISM & FEAR Then we have a mania of fear and political fixation on terrorism. In my estimation, the USGovt, the USMilitary, and the shadowy groups who bear alphabet soup on unmarked lapels instill 1000 times as much fear in my life as any Moslem lunatic in a faraway land. When a youngster with a relatively undeveloped brain, it was an easy call for me to conclude the Warren Commission was a whitewash in the wake of the JFKennedy assassination. One can learn of unnatural deaths, with some investigation, for all who stood on the Dallas Grassy Knoll. A similar whitewash is my conclusion for the 911 Commission in the wake of the World Trade Center attack. A scad of 30-year Treasury Bonds issued before the 1971 departure from gold-backed USDollars were stored in the WTC vaults. And a scad of financial records pertaining to the JPMorgan & Enron case were stored in the third building. A scad of engineering professors have challenged the official reports, citing mere laws of physics. Are such engineers enemies of the state? The Nazis developed what was called Reich Physics back in their day, so that science would salute the fascist regime. Other scientific disciplines followed suit. Even Robert Fisk casts much doubt on the truth beyond the 911 events in The UK Independent editorial dated 25 August 2007. He is their Middle East correspondent. He outlines numerous questionable facts and seeming contradictions. My view is simpler. A syndicate took control of the White House since 1982, marred by a certain event, which pursues a secret agenda and a clandestine business. Enough. When Habeas Corpus is suspended, when internment camps are completed on US soil, when torture is debated as justified, when pre-emptive attack is debated as justified, when confiscation of personal assets can be ordered in response to obstruction of a war whose cause was mostly faked, when unchecked executive decrees flow like a river, my fears are mainly directed within the 50 states and their federal commandants. This is an extreme situation leading potentially to a veiled military dictatorship. All precedent points to the Fascist Business Model leading in parallel to a fascist government regime. A lot of effort is going into this unpublicized plan, probably not an idle exercise. It seems extreme. INSTITUTIONAL DISTRUST The degree of public trust in US institutions is at rock bottom. The level of foreign distrust has never been greater, which likely will result in continued vengeance taken against both the USDollar and its traded vehicle the USTreasury Bond. That retribution could turn extreme. Over 70% of Americans do not trust their own Congress, the representatives who sit in their stead. They seem grotesquely compromised, bought and paid. The 2006 midterm election mandate by the people has been ignored. The war commission report and its recommendations have been ignored. Over 70% of Americans do not trust their own Military to accurately and honestly report the status of the Iraqi War. Probably a higher proportion of Americans regard Wall Street as liars, parasites, con men, and fraud artists. The entire nation appears at extreme crossroads. As though the Untied States were not in enough trouble with systemic tremors, take a look south of the border for an even bigger nightmare unfolding. It is sure to spill over into the US back yard. RISING DISTRESS SOUTH OF THE BORDER South of the border is Mexico, whose fiscal wagon is quietly and dangerously careening down a hill, most assuredly over a precipice. This would constitute another extreme development. The decline of their giant oil field Cantarell, combined with the mismanagement of their PEMEX national oil industry, hampered by their corrupt powerful labor union, stymied by their compromised Parliament, these guarantee a monstrous fiscal problem in Mexico. The reduction in their FOREX trade surplus accelerates from greater gasoline import, a whiplash factor. This story has so far eluded the sleepy lapdog press, but not the oil industry. This story was covered in the August Hat Trick Letter in greater depth. My forecast is for Mexico to disintegrate into a failed state within two years, owing to its lost FOREX trade surplus and utter breakdown of law and order. Mexico City soon will be forced to turn to desperate measures. The Mexican Peso tumbled in July, and has continued lower in August. The financial conditions behind their FOREX revenues from their energy account are being revealed. The MexPeso has fallen from 9.25 to the 9.0 level, well below its 50-day moving average, without recovery. As the USDollar falters against the euro currency, the MexPeso does also. So the MexPeso has faltered even worse relative to world currencies. European exports rise in price to Mexicans. Currency markets sense trouble. The Mexican economy suffers from a significant decline in cash transfers (remittances) from workers in the US sending money home to families. This was addressed in my work as evidence of lost home construction jobs. The volume of money involved in remittances exceeds the total foreign direct investment in Mexico, an alarming data point, so not a small sum. This cramps consumer spending and small business investment, and leads to wider poverty. Count that as another contagion from the US housing crisis, of course denied.

The situation in Mexico continues to deteriorate. As their nation falls further into outright chaos, three key questions arise: 1) What happens to the reliable supply of crude oil to the United States, even as Cantarell sees further decline? 2) What happens to the plans for implementation of the North American Alliance, the economic merger of the US, Canada, and Mexico? 3) What happens to foreign mining rights to Mexican properties, under possible threat of confiscation or hiked royalty demands? These are central questions addressed in the August Hat Trick Letter report. Violence has spread widely across Mexico, including murders of police officials in the northern regions. Even judges and foreign press reporters have been threatened. A splinter group from the Peoples Revolutionary Army claimed responsibility for the July 10th oil pipeline explosions in Guanajuato and Queretaro states. Other pipelines have been threatened. Armed battles in small city streets have erupted, without report in the debilitated compromised US media networks. Rival drug lords are engaged in three-way battles with the Mex Govt. A failed nation state is the likely outcome south of the US border. Such a failure has numerous criteria. Energy network attacks, growing poverty and inequality, inadequate government services, growing power of organized crime, corruption & desertion of police forces, assassination of judges and officials without consequences, and growing farmer bankruptcy are contributing to a failed system in Mexico. Needs of people, upheld laws, tax structures, allegiance to authority, and sense of urgency all seem to be in breakdown mode. The division between rich and poor is stark, and growing worse. Their tycoon Carlos Slim has accumulated three times the wealth that Rockefeller did a century ago, relative to respective national economy size. The failed state of Mexico will be evident from the top down, with origin the financial deterioration of its federal government. Gigantic federal deficits will be the next major story coming from Mexico, with associated disruption and chaos. UGLY DETAILS ON MEXICAN OIL INDUSTRY The supply of crude oil to the United States is substantial from Mexico, behind only Saudi Arabia and Canada. The Mexican energy picture is deteriorating. The elephant oil field Cantarell is in an established 15% annual decline, offset by inadequate expansion elsewhere. Some details are provided by the Mexico City business journal El Financiero. Current oil output is at 3.624 million barrels per day. Gasoline production follows the trend of oil production, with output down 56.4% at PEMEX refineries to 463.2 thousand bbl/day. The shocking data point here is that their gasoline imports rose by 92.1% in June, versus last June 2006. No new gasoline refinery has been built in Mexico in over 20 years, not as bad as in the US, where no new refinery has been built in 35 years. The net financial impact is that Mexico earned $34.7 billion in FOREX reserves in 2006 from oil export, but of that, $10 billion was spent on gasoline import, or 29% of the gain. The great boon from oil discovery in the 1970 decade is coming to an end. Their oil exports in the first half of 2007 stood at 1.718 million bbl/day. That compares to 1.907 mb/day in 1H2006, or 10% less. The decline is amplified by greater gasoline imports. The saving grace is the 40% reduction in natural gas imports. The Mexican trade surplus from energy is vanishing. Analysts expect it to be gone by 2011. My forecast is sooner, due to disruption and a breakdown of order. The effect on their national politics will be severe, causing a failure of state, with a broad internal breakdown of order. THE IMBALANCED ALLIANCE The North American Alliance is intended (without debate, analysis, or vote) to share US bank sector might, broad technology expertise, pharmaceutical depth, augmented by military prowess WITH Canadian energy supply and mineral wealth WITH Mexican cheap labor, energy supply and mineral wealth, and a bonus of new port facilities. The hidden component is the supply of Mexican soldiers to fight in the US war machine. See data. The Alliance increasingly looks like having one horse (Canadian Dollar) pulling the FOREX stagecoach, with two lame horses from the United States and Mexico. Perhaps the US horse will be an image from a printing press that nobody will notice! The prospects for mining rights and constant royalties remain in debate, an uncertainty. Some conjecture and speculation is given in my August report.

THE HAT TRICK LETTER PROFITS IN THE CURRENT CRISIS. From subscribers and readers: “IMO you are one of the best writers that we have, Jim, and Grrrrrrrreat DOES apply. You are just a little short on email etiquette.” (Barb Moriarty of 321Gold in Grand Cayman) “I want to congratulate you and thank you for your quick and frankly stated revision on bonds [the 4.0% forecast]. That was my thinking all along, but I must say that your writing was and continues to be a most valuable input to my thinking in the first place. That type of integrity makes me value your opinion all the more and is likely to keep me as a loyal subscriber for years to come.” (ScottD in Pennsylvania) “I believe your wit and disgust at the state of affairs stand untouched.” (Charlie P in Virginia) “I am currently subscribed to over 60 paid newsletters. Your analysis is by far the most accurate every time. The most impressive characteristic of your thought processes is your ability to think in multi-factorial terms. You are one of the few remaining intellectuals with such capacity intact.” (Gabriel R in Mexico)

Jim Willie CB is a statistical analyst in marketing research and retail forecasting. He holds a PhD in Statistics. His career has stretched over 25 years. He aspires to thrive in the financial editor world, unencumbered by the limitations of economic credentials. Visit his free website to find articles from topflight authors at www.GoldenJackass.com . For personal questions about subscriptions, contact him at JimWillieCB@aol.com

-- Posted Thursday, 30 August 2007 | Digg This Article | Source: GoldSeek.com | Source: GoldSeek.com

Previous Articles by Jim Willie CB

|