-- Posted Thursday, 9 October 2008 | Digg This Article | Source: GoldSeek.com

| Source: GoldSeek.com

By Jim Willie CB

home: Golden Jackass website

subscribe: Hat Trick Letter

Jim Willie CB, editor of the “HAT TRICK LETTER”

Use the above link to subscribe to the paid research reports, which include coverage of several smallcap companies positioned to rise during the ongoing panicky attempt to sustain an unsustainable system burdened by numerous imbalances aggravated by global village forces. An historically unprecedented mess has been created by compromised central bankers and inept economic advisors, whose interference has irreversibly altered and damaged the world financial system, urgently pushed after the removed anchor of money to gold. Analysis features Gold, Crude Oil, USDollar, Treasury bonds, and inter-market dynamics with the US Economy and US Federal Reserve monetary policy.

Pardon the jumpy style, not burdened by depth, preferring breadth instead. The events of the last few days continue to be remarkable, alarming, chaotic, surreal, and desperate. The globe is slowly realizing that the United States is careening toward a probable financial death experience. Nothing has worked to date, and nothing will work in the present, not bailouts, not liquidations, not nationalizations, not papered over fraud, and surely rate cuts. The stark reality contains a blur of a massive locomotive derailed, having run over the mountain ledge, heading downward in a freefall, subjected to the force of gravity, and ripping through a gigantic erected paper net designed to halt its crash. CLOWNS IN CHARGE DO NOT REALIZE THE SYSTEM IS FLAWED AND BROKEN, AS EFFORTS TO REDOUBLE THE DEVICES ARE ALL DRAWN FROM THE SAME DEFECTIVE TOOLBAG. MAJOR BANK FAILURES, BANKRUPTCIES OF MAJOR FINANCIAL FIRMS (LIKE INSURANCE), AND INDIVIDUAL MARKET DEFAULTS COME VERY SOON. Incredible events are occurring behind the scenes, the details of which would shock most people, even those who deal with the underworld. Recall Wall Street propaganda this summer? That the US will be first to emerge from the carnage? Such lunatic promotional nonsense should be recalled when it becomes clear that the Untied States cannot emerge from its broken condition. The game is over, and only the enlightened realize it! What lies ahead is the tragedy of distintegration!!! That includes the nation and its very governmental structure.

GLOBAL RATE CUT: The USFed turned down a chance to cut a couple weeks ago, thinking it would look weak. Now they look desperate. Surely, to defend the USDollar, they wanted coordinated rate cuts, but gold will respond the most. The Dow futures were down 280 points before the coordinated interest rate cut was announced on Wednesday. The USFed, Bank of Canada, Bank of England, Euro Central Bank, Swiss National Bank, and Sveriges Riksbank (Sweden) all announced an official interest rate cut. Yesterday, the Reserve Bank of Australia cut by a full 100 basis points. Hong Kong is considering its own cut also. When the New York City fraudulent rigged bazaar known as the stock market opened, the Dow was suddenly down 220 points, then rallied to plus 180 points, and seemed like it could not do anything but head down, closing down 189 points. What a loud repudiation of a fleeting solution! The rate cut might have some impact on mortgage loans, almost nothing more. The S&P500 index lies below its 200-week moving average, the ultra-longterm series, which was penetrated on the downside last June, the first time in 26 years. Talk about a bear signal!!! On any day in the past twenty years, a 50 basis point rate cut would enable a complete turnaround in the stock market for months on end. What a shock. Banks are insolvent, distrust each other, as the economies are sliding into a quagmire! A great quote came from sage Rick Santelli from CNBC, who said “The Fed rate cut is like shooting arrows at an enemy that is 20 miles away.” He can speak freely only half the time.

GOLD DEFAULT DEAD AHEAD: The COMEX and London Metal Exchange are living on borrowed time in their corrupt gold game. They sell paper gold, and precious little actual gold metal. See a refreshing straightforward interview aired on CNBC of all places (click here). It is by Jurg Kiener, CEO of Swiss Asia Capital. He points out the dual market for gold, one paper and one metal. He expects soon the US ‘gambling price’ gold market in COMEX and LME to default. By that he means a return suddenly to physical price determination. He is quoted to say THE GOLD PRICE WOULD DOUBLE VERY QUICKLY, LIKE IN DAYS AFTER THE EXPECTED METAL DEFAULT. One should expect the interview to be lifted and removed from their website within days, after they realize the explosive nature of his words.

THE FAVORABLE DISCONNECT: In August, my analysis pointed out that a disconnect was necessary for the gold price to rise independently of the USDollar. Gold is no longer just an anti-US$ trade, but rather a trade on global monetary inflation. With today’s virtual global rate cut, one can herald the transition as complete. Notice how since mid-September, the gold price has risen with the USDollar DX index, shown in the big green ellipse. Liquidations and monetizations will go hand in hand, once properly understood. Gold has begun to respond to anticipated extreme new US$ money supply growth and supply needs.

USDOLLAR RALLY AS SIGNAL OF DEATH: Few seem to comprehend that the USDollar is rallying recently as a result of the imminent death of itself and the USTreasury Bond. A vast liquidation is underway of speculative trades, and of US bank assets. For years many analysts properly understood that the USEconomy is debt dependent. Now credit is drying up, and being denied even to good credit risk customers. The USEconomy is falling off the cliff, and evidence mounts. See car sales in September, down almost 30% by Toyota, down 34% by Ford. Layoffs by the tens of thousands are next, right down the vertically integrated car industry layers. As the USEconomy and US bank system continues in death spiral, the USDollar rallies, during unspeakable ruin to US fundamentals. Recall that the tide went out along the shores in Indonesia and Thailand right before the great tsunami hit almost three years ago. Ditto here! The banking crisis and extreme distress that remains stubbornly unfixable in the Untied States urgently motivates foreigners to quickly assemble, implement, and announce a replacement world currency basket. Watch for a euro currency split soon, where Nordic version will compete viciously against the dead USDollar.

HUGE RISK OF LOSING WORLD RESERVE CURRENCY: As preface, the world banking structure rests atop a world currency foundation denominated in USDollars, with USTreasury Bonds and USAgency Mortgage Bonds serving the primary role as financial instruments. These toxic building blocks are all really bad lego blocks. Foreigners must respond very soon, to replace the US$ as global reserve currency, or else risk a similar implosion to their banking systems. Many USAgency Bonds have been replaced by USTBonds, not much of an upgrade. If the USTreasurys soon suffer in the heart attack seizures underway, foreign economies will be at risk of serious deterioration. So foreigners are working toward a solution. One might be announced soon, with a new world reserve basket announced, based upon the Euro, Russian ruble, Japanese yen, and newly crowned Gulf dinar. The common theme is these are all currencies from nations boasting export surplus. They are taking action, but behind the scenes, like in Berlin. The consequence to the USEconomy is dire. The beleaguered nation would be forced to attract foreign capital, and bid up foreign currencies in order to purchase crude oil. The word inflation would soon be replaced in the press networks with the word “hyper-inflation” as the Untied States enters the Third World overnight. It seems that the vast majority will be caught blindsided. Not the Hat Trick Letter!

THREATENED FRANCHISE OF CENTRAL BANKS: The other big powerful underlying failure in progress is of the central bank concept, and its many franchises. They essentially install central planning, Soviet Politburo style, complete with failure. The central bankers around the globe must be panicking over their common failure. They have one thing in common, overarching above trade surpluses or deficits. That common trait is they all manage debt from a fiat currency, and extend credit to inflate. They acted in coordinated style today for the first time in their history. Call it a panic! Central bankers are all scared witless.

MURDER AS AN OPTION: In the last month, numerous emergency weekend meetings took place with work toward bailouts, mergers, recapitalization, slush fund grants, and government action. The deadlines struck me as odd, that they must resolve before Sunday night when Japanese markets opened. Why? Without any doubt, the Bank For Intl Settlements ordered the corrupt American $Trillion Conmen to clean up their banks, let some fail, merge others, and agree to bailouts using government money, just get it done! Without any doubt, creditors have been pulling the lines to Wall Street firms. The grapevine has provided some new juicy information. What option do defrauded banks, big financial firms, and big hedge fund firms have when they are victims of mega-fraud, when US regulatory bodies are in the Wall Street hip pocket, and when US law enforcement is more interested in sex charges for prosecutors than actual enforcement of laws on the books against fraud? THEY MIGHT THREATEN MURDER OF KEY EXECUTIVES BEHIND FRAUD IF NO MEANINGFUL RESTITUTION. That is what! The list of objects for murder threats might easily include a dozen Wall Street CEOs, CFOs, and their salesmen UFOs. Threats might even come from Sovereign Wealth Fund managers. One name cited was the Blackstone CEO, extended from Chinese losses. Be sure to know that any sudden death would be called a heart attack. You know? The type of heart attack that occurs after a bullet enters the cranium. Few tears would flow.

THE BIG LIE ON THE WALL STREET BAILOUT: The historic $700 billion Congressional bailout bill had some key added provisions over the failed House bill. The new funds can buy back bonds owned by foreign investors, like those defrauded in Europe and Asia. The American public was told that the US banking system would have blockage unclogged. BS! It was a congame again, after foreign investors demanded restitution immediately, or else! The US banks will remain clogged. When almost nothing is fixed concerning US internal bank distrust due to toxin floating around, people will eventually realize the US public just paid for Wall Street fraud of foreign financial firms. It might be even worse. Foreign firms can possibly package any kind of rubbish, toxin, or acid into a bond for US swap. No end to the fraud. Oh, lest one forget, the $700 billion is only 15% to 20% of what might ultimately be needed. The overall tally will be much larger, for total bailouts, nationalizations, FDIC refills, tax stimulus, and ongoing programs to rework mortgages. The people have been ignored so far.

EFFECT OF ABSENT SHORT-TERM CREDIT: Few seem yet to comprehend the depth of the risk to the USEconomy if short-term credit continues its vanishing act. Most realize when the US banks are insolvent and lend less, the USEconomy is assured a recession. They do not comprehend that when short-term credit is denied, the USEconomy disintegrates. Imagine a man whose bones are turned into mush, trying to walk. That is the economy with insolvent banks. The man becomes a body without a heart and blood circulation when short-term credit is absent. The commercial side requires it for supply of food, gasoline, housewares, hardware, building materials, and more. Imagine riots for toilet paper, let alone gasoline and food! The financial side requires it for supply of ATM cash, credit card usage, and even payroll income. A heart attack is not a proper analogy. More like a science fiction movie where the victim is vaporized, or is burned suddenly into a heap of plasma.

FUTILITY OF SOLUTIONS: Few pundits, analysts, Wall Street observers, and banking officials seem to comprehend that solutions are almost all flawed. Where is the motive to generate jobs for legitimate income, like infrastructure development or reversal of Asian job exodus??? Where is the connection between Asian investment since 2001, job creation there, and a delayed reaction of the complete destruction of US banks and more? Are they all stupid? Maybe not, but surely compromised, indoctrinated, and committed to a system whose foundation is built on shifting sands. Call it a corporate executive sellout of America. The solutions fail because they are all debt based, like with new USTreasury Bonds to finance bailouts, like with USTBonds in swaps to banks for cratered mortgage bonds, like with USTBonds to finance household stimulus packages, and with monetization to print money to finance whatever the idiots leave on the table on USTBond sales. The problems from debt collapse due to debt-related ills inside banks cannot be solved by more debt instruments, plain and simple. The solutions must, if they are legitimate, involve new income sources, like manufacturing returned to the US soil, like a national grand initiative for infrastructure betterment, like better agriculture management of ethanol solutions, like broader export successfully landing abroad from US firms. The dumbstruck fools running US bank policy are forced to resort to their own failed toolbag. How effective will lower interest rate be, if only another attraction to a debt device? Not much! And the failure to revive and resuscitate will shock the system very soon.

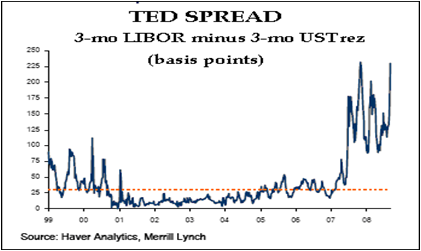

HEART ATTACK SYMPTOMS & CAUSES: To be sure, the LIBOR rates are not responding to supposed solutions, the TED (Treasury EuroDollar) spread remains wide, and the short-term USTreasury Bill yield hovers near zero. These are the symptoms of heart attack. Behind the bank lending constrictions, clogs, and refusals is lost faith, lost trust in borrowers, lost credible value in borrower collateral. The day will come soon when banks will be paid a yield to hold money outside the system, as in financial firms and corporate entities will actually pay the biggest banks and the USFed itself to hold money. See negative yield, which occurred for a brief spell in Japan a few years ago. The ultimate cause of the heart attack symptoms is the split in usury cost, never discussed. The root cause is that JPMorgan continues to push the cost of money down, using its strongarm futures contract devices, complete with more than a small amount of counterfeit additives bought in dark basement chambers. Such a low rate results in revolt among bankers, who refuse to lend at such an absurd rate in today’s risky environment. So the LIBOR spread widens, even the overnight rate. See the TED Spread here. Look like a heart attack on an EKG chart? Yep!

ACCELERATION OF EVENTS: Each week contains its disaster. Each week has included its own deadline timetable to reach agreement on resolution of this or that. Each week is replete with new signals of contagion or breakdown. Recall USFed Chairman Bernanke, the smartest idiot on the planet, who claimed a year ago that no contagion would result from the spark of the subprime mortgage lit fuse. Expect such braindead calls from a university professor, burdened by the limitations of his credentials. Absolute contagion occurred instead, in total defiance to his orthodox heresy. Yesterday the big news saw the United Kingdom nationalize almost their entire banking system with $50 billion, including the venerable Lloyds TSB. Regard these moves as firm evidence of the death of the AngloSphere. Today’s big news is that Iceland collapsed, rescued in part so far by $4.5 billion from Russia, not Europe. As time passes, the financial structures weaken further, certain to break in central connective tissue, as well as in extended sections. My analogy of the giant locomotive train hurtling down over the mountainside ledge fits here. Apply gravity as the acceleration force, and inertia to administer pain. A bright friend, not the least bit in the dark on current events, claimed that stupid American officials believe the runaway locomotive can actually fly.

ENTIRE US BANK SYSTEM JUST FAILED: It is almost totally now nationalized after failure, seemingly without recognition. If the USFed has swapped a mountain of impaired asset backed bonds from crippled US banks, and has taken over AIG obligations, while the Fannie Mae & Freddie Mac acidic office park has been placed under the USGovt aegis, and while the USGovt has bailed out the Wall Street gigantic stream of fraudulent bond sales, then the great majority of the US financial system has been nationalized after failure. This week, after acquiescing to acceptance of various types of bank assets including preferred stock, the USFed announced that it will accept all asset backed commercial paper (ABCP) in swaps. What remains untouched of the US financial system? Credit unions and corporate subsidiaries? A good slice of corporate finance arms can be managed with the ABCP inclusion. Not much remains. Oh, by the way, the AIG risk assumption will turn into a Giant Black Hole. They borrowed $85 billion three weeks ago. Now they have won approval by the clueless US Congress for $38 billion more. My forecast is for AIG to ultimately cost $1 trillion in loans and other bailout largesse, as credit default swaps will hit like a mushroom cloud. Much criticism has come already for this elite club of vipers, as the company spent $440k on a California conference at a beachside resort less than a week after it was rescued. Also, the Fannie & Freddie credit derivatives might easily cost close to another $1 trillion, including mortgage portfolio losses upcoming. To say the USGovt has made a bad investment with the US financial system is the under-statement of the millennium. To say it will turn a profit on anything it touches is cause for a deep belly laugh and thigh slap. Just a sales pitch by conmen!

FLIMSY VIEWPOINTS ON SITUATION: At the Toronto Gold Show, a few conversations involved me with smart people who seemed to have a shallow comprehension of the current situation. One from a well connected organization told me that the entire US bank system will be taken over, with all underwater firms simply given a blank check to render them solvent, in a simple but costly procedure. My eyes blinked, my head twisted, my brain squirmed. The concepts not fully factored in are that the failing machinery is often hidden from view, the assets going rapidly negative in value are not easily measured, the system contains so many functions that are far beyond control and monitor, so many unregulated and syndicate operations are intentionally kept from public view, that the system is guaranteed to crash without any conceivable opportunity to react to its many failing components in any responsible timely manner. When my questions were directed to credit derivatives, he just shrugged his shoulders, and repeated his shallow argument on solution. If an informed fellow from a fine organization cannot grasp the complex nature of any solution, then rest assured that it would go far beyond out of control. Not only are the size and scope misjudged, but so are the hidden depth and exotic complexity by architects often on cocaine in Wall Street houses. Their leverage devices make an industrial chemical plant look simple.

THIRD WORLD, DEAD AHEAD: Few in the Untied States seem to realize that what is happening is the magnificent unstoppable event whereby an inevitable shift of tectonic financial plates is underway. The result will be the Untied States entire system, financial and commercial, will suddenly find itself tragically lodged in the Third World. The chief traits will be major shortages, high prices, absent capital for credit, diverted supply of commodities, poor investment opportunities, massive flight of capital, corrupt law enforcement, widespread violence, despair among the public, horrific loss of wealth, and a severe brain drain as intellectual talent abandons the nation. Oh yes, carpet baggers will arrive soon, and perhaps even an historically unprecedented wave of colonists from Asia, Russia, and Arab nations. Those who own the failed credit during default make ALL THE RULES.

LOST INTEGRITY OF US FINANCIAL MARKETS: The revived short rule restriction has contributed to yet another severe black eye to the reputation of the Untied States. Its financial markets are already considered the playground for Wall Street syndicates, with criminal behavior protected by the system. Foreigners mock our markets for their grotesque unfairness. Insider trading, 3pm rescues, program trading, naked shorts, controlled news sources, conflicts of interest between news networks and advertisers, justification of fraudulent accounting under pretense of national security, these all contribute to the cesspool image. The list of financial firms protected by short rule restrictions included far too many stocks. What really really angered me, as in really really angered me, was the exemption given to Goldman Suchs. They are permitted to short financial firm stocks. At least the short rule restriction ends on Wednesday tonight. When one examines the Mussolini Fascist Business Model, be sure to include the criminal aspect of rules changes to the corrupt model that assures destruction of the system. Now these corrupt clowns want to eliminate ‘Mark To Market’ accounting for bank assets. Calling them worth original parity value will not improve anything for the lending risk, and surely will not lift the systemic faith. The Japanese could pull off the ‘Vampire Banks’ trick where they walked around insolvent, since their financial system, if not culture, contained ten times as much integrity per capita versus the US. The Untied States relies heavily upon faith for the system. Faith is almost all gone!

FLIGHT TO QUALITY RUSE: JPMorgan is the primary usher orchestrator to the phony movement, called a ‘Flight to Safety’ or a ‘Flight to Quality’ as seen with the movement to USTreasury Bond. Absolutely nothing denotes quality of the USTBond complex. The description of safety seems to ignore, deny, and defy the rapid deterioration of all US financial fundamentals. They seem as safe as a spiked chamber slowly closing in the “Lara Croft: Tomb Raider” movie. The image of out of the frying pan and into the fire seems to fit. A USTreasury Bond default appears a total lock guarantee in the near future. A blight on the US financials grows worse with each passing month, as the total cost for bailouts, nationalizations, stimulus packages, and federal deficits mounts. Foreigners own 52% of all USTBond debt. They will eventually say NO MORE! A powerful vortex is building, with ultra-strong low pressure zones colliding with ultra-strong high pressure zones to create a hurricane. It is bigger and more powerful than anything ever having formed on planet earth. The flight to quality or to safety is pointed directly into a black hole. Look for staggering events to come with USTBonds on the supply side, which cannot support the upcoming funding needs.

THE LEHMAN FAILURE WAS A SIGNIFICANT CON JOB: It was planned, calculated, designed, and executed like a criminal act. The Wall Street criminals needed to test the system on credit default swap risk, needed a sink hole from which to hand $138 billion to JPMorgan on a reloaded. It was carried out pre-dawn on a weekend before a hapless bankruptcy judge who found no objection. He probably did not look hard, maybe even bribed. The criminals were able to observe the consequences from senior bond holders who were illegally denied due process in the bankruptcy procedure. The event was a failure called a merger, complete with a huge handout given to JPMorgan so it can continue its illegal enterprise. The real big deception is that JPMorgan was probably within a hair from its own bankruptcy, and therefore required a sacrificial lamb to feed from elaborate entrails. The sad fact is that the Wall Street consolidators need another Lehman-type event soon, since more reloads will be required. The French finance minister publicly decried the Lehman bankruptcy, saying letting it go was a major error. He might not be aware of the Wall Street crime syndicate need to cover up evidence, or the need to create a sink hole for a concealed JPMorgan reload, or the need to illicitly pack printed money into the massive credit default swap crater. Recall that numerous boxes of documents were hurriedly removed from Lehman offices that crucial fateful weekend. No watchful eye by police, no cordon yellow tape to protect a crime scene, nothing. Another Fascist Business Model privilege that does not make America strong.

CITIGROUP ACTUALLY FILED A LAWSUIT TO ACQUIRE WACHOVIA: Sorry, but Wells Fargo is in line to win this ugly pig prize. Citigroup must have lusted deeply for the opportunity to pull off the same trick that Bank of America did, to seize the Merrill Lynch deposits and toss the impaired bond assets into the JPMorgan ‘Garbage Can’ powderkeg. JPMorgan had the great advantage to seize the Washington Mutual deposits and toss the impaired bond assets into their own ‘Garbage Can’ powderkeg. What a sight to behold! The American financial system manages garbage that it keeps in secret mountains of some of the most disgusting ruinous rotting sewage ever known to mankind. The gall of Citigroup to even attempt a bold coup when it is bankrupt, insolvent, and running on the vile fumes of phony accounting. They acquired a bank with HQ in San Salvador (branches in Panama) in recent months that really angered me, since opening an account there was on my list. My guess is that Citigroup has assimilated deposits from Banco Cuzcatlan, much like the Borg of Star Trek fame.

REALITY CHECK ON THE DESTRUCTION IN PROGRESS: The Dow Jones Industrial index should get hit time after time after time until some good economic or banking news emerges. The stupidity evident out there is to expect the Dow stock index to lead on asserting stability, when it must come from housing prices and the solvent condition of leading banks. The ultimate key to the US bank destruction has been a powerful decline in housing prices, not the Dow. It will follow news of things being ultimately repaired. The US banks are destroyed, and that should kill the entire USEconomy in the foreseeable future. Few seem willing to accept this stark ugly fact. Housing prices continue down, and that assures continued lethal pressure on bank assets. That keeps the destructive process relentless and very powerful, like deep knife cuts to a patient lying on a hospital gurney, while being shuttled from room to room for futile treatment. Much more destruction lies ahead, like with at least two more Wall Street firms, many regional banks, and a few insurance companies. Few seem willing to accept this stark ugly fact. Instead they look like idiotic children gazing upon the wrong traffic lights, as truck after truck runs them over in the middle of the road. Little do they realize, PEOPLE ARE ROADKILL.

REALITY CHECK, INVESTMENT ALTERNATIVE: If you had purchased $1000 of Delta Airlines stock one year ago, you would have $49 today. If you had purchased $1000 of AIG stock one year ago, you would have $33 today. If you had purchased $1000 of Lehman Brothers stock one year ago, you will have $0 today. However, if you had purchased $1000 worth of beer one year ago, drank all the beer, then turned in the aluminum cans for recycling, you would have received $214 today at redemptions. Based on the above, the best current investment plan is to drink heavily & recycle. It is called the 401-KEG Plan.

US PRESIDENTIAL ELECTION: We as Americans must vote for the next chief engineer for the locomotive that is running 100 miles per hour (=160 km/hour) into the bottomless chasm, in a vertical descent, without any semblance of controls. Every train needs an engineer, complete with hat, striped shirt, and a whistle at the ready! Be sure that almost no agenda will be the privilege of any new president, that is if the corrupt powers permit the election without disturbance, delay, or deletion. This president has done such a bangup job that he might deserve to be emperor. Expect some of his henchmen to escape into exile,

THE HAT TRICK LETTER PROFITS IN THE CURRENT CRISIS.

From subscribers and readers:

At least 30 recently on correct forecasts regarding the bailout parade, numerous nationalization deals such as for Fannie Mae and the grand Mortgage Rescue.

“Your analysis is of outstanding quality, the best I have read. In particular, as a person on the spot, I can confirm the accuracy of your bleak assessment of our prospects in the UK.”

(JanB in England)

“I just subscribed to your services and must say that your insights are so eye-opening that it is like having a window to the future. I never thought that they would in so much detail encompassing the entire world. With all that is going on, I still wonder how you are so in touch with it all.”

(ChrisB in Australia)

“The latest Hat Trick Letter is great work. I am still reading and absorbing, but this is just great analytical work. Truly inspired. I would say you produce a very sophisticated, detailed product that is the best of the bunch. Truly. You help keep me very focused on current events and help me keep my eyes on the distant horizon.”

(RichardB in Texas)

“Your unmatched ability to find and unmask a string of significant nuggets, and to wrap them into a meaningful mosaic of the treachery-cum-stupidity which comprise our current financial system, make yours the most informative and valuable of investment letters. You have refined the ‘bits-and-pieces’ approach into an awesome intellectual tool.”

(RobertN in Texas)

“Your reports scare the hell out of me every month, probably more so over time, since so many of your predictions have turned out to be very accurate. I am afraid you might be right that by the end of 2008, we are in a pretty severe situation, with civil unrest and severe financial stress on Main Street.”

(GeorgeC in Minnesota)

Jim Willie CB is a statistical analyst in marketing research and retail forecasting. He holds a PhD in Statistics. His career has stretched over 25 years. He aspires to thrive in the financial editor world, unencumbered by the limitations of economic credentials. Visit his free website to find articles from topflight authors at www.GoldenJackass.com . For personal questions about subscriptions, contact him at JimWillieCB@aol.com

-- Posted Thursday, 9 October 2008 | Digg This Article | Source: GoldSeek.com

| Source: GoldSeek.com