-- Posted Monday, 28 December 2009 | Digg This Article | | Source: GoldSeek.com

| | Source: GoldSeek.com

Think isolation. Think monetization. Think trapped. Think Catch-22, no remotely viable option. Think motive for propaganda. Think end of the road in a gigantic USTreasury bubble, in the process of discredit. Think last resort of monetization, due to the absence of bidders at USTreasury auctions. Think pressure like a vise. The USGovt is in a great big bind and chooses not to discuss it. As European nations ponder the plight of sovereign debt default, the United States compares an order of magnitude worse from deeper insolvency. A default closer to home is considered unthinkable. So was a broad mortgage market breakdown. So was an endless housing decline. So was an insolvent broken banking system. So were consecutive $1 trillion federal deficits. All were forecasted here.

BOND BOYCOTT LED BY CHINA

Call a spade a spade! The Chinese, trade partner turned adversary, have been in boycott of USTreasury Bonds for a year. While still a significant creditor for USGovt debt, it also stands as the primary adversary in the movement to displace the USDollar from its global reserve currency, a veritable throne of privilege. Arabs and Chinese are mentioned consistently as the most important creditors for official USGovt debt. Something of note happened in 2006 and 2007. The Japanese stopped adding to their USTreasury Bond holdings. The slack was taken by China. Now something has happened again. China has stopped purchasing the USTreasury debt securities. The United States has been set up for acute risk in funding its debt. The response is clearly to be a greater dependence upon the printing press, as the USGovt will be forced to finance its debt through monetization, perhaps almost exclusively. This is the closest one might ever see of a major industrialized nation engaging in behavior best described as Weimar-like. And US economists reward its chief monetary mechanic with a national award! We witness the ultimate in moral hazard, even its celebration.

The war of words continues with China. The leaders and officials in Beijing have delivered salvo after salvo against the weakened US fortress for months. They direct volleys the deficit flank, the currency flank, the tariff flank, the reform flank, and others. They have led the rebellion to remove the USDollar from exclusive usage in international trade settlements. They have endorsed the phase-out demise of the Petro-Dollar. The deputy governor of the Peoples Bank of China had some stern words recently. Zhu Min from the PBOC said, "The United States cannot force foreign governments to increase their holdings of Treasuries. Double the holdings? It is definitely impossible. The US current account deficit is falling as resident savings increase. So its trade turnover is falling, which means the US is supplying fewer dollars to the rest of the world. The world does not have so much money to buy more US Treasuries. [It is] getting harder for governments to buy United States Treasuries because the US's shrinking Current Account gap is reducing the supply of dollars overseas."

This is a double whammy. Foreigners have less US$ funds to buy when USTreasury supply is exploding, due to smaller US trade gaps and smaller foreign trade surpluses. The outlet is USFed monetization to purchase the official bond supply using printing press funds, a last resort source of money. Asian economies have their own challenges. Gone is the Japanese trade surplus. China, on the other hand, is openly sick & tired of financing a government debt when the direction has not been set toward progress or reform. Improvement of the USGovt finances seems NOT a priority in the eyes of foreign creditors. Zhu was as plain as possible, that the USGovt should no longer rely on China for funding its bottomless deficits. Conditions are extremely likely to grow worse, with more desperation to finance deficits that in no way are reduced. The Fed has no choice but to turn the monetization machine on hyper-drive. A chart accentuates the problem and exposes the risk, thanks to RBS bank.

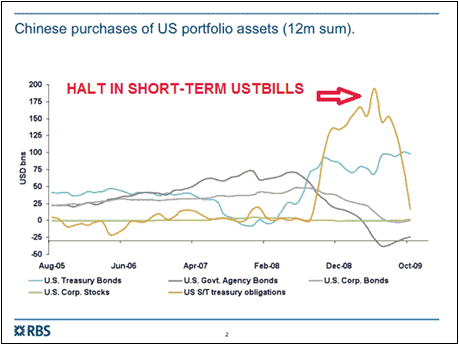

China has made two important changes in their USTreasury management. They have converted much long-term debt securities into short-term debt securities. They have also stopped buying short-term USTreasury Bills almost completely. See how China has sharply reduced their short-term USTBill support (US S/T in brown), which fell off a cliff since summer 2009, when it was an annual outlay of almost $200 billion worth, but now is next to zero. Shown are rolling 12-month sums, meaning around May 2009 the previous 12 months totaled around $190 to $200 billion. As of October 2009, their assembly of USTBills has been nil for a year!! Their long-term USTreasury purchases remain steady (in light blue) in the $90 to $100 billion range, again summed over the last 12 months.

Look more closely at the complex chart above. Notice the very serious dumping of USAgency Mortgage Bond, from a level with running 12-month total near $75 billion in the early summer 2009 to minus $25-35 billion in the last 12 months. Clearly, Beijing leaders have ordered a halt of USTBond purchases. Major entities are selling huge amounts of USAgency Bonds. The Chinese Govt has been selling mortgage backed securities almost as fast as PIMCO. However, they have halted the purchase of USTreasurys. Since May 2009, Chinese USTBond holdings have been flat at $790 billion. The USGovt is more isolated nowadays, left to its printing press device to handle the avalanche of debt. The US financial networks are mum.

Imagine, the US recession does not produce enough trade deficits for foreign sources to recycle, perversely. It sounds crazy. A recession will do that, like one that stubbornly refused to end. Going hand in hand with stronger and more robust economic activity inside the US fenceposts is huge trade deficits, no longer seen. This is yet another ongoing recession signal, since the October trade gap was ONLY $32.94 billion, grossly inadequate for foreigners to purchase USTreasurys. Foreigners have less US$ funds from trade to devote to USTreasury conversion, thereby avoiding the currency lift at home. The experts call the process sterlization, since the new US$ money does not convert, does not push the local currency higher, does not interrupt via a feedback loop the export trade that produced the surplus in the first place. Export of USTreasurys is the nastiest, most sinister, most effective device in creating gigantic unresolvable global financial imbalances.

A TEST TO EXIT FROM 0% RATE POLICY

The USFed decided to keep the official interest rate at 0%. My forecast is either no rate hike for 12 to 18 months, or else a gambit of a 25 basis point hike, but with further hikes halted. A series of rate hikes would cause far more havoc and disruption than the so-called experts anticipate. The chronic 0% rate offered at the US bond ring assures a resumed Dollar Carry Trade, and USDollar decline. This is simple speculation mathematics. The result will continue to maintain the gold bull market. As universally expected, the USFed kept its overnight target at 0-0.25% and pledged to keep rates low for an extended period in its words, again. Their statement contained some rubbish about expressed growing optimism for the USEconomy. They cited an abatement in the labor market deterioration and hope of improvement in the housing market, pure fantasy. Neither has remotely occurred.

More important than such nonsense, the USFed underscored confidence in credit markets. It stands by USFed plans to end most of its emergency lending facilities on February 1st. Removal of the primary true source of liquidity will be a dangerous proposition, but they must fake the billboard messages and give it a trial. It is my belief that the USFed will remove the flow of easy money, aka Quantitative Easing, but only on the fringe. They will cut back on some highly visible monetization of USTreasury and USAgency Mortgage Bonds. But they will not reduce any hidden monetization of the same bonds, a powerful enterprise with magnificent unspoken volume that prevents auction failures.

The USFed is actively running a trial balloon. They are permitting the slow motion rise in the 10-year and 30-year USTBonds. If the 10-year TNX yield rises above 4.0%, which could happen easily, a test will be given. Borrowing costs on car loans and commercial loans would rise in step. But the main event would be the test to the housing market from the mortgage rates sure to rise in step. In parallel, the mortgage bond market would undergo a test. The USFed in my opinion wishes to test its urgently needed but impossible exit strategy. My bet is the test fails. My other bet is they lie about its failure. In time, they will halt the test and admit the USEconomy and US credit market remain too weak to begin a rate hike cycle. In order to prevent a future disaster, they must end the current easing cycle. THE USFED WANTS THE TEST FAILURE TO PROVIDE POLITICAL COVER FOR REMAINING IN A RIDICULOUSLY LOW INTEREST RATE ENVIRONMENT. They might wish to kick the Dollar Carry Trade off its path periodically. They know the extended risks. They know much higher price inflation awaits on the other side of Easy Street. The veto vote goes to the short-term USTreasury Bill market. If conditions were ready for a rate hike, the USTreasury Bills would confirm it across the lower maturities. Notice the 3-month USTBill yield. It cannot even rise to reach the 0.18% plateau seen for the entire spring and summer months. This means no return to normalcy anytime soon. A point of history is worth mentioning. The US Federal Reserve almost never breaks away from the path set by the short-term USTreasury Bill market.

To further point out the futility of policy and the lack of viable options, last week former USFed Greenspan actually claimed the United States was on the path toward a 'formidable fiscal crisis' unless its deficit situation is tackled shortly. He should know since it bears his signature. Next turn to comedy. A recent report prepared for the National Bureau of Economic Research suggested the monster USGovt debt be reduced by allowing inflation to rise. The real value of the debt would suffer erosion, the victims being the creditors. The NBER contains some of the best nitwit economists on the planet, a shining example of US economist lunacy and destructive shamanism, an embarrassment to the nation. Let us not even delve into the risks of price hyper-inflation, which would serve as the greatest shock of reality to these utter charlatan clowns as they maintain the pretense of practicing economics. Fast rising prices would be like a large bowl of cold liquidity splashed onto their faces. Laurence Meyer, the fixture in the banker elite circles, actually said last week during an interview that no connection exists between USGovt deficits, USTBond issuance, and price inflation. The man is a bonafide idiot, yet revered and sought for interviews. Why do people listen to these guys? They are inflation apologists and high priests who sit on the helm of a titanic vessel dodging icebergs. How many gave nods of endorsement to grandiose 2009 federal budget surplus forecasts just a few years ago!?!?

USDOLLAR LEAST UGLY FOR NOW

The 0% rate continues to undermine the USDollar, an unchanging situation. The 0% rate continues to feed the gold bull, whose trough was pushed aside but will soon be placed to feed its appetite. The world requires an occasional US$ Index (DX) rally so as to avoid having it march directly into oblivion. The USGovt deficits are the ball & chain attached to the embattled USDollar. The onliest thing making the buck look good is the ugliness of the other major currencies. It is like going to a dance where all the ladies are grossly unattractive, and on the path to becoming discarded hags. After further review, the least unattractive start to look better with the passage of time. Add some liquidity, and the little beasts earn a bid higher. The fully engineered, entirely contrived USDollar rally began with the November Jobs Report, a work of fiction. It continued with the very real troubles facing European and London banks, from debt based both in Dubai and Southern Europe. The horrendous fundamentals for the beaten down buck had attention drawn away, by the wretched situation facing banks that underwrote massive debt to these two new centers of indebted attention. The Euro and British Pound gave way and buckled.

The last gold rally was led by the United States. The gold price in Euro terms has hardly corrected or budged. Attention is centered upon the European Union, certain to fracture from Parliamentary disappointment, as its monetary foundation suffers a grand erosion in its coastline to the South. Attention is centered upon the European Monetary Union, whose Euro currency will soon be denied usage across Southern Europe. The next round of the gold rally will be led by Europe. The broad advantages of a grand currency devaluation will soon come front and center. Greece, Spain, and other nations will realize the benefits of debt conversion and reduction on the back of returned currencies in the Drachma and Peseta. Then comes steady currency devaluation to enable a competitive position. The common Euro serves as a straitjacket for the distressed nations in the South of Europe. They are stuck, and will surely default one by one. The Revived Roman Empire once more proves frustrating, as it has for a millennium. The sequence of events is complicated. A heavy weight will sit atop the Euro currency from European credit failures until important significant events are unfolded and a new Core Euro is launched. At first the core version might simply be the old version with carved off burdensome Southern gristle and fat. These currency matters are analyzed in the December Hat Trick Letter.

MOTIVE TO MAINTAIN 0% RATES

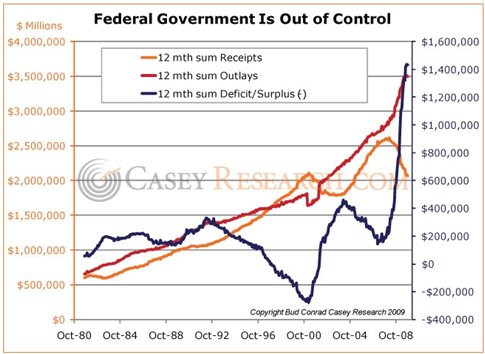

An ultimate factor of practicality is often overlooked. Cheap interest rates to service USGovt debt is a huge reason why the official 0% interest rate policy continues. The USFed claims to want to end its ultra-easy monetary policy, but it is pure rhetoric of deceitful nature. A higher USFed rate would not only deliver a heavy hindrance to the USEconomy, but a great aggravation to the federal deficit. The USGovt revenues are down sharply. Notice the Receipts have fallen from $2600 billion to almost $2000 billion in the last two plus years. They have fallen and cannot get up. In fact they contradict any lunatic notion of a jobs picture improvement. The November Jobs Report was a pure fiction. Thanks to the Casey Research folks for a great chart.

The heady White House staff estimates the current fiscal year debt service to be $202 billion. That amount is actually less than the 2008 debt service cost, even though the official 2009 federal deficit shot into low stratospheric orbit at $1420 billion. Despite much higher debt in 2009, the service cost to the USGovt debt went down, something of an advantage. In fiscal 2009, the average USGovt interest rate on new borrowings was under 1.0%, the lowest ever recorded. They want that to change??? Hardly!!! TRowe Price estimated that if USGovt debt service costs remained constant into year 2009, the cost would have been $423 billion, higher by $221 billion, or almost 110%. Bill Buckler of the Privateer calls 2009 the 'Interest Free Year' very appropriately. The USFed cannot cut rates any lower, unless they go negative. Furthermore, the USFed has used its mouths to make words to the effect that it will stop adding toxic bonds to its balance sheet by March 2010. The USGovt and USFed have enormous motive to keep their borrowing costs down, and to continue the discount to borrowing costs.

My doubts are very high for any end to monetization of USTreasury and USAgency Bonds or for any halt to USFed massive expansions to its balance sheet. If the USGovt and USFed stop buying US$-based official bonds, these debt securities must fight on their own in the bond market for proper valuation. That means higher yields and lower price, since supply is bloated and supply aint stopping!!

FINAL NOTE ON DEBT DOWNGRADES

The debt ratings agencies have been busy in the last few weeks. They do NOT wish for a repeated episode to demonstrate global extreme incompetence, or to suffer further charges of collusion. Their opponents, the many corporate bond losers in the wake of 2008, have begun a parade of lawsuits. Perhaps the discovery phase will produce some ripe evidence from the hallowed bowels of Wall Street. Nah! Claims of national security will block that path. Perhaps religious grounds will be cited, as Goldman Sachs is doing God's work. The prospects of sovereign debt downgrades have led to wide debate about the likelihood of a string of sovereign debt defaults. Such defaults are written in stone, in my view. The main question is whether the Big Three ratings agencies will be ahead of the game in which they purport to be experts, but actually are agents of collusion, objects of coercion, in a system designed with unworkable built-in biases.

Mere discussion by Moodys in recent weeks of a USTreasury debt default is indicative of the lack of creditworthiness. They said a USGovt debt downgrade and a UKGovt debt downgrade are unlikely. They should come out and admit that neither is permitted. Between the lines they declare a debt downgrade is deserved. The USGovt debt burden will climb to 97.5% of GDP next year from 87.4% this year, according to the Organization of Economic Cooperation & Devmt forecast in June. The UKGovt public debt will swell to 89.3% of the economy in 2010 from 75.3% this year, a bigger percentage jump, according to the OECD. Moodys mentioned that all Aaa rated governments are affected by the global financial crisis, with differences in their impact and ability to respond. They must refer to the ability to print money and monetize debt, perhaps even pressure other nations to purchase the debt via their obedient central banks. David Keeble is head of fixed income strategy in London at Calyon, the investment banking unit of the French Credit Agricole. He said, "There has been a huge increase in debt-to-gross-domestic-product ratios as a result of the crisis. It is right that there should be a lot of attention and pressure on these numbers. It is difficult to drive a big wedge between the US and UK in terms of their fiscal outlook. The flexibility that Moodys spoke about is not obvious. It is all a matter of political willpower." My interpretation is more like extreme political coercion of the debt rating agencies by the USGovt and the UKGovt. The heightened pressure is of a corrupt nature, precisely like the force used to grant triple-A ratings to Wall Street banks that failed any rational justification in 2008 before the bank sector implosion in the autumn months of 2008.

THE HAT TRICK LETTER PROFITS IN THE CURRENT CRISIS.

From subscribers and readers:

At least 30 recently on correct forecasts regarding the bailout parade, numerous nationalization deals such as for Fannie Mae and the grand Mortgage Rescue.

"Thanks for the quality of the information you put forth in your newsletter. I read a lot of newsletters, blogs, and financial sites. The accuracy of your information has been second to none over the past couple of years."

(MikeP in Missouri)

"Your October HTL was your best writing since I have been subscribing. It just amazes me how much you write each month, all top-notch stuff."

(DavidL in Michigan)

"I used to read your public articles, and listen to you, but never realized until I joined what extra and detailed analysis you give to subscription clients. You always seem to be far ahead of everyone else. It is useful to 'see' what is happening, and you do this far better than the economists! I can think of many areas in life now where the best exponent is somebody not trained academically in that area."

(JamesA in England)

"You seem to have it nailed. I used to think you were paranoid. Now I think you are psychic!"

(ShawnU in Ontario)

Jim Willie CB is a statistical analyst in marketing research and retail forecasting. He holds a PhD in Statistics. His career has stretched over 25 years. He aspires to thrive in the financial editor world, unencumbered by the limitations of economic credentials. Visit his free website to find articles from topflight authors at www.GoldenJackass.com . For personal questions about subscriptions, contact him at JimWillieCB@aol.com

-- Posted Monday, 28 December 2009 | Digg This Article | Source: GoldSeek.com

| Source: GoldSeek.com