|

-- Posted Monday, 23 March 2009 | Digg This Article | | Source: GoldSeek.com | | Source: GoldSeek.com

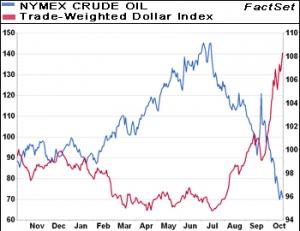

Last week’s surprise move by the Federal Reserve to buy $300 billion in long-dated bonds and effectively start printing money brought a sharp fall in the US dollar, and a strong bounce in oil and gold prices. Last week’s surprise move by the Federal Reserve to buy $300 billion in long-dated bonds and effectively start printing money brought a sharp fall in the US dollar, and a strong bounce in oil and gold prices. Is this the story of things to come? Pimco CEO Bill Gross, the bond king says the Fed may need to expand its balance sheet from a projected $2-3 trillion to $5-6 trillion to get the economy moving again. This is a slow motion process. The more immediate impact, apart from lowering the cost of borrowing, is a lower dollar. Then by 2011 or so Mr. Gross sees the return of inflation, and is buying inflation-protected bonds called TIPS - which also jumped in price last week. Oil marketFor Middle Eastern investors in particular this scenario has important implications for the oil market: a lower US dollar generally means a higher oil price. Remember it was dollar weakness that helped to drive oil prices to $147 last July, and dollar strength popped that bubble (see graph above). But hold on a moment, how are stock prices going to react to quantitative easing or money printing by any other name? Last week the 20 per cent rally in the Dow Jones stopped and reversed on news of the Fed’s action. The US stock market will be nervously watching statements this week for more detail of the Fed and Treasury’s plans. However, if you look at share valuations then they are back to the lows of 2003 and that hardly appears low enough for the profit depression now certainly ahead for major companies. Stock sell-offNow what happens if shares sell-off again, perhaps in a probably not unjustified panic about the three-year outlook for profits? Then the dollar will rally, precisely as it did last autumn, because stocks will be sold for cash, increasing the demand for the dollar. That would lower oil and gold prices, just like last autumn. So it might still be too early to go back into stocks, and even to abandon US treasuries. For there is another down leg in the stock market to endure before such a shift should be considered. All the same, with inflation definitely on the horizon - albeit at some distance - oil and gold will eventually come out on top, and may not suffer as much in the next bear market down shift.

-- Posted Monday, 23 March 2009 | Digg This Article | Source: GoldSeek.com

Previous Articles by Peter Cooper | Source: GoldSeek.com

Previous Articles by Peter Cooper

About Peter Cooper:

Oxford University educated financial journalist Peter Cooper found himself made redundant by Emap plc in London in the mid-1990s and decided to rebuild his career in Dubai as launch editor of the pioneering magazine Gulf Business. He returned briefly to London in

1999 to complete his first book, a history of the Bovis construction group.

Then in 2000 he went back to Dubai to become an Internet entrepreneur, just as the dot-com market crashed. But he stumbled across the opportunity to become a partner in www.ameinfo.com, which later became the Middle East's leading English language business news website.

Over the course of the next seven years he had a ringside seat as editor-in-chief writing about the remarkable transformation of Dubai into a global business and financial hub city. At the same time www.ameinfo.com prospered and was sold in 2006 to Emap plc for $27 million, completing the career circle back to where it began a decade earlier. Over the course of the next seven years he had a ringside seat as editor-in-chief writing about the remarkable transformation of Dubai into a global business and financial hub city. At the same time www.ameinfo.com prospered and was sold in 2006 to Emap plc for $27 million, completing the career circle back to where it began a decade earlier.

He remains a lively commentator and columnist as a freelance journalist based in Dubai and travels extensively each summer with his wife Svetlana. His financial blog www.arabianmoney.net is attracting increasing attention with its focus on investment in gold and silver as a means of prospering during a time of great consumer price inflation and asset price deflation.

Order my book online from this link

|