-- Posted Thursday, 15 March 2007 | Digg This Article

A unique way to invest with "blue sky" potential...

Key Highlights:

Stock Facts:

Trading Symbol: TBLC (OTCBB)

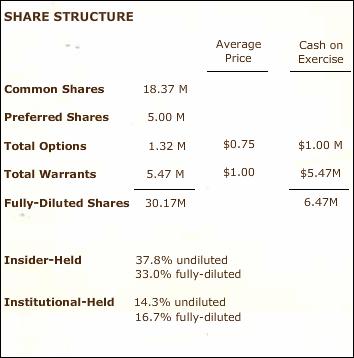

Trading Symbol: TBLC (OTCBB) - Common Shares: 18.37 million

- Preferred Shares: 5.00 million

- Fully Diluted Shares: 30.17 million

- Cash on Exercise: $6.47 million

- Insider Holdings: 33.0% (Fully Diluted)

- Institutional Holdings: 16.7% (Fully Diluted)

Overview:

Timberline Resources Corp. [OTCBB: TBLC] is a unique growth-oriented company that combines the strong cash flow from its 100% ownership in Kettle Drilling Inc. with the "blue sky" potential from mineral exploration. Essentially, investors looking to capitalize on the major upside exploration provides have an opportunity to do so through a reduced-risk investment with Timberline’s drilling services providing a solid foundation.

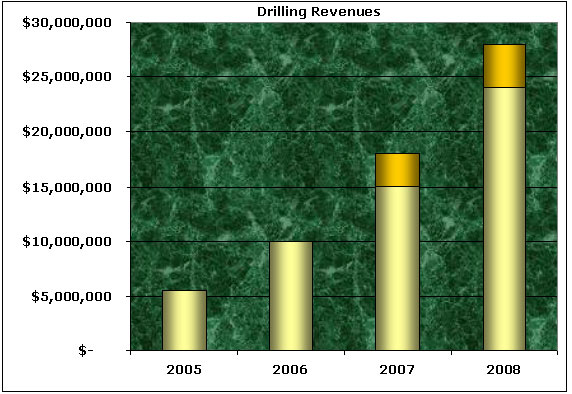

Timberline has seen revenue growth from drilling services surge about 100% year over year with current yearly revenues targeting $15+ million for fiscal 2007 with 2008 moving into the mid to upper $20 million range. Recent expansion into Mexico along with increasing revenue growth from drilling contract rates may alone justify current, if not higher, per share valuations. Then add Timberline’s current portfolio of properties and you end up with a very attractive investment opportunity. Timberline Resources is one of the most exciting stories I have come across recently and thus back in December I named it as one of my top three winners for 2007 in my GoldSeek.com Radio interview.

Management:

Timberline has very strong management team and that is a key element to its current success and to its future potential. John Swallow, Chairman and CEO of Timberline, is the former President and Director of Sterling Mining Company. He is a proven leader and has personally participated in all past financings in the company since his arrival. Mr. Swallow also holds a substantial ownership in Timberline and his dedication to the company is well represented by his past actions including working months without pay, removing a 500,000 share convertibility feature of his loan to the company and not issuing himself cheap shares. Mr. Swallow brings wide-ranging experience from within the local mineral exploration industry as well as extensive knowledge of the junior equity markets.

Another key asset is one of the premier mining and exploration geologists in the industry. Paul Dircksen has 35 years of experience in the mining and exploration industry, serving in executive, managerial, and technical roles at several companies. He has a strong technical background, serving as a team member on nine gold discoveries, seven of which later became operating mines. Mr. Dircksen has also held senior management positions within the industry.

The ability for Timberline to retain and attract such experience as Mr. Dircksen possess is an enormously key asset to the company. This is especially important to recognize during a time when the industry is undergoing a severe strain of experienced talent.

Other key members to the Timberline organization include Doug Kettle, President and Director of Kettle Drilling Inc. since 1996, Eric Klepfer with over 22 years of mining and exploration experience and Vance Thornsberry with 35 years of mining and exploration experience.

Drilling:

Timberline Resources acquired Kettle Drilling in early 2006. Currently the 2nd largest underground driller in the United States, Kettle continues to grow at a very aggressive rate. Kettle and its wholly owned Mexican subsidiary, World Wide Exploration, S.A., currently have 13-15 drill rigs in the field, with an additional three rigs set to enter service shortly, serving several prominent companies including Newmont Mining, Barrick Gold, Industrias Penoles, Phelps Dodge, Teck Cominco, U.S. Gold, and the list continues. The current market demand for top-tier contract drillers such as Kettle is "virtually unprecedented". With the current mineral boom set to continue, this will aid in Timberline’s high growth rate over the coming years.

In January, Timberline announced Kettle Drilling reported gross revenues of $6.47 million for the part of 2006 it was amalgamated under Timberline and a gross operating profit of $1.48 million (Note: Timberline’s fiscal year ends September 30th). An overall net loss was reported as Kettle continued on its rapid expansion schedule including its launch into Mexico. Between March and the September year-end, Kettle sharply ramped up its management team and technical staffing, while purchasing and placing into service three  new state-of-the-art computerized drill rigs. World Wide incurred significant costs for staffing, training, travel, and permitting, while importing and placing into immediate service three of its own drill rigs (and related equipment) in Mexico.

new state-of-the-art computerized drill rigs. World Wide incurred significant costs for staffing, training, travel, and permitting, while importing and placing into immediate service three of its own drill rigs (and related equipment) in Mexico.

Last December, Timberline completed a $2.73 million financing from which proceeds were used in part to finance the purchase of four additional drill rigs. They are being staged for service over the coming months and are expected to alone generate approximately $6 million in additional combined annualized revenues!

Last month, Timberline reported its latest results and reported record first quarter revenues of $3.21 million - also note that the first quarter is typically the slowest quarter of the year for drilling operations. With revenue growth expected to target $15+ million this fiscal year, as new drill rigs enter service along with growing contract rates, I believe 2007 will set the stage for even more exciting growth in fiscal 2008.

Drilling Revenues: Fiscal 2007 estimated at $15 million with upside potential, marked with the darker gold color, and 2008 forecasts ranging around $25 million. Note: Such projections are made by this author and may not necessarily represent the company’s forecasts. Timberline’s fiscal year ends September 30th.

The strong demand for qualified drill equipment and operators is set to continue as the commodity bull markets persist. As such, the ongoing explosion in exploration and expansion of current mining operations are key components to the exceptionally strong growth seen with Kettle Drilling. With approximately 80% of its drill fleet specializing in underground operations, I suspect as the bull market matures the specialty of underground drilling will make Kettle even more desirable.

In the unlikely event the commodity market cools off, Kettle Drilling’s underground focus will protect them to a far greater degree than other drilling companies. Underground drilling is primarily involved with current mining operations while surface drilling focuses on the exploration side. Should a sudden drop in metal prices occur resulting in a decrease in exploration activity, surface drillers face far greater risks. Underground mining operations are not nearly as price sensitive in such a scenario and would be less likely to feel the change in a cooling commodity market.

Yearly revenue growth is set to continue to move higher and was up higher 30-50% in 2007. Combined with additional drill rigs being added to the fleet, I believe it is quite possible the $15 million target for fiscal 2007 could be exceeded. In 2008, I forecast revenues easily moving into the mid $20 million range with upside potential perhaps reaching $30 million. Merger and acquisitions activity is also another factor to consider which could grow revenues at even a far more aggressive rate.

A drill rig is currently averaging around $1.5 million/rig in revenues and at around the present 20% profit margins brings in roughly $300,000 in pre-tax income per rig. Therefore the payback period is currently around two years and should decline with increasing margins. With such margin expansion Timberline should not have difficulties maintaining its aggressive expansion via organic growth at upwards of 50 to 100%.

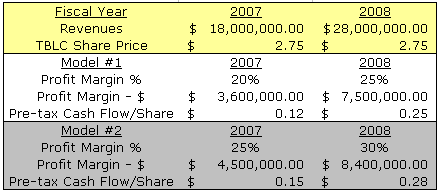

Profit margins remain quite healthy, currently running around the 20% level. With drilling contract rates growing faster than costs, I believe profit margins will grow aggressively in the coming year(s). Assuming a 20-25% profit margin based off of $18 million in potential 2007 revenues along with a 30 million fully-diluted shares, such a model would bring in $0.12 - $0.15 in pre-tax cash flow per share. Moving forward to fiscal 2008 (which begins in October 2007), this figure could potentially move up to around $28 million in revenues and with a 25% profit margin, Timberline would bring in $0.25 in pre-tax cash flow per share cash margins!

Note: 30 million shares used in the above model. Projections are made by the author only and such a hypothetical model may not represent the forecasts of the company.

The models above show strong cash flow from drilling which allows the company to continue to continue their aggressive organic growth while also permitting to redirect some of the revenues into exploration, hence the "revenue-backed exploration" business model. I believe the market value of Timberline may currently only be reflecting the value of its high-growth drilling business without recognizing its exploration portfolio and potential.

Exploration: Blue Sky Potential

Exploration makes Timberline’s business model even more exciting. The growth in drilling services provides the solid foundation to what I wish to view Timberline as, a high-potential exploration play without the risk typically associated with exploration investments. Confidence in Timberline starts with its talented team and investors know that provides the groundwork from which to build. Not only should years of experience provide confidence in Timberline, the fact that their Vice President, Exploration and Director - Paul Dircksen - holds 35 years worth of it. Mr. Dircksen served as a team member on nine gold discoveries, seven of which later became operating mines! Not many in the industry have a tremendous resume such as this one.

With metal prices making record highs and mining companies facing greater difficulties replenishing their dwindling reserves, exploration has not only become a priority but is a necessity. Investors , the area of the mining sector likely to see the greatest gains in the coming years. I believe we are still in the early stages of the exploration boom, mergers and acquisitions will continue to grow while greater investment interest in exploration companies will drive up prices in the coming years. Despite this, one of the greatest challenges facing this industry is experience. This will assist to greatly distinguish Timberline in the field where many exploration companies are looking to attract investor interest.

Exploration has taken a more aggressive turn over the past year for Timberline and more information about its property portfolio will be made available as we move through 2007. Currently, Timberline holds several properties, a few which catch my eye and which I will focus on below. It should be noted that Timberline’s business strategy is not to become a producer, but rather identity and develop properties which can be later joint-ventured, preferably to major mining companies. This is a business model practice I highly favor as production companies must take on additional risks.

I will go through some key points below on Timberline’s properties. Readers may wish to skip the below portion and move onto the next section should some of the highlighted details below not be of interest, but I would like readers to understand current properties hold the potential for "multi-million" ounce gold deposits. This blue sky potential exploration provides is where investors could end up being well rewarded.

Unlike most exploration investments, Timberline is unique in that its business model combines the drilling business with exploration which allows for a portion of the drilling cash flow to be invested back into exploration. The point being Timberline is not forced to continually raise capital and dilute shareholders as it continues to develop its exploration business.

Properties:

Properties:

Conglomerate Mesa: Timberline signed a Memorandum of Understanding (MOU) in September 2006 outlining the terms for a Lease/Option to Purchase Agreement for the Conglomerate Mesa Gold Project in Inyo County, California. The project hosts structurally and stratigraphically controlled, sediment-hosted gold mineralization similar to the "Carlin-type" deposits of north-central Nevada. Four claim blocks have been acquired or staked within the project area totaling 250 claims, covering nearly ten square miles, including several mineralized gold zones identified by prior operators. Timberline believes that the property has the potential to host multi-million ounce gold deposits.

During BHP’s holding of Conglomerate Mesa, they drilled some impressive holes, two which I highlight here:

Dragonfly Zone:

40 ft of 0.37 ounces per ton (oz/t) gold

(within 140 ft of 0.12 oz/t gold)

Resource Area:

40 ft of 0.15 oz/t gold

The history of the property dates most recently back to the 1990’s when Newmont Mining explored and outlined mineralized material, pre-dating NI 43-101 standards, 175,000 ounces of gold contained in 3 million tons grading 0.06 oz/t. Note: Newmont Mining defined such a resource base at just one of the mineralized zones ("Resource Area"). After withdrawing from the property, BHP moved in and explored further before dropping the property as they exited the gold industry entirely due to nearly 20 year low gold prices. The MOU provides Timberline the right to purchase a 100% interest in the Project, subject to a 4% net smelter returns (NSR) production royalty of which 1% may be purchased for $1-million.

Timberline’s V.P. of Exploration, Paul Dircksen stated, ``The host rock lithology, alteration, and geochemistry at Conglomerate Mesa represent the discovery of Carlin-style gold mineralization outside the main trends of north-central Nevada. The grades and distribution of mineralization indicate the potential for the discovery and delineation of a multi-million ounce gold deposit amenable to bulk or underground mining techniques.’’

East Camp Douglas: In 2006, Timberline exercised its option on this project, located along the prolific Walker Lane Mineral Belt in south-central Nevada. Paul Dircksen, Timberline’s V.P. of Exploration, stated, ``We have mobilized a field crew to ECD to conduct geochemical sampling along with detailed surface and geological mapping, focused on alteration and structural interpretation. We are also digitizing and reviewing available historical data from previous operators to assist in prioritizing exploration targets, which we plan to drill by mid-2007. The ECD Project has district-scale potential with significant gold intercepts and thereby meets Timberline’s corporate strategy of identifying and exploring projects capable of hosting a multi-million ounce precious metal deposit.’’

Drilling by previous operators included intercepts of 60 feet of 0.47 oz/t gold and 10 feet of 0.19 oz/t gold, with select rock chip samples grading up to 4.9 oz/t gold. The project area was recently expanded based on the discovery of a broad zone of intense sulfate alteration, within which silica-rich breccia samples grading up to 0.23 oz/t gold were collected.

Timberline may purchase the property for $10,000 subject to a 3% NSR royalty, of which 1% may be purchased for $2 million.

At the end of January, the company announced it expanded its land position at East Camp Douglas. A block of 28 additional unpatented lode mining claims was recently located, contiguous with the original 87-claim project land package. The additional ground was staked based on the discovery of a broad zone of intense sulfate alteration, within which silica-rich breccia samples grading up to 0.23 oz/t gold were collected.

Snowstorm Project:

Snowstorm Project:

The Snowstorm Project is located in north Idaho’s "Silver Valley" and features the historic Snowstorm Mine, a small but profitable operation from the early-1900s that produced 800,000 tons of ore averaging 4% copper and 6 oz/t silver. The Snowstorm property lies in the southwest corner of the Montana Copper Sulfide Belt where it overlaps the northeast corner of the Coeur d’Alene Mining District, just north of Hecla’s Lucky Friday Mine.

Timberline now controls 100% of the Snowstorm Project with Hecla retaining a 4% NSR royalty on any future production from the project.

Breaking News - as this report goes to publication, Timberline announced: "plans to reactivate the Snowstorm Project this year as the Silver Valley experiences investment activity not seen in several decades, led by Hecla Mining Company (NYSE: HL) at its neighboring Lucky Friday Mine. Hecla recently reported that it has completed a positive scoping study which outlines how it could increase annual production there by as much as 70%, extend the mine life, lower its cost per ounce, and increase the mineable resource. The study also estimates $150 to $200 million of capital for a new mill, a surface shaft to the existing levels, and an underground shaft to more than 1,000 feet below the deepest identified resources. Based on the study’s positive economics, Hecla expects to begin a prefeasibility study shortly, to be completed by year-end. Hecla went on to add that it is conducting the first generative exploration program on its Silver Valley properties in 50 years. Hecla maintains a 4% NSR royalty on the Snowstorm Project.

…

Timberline VP of Exploration Paul Dircksen stated, ``Hecla’s planned investment at Lucky Friday is timely and adds to our excitement about the potential for economic discovery at Snowstorm. Although we have been approached by several potential exploration partners, we have been unable to reach acceptable terms to-date. While we remain very open to bringing in an experienced and qualified partner, given the current investment interest in the Silver Valley and the persistent strength of metals prices, we are also pleased to maintain our 100% ownership and advance the project ourselves."

The work plans at Snowstorm include the rehabilitation of underground access to the Snowstorm No. 3 haulage level, enabling the drill testing of known copper-silver mineralization that surrounds the historic high-grade stopes, both peripherally and down-plunge. Past drilling peripheral to the Snowstorm workings, primarily by Hecla, has demonstrated a ``halo’’ grading approximately 1% (20 pounds per ton) copper and 1 oz/t silver and containing an estimated 5 to 10 million tons of mineralized material. The Timberline drill program will seek to confirm and expand this historical resource. The anticipated cost of this next exploration phase is approximately $250,000 to $400,000."

Other Projects:

Olympic-Sun & Cedar Mountain Project: Nevada - The Olympic property consists of 112 unpatented claims; The Sun property consists of 47 unpatented lode claims, along trend and two miles southeast of the Olympic Mine. Historical records credit the Olympic with 40,000 ounces of gold production in the early 20th century from three levels and 3,000 feet of underground workings, primarily from a low angle, epithermal quartz vein that ranged from 2 to 7 feet thick and reportedly averaged 0.95 oz/t gold.

In May 2006, Timberline entered into a Memorandum of Understanding (MOU) with Christopher James Gold Corporation (TSX-V-CJG) to explore the Olympic-Sun and Cedar Mountain projects along the Walker Lane Mineral Belt of south-central Nevada. The MOU provides CJG the right to earn a 60% interest in each project by incurring US$1.5 million in exploration expenditures for the Olympic-Sun project and US$1.0 million for exploration on the Cedar Mountain project over a four-year period. An additional 15% interest may be earned in each project by CJG upon its completion of a bankable feasibility study. In addition, CJG must issue 100,000 shares of its common stock to Timberline for participation in each project before the first anniversary of a finalized agreement.

The Cedar Mountain project includes the PAC, HD, and ACE properties.

Long Canyon: Nevada - 9 miles east-southeast of the East Camp Douglas project. 22 mining claims, Timberline’s V.P. of Exploration, Paul Dircksen, stated, "Long Canyon represents significant early-stage exploration targets within a regional permissive structural regime containing gold values genetically associated both the mafic and rhyolitic intrusives, not unlike those found in other mines such as Midas".

Downeyville Project: Nevada - 21 unpatented mining claims along the Walker Lane Mineral Belt in Nye County, Nevada, approximately ten miles north of the Paradise Peak Mine.

Spencer Project: Idaho - The Spencer Gold Project covers 640 acres on the western end of the Kilgore-Spencer Trend, a northeast-trending belt of rhyolite volcanics known to host epithermal gold-silver mineralization. The project is located about four miles east of Spencer, Idaho, just south of a privately-held opal mine. The Company believes that the Spencer property has the potential to host both open-pit and underground gold deposits.

Copper Sulfide Belt: Montana - In 2004, Timberline acquired four properties on the Montana Copper Sulfide Belt in Lincoln and Sanders counties, all of which were then leased to Sterling Mining Company. All four prospects have the potential for Revett-hosted, bulk-tonnage silver-copper mineralization, similar to that found in well-known deposits at Troy, Rock Creek and Montanore. The properties were held by U.S. Borax and its successor company, Kennecott Exploration, during the 1980s and early-1990s.

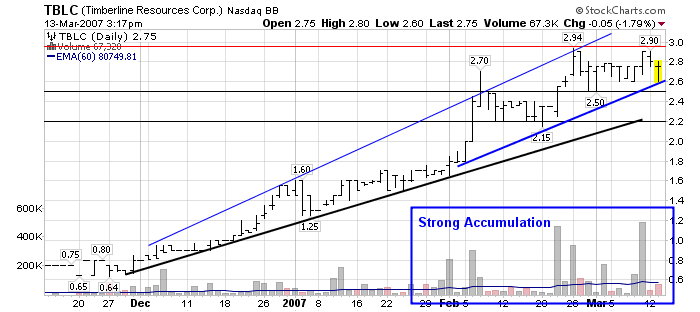

Technical Chart:

Technically, Timberline has performed exceptionally well over the past months. It is quite apparent that there is new investment capital being deployed all the way to our near-record levels. There is a hungry appetite for shares at these present levels. I believe the news of Timberline’s discounted valuations has indeed begun to make its way around the investment community and there is competition for the remaining float.

If the $2.90-3 price resistance level falls, there is a good possibility Timberline may see a further extension of this powerful rally potentially up to $4/share or higher. Although a consolidation seems likely after such gains, there remains very strong support around the $2.50 then again around $2.25 area and past corrections on the way higher have shown very few shares sold on pullbacks. Investors are regularly seen buying Timberline at the ask price and some even with some new share supply entering into the market from the financing done to acquire Kettle Drilling over a year ago.

Financing, Investors & Share Structure:

The company has proven its ability to successfully raise capital and attract institutional support in the process. Most recently, the company completed a $2.73 million financing, most of the proceeds used to acquire more drill rigs. The financing attracted the support of Praetorian Offshore Ltd, subscribing for 3.25 million of the 4.2 million units, making them a shareholder of over 10% of the company.

Since the close of that financing, Praetorian Capital has made additional open market purchases. Most recently, SEC records indicate buying by Praetorian at $1.68, $1.70 and a few weeks ago at $2.36. A strong show of support from an institutional holder which I view as a strong testament to the current valuations and potential of Timberline.

Since the close of that financing, Praetorian Capital has made additional open market purchases. Most recently, SEC records indicate buying by Praetorian at $1.68, $1.70 and a few weeks ago at $2.36. A strong show of support from an institutional holder which I view as a strong testament to the current valuations and potential of Timberline.

The past financings also have the potential to bring in several million in additional funding to Timberline. Taking a look to the right, you can view the share structure - quite investor friendly.

If all warrants and options were to be exercised, Timberline would see an additional $6.47 million enter into its treasury. Such an occasion would bring the total fully-diluted share structure to just over 30 million!

Also note that 50% of the company, upon a fully-diluted basis, would be held between insiders and institutional holders.

Conclusion:

Timberline has a very attractive business model combining the strong growth from drilling services with the blue-sky potential from exploration - "revenue backed exploration." This powerhouse combination provides a business model where investors have exposure to the upside from exploration from reduced risk from the foundation drilling services provide.

As precious metals and commodity prices continue in their bull markets, the growing supply and demand deficit will continue to promote exploration activities. Timberline is in a terrific position to capitalize on this opportunity. With drilling targeting $15 million or more the current yearly revenues, moving into the $25 million plus in fiscal 2008, drilling services can continue to organically grow at aggressive growth rates. Such a business model also allows, unlike most exploration investments, for a portion of the drilling cash flow to be invested back into exploration. The point being Timberline is not forced to continually raise capital and dilute shareholders as it continues to develop its exploration business.

With the current share price and investment support, in the money warrants and options should bring in several million in additional funds to the company and place Timberline in a position of strength to continue to develop as aggressively as we have seen over the past year. The exploration division is headed by a well-seasoned team; past success gives confidence to future multi-million ounce discovery potential.

I have personally made Timberline my largest portfolio holding and believe that the upside remains substantial from these levels. My confidence resides in the exploration potential, faith in its experienced management to continue development of the company into even a more attractive asset, the solid foundation its high-growth drilling brings to the investment negating typical risks seen in other exploration plays, and its attractive share structure. I personally believe the drilling component alone is only being valued by the market and therefore any of the properties and potential they hold, is yet to be valued in the share price. As such, with the growth in drilling and exploration progress, success the company could easily hold a $5/share valuation within the next 12 months - potentially higher should a discovery of economic size is made and/or additional M&A activities!

In the interest of full disclosure, I plan to keep Timberline as my largest holding in the coming months, if not years, as the bull market develops. The company provides reduced-risk entry of investing into exploration and an easy to understand business model. I participated in the funding which Timberline used to acquire Kettle Drilling over a year ago - as such, I may use a further move in the stock to sell about 5% of my position to purchase warrants from the financing. During the past year, I approached Timberline Resources in an effort to help better communicate their message to the marketplace as I believed and continue to believe they remain an undervalued asset. As such, Timberline is also an advertiser on websites that I own.

All investors interested in Timberline are urged to perform their own due diligence, to discuss this with a financial advisor, and to not simply go on my opinion alone. I do believe your research and conclusions will concur with mine. I have made this my largest position as I believe 2007 will continue to see Timberline’s business model unfold. Timberline Resources Corp. could be a leader in the exploration sector during the months and years and I look forward to watching the story unfold!

Resources:

Website: http://www.timberline-resources.com/

Quote: http://finance.yahoo.com/q?s=tblc.ob

SEC Filings: http://finance.yahoo.com/q/sec?s=TBLC.OB

Peter Spina’s Free E-Mail List: www.GoldSeek.com/email

Latest Gold Price & Investor Information: www.GoldSeek.com

Latest Silver Price & Investor Information: www.SilverSeek.com

Additional Research & Reports:

www.goldforecaster.com

www.silverforecaster.com

- March, 2007

Contact Information:

1100 E. Lakeshore Drive, Suite 301

Coeur d’Alene, ID 83814

phone 208.664.4859

fax 208.664.4860

e-mail info@timberline-resources.com

Disclaimer & Additional Disclosure

The owner, editor, writer and publisher and their associates are not responsible for errors or omissions. The author of this report is not a registered financial advisor. The author has received a compensation fee for research, publishing, distribution along with the marketing services provided on the author’s website, www.goldseek.com. Readers should not view this material as offering investment related advice. Authors have taken precautions to ensure accuracy of information provided. Information collected and presented are from what is perceived as reliable sources, but since the information source(s) are beyond our control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The information presented in stock reports are not a specific buy or sell recommendation and is presented solely for informational purposes only. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market.

Nothing contained herein constitutes a representation by the publisher, nor a solicitation for the purchase or sale of securities & therefore information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. Investors are advised to obtain the advice of a qualified financial & investment advisor before entering any financial transaction.

GoldSeek.com is a leader in precious metals information, established in 1995 and ranked as one of the most visited gold resource website in the world. More information can be found at www.GoldSeek.com and the author may be contacted via: http://www.goldseek.com/contact.php

-- Posted Thursday, 15 March 2007 | Digg This Article