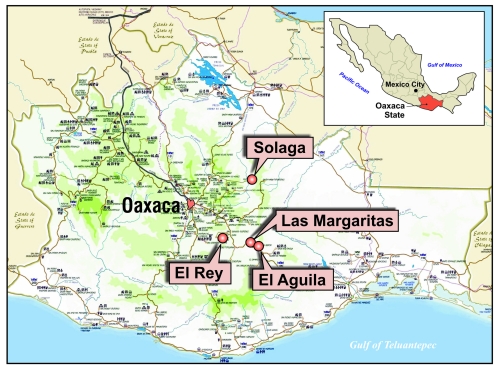

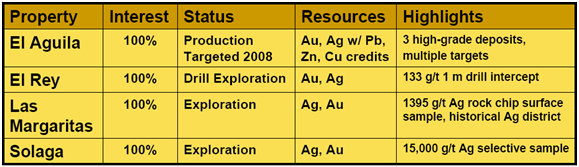

Once funded, Gold Resource Corp. is set to be in production in about a year from now. The company has set a strategy of using 1/3 of future cash flow to further develop the company, therefore maximizing shareholder value by minimizing share dilution. Some of this capital is likely to be used in the development of other projects in Oaxaca, Mexico.

Gold Resource Corp. has the potential for a total of 4 high-grade projects all of which could be feeding one mill. The El Rey project, most notably, released drill results in the past few weeks which included 132.5 g/t gold over a 1 meter intercept! It appears that a high-grade gold vein has been intersected and further drill exploration programs looks to outline this potential new gold structure. Stay tuned.

Yet the excitement of the other 3 projects should not take our focus off the immediate prize. El Aguila is a property with 3 known high-grade deposits with multiple targets. Production is targeted in the 2nd half of 2008. The $100 production cost will allow for CAPEX payback of just 6 months.

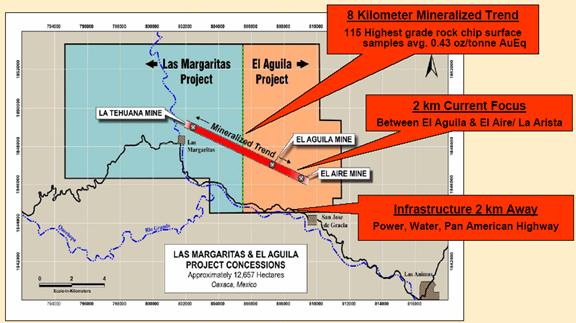

The current focus at the El Aguila project is on the 2km out of an 8km mineralized trend. The El Aguila mine will be an open-pit, with mostly gold production. The following years will bring attention into El Aire / La Arista, where high levels of precious metals and base metals will be mined.

The breakdown of the gold equivalent number is provided above (please note the conversion values which were used for the calculations). As the system grows, more base metals are also being added to the growing precious metals resource estimate. High grade levels of lead, zinc and copper are being encountered with the majority of high grade resources coming from precious metals (gold & silver). Pursuant to industry practices, Gold Resource Corp.’s base metals will be used as credits against costs of precious metals production.

Map above: Intrusives are potentially large bodies of crystallized igneous rock formed from magma that has forced its way up through subsurface rock units. Intrusives potentially generate the source of and / or the plumbing system for certain mineral deposits.

Latest News: During compilation of this report Gold Resource Corp. announced that they:

“Recently completed a geomagnetic survey over an approximate 2 kilometer area of its El Aguila Project. The geomagnetic survey … indicates several anomalies. Two significant anomalies occur in the La Arista area. The first anomaly in the La Arista area is located over the highest grades and most extensive widths of mineralization drilled to date (See map).

The second important geomagnetic anomaly in this area is located about 200 meters south east from the first anomaly (See map) and in an area not yet explored.”

“Not yet explored,” is just another indication that we have tremendous resource growth potential at the El Aguila project alone. But read Gold Resource Corporation's president Bill Reid’s comments below and one can see the potential that this system is growing into a monstrous system:

"We continue to be impressed with the La Arista area as to the width and high-grade nature of the mineralization. Additional deeper high-grade intercepts in essentially the bottom of Hole #7083 indicate we have not yet found the vertical limits to the mineralization. In addition, it bodes well that the recent geophysical survey indicates two significant geomagnetic highs in this area that potentially indicate that this mineralization has an extent and depth much greater than we previously anticipated. These distinctive geophysical anomalies may represent igneous intrusives at depth that could play a role in the source and distribution of the mineralization."

"Drilling, and now geomagnetics, continues to bolster our belief that the El Aguila Project is a potentially very large, robust and high-grade epithermal system." – Bill Reid, President G.R.C.

I feel confidentthat continued progress will yield tremendous expansion of resources for Gold Resource Corp. I believe last year’s drilling/exploration progress in bringing shareholders a much larger resource will lead the way to next year’s successful construction and commencement of mining of this high grade project. As the company expands and builds the mine and as it continues to define the size and scope of the resources, I would believe there is a good possibility Gold Resource Corp. could eventually see a multi-million ounce+ gold equivalent resource.

If the company successfully enters into production and meets their targets, there is little from stopping this company to turning into an “ATM on steroids”. Usually a company has a main feature or two which makes its story exciting, Gold Resource Corp. has many. Some of which include:

$100 Production Costs – Emerging low cost producer

Excellent share structure: Projected 37M shares fully diluted

1/3 dividend payout targeted

4 High Potential Projects

Rapidly Expanding Mineralized Material Estimates

Focusing on projects with less than 1 year CAPEX payback

Management - have placed 6 mines into production

No debt

Sub $150M market capitalization

Last year I needed confirmation to feel confident in my $5- 10 share price estimate. Should Gold Resource Corp. stay on track and meet their targets, using current assumptions, I could easily see a $10-20 price with much more upside through additional discoveries. We have a lot of good indications to lead us to believe that the potential of this system could be much larger. Therefore I do believe there remains a much larger upside potential than $20 with current and future metal price trends.

10 share price estimate. Should Gold Resource Corp. stay on track and meet their targets, using current assumptions, I could easily see a $10-20 price with much more upside through additional discoveries. We have a lot of good indications to lead us to believe that the potential of this system could be much larger. Therefore I do believe there remains a much larger upside potential than $20 with current and future metal price trends.

That level of risk/reward is one which continues to make this one of my top holdings. It is a story I am excited to follow into year two and onwards. Please take some more time and learn more about Gold Resource Corp. and further your research. The company remains under the radar screen of many metal investors. I believe that opportunity may not last too much longer.

- Peter Spina, Founder of GoldSeek.com

Click here to download this report - PDF format.

Please note: I am a shareholder of Gold Resource Corp. and the company is an advertiser on a website I am the proprietor of, GoldSeek.com.

For further research and information:

Past Gold Resource Corp. Reports:

o November, 2006: http://news.goldseek.com/PeterSpina/1163510603.php

o January, 2007 Update: http://news.goldseek.com/PeterSpina/1169579532.php

Gold Resource Corp Resources:

o GoldSeek.com Goldcast Presentation: http://www.goldseek.com/goldcasts/GORO/

o GoldSeek.com Radio Gold Nugget Interview: Bill Reid: http://radio.goldseek.com/billreidgoldnugget.php

Peter Spina's Free E-Mail List: www.GoldSeek.com/email

Latest Gold Price & Investor Information: www.GoldSeek.com

Latest Silver Price & Investor Information: www.SilverSeek.com

Additional Research & Reports:

www.goldforecaster.com

www.silverforecaster.com

- November, 2007

Disclaimer & Additional Disclosure

The owner, editor, writer and publisher and their associates are not responsible for errors or omissions. The author of this report is not a registered financial advisor. The author has received a compensation fee for research, publishing, distribution along with the marketing services provided on the author's website, www.goldseek.com. Readers should not view this material as offering investment related advice. Authors have taken precautions to ensure accuracy of information provided. Information collected and presented are from what is perceived as reliable sources, but since the information source(s) are beyond our control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The information presented in stock reports are not a specific buy or sell recommendation and is presented solely for informational purposes only. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market.