-- Posted Tuesday, 6 June 2006 | Digg This Article | Source: GoldSeek.com

| Source: GoldSeek.com

Tuesday, June 6, 2006

For investors who’d rather be smart than lucky

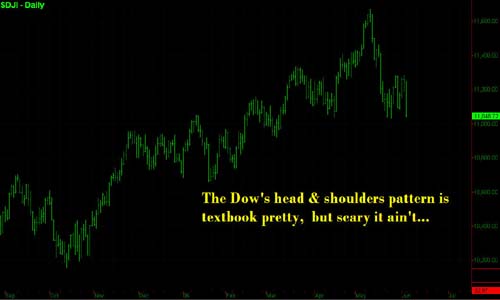

I’ve long doubted the usefulness of head-and-shoulders patterns, since they tend to be everywhere you look for them. Still, there’s no denying that the one the Dow Industrial Average has been carving out since early March is quite a looker (see below). Yeah, it needs a little more development on the right shoulder to give it proper symmetry. But otherwise, it looks good to go for an 800-point plunge. Does that sound bearish enough? Maybe to you, it does -- but not to me. For if this market is about to unravel the way I expect it to, a 3000-point leg down sounds about right. But a measly 800 points? That wouldn’t begin to discount some of the more problematical trends that are in the pipeline already, including a real estate collapse and a run on the dollar.

I haven’t talked much about that last problem, mainly because my deflationist point of view supposes a strengthening of the dollar rather than a weakening. But I could be wrong over the near term. Indeed, although I still believe deflation is not merely likely but absolutely inevitable, I’m willing accept that the dollar may swoon before a massive credit deflation begins. One factor that has made this more likely is a threat from some major oil producers to supplant the greenback as the world’s only reserve currency.

Rubles Only, Please

As of tomorrow, Russia will accept only rubles for its oil and natural gas, and in a month or so Iran and others who use its Euro Oil Bourse will take only euros. These changes have enormously bullish implications for gold, for reasons I shall explain, but catastrophic implications for the U.S. and global economies. For Russia and Iran themselves, it will amount to shooting themselves in the foot, although the economies of both of these countries are so robustly cockroach-like that they will probably still be able to hop along, missing a foot, without too much trouble.

In the meantime, with all of the news coverage that the repricing of oil in currencies other than the dollar has received, its surprising to me that so few commentators have addressed some related issues that are as crucial as they are obvious. Such as: Does Euroland really want this to happen? Obviously, if oil transactions are priced increasingly in euros rather than dollars, it will cause the euro to strengthen. Although this is an outcome that European pride could live with and perhaps even gloat over, it would be the death knell for already beleaguered European manufacturers. Mercedes Benz, a notable bellwether, has problems enough already trying to meet competition from Japan and, imminently, China. Since it is not politically feasible for the firm to move production offshore, they’ve dealt with their growing competitive disadvantage in the only way they could for now: by letting quality control freefall. If you don’t believe it, just check out the reliability ratings compiled by Consumer Reports and J.D. Powers.

Audi, VW Revaluation

But imagine what trouble the automaker would be in if a strong D-mark were to push the price of Benzes, Audis, BMWs and Volkswagens 10 to 15 percent higher. At that point they might have to start giving away cars, using overly generous rebate offers such as we’ve become accustomed to from GM and Ford.

And that is why Iraq’s little experiment with a euro oil bourse is destined to fail. For in fact, no country wants to be tied to a strong currency, since it is an export-killer, nor will euroland or any other country permit its currency to appreciate relative to others. In practice, this has meant G7 countries have allowed -- and deliberately caused -- their currencies to cheapen relative to gold while pretending otherwise – pretending that their currencies were being held “strong.” But make no mistake, when we speak of the euro, or the dollar, or the yen as being “strong” over a period of time, it is a relative term, since virtually all of the world’s major currencies are in fact fundamentally worthless.

No one cared much about this when gold was quiet. But with bullion threatening to hit $1,000 an ounce on the next big thrust, the world’s central banks are about to have their cover blown. A runaway gold price would moot all of the supposed distinctions between the major currencies, making monetary policy maneuvers not only more difficult but ultimately meaningless.

Putin’s Ace

Russia sits on the periphery of all of this jockeying around, a canny opportunist with little to lose. Its rubles might as well be Confederate money, since Russia itself is one of the most corrupt sovereign entities on earth. But for the time being, because Russia supplies 15% of the world’s oil and natural gas, Putin can say with a straight face that the ruble deserves a major role in the global currency system. Nor does he seem particularly worried about a revalued ruble pricing Russian exports out of reach, since Russia has no exports other than the basics of survival: fuel, weapons and vodka.

The important thing to realize is that neither Russia nor Iran, nor OPEC, nor anyone oil-producing nation, will be able to demand “hard” money for oil, at least not for long, since countries that import oil – i.e., most of the rest of the world – could not begin to afford to pay for it in other than depreciating dollars. To suggest that a ruble- or euro-based energy exchange might succeed is to imply that a crushing, deflationary blow is about to be dealt to global output.

Petro-Profits Dilemma

Until the experiment fails, however, Russia, Iran and all other energy exporters who shun dollars will be pressed to find something to do with their vast non-dollar earnings. Assuming they do not wish to convert those earnings back into dollars, it seems obvious that gold and other precious metals will be among the few appealing alternatives. Actually, the amount of petro-profits that will need to be recycled is far too large to be absorbed by capital investment in the world’s $54Tr economy of real goods and services. There’s an alternative, of course – the financial economy, with more than $200Tr of leveraged valuation. But most of the speculative action is facilitated by dollars, not rubles or euros, so the petro-cabal would be back to square one in their efforts to avoid dollarization. What will Russia, Iran et al. use their profits for instead? For lack of alternatives, gold has to be a very significant piece of the answer.

And that is why we could not be more confident in predicting that bullion is within weeks of embarking on a breathtaking rally -- one that will make the move from $300 to $700 look like a sluggish warm-up. As the oil producers of the world prepare to gang up on the dollar, this is the only outcome that can be predicted with near certitude.

***

Oz Seminar a ’Go”

The hidden pivot seminar in Sydney, Australia is a definite, since no fewer than fifteen of you have told me you’ll be there. New York is first, though, in early October, and it will be a no-frills version of the course that I gave in Denver. After that there will probably be just one more session offered – in San Francisco, late in 2006 or early 2007 -- but that would be the last for a long while. If you would like to attend any of these sessions, please let me know asap via e-mail. The course includes post-grad mentoring in a chat room forum.

***

Information and commentary contained herein comes from sources believed to be reliable, but this cannot be guaranteed. Past performance should not be construed as an indicator of future results, so let the buyer beware. Rick’s Picks does not provide investment advice to individuals, nor act as an investment advisor, nor individually advocate the purchase or sale of any security or investment. From time to time, its editor may hold positions in issues referred to in this service, and he may alter or augment them at any time. Investments recommended herein should be made only after consulting with your investment advisor, and only after reviewing the prospectus or financial statements of the company. Rick’s Picks reserves the right to use e-mail endorsements and/or profit claims from its subscribers for marketing purposes. All names will be kept anonymous and only subscribers’ initials will be used unless express written permission has been granted to the contrary. All Contents © 2006, Rick Ackerman. All Rights Reserved. www.rickackerman.com

-- Posted Tuesday, 6 June 2006 | Digg This Article | Source: GoldSeek.com

| Source: GoldSeek.com