|

-- Posted Tuesday, 14 October 2008 | Digg This Article | Source: GoldSeek.com | Source: GoldSeek.com

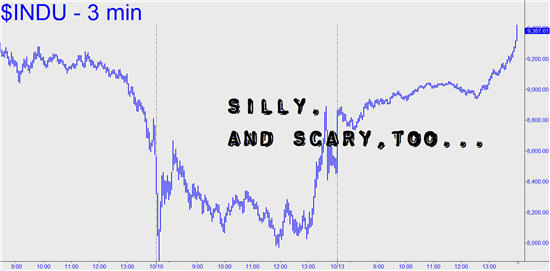

CNBC and the pundits will likely have had awfully much to say about yesterday’s monster rally, so we’ll cut to the chase, limiting our commentary to one word: silly. Were we to take our analysis a step deeper, we’d add one more word: scary. That said, we’ll stand aside if bulls truly want to buy the Dow up to 10000 this week. Ever eager to trade ‘em up, we might be willing to go along for the ride ourselves for another few hundred points, were we certain there will be no tomorrow; for that would mean there would be no corporate earnings to deal with over the next six to twelve months. But there almost certainly will be, and that is why we’d prefer to watch this rally climax, then detumesce, from the sidelines. We put out a forecast Sunday night that said the Dow would be up at least 700 points. Having been proven wrong – having, in fact, seen our surreal forecast steam-rollered -- it’s time to let the bulls have their fun.

Let’s move on to the more important concerns about Gold raised in yesterday’s commentary. We said that a possible risk to bullion hoarders is that its price could soar, then collapse, too quickly to act upon. Imagine gold going to $5000 an ounce, then back down to $100, in a matter of days – or even hours. We said the odds of such an occurrence were not remote, but let’s be blunt about it: It really could happen. And the burden of proof should rest not with the supposed whack-jobs on this issue, but with those who would assert that the dollar’s inevitable fall will occur in a rational, measured way. This is poppycock, for one reason: The dollar is already completely, fundamentally, wholly, absolutely and irrefutably WORTHLESS. And the U.S. is b-a-n-k-r-u-p-t. This means that the dollar’s value is purely a figment of the herd’s imagination. Could anyone besides Kudlow therefore doubt that there lies somewhere down the road a moment of truth for the dollar – an epiphany in which what we already absolutely know about it becomes too frightfully obvious to ignore? No Exit at Top If the dollar does indeed disintegrate in an afternoon, where does that leave gold bugs who for years have been holding doubloons for a big payoff? Face it, there won’t be a chance to exit at the top. Exit into what? is a question worth pondering right now, since there is no obvious answer. You wouldn’t want to trade your gold coins and ingots for currency, even a savings-backed yen or yuan, since, with the financial system crashing, gold would be the only money worth owning. On such a day, when banks and other financial institutions would cease to function, the only way you could take your profits on gold would be to exchange the stuff in barter for something else. Good luck.

The good news, not divulged here yesterday, is that there is no compelling reason to even want to exit gold, no matter how high it goes or how hard it falls. For we should expect gold to hold its purchasing power in any case, be it inflationary, hyperinflationary or deflationary. This it has done quite well over thousands of years, and there is no reason to think that whatever is coming will change that. Bottom line: If gold soars to $5,000, you are going to feel glad you’ve got some in your safe deposit box. But if gold should collapse the next day to $100, you will still be glad, since all else save the absolute survivalist essentials will have fallen in value by even more.

Karim’s Turn Tomorrow: A word from our wise friend Karim, who in the Rick’s Picks chat room is Cool Hand Luke. Karim tells us he is “laddering” bids for gold down to $780; that he was massively long ahead of yesterday’s rally and still quite bullish (we have a time-stamped e-mail from him attesting to his off-the-charts buying mood); and that he still thinks oil has a long way to fall. (We agree.) If you want to receive Karim’s advice, as well as Rick’s Picks’ daily commentary, free each day by e-mail, click here. *** Information and commentary contained herein comes from sources believed to be reliable, but this cannot be guaranteed. Past performance should not be construed as an indicator of future results, so let the buyer beware. Rick's Picks does not provide investment advice to individuals, nor act as an investment advisor, nor individually advocate the purchase or sale of any security or investment. From time to time, its editor may hold positions in issues referred to in this service, and he may alter or augment them at any time. Investments recommended herein should be made only after consulting with your investment advisor, and only after reviewing the prospectus or financial statements of the company. Rick's Picks reserves the right to use e-mail endorsements and/or profit claims from its subscribers for marketing purposes. All names will be kept anonymous and only subscribers’ initials will be used unless express written permission has been granted to the contrary. All Contents © 2008, Rick Ackerman. All Rights Reserved. www.rickackerman.com

-- Posted Tuesday, 14 October 2008 | Digg This Article | Source: GoldSeek.com | Source: GoldSeek.com

Previous Articles by Rick Ackerman

|