|

-- Posted Tuesday, 7 October 2008 | Digg This Article | Source: GoldSeek.com | Source: GoldSeek.com

Below is an extract from a commentary originally posted at www.speculative-investor.com on 5th October, 2008.

Trend Change Signaled

In our 3rd October email alert we wrote: "The Fed expanded its balance sheet by $254B during the one-week period ending 1st October, which follows a $204B expansion during the preceding week. As a result, the Fed's balance sheet has grown by almost 50% within the space of just two weeks. This, we believe, is unprecedented."

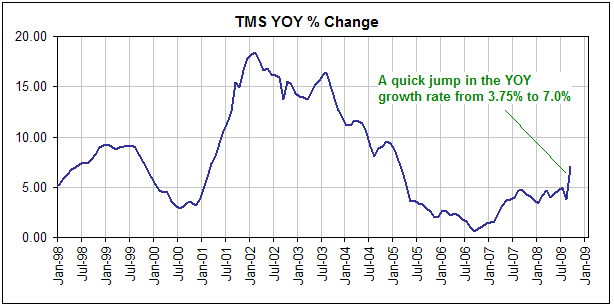

Last week's money creation by the Fed won't appear in broader money-supply data until the end of this week, but the week-before-last's expansion of the Fed's balance sheet has given the True Money Supply (TMS), our preferred monetary aggregate, a substantial boost. In fact, it has pushed the year-over-year (YOY) TMS growth rate from 3.75% to 7.0%, thus signaling a new major upward trend. The situation is depicted below.

Money Velocity

Many analysts will undoubtedly claim that the increasing rate of money-supply growth isn't important because the velocity of money will remain low, but such claims reveal a misunderstanding. There is no magical quantity called "velocity" that operates independently of money supply and demand, causing prices to rise during some periods and to fall during others. Like changes in the purchasing power of money, the thing commonly called "money velocity" is simply an effect of inflation.

By way of further explanation, during the early part of a major upward trend in money-supply growth it will typically be the case that inflation is not widely perceived as a problem. Actually, it's quite likely that deflation will be seen as the bigger threat. This is the situation that we often refer to as a "deflation scare" -- rising money-supply growth (inflation) combined with rising fear of deflation, with the fear of deflation being fanned by falling commodity and equity prices.

During the early part of an inflation cycle the demand for cash balances will tend to be relatively high -- due to falling inflation expectations -- and the average economist will perceive a low "velocity of money". But as time goes by the effects of the increased rate of money-supply growth will start becoming apparent and people will become a little more conscious of the inflation threat, the result being a decline in the demand for cash balances (people will begin to save less cash). The average economist will interpret this as an increase in the velocity of money and may well conclude that prices have begun to rise in response to the increased velocity. Clearly, though, both the increase in velocity and the rise in the general price level are just lagged EFFECTS of the preceding money-supply growth.

The bottom line is that "money velocity" is a redundant concept at best and a misleading one at worst.

A pronounced and sustained increase in the rate of money-supply growth ALWAYS leads to substantially higher prices somewhere in the economy, but due to the time-lags involved it will often be difficult to see the link between money-supply changes and price changes. For example, the rapid rises in the prices of many everyday items over the past three years occurred while the money supply was growing slowly. These price rises were an effect of the rapid money-supply growth that occurred during the first few years of the decade. Also, the quickening in the rate of money-supply growth that has just begun and looks set to continue over the coming year will probably be accompanied by a slowing rate of increase in the general price level, thus setting the scene for a "deflation scare". The reason is that the prices of everyday items have yet to react to the slower money-supply growth of 2005-2007.

Low-profile component of TARP paves the way for the Fed to create more money

In the 24th September Interim Update we mentioned that the Fed had requested the approval of Congress to pay interest on bank reserves, and explained why such a regulatory change would give the Fed a lot more freedom when it came to the printing of new money. The following excerpt from an Economist.com article published on 2nd October provides a bit more information on this issue:

"...although a rate cut remains on the table, the Fed will continue for the moment to rely on the growing use of its balance-sheet to counter the credit crunch. It has created many lending programmes since August 2007 to help banks finance holdings of illiquid assets and so avoid fire sales. But its balance-sheet is running up against constraints.

When the Fed makes loans, it deposits the proceeds in the accounts it holds for its customers -- the banks themselves. Until now it has not paid interest on those deposits, which means banks lend their excess reserves to other banks. All else being equal, that would push the fed funds rate below the Fedís target, which is why it sterilises those excess reserves by selling some of the Treasuries in its portfolio.

So far, so conventional. At the end of July last year, the Fed had $760 billion of unencumbered Treasuries, or 87% of its assets. But the Fedís lending commitments have soared: $29 billion to back the assets of Bear Stearns, a failed investment bank; $85 billion in support of American International Group, an insurer; eventually $300 billion in discount-window credit auctioned to banks; and a vast $620 billion ďswapĒ line which foreign central banks use to lend dollars to their own banks. It has also pledged to swap $200 billion of its Treasuries with investment banks. By October 1st Wrightson ICAP, a money-market research firm, reckoned the Fed had just $158 billion of unencumbered Treasuries left...

The Treasury has helped the Fed out by issuing additional debt exclusively for its use. This helps soak up the excess reserves created by the Fedís numerous loan programmes, which has caused its balance-sheet to balloon to $1.2 trillion. But the Treasury has congressional limits on how much debt it may issue. In search of a permanent way round the problem, the Fed has asked Congress to let it pay interest on bank reserves. It could then expand its balance-sheet indefinitely without driving the fed funds rate to zero; a bank will not lend out excess reserves at 0.25% if it can earn 1.75% at the Fed. The new bill would raise the debt ceiling and permit the Fed to pay interest on reserves immediately."

We understand that a provision allowing the Fed to pay interest on bank reserves was included in the Troubled Asset Relief Programme (TARP) approved by Congress late last week. This means that the Fed can now inject unlimited amounts of new money into the financial system without having to worry about pushing the Fed Funds Rate below its target.

Gold and Money-Supply Growth

We can never know for certain, in advance, which items and which markets will be the eventual main beneficiaries of an upward trend in money-supply growth, but we can make educated guesses. In general, inflation will exert the most upward pressure on the prices of items/investments that are relatively scarce and relatively under-valued.

Value is always a matter of opinion and there are many smart people in the world who disagree with our assessment of relative value, but from our vantage point the broad stock market's high P/E ratio and low dividend yield disqualify it as a likely big winner from the coming inflation. The bond market also looks over-valued, as does the property market. Commodities are likely winners because in most cases their prices remain low in real terms and because the large nominal price gains of the past several years have not yet brought about large increases in supply, but industrial commodities such as oil and the base metals could languish for quite a while in response to the global growth slowdown. Gold, however, often benefits from illiquid financial markets and economic weakness due to its historical role as money. Furthermore, we think gold is cheap relative to most other commodities and most other investments.

Gold was one of the many winners from the last major upward trend in the money-supply growth rate, but this time round we suspect that it will be in a class of its own because the flaws in the monetary system are now more obvious than they were during the first half of this decade. But while it's very easy for us to make the case that gold will be a top -- perhaps even the top -- performing investment over the next few years, it is very difficult for us to identify the timing of the next major gold rally. The fact is that the historical relationship between money-supply trends and gold price trends has not been consistent enough for us to draw definitive conclusions as to WHEN the current surge in money-supply growth is most likely to positively impact the gold market. For example, there's a distinct possibility that the mid-September surge in the gold price marked the start of a major multi-year advance, particularly as it coincided with a sudden large expansion in the Fed's balance sheet; however, it is also possible that gold won't begin to react to the changed monetary conditions until some time next year.

It could be 1-2 years before the new upward trend in money-supply growth begins to have a meaningful effect on commodities in general and 3-4 years before it begins to boost the prices of everyday items, but gold's reaction is likely to occur much sooner due to the anticipatory gold-buying of large speculators (some large speculators will appreciate the inevitable/eventual effects of the monetary inflation and take positions in gold in anticipation of these effects). Regular financial market forecasts and

analyses are provided at our web site:

http://www.speculative-investor.com/new/index.html

We arenít offering a free trial subscription at this time, but free samples of our work (excerpts from our regular commentaries) can be viewed at: http://www.speculative-investor.com/new/freesamples.html

-- Posted Tuesday, 7 October 2008 | Digg This Article | Source: GoldSeek.com | Source: GoldSeek.com

Regular financial market forecasts and analyses are provided at our web site. We arenít offering a free trial subscription at this time, but free samples of our work (excerpts from our regular commentaries) can be viewed at:

http://www.speculative-investor.com/new/freesamples.html

E-mail: Steve Saville

Previous Articles by Steve Saville

|