-- Published: Sunday, 22 March 2020 | Print | Disqus

Chris Marchese

Chief Mining Analyst, GoldSeek & SilverSeek

Week Ended March-21, 2020

$AUY $PAAS $SILV $SVM $NEE.V $NGD $MUX $KL $GUY.TO $GCM.TO $EXK $ELY.V $GOLD $ALO $AGI

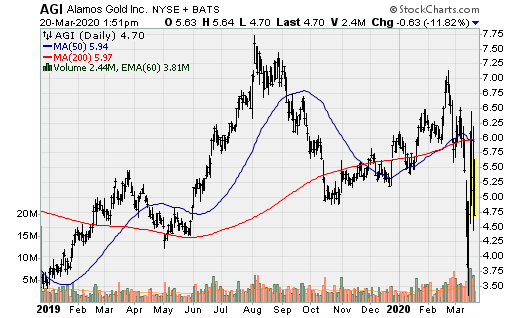

Alamos Gold: Announced it will repurchase, from a third party, an existing 3% NSR royalty on its Island Gold project for cash consideration of C$75m (US$54m). The royalty is within four patented claims that compromise the majority of currently defined mineral reserves and resources. This will immediately reduce operating costs and in turn increased operating cash flow. This is a smart move given the exploration upside potential at Island Gold as well as its future potential to increase average annual output.

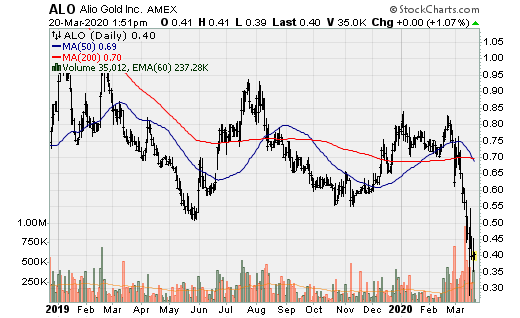

Alio Gold: The company announced a material improvement at its Florida Canyon mine and reported Q4 and FY 2019 results. Full year production was 78.84k oz. Au with cash costs of $1,185/oz. The company also announced the sale of the San Francisco mine to Magna gold on March 6th 2020. Q4 results showed significantly improved operating metrics, achieving record processing rates and the lowest total operating cost (per ton) since acquiring the asset. 2020 production guidance is between 60-70k oz. Au at cash costs between $975-$1,075/oz. All-in sustaining costs (AISC) remain very elevated at $1,483/oz. in Q4, and $1,349/oz. for the full year 2019. The company has a cash position of $16.6m, so if either the corona virus causes a temporary shutdown and/or the price of gold drops below $1,350/oz. or so, the company may very well have to dilute shareholders at a high cost of equity.

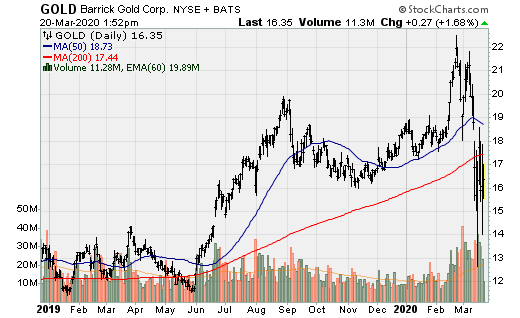

Barrick Gold: The life of the Tier-I Veladero gold mine in Argentina has been extended by at least 10-years following a comprehensive review of its strategy and business plan. The next step is Veladero’s transformation is to connect the mine to cleaner, cheaper power from the grid in neighboring Chile.

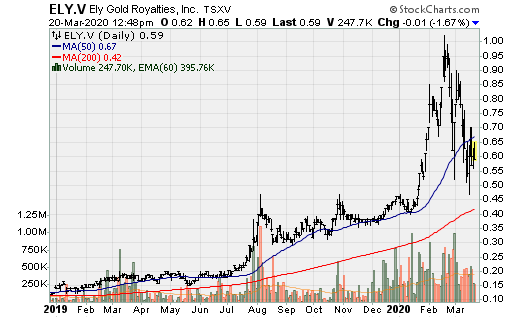

Ely Gold Royalties: On March 13th, 2020, Ely Gold closed the purchase of a 15% NPI (net profit interest) from Liberty Gold. It subsequently announced the purchase of and additional Carlin Trend Royalty. In exchange for $500k, Ely Gold will acquire a 3.5% NPI on the Ren property located in Elko, Nevada. The Ren property is part of the joint venture between Barrick Gold and Newmont Corp forming Nevada Gold Mines.

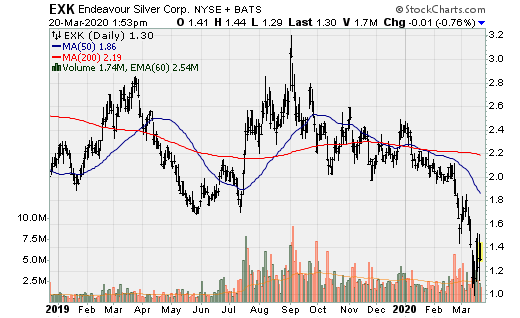

Endeavour Silver: Things are going from bad to worse for the higher-cost silver producer. In 2019, the company announced its El Cubo mine (which was its most profitable operation for a couple years) had become depletes of mineral reserves and it would be winding down operations until the company could drill out additional resources. This lowered output and caused an increase in companywide all-in sustaining costs (AISC). Further, due to heavy selling in silver and the company’s all-in cost structure being well above spot prices, should this continue for a prolonged period of time, it will be a cash drain. Beyond that, this week, the company completed the updated pre-feasibility study (PFS) at its Terronera silver project. Based on the preliminary economic assessment (PEA) and initial PFS, in addition to encouraging drill results after the study was completed, Terronera was to be its cornerstone asset, and by a substantial margin. Instead of publishing a summary of the PFS, Endeavour is now reviewing the study internally as it is less robust relative to the previous PFS. This could be resolved and be every bit at economic as originally thought but this in nonetheless unsettling news for the time being.

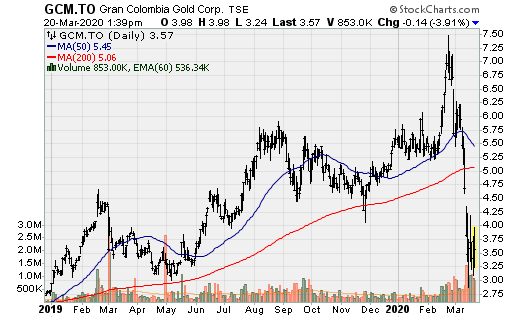

Gran Colombia: Announced it has increased its interest in the recently spun-off Caldas Gold by 1.295m shares at an average price of C$1.89/share. This purchase increases the common shares held by Gran Colombia to 37.545m shares which represents approx. 74.4% of the outstanding common shares. Should it choose to exercise its 7.5m share purchase warrants, it would hold 77.7% of the then outstanding shares.

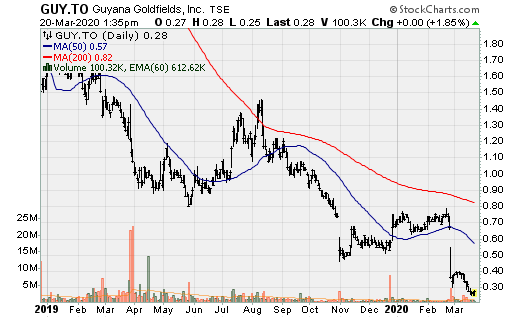

Guyana Goldfields: As a result of travel restrictions in and out of Guyana, the company has temporarily suspended underground development though open-pit and processing plant operations are currently unaffected.

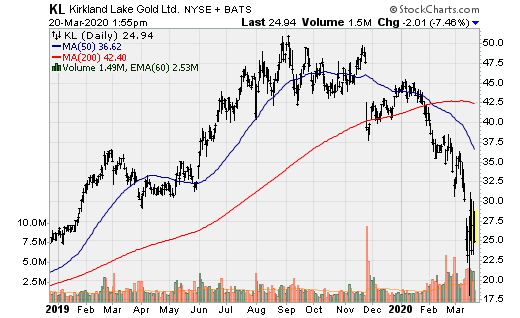

Kirkland Lake Gold: Relative to its size and free cash flow generating ability, Kirkland is one of the best capitalized gold companies in the world. As such, Kirkland is taking advantage of current market conditions to buy back its stock. It initially engaged in a normal course issuer bid (NCIB) to buy back as much as 20m shares! To date, the company has repurchased 10.1m shares at an average price of US$34.65. While this is higher than the current market price, the company should be able to quickly lower the cost basis on its repurchased shares (as its trading well below $34.65). The Company also doubled its quarterly dividend to $0.125/share.

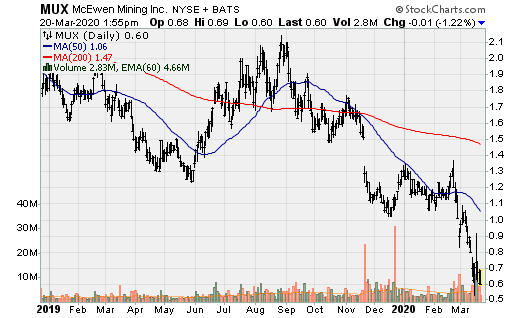

McEwen Mining: Reported Q4 and FY 2019 results. 2019 production was 174,4k AuEq oz., slightly lower relative to 2018 (175.6k AuEq oz.). The company had a consolidated net loss of $60m in 2019. This is due to having high-cost operations and aggressively drilling in 2019. Operating Cash flow was (-$17.6m) in Q4 and (-$39.5m) for the full year 2019.

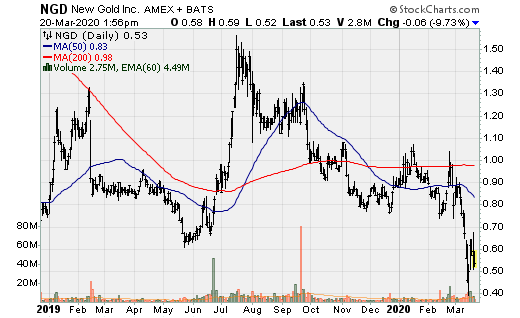

New Gold: Reported it has temporarily suspended operations at its Rainy River mine so that its local workforce can follow the fourteen-day period of self-isolation as recommended by federal, and provincial authorities related to the travel outside Canada as frequent border crossing is a common practice in the region as the mine is close to the US border.

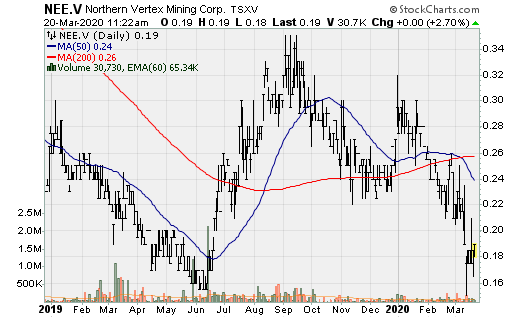

Northern Vertex: Announced the receipt of final federal permitting approval for the Phase III expansion at its Moss Mine. This allows the company to expand its current operations from its patented claims onto its surrounding unpatented claims on federal bureau of land management (BLM) managed public lands.

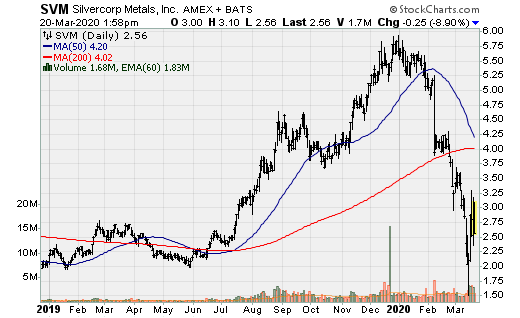

Silvercorp: Since mid-February its Ying and GC mines have ramped up operations. The company has also announced a share buyback program. The company announced an NCIB to acquire up to 8.67m shares, which is roughly 5% of the shares outstanding.

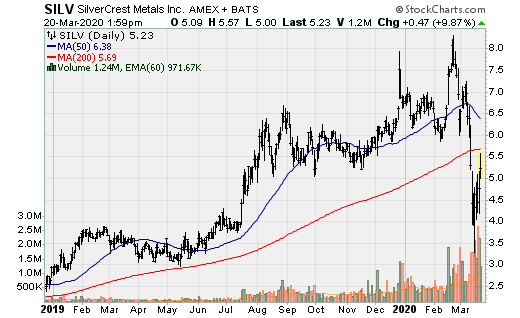

SilverCrest Metals: On March 11, 2020 the company entered into a bought deal financing with National Bank Financial (NBF) to raise C$75m through the issuance of 9.1m common shares @ C$8.25/share. On March 18, following the route in the equity markets as a whole, NBF announced it will terminate its obligation on the basis on the “disaster out” clause of the agreement. The agreement between SilverCrest and NBF created a binding legal obligation on the part of NBF to complete the transaction as is custom for bought deal financings. SilverCrest is of the view that NBF is not entitled to terminate the agreement. This is because the coronavirus pandemic considered by NBF as the basis for terminating this agreement was fully evident when the bought deal financing was agreed upon with expectations that the precious metals market would respond positively to this known risk. In turn, SilverCrest intends to pursue legal remedies against NBF for break of its obligations under the terms of the agreement. SilverCrest looks to be standing on very solid ground as the coronavirus was already well documented at this the time the agreement was made, though anything can happen when the courts are involved, right or wrong.

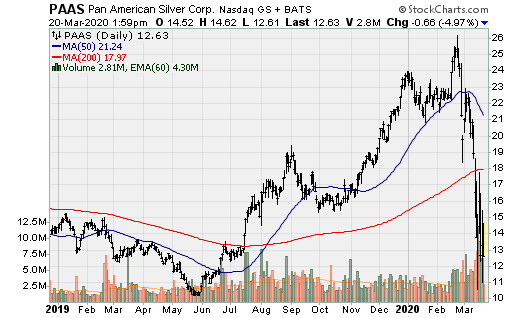

Pan-American Silver: The Peruvian government declared a National State of Emergency requiring a 15-day national quarantine. In turn, Pan-American announced that operations at its four mines in Peru.

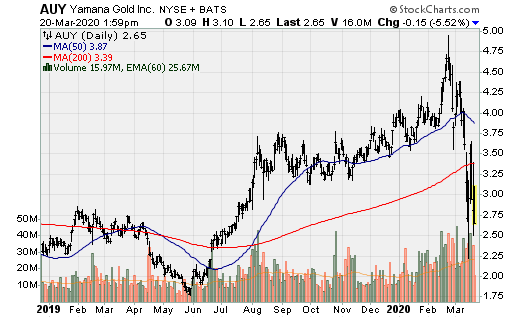

Yamana Gold: Following a mandatory social isolation declaration issued by the government of Argentina, and after consultation with employees, various agencies, and other stakeholders, the company will be implementing a temporary, partial demobilization of its workforce at its Cerro Moro mine in the Santa Cruz Province. Between March 20th and March 31st, the company will demobilize local employees and contractors at Cerro Moro and continue to work with a limited workforce comprised of employees and contractors primarily from out of province. Underground operations will be reduced and Cerro Moro will operate largely from its open pit operation and from stockpiled material.

Chris Marchese for the Gold Seeker Report

Chief Mining Analyst at GoldSeek & SilverSeek

Chief Mining Analyst with GoldSeek and SilverSeek. Previously he was the Senior Mining Equity and Economic Analysis at The Morgan Report. He was a Co-Founder and Director of Lemuria Royalties, before it was acquired in March 2018. He also co-authored The Silver Manifesto with David Morgan in 2015.

| Digg This Article

-- Published: Sunday, 22 March 2020 | E-Mail | Print | Source: GoldSeek.com