-- Published: Thursday, 20 November 2014 | Print | Disqus

Gold has been volatile in recent weeks. It broke down, then it bounced back up. So where does it currently stand?

Gold’s timing will help us in identifying the lows and the steps upward towards a new bull market.

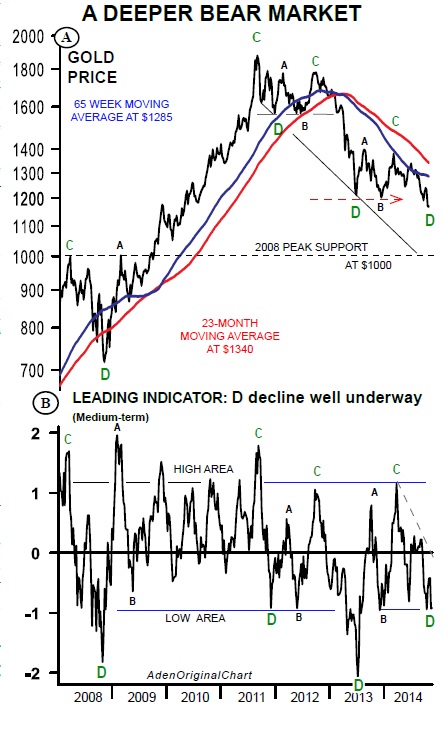

Chart 1 shows our favorite gold timing tool. As our older readers know, gold has had recurring cycles going back for years.

Currently, a D decline has been underway since last March when gold’s 2014 rise petered out. D declines tend to be the worst decline in gold’s cycle. And during bear markets, D declines usually take gold to new lows for the bear market.

This is exactly what happened this month. Most impressive, the leading indicator has yet to fall into the extreme low areas that normally coincide with D lows... This means gold could still go lower before this decline is over.

On the downside, gold will remain weak below $1200, and especially below its $1180 low. And the longer this is the case, the more likely we’ll see lower lows soon.

A clear decline below $1150 means $1100 would be a shot away. This would likely take the indicator down to test the extreme D lows.

GOLD SHARES: Fell the most

Gold shares, however, took the cake. They plunged much more than gold and silver. And the gold share indexes fell to their 2008 lows. That is, they fell to the lows of the depths of the financial crisis washout.

The HUI Gold Bugs index is now starting to consolidate near these lows above 150, and as long as that’s the case, we just may see the start of constructive base-building.

Gold mining shares are weaker than gold, the most they’ve ever been since the 1960s. This

weakness is not over yet, but the 5 week moving average works well in identifying the start of a turn.

So keep an eye on 170 for HUI. If it can stay above this level, gold shares will be looking better and they could then be leading gold.

---

Mary Anne & Pamela Aden are well known analysts and editors of The Aden Forecast, a market newsletter which provides specific forecasts and recommendations on gold, stocks, interest rates and the other major markets. For more information, go to www.adenforecast.com

| Digg This Article

-- Published: Thursday, 20 November 2014 | E-Mail | Print | Source: GoldSeek.com