How credit crises begin and end

From the standpoint of investor sentiment the credit crisis has reached the point of maximum saturation. Every TV news program and political commentator, every newspaper and every magazine in town is writing about it. It is being depicted as a virtual apocalypse that can’t be stopped. For example, the headline for the latest cover of Time magazine reads: "The New Hard Times.” It features a photograph of a soup line from the Great Depression.

Whether the latest cover of Time will mark a major turning point in the stock market, along the lines of the infamous “Death of Equities” Business Week cover from 1979 remains to be seen. It does, however, represent a manifestation of bearish sentiment that is typical of major cycle lows.

Survivalism is another theme that has become quite popular in recent months. It wasn’t too long ago that the focus of America’s mainstream media and pop culture was on personal growth and prosperity. Ever since the credit crisis has taken center stage, prosperity has given way to survival.

Millions of Americans are afraid of the economic consequences of the credit crisis and what it might mean to their livelihoods. They are buying survival supplies at a rate unsurpassed since the months prior to Y2K. An article in the November issue of Details magazine highlights the growing trend toward survival supply hoarding among the 30-something suburbanite crowd. These well-heeled members of the corporate world are wary of a potential societal breakdown and many of them are taking pains to prepare for it.

The article quotes Jim Rawles of SurvivalBlog.com, who says surivivalism is growing at a rate not seen since the 1970s. It is being fueled, he says, by such obvious crises as the housing crash, the tanking economy, looming environmental disasters, the spike in oil prices and the hurricanes and extreme weather of recent times. Never mind that much of what passes for a survival kit among these “preppers” is often nothing more than a few bottles of water, some vacuum packed crackers and brie and a couple of cases of champagne. The contrarian sentiment implications of this new focus on personal survival are undeniable.

Suburbanites aren’t the only ones feeling the fear right now. According to the Financial Times, hedge funds have lately spurned sophistication for perceived safety and have moved $100 billion into low-yielding money market funds. According to a recent FT article, Citigroup estimates that hedge funds have now placed $600 billion in cash, with $100 billion of this held in money market funds. Remember the days of old when a heavy move into cash on the part of the public was the sign of high fear among investors? Nowadays it’s the formerly fearless hedge funds who are parking money in cash. Oh, how the mighty have fallen.

Other signs that the latest panic has run its course are seen in the latest headlines concerning the rush to own gold as a crisis hedge. As the FT pointed out in an article dated October 1, the investment demand for gold coins has reached stratospheric proportions. Said one member of the London Bullion Market Association, “There is an enormous pick-up in investment demand [for gold]. I have never seen a market like this in my 33-year career. The gold refineries cannot produce enough bars.”

Closer to home the U.S. mint temporarily suspended sales of the popular American Buffalo one-ounce gold coin after its inventories were depleted recently. As the FT observed, “The scarcity of gold coins comes as investors in bullion-backed exchange traded funds (ETFs) have amassed a record 1,054 tonnes of bullion, becoming the largest holders of gold after the reserves of the US, Germany, the International Monetary Fund, Italy, France and Switzerland.”

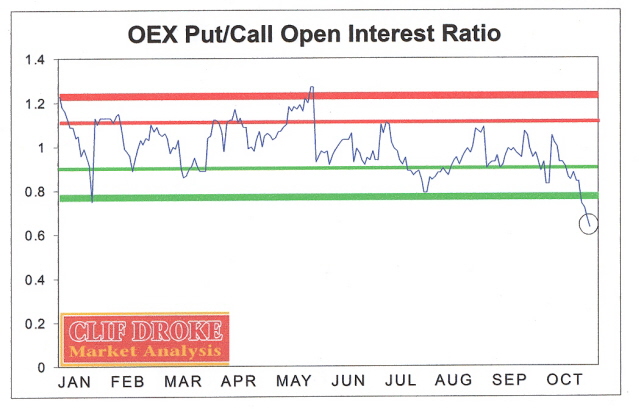

Lending additional weight to a panic low being confirmed in the days ahead is a “smart money” indicator that has been very reliable in recent years. The OEX put/call open interest ratio has registered its most impressive reading of the entire year as of Friday. This indicator, which is used to measure the net bullish or bearish sentiment among “smart money” options traders, has approached levels normally associated with a major interim market bottom. The last time a comparable reading was seen in this indicator was on January 18, which was just one day before the internal low in the S&P that held (on a closing basis) for the next five months.

Baby Boomers and the credit crisis

Let’s turn now our attention now to the credit crisis itself, specifically, who or what caused it and why?

Could the credit crisis be part of a plan to forcibly prolong and/or increase America’s productive output in the face of an oncoming retirement wave of Baby Boomers? That’s what some observers are wondering and I’ve heard more than a few of my friends and colleagues speculate on this possibility. Since there is an obvious demographics gap in the U.S. where, in just a few short years, the number of retirees will drastically outnumber workers, many have wondered where the Social Security shortfall will be made up. Enter the credit crisis…

Reporting on the effects of the crisis on the Baby Boomers’ retirement plans, the Associated Press noted that Americans’ retirement plans have lost as much as $2 trillion in the past 15 months, according to a Congressional report. The AP reports, “More than half the people surveyed in an Associated Press-GFK poll taken Sept. 27-30 said they worry they will have to work longer because the value of their retirement savings has declined.”

The AP said that public and private pension funds and employees’ private retirement savings accounts — like 401(k)’s — have lost some 20 percent overall since mid-2007. This will force many Americans to delay their retirement.

The AP also reports on a new AARP study, which found that because of the economic downturn, one in five workers 45 and older has stopped putting money into a 401(k), IRA or other retirement savings account during the past year, and nearly one in four has increased the number of hours he works.

The real reason for the crisis

An endless stream of editorials and market commentary remind us that the real estate bubble, and the cheap credit that created it, is to blame for the present financial crisis.

For instance, in the Sept. 19 edition of the Financial Times, David Blake editorializes that “Greenspan’s sins return to haunt us.” His analysis of the credit debacle returns to the point made by so many commentators that the present crisis was created by the era of cheap interest. Cheap credit, however, is only half the reason for the crisis as we’ll discuss here.

This widely held notion that loose credit is the key factor in the collapse of financial bubbles is perhaps best summarized in the title of a forthcoming book entitled “Bailout Nation: How Easy Money Corrupted Wall Street and Shook the World Economy.” The belief that easy money equals speculative boom followed by inevitable bust has become so firmly ingrained that it’s almost impossible to challenge it in the popular discourse.

There is no question that loose and easy credit tends to stimulate speculation, which in turn can quickly degenerate into a dangerous bubble. But, oh, how easy we forget that there are always two sides to any boom and bust. The boom phase is always marked by loose credit and easy monetary conditions. But in modern times, booms don’t collapse of their own accord: they are brought to a screeching halt in the form of tight money policies of central banks. Bankers being reactionary by nature, they tend to overreact to the very bubbles they help create by slamming on the credit brakes. In doing so they only exacerbate the problem by creating the crash that brings the boom times to an inglorious end.

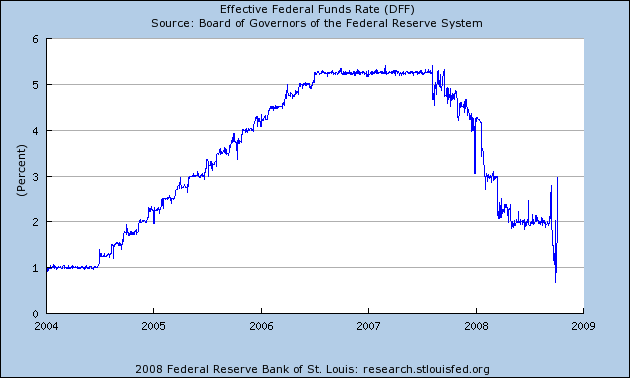

The credit crisis traces its origins to the second quarter of 2004. By that time the Fed (under then Chairman Greenspan) had already begun its contraction of money supply even as Greenspan initiated a campaign of higher interest rates.

Indeed, money growth is the real issue here. The heart of the matter lies in the Fed’s stated goal of controlling U.S. economic performance by refusing to let the nation’s growth rate exceed a pre-conceived (and very low) percentage range. The idea that growth should be contained is a relic of Soviet-style Communism. Growth, as our forefathers believed, should be allowed to proceed at its own natural pace. Money supply should be allowed to expand in lock-step with the economy. If the economy wants to grow at a rate deemed by monetary officials to be “too fast,” then let it grow. The “experts” have no right to impinge on the combined productive capacity and energy of the populace.

A flexible currency that can expand and contract to meet the ever-changing needs of commerce isn’t a bad thing, as some writers allege. In the hands of honest men it can be a tremendous benefit to all. A rigid, flexible currency is the last thing a vast and dynamic nation such as ours needs in today’s fast-paced world. The problem with our money system are the men who have control of it, viz. a small band of small-minded bankers with little or no regard to the needs of everyday commerce. The men and women who control U.S. monetary policy display a clear lack of concern for free enterprise and by all appearances are more interested in furthering the interests of the corporate statists than of the smaller businesses that form the backbone of the domestic economy.

What is needed here is a growth-oriented monetary policy and it’s questionable that Mr. Bernanke is the right man for the job. He has been painfully slow in responding to the crisis every step along the way. He’s had several opportunities to avert disaster before the crisis began spiraling downward, beginning with last year, and yet he mostly chose to sit back and do nothing. Only when the market forced him to act has he responded and half-heartedly at that. At times it has seemed that he wanted the credit crisis to inflict maximum damage.

Before he began his tenure as Fed president, Bernanke was known for adoption of Milton Friedman’s view of money supply growth as a means of escaping a financial crisis with so-called “helicopter money.” In academic circles Mr. Bernanke even acquired the moniker of “Helicopter Ben.” Bernanke has been at the helm of the Fed now for almost three years and has had abundant opportunity to test his theories of money creation. He has so far failed the test miserably and if anything seems more committed to a deflationist monetary policy. Unless he can show some dramatic results soon he’ll forced to reconcile with his new (and deserved) moniker of “Mr. Deflation.”

Only when the Fed gets serious about liquidity will investors have any reason to relax. On that score, the Fed and other central banks have just announced plans to provide as much dollar liquidity as needed in short-term funding markets, an assurance that has been lacking until now. On Oct. 13, the 15 Eurozone countries said they would guarantee new bank debt until the end of 2009. Several European countries also announced plans to guarantee interbank landing and directly inject capital in financial firms. The U.K. government is expected to inject up to $63 billion in three U.K. banks.

Meanwhile the U.S. is expected to provide interbank lending and bank debt guarantees and direct capital injections in financial institutions. Liquidity has been the main issue in recent weeks and once the markets have this assurance can they finally return to a semblance of stability along with a decrease in volatility.

Clif Droke is the editor of the three times weekly Momentum Strategies Report newsletter, published since 1997, which covers U.S. equity markets and various stock sectors, natural resources, money supply and bank credit trends, the dollar and the U.S. economy. The forecasts are made using a unique proprietary blend of analytical methods involving internal momentum and moving average systems, as well as securities lending trends. He is also the author of numerous books, including “Channel Buster: How to Trade the Most Profitable Chart Pattern.” For more information visit www.clifdroke.com