For Kaoru Sekiai, getting steady returns for his pension clients in Japan used to be simple: buy U.S. Treasuries.Compared with his low-risk options at home, like Japanese government bonds, Treasuries have long offered the highest yields around. And that’s been the case even after accounting for the cost to hedge against the dollar’s ups and downs — a common practice for institutions that invest internationally.

It’s been a “no-brainer since forever,” said Sekiai, a money manager at Tokyo-based DIAM Co., which oversees about $166 billion.

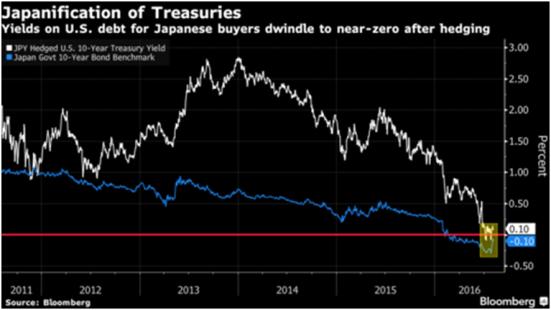

That truism is now a thing of the past. Last month, yields on U.S. 10-year notes turned negative for Japanese buyers who pay to eliminate currency fluctuations from their returns, something that hasn’t happened since the financial crisis. It’s even worse for euro-based investors, who are locking in sub-zero returns on Treasuries for the first time in history.

That quirk means the longstanding notion of the U.S. as a respite from negative yields in Japan and Europe is little more than an illusion. With everyone from Jeffrey Gundlach to Bill Gross warning of a bubble in bonds, it could ultimately upend the record foreign demand for Treasuries, which has underpinned their seemingly unstoppable gains in recent years.

“People like a simple narrative,” said Jeffrey Rosenberg, the chief investment strategist for fixed income at BlackRock Inc., which oversees $4.6 trillion. “But there isn’t a free lunch. You can’t simply talk about yield differentials without talking about currency differentials.”

Ten-year yields in the U.S. are currently about 0.23 percentage point below a basket of bonds from Australia, France, Germany, Italy, Japan, Spain and Switzerland on a hedged basis, versus 1.4 percentage points above on an unhedged basis, according to data compiled by BlackRock. At the start of the year, hedged Treasuries yielded over a half-percentage point more.

In Japan, where 10-year government bonds yield less than zero, the advantage for Treasuries has dwindled from a percentage point at the start of the year to less than 0.1 percentage point now. Without much added value for overseas investors, it’s harder to see foreign demand driving Treasuries to new records, especially as the Federal Reserve moves toward gradually raising rates.

For a large swathe of institutional investors, especially those with conservative mandates, hedging is the norm when they go abroad. It eliminates the need to worry about the daily ebbs and flows in exchange rates and how that might affect their returns. When it comes to Treasuries, overseas buyers usually lock in a fixed exchange rate on the interest payments they get in dollars.

Conversion Costs

In that trade, the cost to convert payments from one currency to another is determined by the cross-currency basis swap. Take Japanese insurers as an example. Under normal circumstances, they would swap their yen for dollars and get interest on the yen they loaned out over the course of the contract.

But now, because the rate has turned negative, they’re effectively paying interest to lend the yen, which eats into their bond returns. That’s on top of the Libor rate they’ll need to pay for borrowing the dollars, which currently stands at 0.79 percent over three months.

The basis, as it’s known, was at minus 0.6425 percentage point for yen-based investors, which is close to the most expensive in five years. For those with euros, the basis is minus 0.43 percentage point. That’s more than twice as costly as the average over the past three years.

“We’re at a point now where investors have to start thinking about this,” said Sachin Gupta, a foreign-bond fund manager at Pimco, which oversees $1.51 trillion. “As the cost of hedging rises to such an extent, there’s no extra carry to be had. That itself will slow down the demand — and, at some point, even reverse the demand — for Treasuries.”