-- Published: Friday, 10 March 2017 | Print | Disqus

Just as everyone was finally accepting the idea of deflation and negative interest rates, inflation decides to pay a return visit. In the past day, articles with the following headlines appeared in major publications around the world:

Swiss inflation rises at highest monthly rate in 5 years

China February producer inflation fastest in nearly nine years

Year-over-year import prices at highest level in five years

ECB keeps bond-buying, rates unchanged amid inflation flare-up

Food inflation doubles in a month as UK shoppers start to feel the pinch

What happened? Well, towards the end of 2015 most of the world’s major governments apparently got spooked by deflation and decided to ramp up their borrowing and money creation. China, for instance, generated the following stats in 2016:

- New loans totaling 12.65 trillion yuan, or $1.8 trillion.

- M2 money supply growth of 11%.

- Debt-to-GDP ratio jump from 254% to 277%.

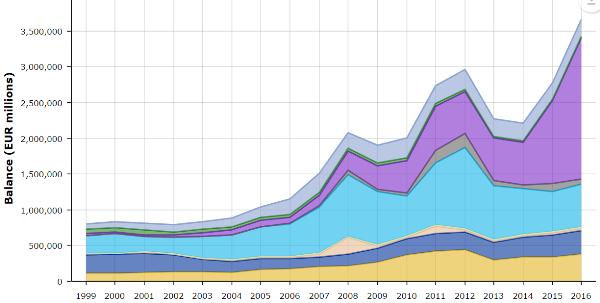

In Europe, the European Central Bank ramped up its bond buying program, pumping about a trillion newly-created euros into the Continental economy:

And the US increased its federal government debt by over $1 trillion, presumably spending the proceeds on things that raise wages or increase the demand for commodities.

Since there’s no way for the growth of global production to match this blistering pace of new money creation, the result is higher prices for just about everything. Oil and most other industrial materials are more expensive, wages are rising, long-term interest rates (the cost of money) are up; you name it, it went up in the past year.

What comes after a debt-driven spike in inflation? History is pretty clear on this one: instability, as rising interest rates spook the fixed income markets and rising business costs spook stock speculators. Toss in global political upheaval as populism (the inevitable result of previous bad policies) sweeps the globe, and the “Great Moderation” of the past year – which was as it turns out just a bunch of clueless people borrowing a ton of money – will give way to something a lot more interesting.

The only amusing part of what’s coming will be the disarray among the economists and politicians who have been advocating a higher inflation target, as if a modern economy is a thermostat that can be dialed up and then back down by an omniscient homeowner. As Jim Rickards likes to say, it’s not a thermostat, but a nuclear reactor that can, if allowed to get too far out of balance, go critical.

| Digg This Article

-- Published: Friday, 10 March 2017 | E-Mail | Print | Source: GoldSeek.com