-- Published: Monday, 26 November 2018 | Print | Disqus

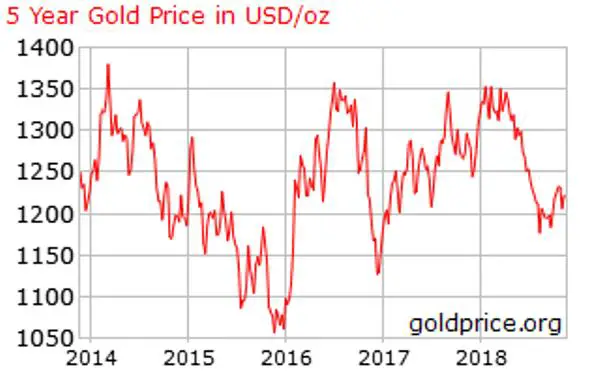

Precious metals investors don’t have much to console them these days. Just about the only bright spot is the nice, though ephemeral, pop in the gold/silver price that seems to happen every January. Sometimes it persists for six or so months, sometimes it ends before the snows do. But either way it’s more fun than the rest of the year.

This pattern repeats because Asians like to give gold and silver jewelry as wedding gifts, and they like to have their weddings in the Spring. So they do their anticipatory buying in January, which tends, other things being equal, to push up the price.

There’s no reason to expect Asian buying to depart from the usual this January, so – especially given 2018’s grinding price decline which has put the metals on sale – it’s reasonable to expect positive trends to kick in shortly.

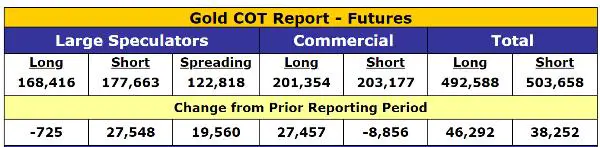

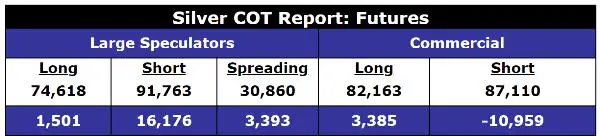

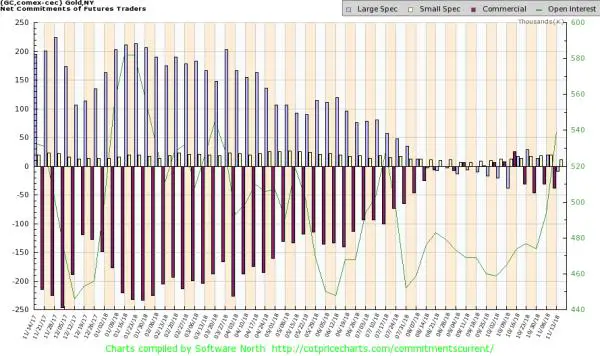

In fact, the set-up this time is looking a lot like 2016, by far the best run of the past five years. Because in addition to the normal seasonal factors, the structure of the paper (i.e., futures contract) markets is also bullish. This past week, commercial traders – who tend to be right at big turning points – went aggressively long and are not far from being net long, meaning they strongly expect higher prices in the next few months. Speculators, meanwhile, tend to be wrong at turning points, and they’re now net short, which is also both unusual and very bullish.

Here’s the same data for gold in graphical form, which illustrates how unusual the current structure has become.

So let’s fantasize a bit about a replay of 2016, when both gold and silver rose for a solid six months, and recall the fire that that lit under the mining stocks. Here’s silver miner ETF SIL, one of many fond memories that would be nice to revisit:

| Digg This Article

-- Published: Monday, 26 November 2018 | E-Mail | Print | Source: GoldSeek.com