-- Published: Wednesday, 28 November 2018 | Print | Disqus

Looks like we just hit an inflection point. So far this morning:

(Reuters) – Sales of new U.S. single-family homes tumbled to a more than 2-1/2-year low in October amid sharp declines in all four regions, further evidence that higher mortgage rates were hurting the housing market.

The Commerce Department said on Wednesday new home sales dropped 8.9 percent to a seasonally adjusted annual rate of 544,000 units last month. That was the lowest level since March 2016. The percent drop was the biggest since December 2017.

New Home Sales ‘000s

source: tradingeconomics.com

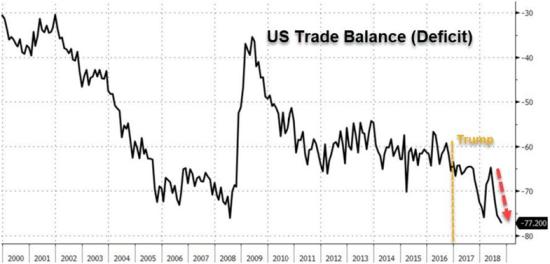

The trade deficit spikes:

(Zero Hedge) – The October advanced trade balance (deficit) of goods worsened to $77.2 billion ($77.0 billion expected) from $76.3 billion in September.

• Imports rose 0.1% in Oct. to $217.764b from $217.554b in Sept.

• Exports fell 0.6% in Oct. to $140.517b from $141.303b in Sept.

This is a new record high deficit for Trump’s America…

In December 2016, the US goods trade deficit was $63.485 billion.

In October 2018, the US goods trade deficit is $77.2 billion.

A dramatic rise of almost $14 billion since Trump’s election and trade war started.

And the Fed blinks:

(CNBC) Federal Reserve Chairman Jerome Powell said Wednesday he considers the central bank’s benchmark interest rate to be near a neutral level, an important distinction from remarks he made less than two months ago.

“Interest rates are still low by historical standards, and they remain just below the broad range of estimates of the level that would be neutral for the economy — that is, neither speeding up nor slowing down growth,” Powell told the Economic Club of New York in a speech being closely watched in what has become a volatile financial marketplace.

The chairman’s observation on rates in early October helped set off a rough period on Wall Street, after he said the Fed was “a long way” from neutral. Major averages dipped briefly into a 10 percent correction and worries grew that more rate hikes might meaningfully slow down the strong economic growth of the past two years.

President Donald Trump has stepped up criticism lately about both the central bank and Powell. Trump has gone beyond criticism of the rate hikes and has even objected to the Fed’s balance sheet unwind, in which it is reducing the size of the bond portfolio it accumulated when trying to stimulate the economy.

Gold welcomed the possible end of quantitative tightening:

This is of course just the first step in a long dance that will progress through:

1) The end of rate increases sometime in early 2019

2) The beginning of rate cuts soon thereafter

3) And return to ZIRP, NIRP and QE not long after that

From here on out every Fed meeting will be an adventure.

| Digg This Article

-- Published: Wednesday, 28 November 2018 | E-Mail | Print | Source: GoldSeek.com