-- Published: Tuesday, 23 September 2014 | Print | Disqus

Summary

- The following is a sample excerpt from a paid report we published in April of 2014 for our Top 10 Companies to Watch in Summer of 2014.

- Seabridge Gold is a top-tier development company. The KSM Project has 38.2 million oz gold and 9.9 billion lbs of copper.

- Seabridge recently also obtained necessary environmental permits from the province of BC on July 31st. It still needs approval from Federal gov't.

Introduction

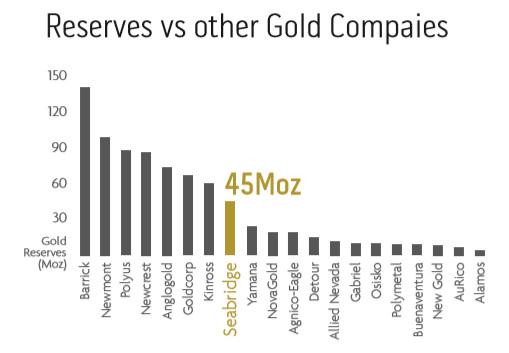

Seabridge Gold's most formative years were between 1999 and 2003, when the company acquired projects that would provide leverage to a rising gold price. Seabridge management has done a fantastic job of achieving these goals and ranks 1st in reserves per share (0.95 oz) of the leading gold companies by a wide margin. Seabridge Gold (NYSE:SA) owns the KSM (Kerr-Sulphurets-Mitchell) property which has proven and probable reserves of 38.2 million ounces of gold and 9.9 billion pounds of copper. Total gold reserves, between all projects, are 45 million ounces, which ranks Seabridge among the world's top 10 gold companies. Management has done an incredible job of keeping a tight share structure with only 49 million fully diluted shares, which adds additional leverage to metal prices and positive results.

Financial

Seabridge has over $30 million in working capital after closing a $16.8 million bought-deal December 10, 2013. At the time, Seabridge said the financing would be used for 2014 drilling at the Deep Kerr Zone.

Management

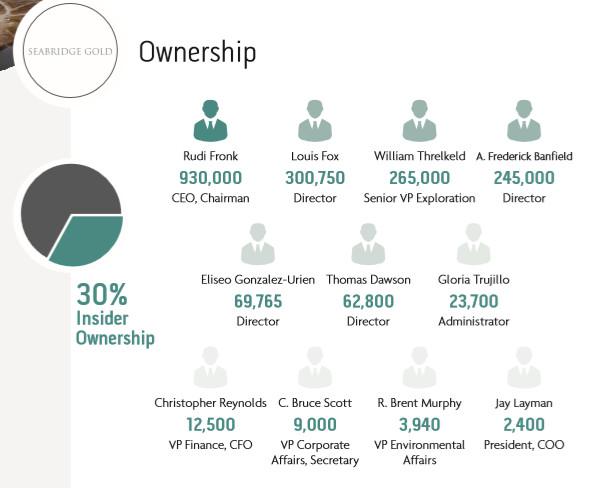

The management team at Seabridge is loaded with talent and experience. President and COO, Jay Layman was previously VP Solutions and Innovation for Newmont, managing Global Technical Services as well as numerous feasibility studies. Senior VP, Exploration William Threlkeld has been with Seabridge for 11 years and has been instrumental in the resource expansion at both KSM and Courageous Lake. Peter Williams brings 30 years of experience on the technical side, and was most notably responsible for mining engineering for Newmont, hence why he is now Senior VP of Technical Services. The management team has done an outstanding job not diluting the float. CEO Rudi Fronk has been with Seabridge for 11 years and owns 930,000 shares, exactly the type of interest you would like to see from the CEO. Insider common share ownership is ~4%.

Project

The KSM project is one of the largest undeveloped gold-copper projects in the world. The KSM project has gone through many rigorous assessments including 2 PEAs and 3 Preliminary Feasibility Studies. The 2012 PFS identified a mine life of 55 years for proven and probable reserves using an open-pit and block cave underground mining method. Using $1320 gold and $3.00 copper the KSM project yields a $3.5 billion NPV, 10.3% IRR and 6.7-year payback. The initial capex on a project of this magnitude is substantial; the estimated price tag is currently $5.3 billion. Due to the magnitude of the resource size, the project economics are extremely leveraged to movements in metal prices. Moving from $1320 gold and $3 copper to $1650 and $3.75 the project NPV becomes 7.7 billion with a 14.7% IRR and 5-year payback.

The Deep Kerr expansion zone is very exciting for investors as the deposit is estimated to have 5.9 million ounces of gold and 6.1 billion pounds of copper in the inferred category, and is open for expansion in multiple directions. Additionally the Deep Kerr area is significantly higher-grade material, which can add considerably to margins and mine life. Royal Gold owns a 2% NSR option on the KSM project exercisable for $160 million, with the option to earn another 0.75%.

Somewhat unfairly overshadowed is the Courageous Lake project in the Northwest Territories of Canada. The FAT deposit hosts 8 million measured and indicated ounces with an additional 3.4 million in the inferred category. The July 2012 PFS demonstrates solid potential to build a mine at higher gold prices. At $1384 gold, the NPV is $303 million with a 7.3% IRR and 11 year payback. Using a gold price of $1925 the NPV vaults to $2 billion with an 18.7% IRR and 4-year payback. Seabridge is actively exploring this area for a 2nd higher-grade deposit. The Walsh Lake deposit shows good potential with the initial resource estimate coming in at 454,000 ounces at 4.02 g/t using a 1 g/t cut-off.

Outlook

Seabridge is extremely leveraged to the gold price and has one of the lowest enterprise value-per-ounce ratios in the world at ~$9/ounce. Seabridge will be aggressive with the drill bit in 2014 at Deep Kerr as the deposit is higher-grade material and is open in all directions. A $16 million dollar budget has been approved for Deep Kerr and the goal is to hit higher grades which would improve project economics. An environmental assessment approval is also expected by mid 2014. A JV or a takeover is always a possibility with a large resource in safe jurisdiction.

http://tickerscores.com/

| Digg This Article

-- Published: Tuesday, 23 September 2014 | E-Mail | Print | Source: GoldSeek.com