-- Published: Monday, 8 February 2016 | Print | Disqus

Gold Today – The New York gold price closed Friday at $1,173.60 up from $1,155.70 up $17.90. With China closed this week, it held there at London’s opening and then the LBMA set it at $1,173.80 up from Friday’s $1,158.50 up $15.30 with the dollar index up slightly at 96.97 up from 96.62 on Friday. The dollar was weaker against the euro at $1.1156 down from $1.0956 against the euro on Friday. The gold price in the euro was set at €1,052.17 up from €1,034.74. Ahead of New York’s opening, the gold price was trading at $1,175.85 and in the euro at €1,057.09.

Silver Today –The silver price in New York closed at $15.04 up 18 cents at Friday’s close. Ahead of New York’s opening, the silver price stood at $14.95.

Gold (very short-term)

The gold price will consolidate with a stronger bias, in New York today.

Silver (very short-term)

The silver price will consolidate with a stronger bias, in New York today.

Price Drivers

The “Year of the Monkey” begins today and China is closed. With that demand postponed for the holiday and returning at its end we expect dealers to try to pull prices back, but currency considerations and physical demand will rule the gold price. While the Chinese Lunar New Year is the highpoint for Chinese gold demand, it does not drop off significantly afterwards as the steady current of growing middle classes continues to attract demand. And this is not just a one-off purchase when they become middle class it signals the start of a continuous purchasing pattern. The plunge of the Shanghai equity market last year and continuing this year has reasserted the attractions of gold. Likewise while the Chinese authorities are trying hard to hold the Yuan up [It’s cost them over $100 billion so far] the currency should slip considerably as it is overvalued.

- More in www.goldForecaster.com [To find protection from confiscation: www.Stockbridgemgmt.com ]

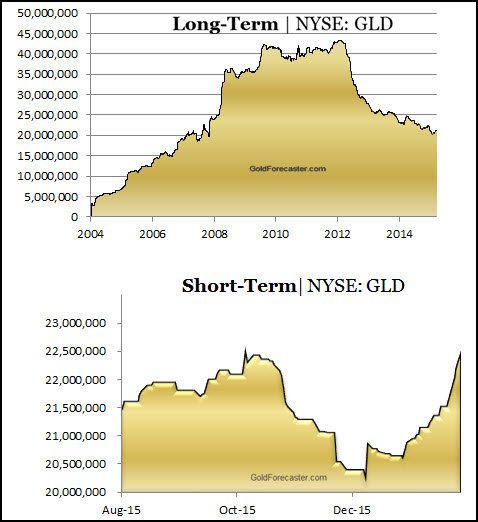

Friday saw another large purchase of 4.481 tonnes into the SPR gold ETF, making just under 30 tonnes bought in the last week. If the buying continues at this rate we will see the entire amount of gold sold from this fund in 2015 bought back in the first six weeks of this year. The Gold Trust saw another 1.56 tonnes added to the Gold Trust. The holdings of the SPDR gold ETF are now at 698.462 tonnes and at 173.03 tonnes in the Gold Trust. We can see no reason why this pace of buying should not continue as the news on the dollar front continues to point to a lower dollar now.

The rise in the gold price is U.S. investor driven as physical demand overwhelms paper sales. This tells us that institutional gold views have been changed by global considerations, despite reports indicating that the U.S. economy looks solid even though growth is weakening. This is a change in perspective as U.S. investors tend to be parochial when it comes to their markets. We find it difficult to see this as a short-term perspective it is a sea-change in their views. For the last 8 years the U.S. has anticipated a strong recovery. Institutional views are, in the majority, for a weakening of the U.S. economy and an even weaker global economy, which will drag down national economies. Currencies will give of the strongest distress signals favoring gold and silver.

Silver– Silver should continue to outperform gold.

- Subscribe www.SilverForecaster.com

Regards,

Julian D.W. Phillips for the Gold & Silver Forecasters

Global Gold Price (1 ounce) |

| Today | Yesterday |

Franc | Sf1,170.44 | Sf1,148.59 |

US | $1,175.85 | $1,159.20 |

EU | €1,057.09 | €1,035.18 |

India | Rs.79,890.19 | Rs. 78,425.10 |

China | Y 7,730.33 | Y 7,618.61 |

| Digg This Article

-- Published: Monday, 8 February 2016 | E-Mail | Print | Source: GoldSeek.com