-- Posted Friday, 14 June 2013 | | Disqus

Today’s AM fix was USD 1,379.75, EUR 1,035.54 and GBP 882.76 per ounce.

Yesterday’s AM fix was USD 1,386.25, EUR 1,039.71 and GBP 885.33 per ounce.

Gold fell $5.40 or 0.39% yesterday to $1,383.30/oz and silver and finished up 0.18%.

Gold is lower in most currencies today except sterling which has come under pressure.

Gold is lower in most major currencies again this week and very marginally lower in dollar terms – down 0.2% for the week. A lower weekly close would again be bearish technically and could signal further weakness.

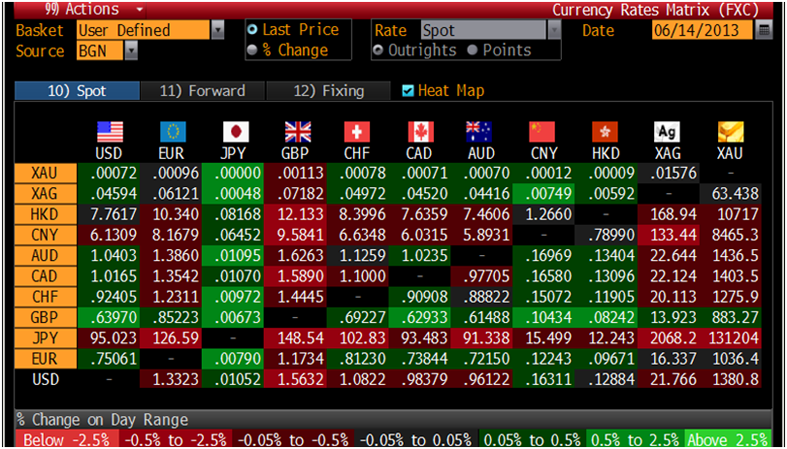

Cross Currency Table – (Bloomberg)

The most recent increase in duties on gold, curbing of gold financing and restrictions on gold imports by banks and state-run trading companies to a consignment basis in India have led to the expected short term decline in demand which may be contributing the gold’s inability to close above $1,400/oz.

Gold Adjusted For Inflation (CPI) 1970 to Today

James Steel, chief commodities analyst at HSBC in New York continues to be constructive on gold in the medium and long term and sees gold rising to $1,600/oz in the second half of 2013.

In a Bloomberg audio interview, Steel said that this year the gold market has been under pressure and has experienced a rotational shift out of commodities in general driven by the constant chatter of a tapering off in QE and experienced very steep declines in mid April. He likens it to a rugby scrum pulling back and forth near the $1/400oz level, between ETF outflows and strong physical demand for coins and bars, notably from China.

Steel said that in the past few weeks the heavy ETF outflows have died down, and prior to this year they were mostly static. The peak for ETF's was 85M ounces at the end of last year. He says most institutions have already exited that wanted to get out.

Market chatter has been nervous about the unwinding of QE3. Steel points out that unwinding or paring back is very different than an exit. The Fed many need to do tapering for a long time before it ends their program.

Steel mentions that it was the jewellery market that drove the gold market in the past and now it is investment demand and demand from China. He believes gold will average is $1,542/oz and he is predicting a rally in the second half of the year up to $1,600/oz. Longer term, he is on record as saying that gold will rise to over $2,000/oz.

Gold in USD, 3 Year – (Bloomberg)

Steel has specific responsibilities for precious metals in HSBC and is one of the more astute analysts of the gold market working in the banks. He knows his financial, economic and monetary history.

Prior to joining HSBC in 2006, he ran the New York research department for Refco, a large US commodities brokerage house. Jim also worked for The Economist in the Economist Intelligence Unit covering commodity producing nations.

Unlike some widely covered ‘celebrity economists,’ Steel has a deep knowledge and understanding of supply and demand and the other fundamentals driving the gold market.

NEWS

Gold edges lower for second session on stimulus fears - Reuters

Gold Drops as SPDR Assets Decrease Amid Fed Stimulus Speculation - Bloomberg

Platinum Outshines Gold Amid Supply Concerns - Bloomberg

Gold Bears Return as ETP Rout Extends to 17th Week - Bloomberg

COMMENTARY

Video: GoldCore on Russia Today On Gold, Silver, Bonds And Ireland – You Tube

Audio: HSBC’s Steel Says Gold To Over $1,600/oz By End 2013 - Bloomberg

Why Fundamental Rationale For Holding Gold Is As Robust As Ever – Sovereign Man

Roubini's Misguided Attack On "Gold Bugs" – Zero Hedge

www.GoldCore.com

-- Posted Friday, 14 June 2013 | Digg This Article | Source: GoldSeek.com

| Source: GoldSeek.com