-- Posted Friday, 6 December 2013 | | Disqus

Today’s AM fix was USD 1,230.75, EUR 900.59 and GBP 752.38 per ounce.

Yesterday’s AM fix was USD 1,234.00, EUR 907.69 and GBP 754.79 per ounce.

Gold fell $13.52 or 1.1% yesterday, closing at $1,229.69 /oz. Silver slipped $0.20 or 1.1% closing at $19.45/oz. Platinum dropped $11.51, or 0.8%, to $1,356.99/oz and palladium rose $6.00 or 0.8%, to $730.50/oz.

Gold in U.S. Dollars, 5 Day - (Bloomberg)

Premiums in China and India remained robust overnight and way over western premiums. Bullion premiums in western markets have seen little movement this week. Gold bullion bars (1 oz) are trading at $1,283.78/oz or premiums of between 3.75% and 4.5%, and gold gold bars (1 kilo) are trading at $40,899/oz or premiums of between 3% and 3.5%.

Gold headed for a weekly drop of 1.9% as traders and more speculative investors await U.S. payrolls figures. Recent economic data boosted speculation the Federal Reserve may start trimming its $20 billion per week debt monetisation programme sooner than estimated. Although such speculation has been ongoing for a number of months now and has been proven incorrect.

Prices fell as low as $1,211.75 on Wednesday the lowest since July 5, prior to a very sharp $40 rally brought gold to over $1,250/oz again. Then determined selling capped prices at that level and a seller or sellers seemed determined not to see gold turn positive on the week. This would have led to technical and momentum buying.

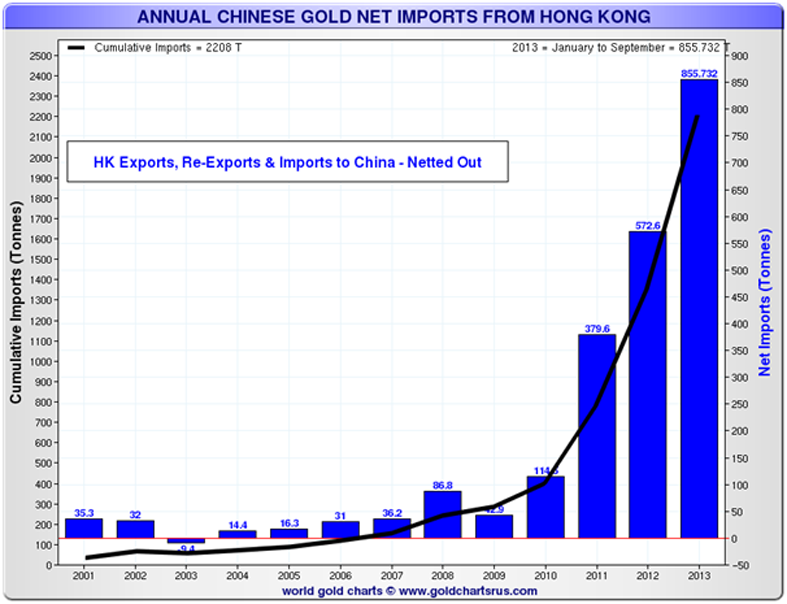

As we noted yesterday, Chinese imports through Hong Kong alone are set to top 1,000 tonnes this year and this does not include other gold imports into China ex Hong Kong. Therefore, total Chinese gold demand could be as high as 2,000 tonnes. Total annual gold supply is expected to be around the 2,700 tonne mark. Therefore, China alone could swallow up nearly 75% of global gold mine supply this year.

Annual Chinese Gold Net Imports - 2001 to 2013 YTD

It is important to note that the huge Chinese demand in tonnage terms, 1,000 tonnes and possibly as high as 2,000 tonnes, is only worth roughly $39 billion and $78 billion in dollar terms. This is nearly what the Federal Reserve is printing every single month since late 2012.

Gold has tumbled 27% this year and is set for the first annual loss since 2000, as weak hands and hot money has exited the market on the recent price weakness. The majority of bullion buyers remain steadfast and demand remains robust, particularly in China and Asia. Even in western markets, while demand is lower than recent years, dealers, refineries and mints all report much more buyers than sellers which contradicts the notion that investors or gold buyers have “lost faith” in gold.

It is worth noting that, while gold is down 27% this year, it remains up 63% in the last 5 years - since the financial crisis began. Thus, again proving its worth as a long term store of value.

From a longer term perspective, it is also important to note that gold is now almost half of its record inflation adjusted high or real record high from 1980 at $2,400/oz (see chart). As we have said since 2003, we expect that number to be surpassed in the course of this secular bull market.

Economists Warn Depositors May Be Burnt In Bail-Ins

On Tuesday we launched our in depth research report ‘From Bail-Outs to Bail-Ins: Risks and Ramifications’ in order to shed light on and foster debate on what we believe is one of the most significant risks facing investors, savers, all depositors and most western economies - bail-ins.

In it we detail, how bail-ins are a real risk not just to vulnerable countries like Greece, but to any countries in the EU, the UK, the U.S., Australia, New Zealand, Japan and most of the G20 countries.

Below some leading economists and financial commentators in Ireland give their perspective regarding the risks of bail-ins. If you manage money in any way, your own or others, it will be prudent to heed their warnings.

Dr Constantin Gurdgiev

"The recent abatement of the euro area crisis and the reduction in overall global financial uncertainty have led to a decline in the demand for gold as a safe haven instrument and speculative asset.

This is the good news. In line with more normalised demand for gold and the precious metals, the risk hedging properties of these assets remain intact and require continued and structured approach to their inclusion when building a diversified, long-term focused investment portfolios.

In addition, changes in the regulatory and policy responses to the financial crises, established in response to the Cypriot banking crisis, warrant longer-term re-weighting of optimal gold and other precious metals' shares in defensive portfolios.

Given that the euro area is moving toward a pro-forma inclusion of the depositors bail-ins in the standard toolbox for dealing with the financially distressed national banking systems, the case for gradual cost-minimising increase in long term share of these instruments in individual investors portfolios is being made not only by the market forces, but also by regulatory changes.

Contrary to the short-term signals in the spot markets, gold and other precious metals role in delivering long-term risk management opportunities and tail risks hedging is becoming more important as the immediate volatility and short-term risks recede."

Dr Constantin Gurdgiev lectures in Finance in Trinity College, Dublin and in the Smurfit School of Business, UCD. He serves as the Chairman of Ireland Russia Business Association. In the past, he served as non-executive member on the Investment Committee of Goldcore.

Cormac Lucey

“In November 2012, it was reported by RTÉ’s David Murphy that CRH, the building materials maker and the biggest company on the benchmark Irish stock index, “was mandated by its board not to leave cash in a bank in the euro zone during any weekend”.

The logic of CRH’s stance only became fully clear after weekend decisions taken by Eurozone finance ministers had a severe and adverse effect on the financial claims of depositors in Cypriot banks in March 2013.

Had ordinary retail and SME depositors in Cyprus’s banks known in February of CRH’s stance and of the logic behind it, does anyone seriously think that they would have left themselves so vulnerable in March?

The lesson from Cyprus is that individual and business depositors (small, medium and large) need to show at least as much care in making their deposit decisions as large corporations such as CRH.

Depositors should seriously consider two questions when putting money into a bank:

(i) is there is a serious possibility of the bank failing?

(ii) if the bank fails, is there then a serious possibility that the government would be unable to honour deposit guarantees in full?

If there is a significant possibility, even small, of capital loss, depositors should ask themselves the same question that corporate treasurers regularly ask themselves: am I being adequately compensated by the deposit rate for the risk I am now exposing my money to?”

Cormac Lucey is a chartered accountant, financial analyst & lecturer at the Irish Management Institute (IMI). He was special advisor to Michael McDowell, former Attorney General of Ireland, from 2003 to 2007. He is a commentator on economics and politics.

Jim Power

“The attempted bail-in of all deposits in the Cypriot banking crisis and the eventual decision to bail-in deposits in excess of €100,000 has drawn a line in the sand and has created a very dangerous and damaging precedent. A banking system has to be based on trust and confidence; the Cypriot decision and subsequent statements from European policy makers suggest that trust and confidence have been seriously, and possibly irredeemably, damaged.

Any individual or any corporate treasurer would be taking an unacceptable risk in making a decision to leave deposits in excess of €100,000 in any single bank, unless one is convinced that the institution is 100% sound. The events of the past 5 years should have taught us that such a conviction would be dangerous.

For investors, bank diversification is essential, but more broadly, asset diversification has to be the priority for anybody with any wealth. We still live in very dangerous and uncertain times and investors should do whatever it takes to manage risk and ensure that all of their eggs are not in a single basket that may be badly holed.”

Jim Power is a graduate of University College Dublin with a BA in Economics & Politics, and a Master of Economic Science Degree. He is Chief Economist at Friends First Group, a wholly owned subsidiary of Eureko, one of Europe’s largest insurance groups. He teaches Finance and Economics on the Local Government MBA at Dublin City University, and Business Economics on the Executive MBA at the Michael Smurfit Graduate School of Business, University College Dublin.

Download our Bail-In Guide: Protecting your Savings In The Coming Bail-In Era (11 pages)

Download our Bail-In Research: From Bail-Outs to Bail-Ins: Risks and Ramifications (51 pages)

-- Posted Friday, 6 December 2013 | Digg This Article | Source: GoldSeek.com

| Source: GoldSeek.com