-- Published: Thursday, 16 January 2014 | Print | Disqus

Nick Laird’s “Gold Charts ‘R’ Us” may be the best source of gold charts in the world (www.sharelynx.com). Nick has literally 1000’s of pages and 10,000’s of charts on gold as well as silver, stocks and numerous other things. Indeed, I suspect I have barely touched the surface of his treasure trove. For Nick it is a work of love. For the probably hundreds of users of his website (by subscription only) Nick is a godsend. If the chart does not exist, Nick will find the data and create it.

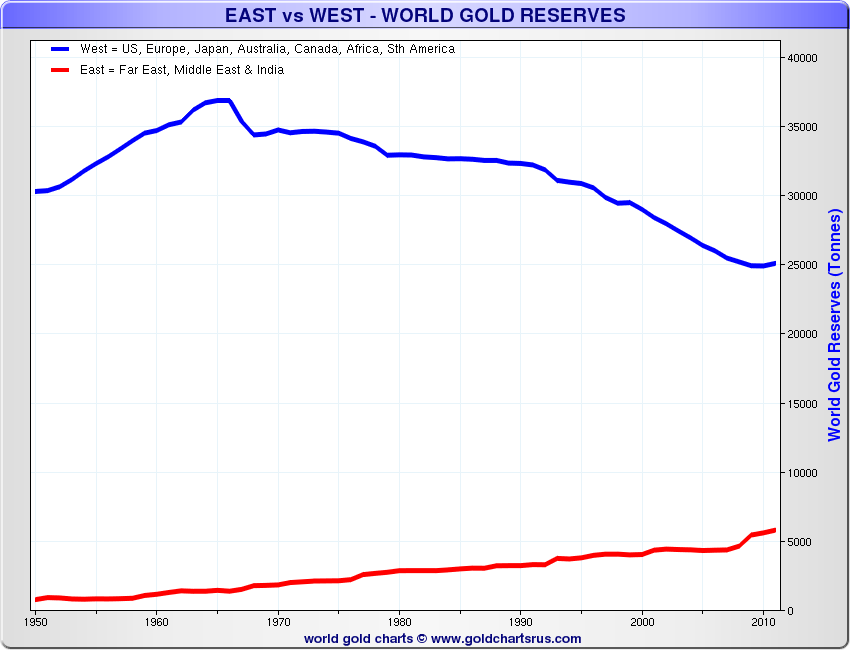

Sometimes it is just best to cruise through his charts and see what is of interest. With that in mind I came upon a series of charts that compares the gold reserves held by Western central banks (UK, USA, Japan, Europe, Canada, Australia/New Zealand, Mexico and Central America, South America and Africa) with the gold reserves held by the Eastern central banks (Far East, Middle East and India). The charts also cover off demand and supply in the East and West as well.

The charts are revealing as they support the notion that many have been talking about that despite the $700 fall in the price of gold since the peak in September 2011 gold has been moving at a fairly rapid pace out of the west to the east. Chinese officials some time ago were on record stating that they wished to back their currency (the Yuan or Renminbi) with gold. As well the Chinese eventually want to have at least as much gold as is held by the US and even to have as much gold on a per capita basis as does the US. Some Chinese officials have stated that holding gold to back their currency is essential to China’s economic security.

So in some ways with the big drop in price, it shouldn’t have been a surprise that demand for physical gold has soared particularly in China. Chinese demand and imports have more than offset the loss of gold from the SPDR Gold Shares (GLD-NYSE) in 2013. The GLD has lost assets every month in 2013 estimated at upwards of 800 tonnes for the year. On the other side China imports of gold in 2013 were a record of over 1000 tonnes as China now surpasses India as the world’s largest consumer of gold. In the East, holding gold is viewed not unlike how someone in the West would view their bank savings account. The US wants the world to continue to view the US$ as the world’s reserve currency whereas China is preparing the Yuan to eventually be viewed as a potential global reserve currency. The East and the West view gold differently and that helps explain the surge in demand in the East even as the West appears to be shunning it.

Or is the West shunning it? While there has been a huge drop in the holdings of GLD 2013 saw record demand for American gold and silver eagles while Canada saw record demand for gold and silver Maple Leafs. The UK mint and the Perth mint in Australia both faced the highest demand in years. COMEX gold stocks have fallen to record lows (registered stocks eligible for delivery), while volumes surged 61% on the Shanghai Gold Exchange (SGE) in 2013. The London bullion market has seen intermittent shortages of 400-ounce gold bars helping to push premiums for physical delivery for 400-ounce bars as high as 50 cents. Premiums for gold and silver coins in North America have been at the highest levels seen in years.

The charts below appear to only go until the end of 2012. Nonetheless, the trend is in place and if 2013 were included, the levels would be higher for the East. The first chart shows the long decline in gold reserve holdings of the Western central banks especially during the 1990’s. However, the past few years are seeing a slow uptick in the holdings of the Western central banks. The Eastern central banks have been adding to their gold reserve holdings for years, however, it appears to have accelerated in the past few years. Central banks have been net purchasers of gold for reserves since 2009. Up until then central banks were net suppliers to the gold market.

Source: www.sharelynx.com

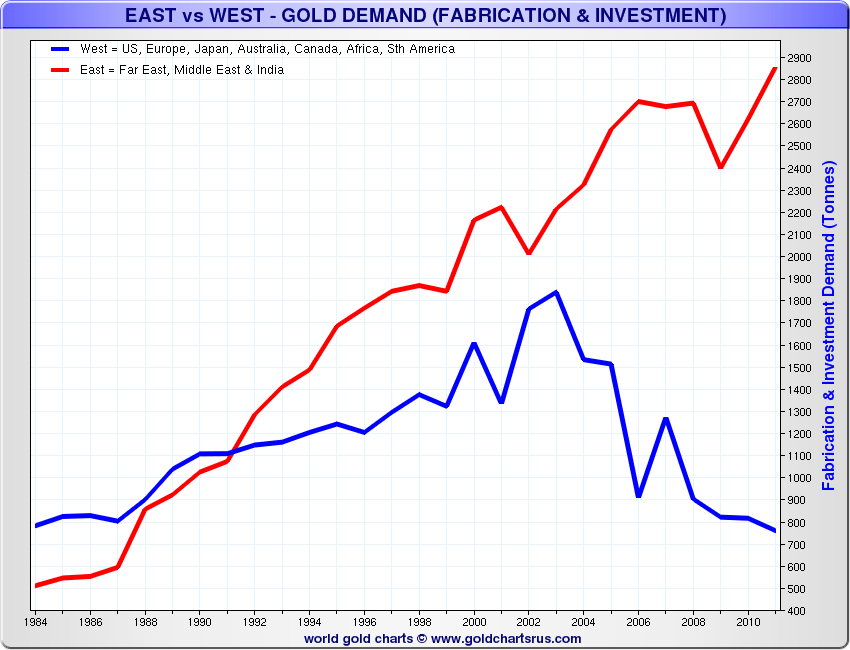

Gold demand particularly for investment purposes has soared in the past few years especially in the East. It has helped offset a decline in demand in the West. The rising demand in the East has more than offset falling demand in the West. Falling demand in the West has been led by disinvestment from the GLD.

Source: www.sharelynx.com

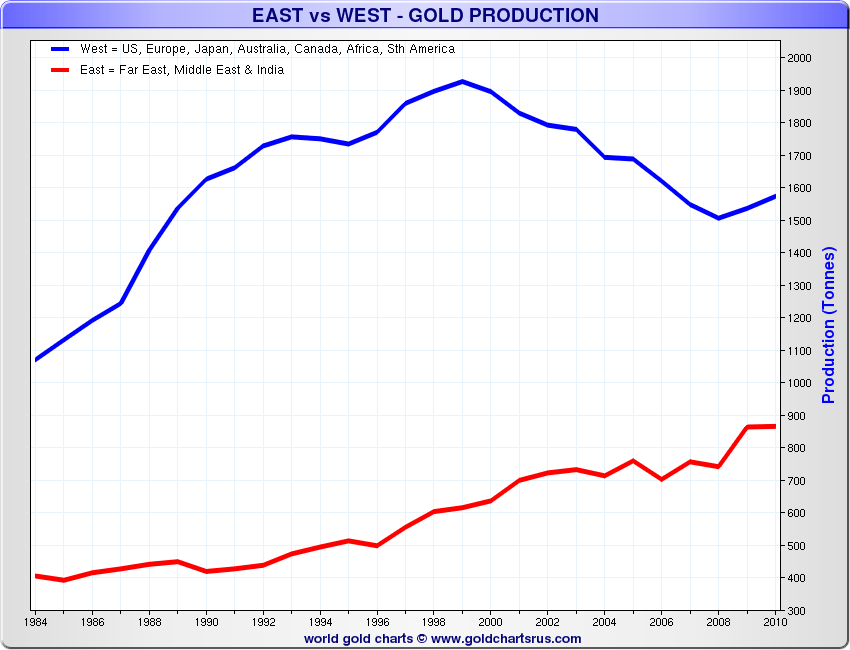

Following years of declining production in the West with flat production in the East production is rising in both East and West once again. However, production turned higher sooner in the East and has gone up faster. China is now the world’s largest gold producer surpassing South Africa and the US. Gold produced in China is not exported as it all consumed in China. Chinese production is estimated to hit 430 tonnes in 2013.

Source: www.sharelynx.com

Some are calling the shift of gold from the West to the East as one of the most massive wealth transfers in history. That can probably only be determined in hindsight and only after gold prices move higher from current levels. Nonetheless, the shift of gold from the West to the East appears to be set and it may even grow. The question is who is right? Is the West’s view that gold is a barbarous relic and not worthy of a place in investment portfolios correct? Or is it the East’s view that holding gold is akin to one’s bank account? Only time will tell who is ultimately right. Gold does have a long history as insurance and holding its value especially during times of financial stress. The current assumption in the West is that the economy is growing and therefore holding gold is not that important any more. The East on the other hand appears to believe otherwise even as their economies outperform Western economies.

26 Wellington Street East, Suite 900, Toronto, Ontario, M5E 1S2

phone (416) 604-0533 or (toll free) 1-866-269-7773, fax (416) 604-0557

david@davidchapman.com

dchapman@mgisecurities.com

www.davidchapman.com

2014 All rights reserved David Chapman

General disclosures

The information and opinions contained in this report were prepared by MGI Securities. MGI Securities is owned by Jovian Capital Corporation (‘Jovian’) and its employees. Jovian is a TSX Exchange listed company and as such, MGI Securities is an affiliate of Jovian. The opinions, estimates and projections contained in this report are those of MGI Securities as of the date of this report and are subject to change without notice. MGI Securities endeavours to ensure that the contents have been compiled or derived from sources that we believe to be reliable and contain information and opinions that are accurate and complete. However, MGI Securities makes no representations or warranty, express or implied, in respect thereof, takes no responsibility for any errors and omissions contained herein and accepts no liability whatsoever for any loss arising from any use of, or reliance on, this report or its contents. Information may be available to MGI Securities that is not reflected in this report. This report is not to be construed as an offer or solicitation to buy or sell any security. The reader should not rely solely on this report in evaluating whether or not to buy or sell securities of the subject company.

Definitions

“Technical Strategist” means any partner, director, officer, employee or agent of MGI Securities who is held out to the public as a strategist or whose responsibilities to MGI Securities include the preparation of any written technical market report for distribution to clients or prospective clients of MGI Securities which does not include a recommendation with respect to a security.

“Technical Market Report” means any written or electronic communication that MGI Securities has distributed or will distribute to its clients or the general public, which contains a strategist’s comments concerning current market technical indicators.

Conflicts of Interest

The technical strategist and or associates who prepared this report are compensated based upon (among other factors) the overall profitability of MGI Securities, which may include the profitability of investment banking and related services. In the normal course of its business, MGI Securities may provide financial advisory services for issuers. MGI Securities will include any further issuer related disclosures as needed.

Technical Strategists Certification

Each MGI Securities technical strategist whose name appears on the front page of this technical market report hereby certifies that (i) the opinions expressed in the technical market report accurately reflect the technical strategist’s personal views about the marketplace and are the subject of this report and all strategies mentioned in this report that are covered by such technical strategist and (ii) no part of the technical strategist’s compensation was, is, or will be directly or indirectly, related to the specific views expressed by such technical strategies in this report.

Technical Strategists Trading

MGI Securities permits technical strategists to own and trade in the securities and or the derivatives of the sectors discussed herein.

Dissemination of Reports

MGI Securities uses its best efforts to disseminate its technical market reports to all clients who are entitled to receive the firm’s technical market reports, contemporaneously on a timely and effective basis in electronic form, via fax or mail. Selected technical market reports may also be posted on the MGI Securities website and davidchapman.com.

For Canadian Residents: This report has been approved by MGI Securities which accepts responsibility for this report and its dissemination in Canada. Canadian clients wishing to effect transactions should do so through a qualified salesperson of MGI Securities in their particular jurisdiction where their IA is licensed.

For US Residents: This report is not intended for distribution in the United States.

Intellectual Property Notice

The materials contained herein are protected by copyright, trademark and other forms of proprietary rights and are owned or controlled by MGI Securities or the party credited as the provider of the information.

Regulatory

MGI SECURIITES is a member of the Canadian Investor Protection Fund (‘CIPF’) and the Investment Industry Regulatory Organization of Canada (‘IIROC’).

Copyright

All rights reserved. All material presented in this document may not be reproduced in whole or in part, or further published or distributed or referred to in any manner whatsoever, nor may the information, opinions or conclusions contained in it be referred to without in each case the prior express written consent of MGI Securities Inc.

| Digg This Article

-- Published: Thursday, 16 January 2014 | E-Mail | Print | Source: GoldSeek.com