-- Published: Sunday, 19 January 2014 | Print | Disqus

A great week for the precious metals as gold and silver slowly chopped their way higher until Friday which saw a nice move that will take them soon to resistance.

As for the markets, Monday saw a huge shakeout and it shook me out.

Tuesday saw a total reversal leaving me and many others with too much of a cash position.

It didnít take long to get back into things though with so many stocks on the move and in a big way.

Itís not uncommon these days to see a stocks hit my buy point and rip 20% in a single day.

Perhaps the most extraordinary thing is that many of these stocks are only selling for a few dollars.

I have traded the big leading stocks almost exclusively but the moves are now coming in much cheaper stocks which means the money is beginning to rotate into a new equity class whose emerging leaders will one day be the very expensive stocks that lead the entire market.

Itís not everyday when we get the chance to get in on the ground floor so to speak.

Letís take a look at the precious metals charts before I get into my major homework for the weekend for subscribers.

Gold had a very constructive week as we slowly come off lows.

Gold ended the week up 0.27% and is now poised to breakout to $1,280 where its got more resistance.

Iíve said that the slower we move off this base and move higher the better and we are off to a great start.

Once we hit $1,280 we could see 3 days to a week of consolidation but then $1,300 is the next area of resistance.

Iím not interested in trading gold here but it looks really nice right here for a quick run to $1,280.

Mining stocks are really starting to move off epic lows but they will be slow as well for the most part.

Silver rose 0.71% this past week as it moves off its lows following gold.

Great stuff here that should soon see $21.50 hit. A break above $20.50 is the buy point here.

We should see silver hit resistance when gold does.

I see it as the less I have to say here the better for the next couple years or so.

Itís still a solid area to consider buying or adding to a physical metals position for the long-term in my view.

Platinum rose 1.17% for the week and looks really good.

Platinum is leading gold and silver here as itís breaking out first.

Its got resistance at $1,480 and then up at $1,520.

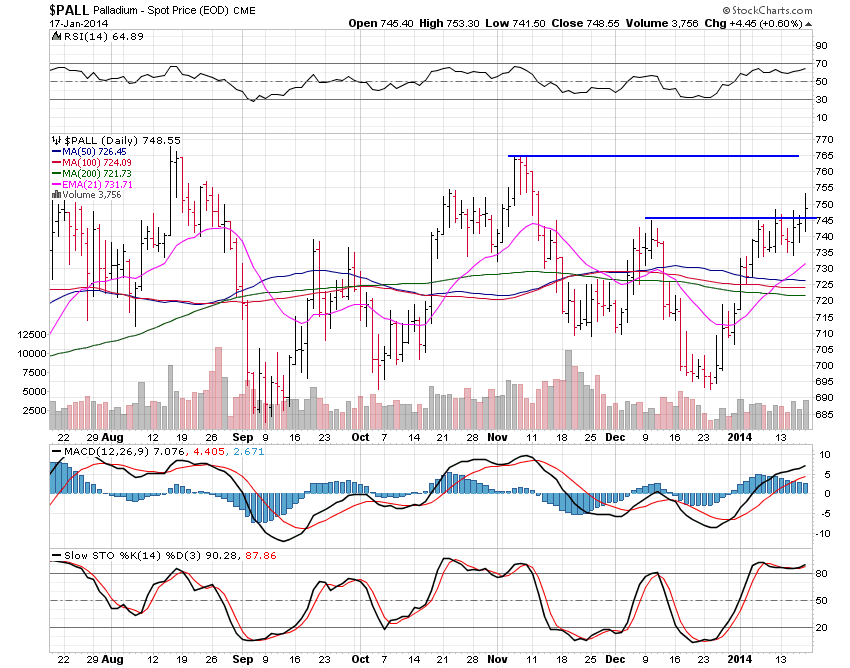

A super move from palladium also as it wandered higher by 0.63% this past week.

Itís also leading gold and silver and now is on its way to next resistance at $765.

Well, itís a good thing I donít have much to say as the precious metals are coming slowly and very constructively off their major lows.

Itís also a time to consider buying into select mining stocks as they have put in major lows.

They may not fly higher for years to come but they are really looking like a great long-term hold as they slowly move back towards highs.

Enjoy your long weekend and thank you very much for reading.

Warren

http://www.wizzentrading.com

| Digg This Article

-- Published: Sunday, 19 January 2014 | E-Mail | Print | Source: GoldSeek.com