-- Published: Friday, 31 January 2014 | Print | Disqus

(The following is the third of a five-part series on how gold performs during periods of deflation, chronic disinflation, runaway stagflation and hyperinflation. The third installment examines gold’s safe-haven role during a stagflationary breakdown like the one in the 1970s.)

Gold as a runaway stagflation hedge (United States, 1970s)

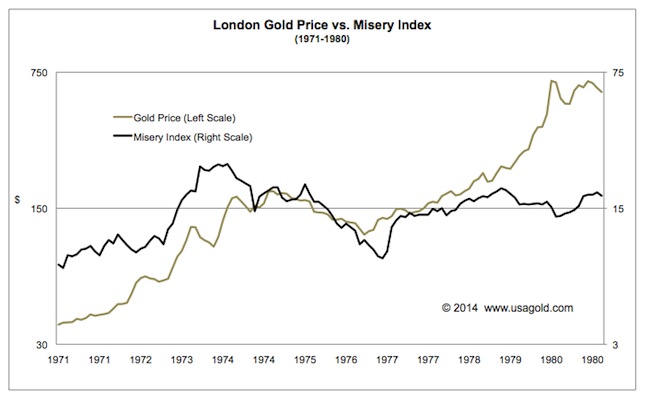

IN THE CONTEMPORARY GLOBAL FIAT MONEY SYSTEM, when the economy goes into a major tailspin, both the unemployment and inflation rates tend to move higher in tandem. The word “stagflation” is a combination of the words “stagnation” and “inflation.” President Ronad Reagan famously added unemployment and inflation together in describing the economy of the 1970s and called it the Misery Index. As the Misery Index moved higher throughout the decade so did the price of gold, as shown in the graph immediately below.

At a glance, the chart tells the story of gold as a runaway stagflation hedge. The Misery Index more than tripled in that ten-year period, but gold rose by nearly 16 times. Much of that rise has been attributed to pent-up pressure resulting from many years of price suppression during the gold standard years when gold was fixed by government mandate. Even after accounting for the fixed price, it would be difficult to argue that gold did not respond readily and directly to the Misery Index during the stagflationary 1970s.

In a certain sense, the U. S. experience in the 1970s was the first of the runaway stagflationary breakdowns, following President Nixon’s abandonment of the gold standard in 1971. Following the 1970′s U.S. experience, similar situations cropped up from time to time in other nation-states. Argentina (late 1990s) comes to mind, as does the Asian Contagion (1997), and Mexico (1986). In each instance, as the Misery Index rose, the investor who took shelter in gold preserved his or her assets as the crisis moved from one stage to the next.

Fortunately, the 1970′s experience in the United States was relatively moderate by historical standards in that the situation fell short of escalating to either a deflationary or hyperinflationary breakdown. These lesser events, however, quite often serve as preludes to more severe and debilitating events at some point down the road. All in all, it is difficult to classify stagflations of any size and duration as insignificant to the middle class. Few of us would gain comfort from the fact that the Misery Index we were experiencing failed to transcend the 100% per annum threshold or failed to escalate to a state of hyperinflation and deflation. Just the specter of a double-digit Misery Index is enough to provoke some judicious portfolio planning with gold serving as the hedge.

Michael J. Kosares

www.USAGold.com

| Digg This Article

-- Published: Friday, 31 January 2014 | E-Mail | Print | Source: GoldSeek.com