-- Published: Friday, 23 May 2014 | Print | Disqus

Today’s AM fix was USD 1,292.00, EUR 948.60 and GBP 767.17 per ounce.

Yesterday’s AM fix was USD 1,294.50, EUR 945.93 and GBP 767.02 per ounce.

Gold climbed $3.50 yesterday to $1,296.00/oz. Silver rose $0.18 to $19.52/oz.

Gold is flat for the week while palladium has gained 2.3% this week and platinum has climbed nearly 2%. Palladium was steady in early European trading after hitting $837.40 an ounce in the previous session — its highest since August 2011.

Gold is marginally lower today at $1,292.30/oz and remains in lock down in an unusually tight range between $1,284/oz and $1,306/oz this week. Gold in Singapore again traded over the $1,295/oz level prior to selling in London saw gold fall to a low of $1,290.90/oz.

Chinese President Xi Jinping Raises Toast (In Vodka?) With Russian President Vladimir Putin

Gold prices are marginally lower for the week. This is despite some bullish news including the central bank gold agreement, news of the very large 900,000 ounce Russian gold purchase and the easing of India’s futile recent ‘war on gold’. The historic Chinese Russian economic agreement is also bullish from a geopolitical and monetary perspective.

The deterioration of the situation in Ukraine and deepening military conflict is another development which is gold bullish. Russia's top general said on today that Moscow would take steps to respond to what he said was increased NATO activity near its border amid the crisis in Ukraine.

"The intensity, the operational and combat readiness of the NATO alliance's troops is being increased near the Russian border. In these circumstances ... We have to take retaliatory measures," General Valery Gerasimov, the chief of general staff of the Russian armed forces, said.

Gold in U.S. Dollars, 5 Minutes, 5 Days - (Thomson Reuters)

Given recent developments and the geopolitical backdrop we expect gold may soon break higher out of the its very narrow trading range.

There are a lot of things going on underneath the surface of the superficially calm gold market this week and this month. That superficial calm is likely to give way in the coming days as we appear on the verge of a sharp move to the upside or downside. This seems likely, once gold breaks out of the very narrow range between $1,283/oz and $1,310/oz that we have been in for nearly 5 weeks now.

Should physical demand pick up on rising geopolitical tensions and Indian demand return with the easing of import duties, gold should quickly challenge resistance at $1,310/oz.

Physical demand in western markets remains somewhat subdued. The lack of price direction is making some buyers hesitant.

Gold American Eagle sales by the U.S. Mint have been pretty lacklustre this month, at 18,000 ounces, less than half of last month's total and well down from the record levels of 70,000 ounces sold in May last year after April’s big sell off.

Palladium was steady near a two-and-a-half-year high on Friday and was headed for its best week in two months on supply fears due to the prolonged strike in South Africa and concerns about Russian supplies. Platinum was on track for its second straight weekly gain, also on supply worries.

Sales of platinum American Eagle coins by the U.S. Mint, which resumed in March after a four-year hiatus, have turned out to be pretty sluggish so far. After an early rush for coins, which saw 10,000 sold between March 10 and the end of that month, April sales eased to 1,200 ounces, while sales in May have totalled only 700 ounces so far.

Holdings of physically backed palladium exchange-traded funds hit record highs this week after heavy inflows pulled in half a million ounces of metal in less than two months. ETF holdings, as measured by Reuters, hit 2.271 million ounces, beating the previous all-time high from 2011 of 2.269 million ounces, after a near 8,000-ounce inflow into Standard Bank's Johannesburg-listed Palladium ETF on Monday.

Barclays Fined $26 Million Over Gold Fixing - Profited At Customer’s Expense

This morning, Barclays has been fined £26 million by the Financial Conduct Authority (FCA) for manipulation of the London gold fixing between 2004 and 2013.

Barclays has contributed to setting the price of gold in London since June 2004. The Gold Fixing is an important price-setting mechanism which provides market users with the opportunity to buy and sell gold at a single quoted price.

Former Barclays trader Daniel James Plunkett has been fined £95,600 and banned from working in the City.

As a director on the precious metals desk at Barclays, Plunkett was responsible for pricing products linked to the price of precious metals and managing Barclays' risk exposure to those products.

The FCA says:

The Financial Conduct Authority (FCA) has fined Barclays Bank Plc (Barclays) £26,033,500 for failing to adequately manage conflicts of interest between itself and its customers as well as systems and controls failings, in relation to the Gold Fixing. These failures continued from 2004 to 2013.

Much of the coverage if focussing on one incident with one trader rather than the period 2004 and 2013 as per the first line of the FCA press release. The convenient scapegoat “rogue trader” meme appears live and well.

The rogue trader aspect of the story appears to be old news as the Barclays precious metals trader, Daniel James Plunkett is accused of manipulating the price on June 28, 2012. He ceased to have a controlled function on the 12th October 2012, when he was terminated from the FSA Register.

Therefore, this is not new news for the Barclays or the FSA, despite the widespread publicity garnered today.

Barclays may be engaged in public relations due to the damaging allegations of gold price rigging.

The FCA need to provide more detail and evidence regarding their statement that the manipulation took place from 2004 to 2013. Otherwise, they too will be accused of being involved in public relations here in order to make it look like they are being tough on banks and that they are on top of the many gold price rigging allegations in recent months.

It is interesting that the allegation is that price suppression took place on June 28, 2012. This was a time of great concern regarding systemic risk and possible contagion in the Eurozone. Bond yields were surging in the Eurozone and risk free assets such as Treasuries and even Bunds were being questioned.

The allegations are interesting but may be a bit of a distraction. Especially, as some of the sharp sell offs seen in 2012 came about due to massive concentrated selling of gold futures contracts on the COMEX. Therefore, it would seem appropriate to have more concerns about massive concentrated selling and manipulation on the COMEX which is the remit of the CFTC.

Still, I suppose we should be grateful for small mercies and anything that shines a light on possible gold manipulation and may help create transparency, free markets and the rule of law should be welcomed.

The development shows how vulnerable the system is to abuse with little transparency or oversight of traders, banks and indeed central banks.

“Geopolitical Earthquake” As China Russia Sign Historic Agreement

China and Russia signed an historic agreement in Shanghai this week - the ramifications of which have yet to be appreciated.

The agreement between Putin and Jinping in Shanghai opens the way for a new stage of comprehensive partnership and strategic cooperation between the re-emerging superpowers. The agreement comes after several rounds of negotiations in the past decade.

Russia will sell $1 trillion worth of natural gas to China which importantly will be settled in Russian ruble and Chinese yuan rather than petrodollars.

Russian Central Bank Gold Reserves, Millions of Troy Ounces - (Gold Charts R Us)

The official Chinese news agency, Xinhua News Agency, sees the deal as "another important result of China and Russia strengthening their relations as comprehensive energy partners".

At the BRICS (consisting of Brazil, Russia, India China and South Africa) summit in July, the $100 billion BRICS Development Bank was announced as a project financing bank for the BRICS and the developing world and as an alternative to the International Monetary Fund (IMF) and the World Bank. This important multi-lateral bank is in gestation.

In April, Chinese President Xi Jinping visited Germany and suggested a daring proposal to expand and increase the use of the Chongqing-Xinjiang-Europe railway, which is already running from China to Germany. That railway decreases cargo travel time from eastern China to Europe by half.

Increased strategic cooperation, trade and economic growth could lead to a geopolitical earthquake in terms of the grand chessboard and the balance of power between the heavily the U.S. and emerging superpower China.

China and Russia signed an extensive joint strategic agreement that touches on more than just oil and natural gas. The two agreed to explore the joint construction of power plants, including nuclear power plants, in Russia to help China meet its energy needs.

They agreed to construct important infrastructure including cross border bridges and improve trade linkages through ports and railways. They are also looking to boost cooperation in a wide range of fields - from nuclear energy to civil aviation and manned space flight.

Increased cooperation goes beyond just trade, according to Zhang Lihua, a professor of international relations at Beijing's Tsinghua University. She said China could use Russia's support in dealing with Japan and with territorial disputes in the South China Sea.

"Russia, on the other hand, needs China's support with Syria, Ukraine and other issues in the Middle East," Zhang said. The two countries have "shared interests in dealing with regional disputes and in balancing the influence of the United States."

Russia is also facing the threat of growing sanctions from the West. Lin said the threat of sanctions "could have a small impact, but nothing beyond that." That's because "China has a different view" when it comes to sanctions.

Some papers are also analysing the impact of the deal on the world foreign exchange market.

A commentary in the Beijing Youth Daily says the deal will probably encourage more countries to stop trading in U.S. dollars, if China and Russia decide to switch to clearing payments in Russian roubles and the yuan.

"The world economy and finance will then embark on a process to get rid of the US dollar, and the dominance of the dollar will gradually lose its support. The US will then face more challenges in its ability to control global economics and politics," it says.

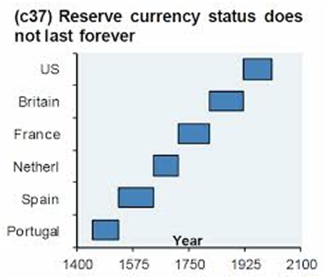

The era of the dollar as sole global reserve currency is gradually coming to a close - see Currency Wars: Bye, Bye Petrodollar - Buy, Buy Gold. Global reserve currencies have a life span of roughly 100 years and the dollar is in its latter days. It will go the way of previous reserve currencies - from ancient Roman to medieval Spain to 17th century Holland and to 18th century France to the British Empire. Through currency debasement, reserve currencies lose their status - very slowly at first and more rapidly towards the end.

Reserve currency status does not last forever. Empires rise and fall.

The world is constantly changing and evolving. Nothing lasts forever …

- www.GoldCore.com

| Digg This Article

-- Published: Friday, 23 May 2014 | E-Mail | Print | Source: GoldSeek.com