-- Published: Monday, 9 June 2014 | Print | Disqus

Today’s AM fix was USD 1,255.00, EUR 920.70 and GBP 746.67 per ounce.

Friday’s AM fix was USD 1,254.00, EUR 919.96 and GBP 745.90 per ounce.

Gold fell $0.20 or 0.02% Friday to $1,252.90/oz. Silver was unchanged at $19.03/oz. Gold and silver were both up on the week at 0.17% and 1.17% respectively.

Gold bullion traded near the highest price in a week in London as the dollar fell against major currencies.

Senior international bankers have told The Financial Times that Russian companies are preparing to switch from dollar to renminbi contracts and other Asian currencies amid fears that western sanctions may freeze them out of the U.S. dollar market.

Palladium reached a 34-month high to over $843/oz.Palladium has surged 18% this year as mine workers have downed tools since January in South Africa, the second-largest producer and on concerns about Russian supply, the world’s largest producer.

Mineworkers have been on strike since January in South Africa, the largest platinum producer. Minister of Mineral Resources Ngoako Ramatlhodi said June 7 that today would be the last government-led meeting to resolve the impasse. Palladium ETPs rose to a record on June 6 and platinum assets reached an all-time high last month.

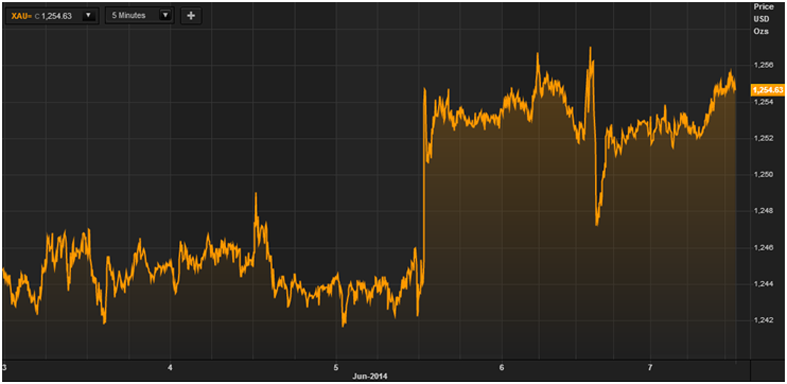

Gold in U.S. Dollars - 5 Days - (Thomson Reuters)

British taxpayers risk losing their entire £45 billion stake in Royal Bank of Scotland (RBS), the parent company of Ulster Bank, which is in grave danger of failing within 10 years, according to an explosive new book.

According to The Independent on Sunday, a new study of the bank, which brought the UK to the brink of financial ruin, reveals RBS still has a £100 billion “black hole” in its finances due to “five broad areas of alleged criminality and wrongdoing”.

Financial journalist Ian Fraser, who wrote Shredded: Inside RBS, The Bank That Broke Britain, said: "The result has been that, at the time of writing, RBS is probably a worse bank than it was under Fred Goodwin.”

They include the mis-selling of financial products such as payment protection insurance, the alleged duping of investors who were persuaded to plough more than £12 billion into RBS shares just before the banking crash in 2008, further fallout from the Libor scandal, and current criminal investigations into the manipulation of the £3 trillion-a-day foreign exchange markets.

Shredded: Inside RBS, The Bank That Broke Britain, by the financial journalist Ian Fraser, concludes that the governments led by Gordon Brown and David Cameron have “let the people of Britain down” by failing to reform RBS after it received its mammoth bailout under the stewardship of former chief executive Fred “The Shred” Goodwin.

“Whatever happens, it now seems impossible that British taxpayers will ever see a return on their £45.5 billion investment in the bank,” he writes in the book.

RBS is under the spotlight again Fraser analyses the bank’s extraordinary largesse under Goodwin, whom, he claims, squandered billions of pounds on overpriced acquisitions, fleets of Mercedes and extravagant buildings and decor.

Fraser claims the “true villains of the piece” are the “politicians, central bankers, regulators and the Basel Committee on Banking Supervision” who allowed people like Goodwin believe they could “get away with virtually anything, whilst defying financial gravity and existing above the law”.

Fraser writes: “Morality and ethics were thrown out the window and we saw the mis-selling of rip-off products on an epic scale – including the scandals of payment protection insurance and interest-rate swap agreements sold to small and medium sized enterprises.

The Treasury, the FSA [Financial Services Authority] and the Bank of England all turned a deaf ear to the complaints from the banks’ millions of ‘victims’ and paid scant heed to the overall balance-sheet strength – capital, liquidity and asset quality – of British banks.

And, at various stages between 1988 and 2008, British politicians also outsourced critical aspects of banking regulation and supervision to the private sector body, the Basel Committee on Banking Supervision, which enabled the bankers to write their own rules. That, in itself, was an error easily as bad as any committed by Goodwin. So he is right. We can’t just blame it all on him.”

RBS and Ulster Bank At Risk Of Bail-In?

Bail-ins are likely to happen at banks that are close to failure in countries that have adopted the BIS bail-in conventions and or do not have financial resources to bail-out their banks. Thus, deposits in failing banks in G20 nations may be subject to bail-ins.

The total debt to GDP ratios, household, corporate, financial and sovereign debt, in Japan, the UK and the U.S. are all at very high levels. All three countries have banks whose outlook is far from positive.

Many analysts warn that many Wall Street and City of London banks are bigger now than they were prior to the collapse of Lehman.

The Eurozone debt crisis has abated in recent months but many analysts and economists are concerned that it is only a matter of time before the debt crisis returns with Greece, Spain, Portugal, Italy and Ireland all remaining vulnerable.

European banks have been recapitalised but should the sovereign debt crisis return or a new global systemic crisis happen, à la Lehman Brothers, individual banks would likely again face capital shortages.

Greece, Cyprus, Spain, Italy, Portugal and Ireland all remain vulnerable. However, other countries in the EU also have risks, including the UK.

The Bank of England is to test whether UK banks and building societies would go bust if house prices crash again. A ‘stress test’ will examine whether banks will need bailing out, or bailing in as seems more likely now, if house prices materially correct again.

The test is being drawn up by the Bank’s Financial Policy Committee, whose members include Governor Mark Carney.

London house prices have all the symptoms of a classic bubble. Many UK banks are already over extended and the real risk is that many banks would not be able to withstand house price falls. This heightens the risk of bail-ins.

Bail-ins can now be used in the UK, EU, U.S. and G20 countries. Banks internationally and especially in Europe remain vulnerable. After Cyprus, which country will be the next to suffer bail-ins? Will RBS and by extension Ulster Bank, be the first UK and Irish banks to be subject to bail-ins?

GoldCore Research: From Bail-Outs To Bail-Ins: Risks And Ramifications download your guide here.

| Digg This Article

-- Published: Monday, 9 June 2014 | E-Mail | Print | Source: GoldSeek.com