-- Published: Friday, 13 June 2014 | Print | Disqus

Today’s AM fix was USD 1,273.00, EUR 938.17 and GBP 750.06 per ounce.

Yesterday’s AM fix was USD 1,261.75, EUR 932.90 and GBP 749.66 per ounce.

Gold jumped $12.80 or 1.02% yesterday to $1,273.80/oz. Silver surged $0.35 or 1.82% to $19.56/oz.

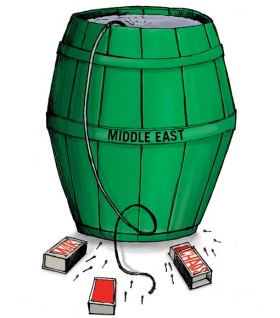

Middle East ‘Powder Keg’

Gold consolidated near a two-week high today and is set for the first back to back weekly advance since April, as concerns that a U.S. recovery may be stalling and geopolitical risks in the Middle East led to safe haven demand.

Gold is 1.6% higher this week, after rising 0.3% last week. Silver is also poised for the second week of gains. In the physical gold market, premiums on gold bars are quoted at 80 cents to $1.20 an ounce in Singapore and Hong Kong.

The unrest in Iraq drove oil to an eight-month high and sent stocks tumbling globally. U.S. crude touched an intraday high of $107.68, and was up 75 cents at $107.28, extending the previous session's $2.13 gain on concerns about oil supplies.

After a long period of consolidation, oil prices look like they could be on the verge of breaking out of their range and moving higher (see chart).

Gold in U.S. Dollars - 1 Week (Thomson Reuters)

Iraq and disappointing U.S. economic data propelled gold and silver higher yesterday. Disappointing U.S. retail sales and an uptick in weekly jobless claims led to investor buying of haven assets.

The Commerce Department reported a gain in retail sales of 0.3% in May. Economists were expecting a gain of 0.6% last month. Jobless claims rose 4,000 to a seasonally adjusted 317,000 according to the Labor Department. This is 7,000 more than economists were expecting.

Uncertainty has returned and in a big way. This is favouring safe haven assets such as gold and weakness in toppy looking risk assets such as many stock markets.

The combination of poor economic data along with the risk of war in Iraq could be the catalyst that gold needs to get out of its recent funk.

NYMEX Light Sweet Crude Oil (WTI) - 20 Years (Thomson Reuters)

Violence in Iraq exploded as Iraqi separatists, the Islamic State of Iraq and al-Sham (ISIS), took over the second largest city in Iraq. ISIS forces are just 50 miles from Iraq’s capital, Baghdad.

Sunni Islamist militants gained more ground in Iraq overnight, moving into two towns in the eastern province of Diyala. U.S. President Barack Obama is considering military strikes to halt their advance towards the capital Baghdad.

Gold in U.S. Dollars - 1 Month (Thomson Reuters)

To the north, a Kurdish militia known as Peshmerga took over key government installations in strategically important, oil hub of Kirkuk. The situation in Iraq has deteriorated significantly in a very short period of time and an all-out sectarian conflict is looking more likely as each day goes by.

With Syria's Kurds already exploiting civil war there to run their own affairs, Iraqi Kurdish expansionism is worrying U.S. ally Turkey, which has its own large Kurdish minority and fears a renewed attempt to redraw borders and create a Kurdish state.

Iraqi President Maliki's army already lost control of much of the Euphrates valley west of the capital to ISIS last year, and with the evaporation of the army in the Tigris valley to the north, the government could be left with just Baghdad and areas south - home to the Shi'ite majority in Iraq's 32 million population.

Gold in U.S. Dollars - 5 Year (Thomson Reuters)

The Wall Street Journal is reporting that Iran sent two battalions of Iranian Revolutionary Guards to help the Iraqi government in its battle against ISIS. This is an important development. Iran has already intervened in Syria and has the power to crush ISIS in open combat.

Iran, which it is believed funds and arms Shi'ite groups in Iraq, could be brought deeper into the conflict, as could Turkey to the north. In Mosul, 80 Turks were held hostage by ISIS after Ankara's consulate there was overrun.

Iranian or Turkish intervention would make the conflict inside Iraq much worse. Israel wants to see a continuation of the tough line against Iran which it continues to see as an existential threat.

Gold bullion has increased 6% this year in part as tension between Russia and the U.S. and EU led to some haven demand. Developments in the Middle East are likely to deepen geopolitical tensions between Russia and the West and this should support gold and indeed lead to higher gold prices in the coming months.

There is still the potential for a wider Middle East conflict as the region remains a ‘powder keg.’ Iraq may be the match that sees the region explode into chaos and war - with attendant effects on global oil prices and the global economy.

| Digg This Article

-- Published: Friday, 13 June 2014 | E-Mail | Print | Source: GoldSeek.com