-- Published: Thursday, 3 July 2014 | Print | Disqus

By Andrew Hoffman

Long-time readers know I love to include literary references to demonstrate key points; and none more so than the “aha moment” in my favorite movie of all time, V for Vendetta. That is when Inspector Finch, who can’t seem to pinpoint exactly what’s wrong with England realizes how the spreading social cancer started, where it currently stood and where it was headed.

Not that what ails America – and the entire world – is news to Miles Franklin Blog readers, as we have been writing of the inevitable collapse all fiat currency regimes beget for more than a decade. However, given the unprecedented nature of government, corporate, and individual responses to the banking system’s 2008 death, even we find ourselves at times struggling to grasp the gravity of the situation.

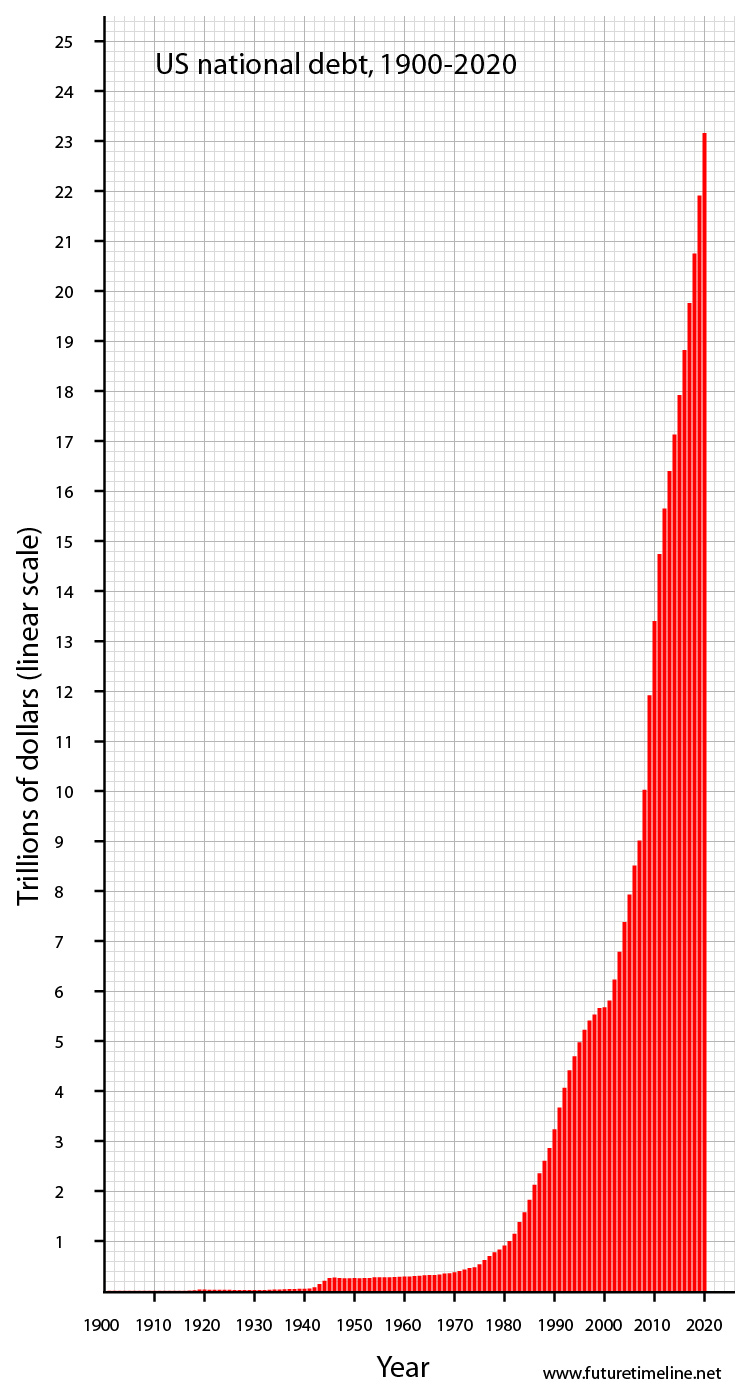

We have long written that the “end game” of currency collapse is in sight when debt growth morphs from arithmetic to geometric, and finally parabolic – which is exactly where the entire world stands today. And yet, despite such financial horror staring us straight in the face, the majority remain slaves to a “normalcy bias” that claims so long as we haven’t imploded yet, “all’s well.” Of course, we did implode six years ago; and today, nearly all measures of global economic activity and financial health are dramatically worse – in most cases, at multi-generational lows.

Never before has a Ponzi scheme been better defined than today’s worldwide fiat currency regime; which unquestionably, has reached its inevitable, terminal stage. As Bill Holter noted yesterday – quoting of all people the J.P. Morgan – “Only Gold Is Money, And Everything Else Credit.” Our guess is this time-honored truism will be universally realized far sooner than most can imagine; and if Jim Sinclair is correct, the second half of 2014. That is, NOW!

Futuretimeline.net

Last week, we wrote of how the “recovering” Italian economy (if a 40-year high in total unemployment, 43% youth unemployment and flat GDP constitute “recovery”) saw its debt load surpass that of Germany, despite having an economy barely half the size. Believe it or not, economic afterthought Italy is among the five largest debtors on the planet; although in actuality, if corporate debt were incorporated into the equation, leading “financial engineers” like the UK and France would likely be far higher. And if honest GAAP accounting was utilized to measure true debt levels, who knows how ugly such metrics would look?

That said, for such an inconsequential nation to have racked up $3 trillion of debt speaks volumes of the fiat currency regime that enabled such a financial monstrosity; let alone, unfettered Central bank monetization – both directly and indirectly – that has caused Italian interest rates to plunge to multi-decade lows. Think about it. This is a country that has had three Prime Minister resignations in the past three years, an utter catastrophe of a PIIG economy, and at times, widespread social unrest. However, in the terminal stages of history’s most global Keynesian experiment, a Central banker simply saying he’ll do “whatever it takes” to save such dying nations temporarily trumps reality.

Sadly, this is a truly global pandemic – as following the 1971 abandonment of the gold standard, not a single country objected. To the contrary, greedy politicians saw that fateful event as a short-term opportunity to “leverage up” their balance sheets at the expense of future generations. Which, they did in spades, yielding a 2014 world at the precipice of collapse. True, the “1%” are thriving due to epic levels of “free money” handed to them by said Central banks. However, the “99%” are growing larger in size and more desperately impoverished each day; as such epic misallocation of capital – from Main Street to Wall Street – has created a Frankenstein-like monster combining depression-like economic conditions and 1999-like bubble valuations. Not to mention, turning the world’s most valuable assets – gold and silver – into the cheapest; incredibly, at prices well below their respective costs of production. Gee, I wonder how long these unprecedented anomalies will last.

Zero Hedge

But behind all the madness, it’s always the same root cause – DEBT; in this case, involving the most epic astronomic buildup of all time. Sovereign debt receives the bulk of media coverage, such as America’s $17.6 trillion national debt (plus $5+ trillion “off balance sheet”). However, no segment of society is immune – including “recovering” U.S. corporations, which increased net debt by 14% in the past 12 months alone to a record $2.3 trillion. As for said “99%,” record entitlement spending – encompassing more than half the population – says it all; as does the below chart of what they’ve been borrowing for. Student loans, which have proven to yield financial death in the majority of cases over the past decade, have doubled since the 2008 financial crisis, to an all-time high of $1.2 trillion – sporting record high delinquency rates of 13%. Not only that, they are non-dischargeable, even via bankruptcy, and nearly entirely funded by taxpayers. And oh yeah, as of today, the interest rate on new student loans is increasing by 20%. Yes, only TBTF banks pay 0% interest on loans. For the rest of us, that’s what we receive (until rates are inevitably decreed negative). And as for what we borrow at, don’t make me laugh.

Zero Hedge

Regarding auto loans, we have spent countless hours discussing the horrific situation that has turned the U.S. auto industry into the new subprime lending “leader.” Between channel stuffing, subprime lending, product recalls; and now, record term amounts and lengths (of up to 84 months, averaging nearly $28,000 per loan), GM is losing as much money as its pre-bankruptcy days, en route to yet another taxpayer “bailout.” And thus, for those excited about yesterday’s report that U.S. auto sales made an eight-year high, put the champagne on ice. Just like supposed “jobs” returning to pre-2008 crisis levels, the actual data tells a far different story. Behind every job is an equal or greater amount of debt growth, inflationary, operating losses and societal burden. That is assuming said “jobs” are real at all; as we’ll be reminded again tomorrow – when as usual, the BLS attributes the vast majority of labor market improvement to its fictitious “birth/death” algorithm. Essentially, any and all “economic strength” these days is mere illusion – interspersed with heavy doses of propaganda, such as ignoring the fact that outside of oil and gas extraction, U.S. “industrial production” is down an astounding 24% from its 2006 peak.

Actually, it was this article from the great John Rubino that sparked today’s “aha moment” regarding debt acceleration, particularly in the supposedly “recovering” States of America. Specifically this graph of the recent surge in credit card debt growth, amidst an environment of negative 3% first quarter GDP growth, horrific real economic data, stagnant nominal wages, surging food and energy inflation, and historic economic uncertainty. TPTB will try to spin this as the “return of the consumer.” However, per this article, such this “debt explosion” is simply an ugly inflection point, in which the average American realizes he must dramatically increase borrowings “just to get by.” In other words, to pay said student and auto loans; as well as surging food, energy and insurance costs; as well as essentially all “need versus want” items. This is not speculation, by the way, but cold hard fact.

By the way, note how gold and silver are rising this morning – despite every conceivable Cartel “roadblock” – amidst the supposedly “wildly bullish” ADP employment report. As usual, ADP’s data was heavily “seasonally adjusted” with but one aim – to “goal seek” itself into the historical trend of the equally rigged NFP report. Moreover, such enormous “job growth” was entirely inconsistent with surveys of small business hiring plans; and worse yet, a simultaneously published Gallup poll indicated net private job losses, whilst government hiring rose to its highest level since the data series commenced in 2008! In other words, as is the case with all supposedly bullish economic reports, it was “noise” at best, and “fraud” at worst! To wit, weekly Mortgage Purchase Applications (-1.0%) and May Factory Orders (-0.5%) were simultaneously released; yet again, validating our claim that real 2Q GDP “growth” is non-existent. And thus, when the NFP report is published tomorrow morning, take a deep breath and wait for the internals to circulate. We assure you the more you look the uglier this heavily rigged report will appear.

To that end, don’t let the unfettered money printing, market manipulation and propaganda that has engulfed the planet in unprecedented fashion distract you from the horrific reality of parabolic debt growth in its terminal, irreversible stage. This is how all Ponzi schemes have ended throughout thousands of years of history. Only in this case, it is by far the largest sustained by unprecedented financial engineering that will inevitably implode with the “economic force” of an F-5 tornado.

And when it does, it will be too late to protect yourself with the “universal debt antidote” of physical gold and silver. Educating of the importance of this “life or death” fact is the sole purpose of the Miles Franklin Blog; and thus, if you consider taking this extremely prudent step, we hope you’ll give us a call at 800-822-8080, and give us a chance to earn your business. There’s a reason we’ve been around for 25 years, whilst dozens of competitors have come and gone. Great service, competitive pricing and a deep down care for the well-being of our clients. Not to mention, we put our money where our mouth is; and in our view, our Brink’s Montreal storage program is the world’s best!

http://blog.milesfranklin.com/

| Digg This Article

-- Published: Thursday, 3 July 2014 | E-Mail | Print | Source: GoldSeek.com