-- Published: Tuesday, 22 July 2014 | Print | Disqus

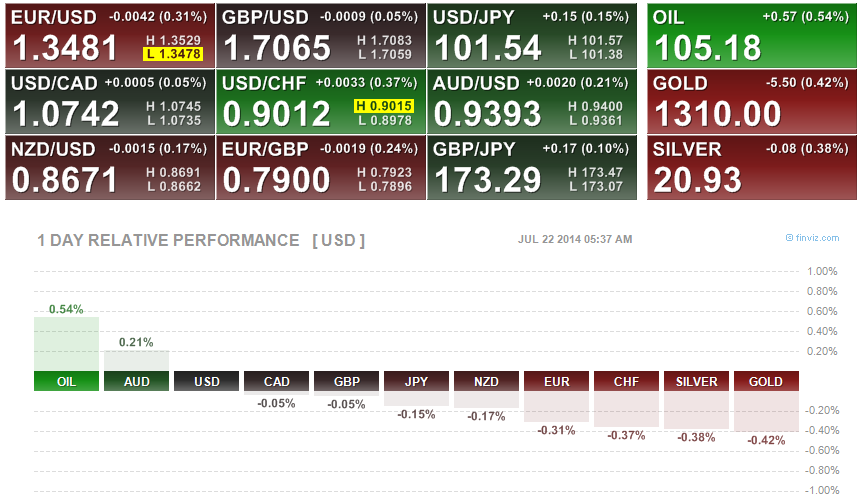

Today’s AM fix was USD 1,307.00, EUR 969.44 and GBP 765.76 per ounce.

Yesterday’s AM fix was USD 1,312.75, EUR 970.75 and GBP 768.72 per ounce.

Gold rose $2.40 or 0.18% on yesterday to $1,312.90/oz and silver climbed $0.09 or0.43% to $20.94/oz.

Gold prices are flat in London this morning after gold in Singapore fell from $1,312/oz to $1,305/oz. Futures trading volumes were low and 16% below the average for the past 100 days for this time of day.

Increased risk appetite as seen in rising stock prices countered haven demand but continuing tension in Iraq, Syria and Gaza saw oil prices tick higher again.

Silver for immediate delivery was 0.3% lower at $20.87/oz in London. Platinum lost 0.4% to $1,484.50/oz. Palladium fell 0.5% to $871.20/oz. It reached a 13-year high of $889.75 on July 17.

Weakness on equity markets helped gold prices rise slightly yesterday as heightened geopolitical tensions boosted the demand for haven assets. Unrest in the Middle East and Ukraine may have helped gold rebound 8.7% this year.

Data may show today that U.S. inflation held at the fastest pace since October 2012, putting pressure on the Federal Reserve to tighten monetary policy.

Rising interest rates will be bearish for stocks, bonds and property. They are likely to be bullish for gold.

This was seen clearly in the 1970s when rising interest rates were negative for stocks and bonds but positive for gold. It is towards the end of the interest rate tightening cycle that gold will be vulnerable to falling when depositors are again incentivised to save through positive real interest rates.

Relations between western powers and Russia have sunk to a new low after UK Prime Minister compared “Russia’s aggression” to that of “Nazi Germany.”

David Cameron accused Vladimir Putin of “bluster and obfuscation” on last night and called on Europe to impose “hard-hitting sanctions” on Russia after the downing of Flight MH17.

More hawkish U.S. and European leaders pushed for harder sanctions on Russia and the prospect of economic war and currency wars looms larger by the day.

There is a real sense of certain UK and U.S. leaders crossing the rubicon … this makes cyber, economic, currency and actual war more likely.

Gaza And Ukraine: Pawns In A Deadly, Grotesque Geopolitical Game

by David McWilliams

Ukraine, Gaza, Iran, Isis, Syria and Turkey are all just pawns in a grotesque geopolitical game. All sides have their narratives. But in all cases, innocents must die.

When an airliner is blown out of the sky by people who want part of their country to break away, it’s time to actually take things seriously. This isn’t just some country. We are talking about Russia here and its southern border with Ukraine. The West (and that includes us) will now demand that the Russians disown their out-of-control compatriots in Ukraine. We will be treated to experts suggesting that this is evidence of the war mongering of the Russians, the instability of Putin and the need for Ukraine to move towards the EU with haste.

I am writing this morning from the Balkans and as a result, have been listening to different interpretations of what has been going on globally. Many of these views are more understanding of the Russian interpretation than the western one. Over the years, having spent some time in Russia, I have been aware of the very different ways the Russians and the West view the same events.

When seen from the Russian perspective, Ukraine is just another example of the gradual but definitive encroachment of the West into all things Russian. Russia and Ukraine are not different cultures. They are part of the same broader Russian/Slavic family. Our narrative is that the Russians are happy to keep Ukraine unstable and that what happened to the Malaysian airliner was the risk Russia was running by arming the separatists with sophisticated weapons.

Seen from the Russian side, it isn’t the Russians who are doing the destabilising but the Americans.

For them, the Americans arming and financially supporting an opposition in Ukraine would be like the Scottish Nationalists being financed by Russia. How do you think London and Washington would react to that? How do you think they’d react to the idea of a Russian puppet running an independent Scottish state from Edinburgh?

This is how close Ukraine is to Russia.

Now when you think about it in those terms, do you think Putin will back down and do what the West wants him to do?

Many in Russia believe that ultimately Ukraine is simply a pawn to keep Germany away from Russia. They believe that the only real alliance in Europe is one between an energy-rich Russia and an energy-impoverished Germany, between a technology and manufacturing-rich Germany and a manufacturing-poor Russia. These Russians regard an alliance with Germany as the logical geopolitical relationship for Europe in the first half of the 21st century. They regard the EU as a relic of the 20th century, necessary to protect western Europe under the umbrella of Nato both from itself and ultimately from the Red Army. With this threat gone, many Russian strategists argue that an alliance between Russia and Germany is going to happen.

Such a coalition would terrify America because it would mean that America would no longer be a player in Europe. This is why America heightens the fears of those who would have most to lose in such an alliance – such as Poland. Therefore Poland gets all the best American military equipment, gets the US investment and regular US pats on the back. By destabilising Ukraine, the Americans can heighten the regional angst of the Poles and also line the Germans up against the Russians in defence of a Ukrainian state, which is little more than an IMF supplicant propped up by IMF/EU loans to cover the day-to-day pilfering of its home grown kleptocracy.

Again when seen from Moscow, further south on the other side of the Black Sea, America is happy to allow its ally, prime minister Erdogan, in Turkey to tear up the Turkish constitution, jail opposition politicians and questioning journalists, and allow him to do the very thing that they scolded Putin for doing, staying in power by jumping from prime minister to president and back.

While Erdogan makes a mockery of Ataturk’s Turkish republican values, America sells Turkey the finest military hardware because Turkey promises to put manners on Russia’s ally in the region, Assad in Syria. Furthermore, the Turks and the Persians have hated each other for millenniums, so a strong Turkey keeps Russia’s other ally, Iran, in check.

America’s other ally in the region, Saudi Arabia, lends its support to al-Qaeda and its various Sunni offshoots such as Isis in Iraq, revealing that America is either very capable of playing both sides or is terribly out of its depth in the region. All the while, America’s biggest ally in the region, Israel, pulverises Gaza, but Gaza itself is held by Iran’s ally Hamas and thus is a pawn in Iran’s regional game.

Hamas were out of favour with Iran for not backing Assad in Syria at the beginning, but now with Assad securely in power after an unbelievable 150,000 people have been killed in Syria, Hamas has to cozy up to Iran again. The Hamas embrace of Iran was made more urgent by the eclipse of the Muslim Brotherhood, the Qatari-financed movement in Cairo, which is now on the run.

This grotesque geopolitical chessboard, where each conflict can be seen as a proxy war for something else is the kaleidoscope through which the world is seen from Moscow and Washington and indeed the other capitals of major world players from Beijing to London.

All sides have their narratives, allies and interests. All desperately want to remain in control and are happy to turn a blind eye to the atrocities committed by their allies. In all cases, innocents are killed.

So the Americans look the other way in Gaza, while the Russians discount the killings in Aleppo. The French get all hot and bothered about Ukraine while ignoring the fact that its own troops are up to their eyes in the civil war in Chad and southern Libya. Britain lectures Russia on intervention in Ukraine while ignoring the fact that their troops are in Afghanistan.

Maybe it’s because I am in the Balkans 100 years after Gavrilo Princip killed Franz Ferdinand and kicked off a global conflict, but the unstable alliances of 2014 look equally as fragile as they did in 1914.

Sometimes when you are living through historic times you don’t realise it, but last week’s events from Ukraine to Gaza and Iraq do have a momentous feel to them.

David McWilliams

Global Macro 360° offers actionable and affordable insight into what’s going in the global economy; insight that you can use to protect and grow your wealth.

David McWilliams is the author of Global Macro 360° which is his valuable daily guide to understanding the global economy, in order to invest in financial markets, thereby creating and preserving personal wealth.

GoldCore greatly value David’s daily insights and in partnership with David McWilliams, are offering you a one week free trial to Global Macro 360°. Plus, you will gain access to all the content on the Global Macro 360° website.

Sign up here in order to view more and login as a member to Global Macro 360.°After your one week trial has expired, and if you like what you’ve been reading, you can sign up to GoldCore Super Saver Annual Membership – (€300.00 )

| Digg This Article

-- Published: Tuesday, 22 July 2014 | E-Mail | Print | Source: GoldSeek.com