-- Published: Thursday, 24 July 2014 | Print | Disqus

Today’s AM fix was USD 1,300.00, EUR 964.68 and GBP 763.76 per ounce.

Yesterday’s AM fix was USD 1,307.50, EUR 971.04 and GBP 767.54 per ounce.

Gold fell $1.60 or 0.12% yesterday to $1,304.90/oz and silver slipped $0.02 or 0.1% to $20.92/oz.

Gold has eked out small gains in London this morning after gold in Singapore fell nearly $10 overnight. Futures trading volume on the move down were very low and 37% below the average for the past 100 days for this time of day, according to Bloomberg data.

Silver for immediate delivery dropped 0.2% to $20.95 an ounce in London. Platinum declined 0.3% to $1,480 an ounce. Palladium rose 0.3% to $876.20 an ounce. It reached a 13-year high of $889.75 on July 17.

Geopolitical tension should support gold at the 200 day moving average at $1,286/oz. Gold breached the 100 day moving average at $1,301 overnight and the next level of support is at the 50 day moving average at $1,294 (see chart).

Gold in U.S. Dollars - 50, 100, 200 SMAs (Thomson Reuters)

Worries over tougher sanctions on Russia and their potential impact on fragile Eurozone growth and the conflicts in Ukraine and the Middle East are leading to some safe haven demand. Geopolitical tensions threaten oil supplies from key oil producing regions which should also support gold.

A more hawkish FOMC tone and positive payroll data could pressurise gold in the short term as the short term trend is again lower after last weeks falls.

The China Gold Association said in a statement on Thursday that China's gold demand fell 19.4% in the first six months of 2014 from year ago. We are not sure if the Chinese Gold Association numbers are an accurate reflection of actual Chinese demand. We believe the data from the Shanghai Gold Exchange (SGE) on gold withdrawals from the SGE is a better indicator of total Chinese gold demand. It shows that total Chinese gold demand is over 998 MT year to date.

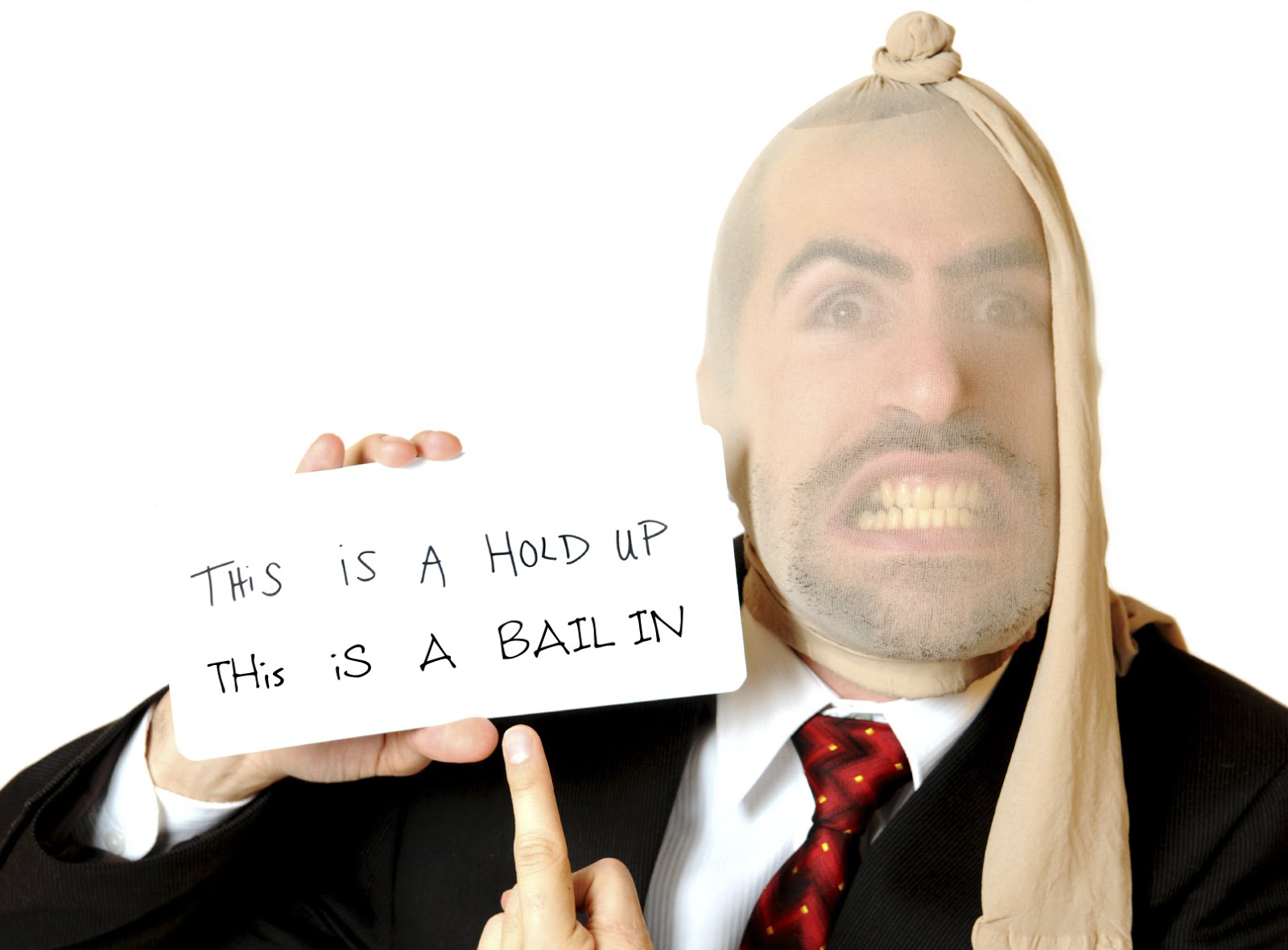

EU Bail-Ins - Austria Next?

The EU drive toward bail-ins continues unabated. So too does the increasing uncertainty for investors in European financial institutions and depositors in European banks.

The coming bail-in regime raises the spectre of the effective loss of their investments and savings due to the new legislation which will again bail out insolvent banks.

On July 8, the government in Vienna had its parliamentary groups pass special legislation for a bail-in of Hypo Alpe Adria bank (HAA), in the range of nearly EUR 900 million.

The Austrian government’s legislation on bail-ins goes further than EU legislation, as it does not exempt from the bail-in the first EUR 100,000 on deposit.

The victims of the bail-in are hundreds of thousands of Austrians who bought life insurance policies.

Indeed, the insurance companies had invested in HAA bonds that will no longer be guaranteed under this legislation. Specifically, it hits the policies of civil servants (at Oesterreichische Beamten-Versicherung), of municipal workers and employees (Wiener Staedtische Versicherung) and others who bought insurance from Uniqua.

Previously, the Austrian province of Carinthia had guaranteed the bank, but incredibly the new legislation declares that guarantee to be invalid retroactively. This then invalidates the transfer of that guarantee to the Austrian state when the bank was nationalized in 2009.

The retrospective bail-in of a state guarantee in respect of subordinated debt is unprecedented in this context.

The Austrian government claims the legislation only applies to the case of the HAA, but critics have correctly warned that a dangerous case of precedence has now been set, leaving the door wide open for other expropriations and deposit confiscation.

The developments cast doubts on Marc Carney’s and Bank of England officials that bail-ins are only for large systemically important institutions.

Bail-ins are coming to financial institutions and banks in the EU, UK, U.S. and much of the western world - with painful consequences for unaware savers.

Must read guide and research to deposit confiscation and banks that are vulnerable to deposit confiscation can be read here:

Protecting Your Savings In The Coming Bail-In Era

From Bail-Outs to Bail-Ins: Risks and Ramifications

| Digg This Article

-- Published: Thursday, 24 July 2014 | E-Mail | Print | Source: GoldSeek.com