-- Published: Friday, 25 July 2014 | Print | Disqus

By Andrew Hoffman

How many reasons to own precious metals- and fear all else-what can I say? I guess we’ll see today, culminating in today’s topic du jour – the increased confidence in our long-standing prediction that not only has global gold and silver mining peaked, but will likely not rebound material even after the Cartel’s inevitable demise.

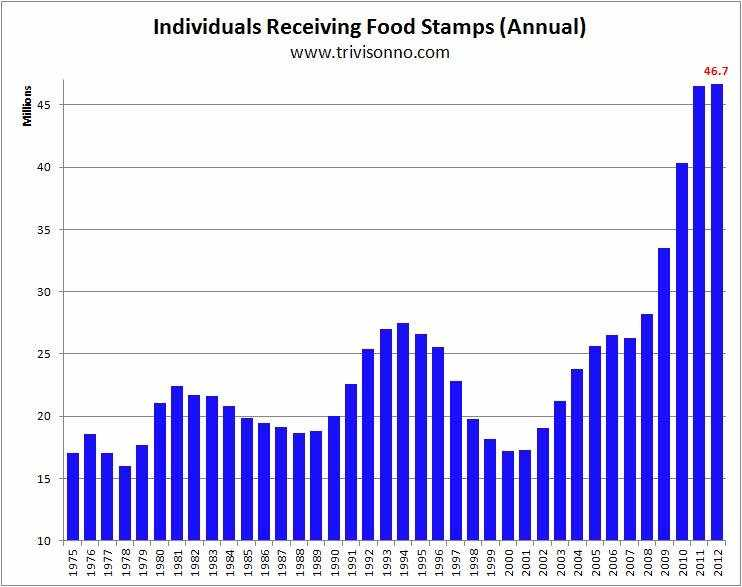

Let’s start with the so-called U.S. “recovery”; which with each passing day becomes more widely understood to be nothing but a scam fabricated by the propaganda machines in New York and Washington. To wit, when the CEO of Wal-Mart says demand weakness is pervasive and entirely non-weather related – it strains credibility to believe otherwise. I mean geez, U.S. movie box office sales are down 25% year-over-year and 41% from two years ago! Yesterday’s news that the IMF downgraded the U.S.’s 2014 GDP growth outlook to a measly 1.7% only solidifies this view; not to mention, its “recommendation” that the Fed maintains zero interest rates well past mid-2015. Putting the “nail in the coffin,” Caterpillar – the world’s largest construction equipment contractor – just announced its 19th straight quarter of year-over-year revenue declines!

DavidStockmansContraCorner.com

That said, when even the “1%” is suffering, it’s even more damning. And in no sector is this more evident than golf, where Dick’s Sporting Goods just fired 400 PGA golf pros due to plunging demand. I’ve been to my local Dick’s several times in recent months; and by and large the golf section is a ghost town. Not to mention, the golf course I live on; which by my estimation has probably held 75% fewer client-sponsored tournaments this year. Heck, my good friend in the “golf entertainment” business told me his July business is down 95% this year with the only gig he performed discounted by 60%. And guess who his lone client was? None other than the U.S. government!

In the run-up to next Wednesday’s FOMC meeting, TPTB’s best laid “deception plans” have been under siege; as not only are “extraneous” events like the MH-17 tragedy emerging at an alarming pace, but the PPT has inadvertently created a 1999-like equity bubble – whilst Treasury yields plummet to the year’s lows, in what we described as the “most damning proof yet of QE failure.” Actually the equity bubble is far worse than 1999; as back then, the entire population participated, under the false assumption of a “new paradigm” of economic prosperity. However, this time around, it is entirely due to Fed money printing and PPT “support” – with only “the 1%” participating. To wit, recall the incredible charts we published last week of how – thanks to Cartel suppression – gold and silver prices are now dramatically more “oversold” than at any time in history. Conversely, as you can see below, the S&P 500’s MACD indicator is now more “overbought” than the 2000 peak (and way above the 2007 peak); which frankly, is the most shocking market development of my 25-year career. Back in 1999, when I was an oilfield service analyst at Salomon Smith Barney, the market was so red-hot my team’s investment bankers were forcing us to focus all efforts on “internet oilfield stocks,” which they wanted to take public at multi-billion dollar valuations. In fact, the “Bubba to Bubba” report I penned in February 2000 is unquestionably the most well- read piece I have ever written. That my friends, was a bubble!

Back to precious metals, the current “suppression tactics” are more onerous than anything I’ve experienced in my 12+ years in the sector. Literally, the “caps and attacks” occur from the second thinly-traded paper platforms open Sunday night to the second they close Friday evening. Every rally is immediately squelched with “Cartel Herald” algorithms, every “key attack time” utilized, and all “PM-positive” news met with heightened paper selling and accompanying anti-PM propaganda. That said, PMs are still the best performing asset of 2014, which should tell you all you need to know about the inexorable growth of global demand – principally from the Eastern hemisphere.

In our view, gold and silver fundamentals are by far, the most bullish since their respective bull markets commenced at the turn of the century. To that end, as we wrote in “That Other Reason to Own Gold,” the outlook for global production may be as dire as the demand outlook is explosive. We have written ad nauseum of the ugly circumstances that have yielded flat production from $250 gold in 2000 to $1,300 today. However, said combination of product scarcity and exploding mining costs is accelerating, yielding our belief that regardless of price, production could plunge by 25% or more in the coming five years.

Recall last week’s article from the great Steve St. Angelo describing how the five largest gold miners’ 2013 ore grades hit an all-time low; ominously, during a period of “high-grading” that will only cause grades to plunge further in the coming years. Since 2005, the average ore grade of these five companies, which cumulatively produce 35% of the world’s gold has plummeted by an astounding 29% to a measly 1.2 grams per tonne – or 1.2 parts per million. Conversely, the amount of ore processed rose by 28% depicting how the utter explosion of production costs is occurring across-the-board.

Moreover, the new project pipeline is nearly non-existent; as care of depletion, exploding costs, and onerous permitting and environmental issues (not to mention, tragic mine collapses like Utah’s Kennecott), there have been practically ZERO major discoveries in the past decade. Not to mention, massive cancellations and postponements such as Ecuador’s Fruta Del Norte and Argentina’s Pascua Lama.

Equally importantly, the junior mining industry – where nearly all major discoveries have traditionally been made – is not just dying, but dead. The “capital strangulation” the Cartel – and a handful of major Canadian banks – has caused since 2007 has finally reached the “max pain” level; as no doubt, roughly three-quarters of all junior miners have since been bankrupted. Trust me, I know as from 2002-08 my entire portfolio consisted of junior miners, and from 2006-11 I worked in the junior mining industry. We discussed this inevitability in last year’s “Junior Mining – and Future Production – Death”; and this week’s announcement that the San Francisco and New York Hard Assets have been indefinitely cancelled “seals the deal” on our predictions.

I have been to all the major North American conferences, and no doubt San Francisco show was America’s largest and best. With it now gone, as well as the less impressive, but highly symbolic New York show it should be crystal clear that the sector for all intents and purposes is bankrupt. In Canada, the Cambridge retail mining conferences in Toronto or Vancouver remain on the docket. However, the same fate will no doubt befall them in 2015 if PM prices are not dramatically higher.

Given exploding costs and “time to production” (from discovery to commercial mining) the financial hell rained down on the industry by seven years of gold, silver and mining share suppression will not be overcome by any circumstance – including the Cartel’s inevitable collapse. In other words, the “perfect storm” of unprecedented global demand and historically low production is all but ensured; and possibly, far sooner than most could imagine. Thus, while the “end of mining” may not occur literally, it by all and intents already has practically.

http://blog.milesfranklin.com/

| Digg This Article

-- Published: Friday, 25 July 2014 | E-Mail | Print | Source: GoldSeek.com