-- Published: Tuesday, 29 July 2014 | Print | Disqus

Today’s AM fix was USD 1,307.50, EUR 972.84 and GBP 770.39 per ounce.

Yesterday’s AM fix was USD 1,305.00, EUR 971.20 and GBP 768.55 per ounce.

Gold climbed $2.30 or 0.18% yesterday to $1,305.10/oz and silver rose $0.12 or 0.58% to $20.62/oz.

Gold rose 0.4% in London this morning after gold in Singapore traded sideways overnight. Futures trading volume continues to increase and was almost double the average for the past 100 days for this time of day, Bloomberg data shows.

Gold in U.S. Dollars - 50, 100, 200 Simple Moving Averages (Thomson Reuters)

Silver for immediate delivery rose 0.8% to $20.73 an ounce in London. Platinum was 0.1% lower at $1,486.82 an ounce. Palladium gained 0.3% to $883.63/oz and remains close to a 13 year nominal high of $889.75.

Geopolitical tension in Europe and in the Middle East is supporting gold. Israel's military pounded targets in the Gaza Strip on Tuesday after Prime Minister Benjamin Netanyahu said his country should prepare for a long conflict in the Palestinian enclave, squashing any hopes of a swift end to 22 days of fighting.

Gaza residents reported heavy Israeli bombing in Gaza City. Israeli aircraft fired a missile at the house of a Hamas Gaza leader and flattened it before dawn. An Israeli military spokeswoman said 70 targets were struck in Gaza through the night. At least 30 people were killed in the assaults from air, land and sea, residents said, after a night of the most widespread attacks so far in the tiny enclave.

The new sanctions are set to inflame relations further. They are on “key sectors” of Russia’s economy, U.S. Deputy National Security Adviser Tony Blinken said yesterday. Russia also signaled possible retaliation, announcing yesterday that it may ban imports of chicken from the U.S. and fruit from Europe because of concern about contamination.

Futures options expiration is over but we are not out of the woods yet and gold and silver could see more volatility this week ahead of key reports on gross domestic product on Wednesday and employment data on Friday. The Federal Reserve's chief policy making committee meets today and tomorrow and this could have another short term impact on prices.

Russia, Kazakhstan, Kyrgyzstan and Tajikistan Buy Gold - Bye Bye Petrodollar

Russia continues to aggressively accumulate gold reserves. Its gold holdings increased again in June as the crisis in the Ukraine and relations with the West deteriorated.

The Russian central bank officially increased its gold holdings by 16.8 tonnes to 1,094.8 tonnes in June, the IMF's International Financial Statistics report showed. In ounce terms, Russia increased its gold holdings by some 500,000 ounces, to 35.197 million ounces in June from 34.656 million ounces in May.

Russia recently became the world's fifth largest bullion holder after the United States, Germany, Italy and France.

Importantly, China’s gold holdings, the world’s biggest store of wealth buyer of gold, haven’t been updated since March, 2009 and remain at just 33.89 million ounces or 1,054.1 tonnes and just 1% of their huge foreign exchange reserves. More than five years later, it is likely that China’s reserves have doubled or trebled as they quietly corner the global physical gold market.

It is important to note that there remain doubts as to the integrity of the gold holdings of the U.S. and concerns that other countries national gold reserves could be encumbered, loaned or sold in the market. Indeed, the Bundesbank is having grave difficulty in having its gold reserves returned from the Federal Reserve in New York.

So far in 2014, Russia has now bought substantially more than their entire annual gold production of nearly 1,500,000 ounces.

Russia was not the only central bank to diversify foreign exchange reserves, primarily held in dollars, into gold. Allies of Russia also bought gold in June. The central banks of Kazakhstan, Kyrgyzstan and Tajikistan, all Russian economic and military allies all accumulated gold in June.

Currency wars are set to intensify and the buying by the former Soviet states is another manifestation of this.

Russia’s foreign reserves fell $39 billion to $472 billion in June, data from the Russian central bank shows. Gold now accounts for 9.3% of the country’s reserves, according to the World Gold Council substantially less than the percentage of gold in fx reserves of the other leading gold owners.

Greece, Serbia, Mexico and Equador also diversifed and increased their gold reserves in June.

Turkey increased its holdings to 16.491 million ounces from 16.172 million ounces in May. It accepts gold in its reserve requirements from commercial banks and as payment from other sovereign nations such as Iran.

Germany, the second-biggest gold holder, lowered its holdings by a tiny 1,000 ounces to 108.805 million ounces from 108.806 million ounces.

Gold advanced the most in four months in June as fighting in Ukraine to Iraq and Israel boosted demand for a haven. Hedge funds and banks almost doubled net-long position in gold during June, U.S. Commodity Futures Trading Commission (CFTC) data show.

Gold’s safe-haven appeal is being driven by heightened tensions between Russia and the West over Ukraine and increasing concerns of financial and economic war and indeed of actual war.

Geopolitical risk in June likely prompted some central banks to further diversify their foreign exchange holdings and buy gold which is used to hedge against geopolitical, currency and credit risks.

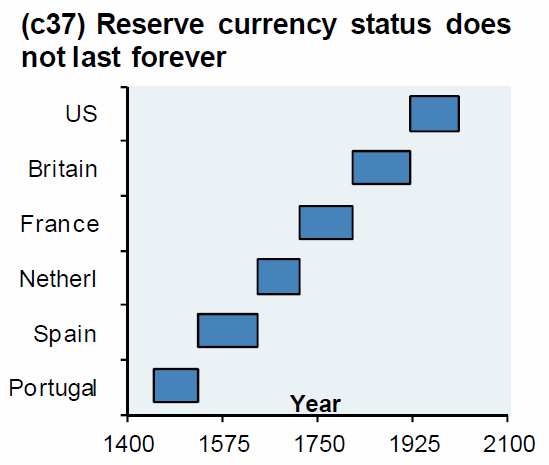

Reserve Currencies In History - Dollar's Demise Cometh

Central banks continue to be buyers of gold at these attractive price levels. As sanctions, economic war and currency wars intensify we expect Russian and Russian ally buying of gold reserves and selling of dollars to intensify. Aggressive buying of gold and particularly silver by Russia will likely lead to defaults on the COMEX gold and silver futures exchanges and potentially an international monetary crisis.

See important guide to Currency Wars here Currency Wars: Bye, Bye Petrodollar - Buy, Buy Gold

| Digg This Article

-- Published: Tuesday, 29 July 2014 | E-Mail | Print | Source: GoldSeek.com