-- Published: Thursday, 14 August 2014 | Print | Disqus

Today’s AM fix was USD 1,315.00, EUR 981.86 and GBP 787.85 per ounce.

Yesterday’s AM fix was USD 1,309.25, EUR 980.42 and GBP 780.71 per ounce.

Gold rose a tiny $1.90 yesterday to $1,311.60/oz while silver fell $0.12 or 0.6% to $19.84/oz.

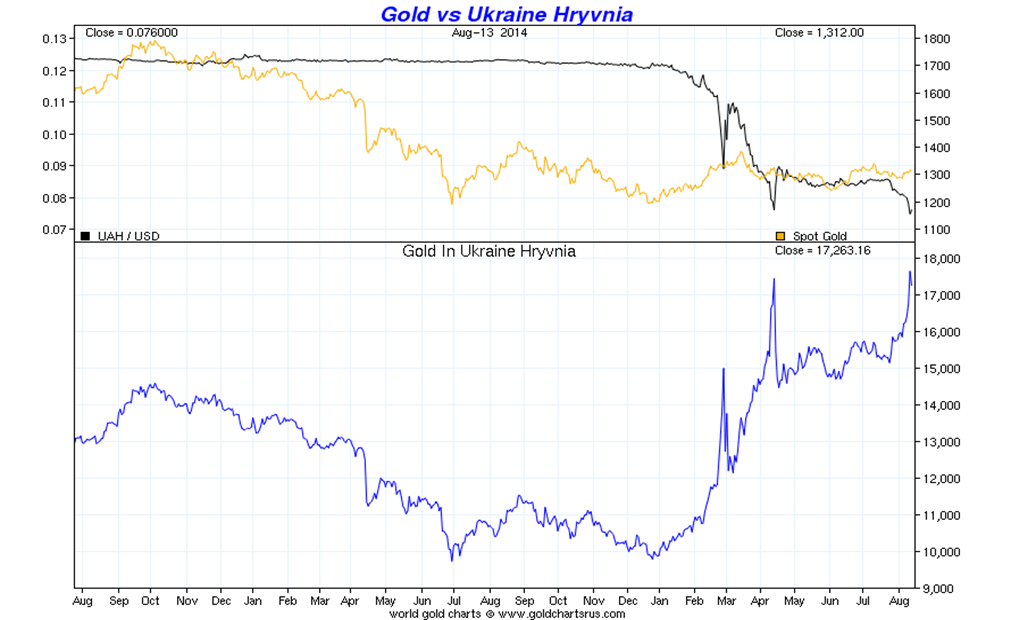

Gold in Ukraine Hryvnia - 2 Years (Sharelynx)

Overnight, gold was slightly lower In trading in Singapore. Gold in London eked out very slight gains this morning. Futures trading volume picked up somewhat but remained 18% below the average for the past 100 days this morning.

The lack of liquidity is contributing to lacklustre trading in all precious metal markets.

Silver for immediate delivery fell 0.2% to $19.98 an ounce. Spot platinum rose 0.1% to $1,474 an ounce, while palladium remained close to multi-year nominal highs and was flat at $883 an ounce.

Gold in Euros - 5 Year (Thomson Reuters)

Geopolitical risk continues to support gold at these levels. Macroeconomic risk was shown in the poor European growth data with the German and French economies still having severe difficulties.

Germany's economy shrank in the second quarter and France again failed to conjure up any growth, snuffing out any signs of a recovery in the euro zone which is now also weighed down by tit-for-tat sanctions with Russia.

Europe's largest economy contracted by 0.2% on the quarter, undercutting Bundesbank forecasts that it would stagnate, with foreign trade and investment notable weak spots. With so much uncertainty surrounding Russia and Ukraine, a quick rebound is unlikely.

With ECB monetary policy already ultra-loose, the data is very worrying. It could mean the ECB will become more aggressive in money printing with a consequent impact on the euro.

It is important to remember that while gold and silver prices have been in lockdown and only eked out small gains so far in 2014 despite increasing risk - especially geopolitical, gold has seen very strong gains in many non-major currencies.

This is especially the case in Ukraine where the currency has lost more than half of its value versus gold. Gold in Ukraine Hrvynia up 70% since the start of 2014. People who own gold in Ukraine would laugh at you, if you said that gold is not a safe haven.

People in Iraq, Iran, Syria, Gaza and elsewhere in the Middle East would also attest to how gold is a safe haven - both for refugees fleeing with portable wealth that is gold and for those who stay in country but see their currency devalued. As would people in Argentina (see chart below) and throughout South America and indeed Africa.

Reuters Interview GoldCore On Gold As Safe Haven

Follow Reuters Global Markets Forum on Twitter here

Follow Mark O'Byrne on Twitter here

Follow GoldCore on Twitter here

Mark O'Byrne, GoldCore

Hi Amanda and everybody in the forum

Amanda Cooper (Reuters News)

And it is time to welcome in our first guest of the day! Please welcome Mark O'Byrne, who is research director of GoldCore. Welcome back Mark!

Mark O'Byrne

Thanks for having me back on Amanda

Amanda Cooper

We said we'd talk about gold's role as a safe haven, particularly now when crisis after crisis, be that political, religious or even health related is blowing up. As you probably saw someone on Twitter said "please mention that s not the primary reason to own gold"

Is it still valid to talk about gold being a safe haven? Mark O'Byrne

Indeed I did ... lol ... so lets address the Twitter comment first. Geopolitical risk is not the primary reason to own gold. There I said it.

Macroeconomic, systemic and monetary risks are also good reasons to have an allocation to physical gold in a portfolio

Steven Slovak

what is so safe about it? it is not easily used in local commerce - if you are seen flashing it - you just may be mugged and if you store with others it can be rehypothocated ad infinitum

Amanda Cooper

I'll make sure I tweet that All right, in today's world, where the major central banks (some of them at least) are positioning to raise rates and you have the S&P seemingly going from record high to record high with barely more than a single-digit correction between peaks....why should you?

If you could tackle Steven's question first

Mark O'Byrne

Hi Steven, Its safe if it is owned in an allocated and segregated manner in a secure vault in safer jurisdictions in the world - such as CHF

Steven Slovak

and when you need access to do it? the only way to use it is to exchange it for paper…

farmland - you can grow food, oil you can burn - gold well it sits there and you pay to store it

Mark O'Byrne

You pick up the phone or email and can have it delivered to your work or home address in 2 to 4 working days - but that is only in worst case scenarios.

Petri Redelinghuys

in 1820 an ounce of gold could buy you a nice tailored suit.... in 2014 an ounce of gold can still buy you a nice tailored suit... it is a store of value, not a return generating investment. At least, that is my understanding

Amanda Cooper

Okay so if we're not talking about unholy hell being unleashed but more a general sense of unease....what would you say was the prime reason for keeping some gold in your portfolio, as opposed to allocating all that cash to bitcoins or the S&P or Greek debt?

Mark O'Byrne

Sorry I shoud qualify it is not absolutely safe - nothing is but significant body of academic research and history shows acts as hedging instrument and safe haven asset. At same time should only be an allocation in a portfolio of some 5% to 20%.

Amanda Cooper

So, back to my question. What's the prime benefit that such an allocation to gold would bring to a portfolio?

Mark O'Byrne

Is all about Diversification and not a Question of 'either or' regarding major assets.

Greek debt is high risk and not a store of value. Bitcoin is interesting but too soon to see how will develop and whether will act as a store of value. Huge potential as a means of exchange and payment obviously.

Most people already own the S&P if they have diversified investment and pension portfolios with an allocation to equities. Indeed some may be overweight the S&P and equities in general after the huge run up we have seen in most indices. We think S&P and many indices are now significantly overvalued and we are due a significant correction ... and potentially a crash ... with October being the period of risk

Amanda Cooper

Ah I was being slightly facetious with those examples. Can you talk to us a little about what kind of flows/demand youve seen from Goldcore's client base over this year?

On the S&P...thats what I just cant get my head around....no market is a one-way street, ever. Except that one!

Mark O'Byrne

Our general advice would be (and different for different investors depending on age, risk appetite, goals in life) have a diversified portfolio with significant allocations to equities (favouring small cap and emerging markets), and bonds ( AAA rated and short duration) and al allocation to physical gold and indeed silver

Steven Slovak

gold drops quick $3 during this

Mark O'Byrne

Knew you were Amanda but still good food for thought

Amanda Cooper

So...who typically is buying gold at the moment? Do you have a broad profile you can talk to us about?

Mark O'Byrne

Hi Petri, Exactly it is a store of value and a form of financial insurance. It is an asset and not an investment as no yield

Hi Steven, Re your last point. Gold is highly liquid and you can sell it at anytime and buy lots of food, shop or shops, farm or farms, land, companies, stocks etc You have a very Amero - dollar centric view of gold. People in South America, Argentina, Eastern Europe and the Ukraine today and indeed people in Cyprus could tell you the value of gold. Those who owned it have protected and grown their wealth despite various crises

Gold in Ukraine Hryvnia - 2 Years (Sharelynx)

Amanda Cooper

Who is buying it now though? The euro zone has moved on from those very dark days in 2010/11/12 when its existence was at stake....and the US is recovering enough for the Fed to wind down QEnfinity....

Michael Wagner

For me a main reason to have gold is a) I like the colour of the Krügerands and b) I can store it in a safe place to have access whenever I may need it and without relying on a bank or even worse a government

Amanda Cooper

@Michael - I think with b) you have made @Mark's day

Mark O'Byrne

There is little buying of gold by retail public today as they have flocked to and are piling into stocks and property. JP Morgans or Joe Kennedy's shoe shine boy come to mind and this should give pause for concern.

Buyers of gold recently have primarily been central banks and particularly Russia (story there in itself) and institutions as seen in increase in ETF holdings recently.

Our clients are a mixture of mass affluent and HNW. Last 2 years we have seen rough 50/ 50 break down in buys to sells. From 2003 to 2011 we saw 95% buys. Only buying of coins and bars is from existing bullion owners who are concerned about the global geopolitical and economic situation and they are adding to allocations.

Amanda Cooper

That's very interesting about the buy/sell split and the shift by the retail public.

Russia buying gold..that's a trend that's been in place for a couple of years now. They're one of the biggest holders of gold now. What do you read into that? Does it have any relevance for current events?

Mark O'Byrne

Sentiment is very poor and as bad as we have seen it. This is industry wide - we know from our conversations with senior people in refineries, mints etc. This is actually quite bullish from a contrarian perspective. As we believe that once prices begin to move up again, there will be a significant uptick in buying from the very depressed levels of today.

Amanda Cooper

Well...yes it's not far off the point of reaching the cash cost/oz of a lot of the deeper, older ZA mines at least.

Steven Slovak

I just don't see walking into a shop and trying to use gold of unknown and unproven origin... mastercard, visa, works better now if you had a gold backed credit/debit card ... hmmmm plus wages would ahve to paid in gold...

Michael Wagner

@ Mark the worst sentiment I have ever seen for gold was in 1999 .....

Mark O'Byrne

Hi Michael, Yes is financial insurance against that rainy day. We all own car insurance and health insurance and gold is financial insurance that can be relied upon in difficult financial and economic times

Amanda Cooper

Gosh yes, 1999 was very grim.....until September that year anyway...

Mark O'Byrne

Very NB point re cash cost. Very little downside risk and significant update potential

Michael Wagner

yep

Mark O'Byrne

Re eurozone and U.S. economies ...

Bill Wosnack

1999 ashanti

Michael Wagner

yep, the Washington agreement changed it for gold and killed the insane hedging strategy Ashanti had in place

Mark O'Byrne

The Eurozone debt crisis is far from over and will rear its ugly head again alas. Events with ESP in Portugal in recent days are an indication of that. Politicians and bankers have managed to delay the inevitable day of reckoning by piling even more debt onto the backs of already struggling taxpayers. This will compound the problem and we believe make it worse in the long term.

Michael Wagner

hedging being the wrong word for that strategy, gambling describes it more accurate

Jeanine Prezioso

GM, just quickly, US July retail sales unchanged, vs consensus of +0.2 pct and June +0.2 pct

Amanda Cooper

Mark youre the second guest we've had in GMF today - one of our Asia guests earlier said the same - that has issued a rather stark warning about the euro zone.

Thanks Jeanine!

Mark O'Byrne

Re the U.S. recovery - it is tentative at best. Even Yellen yesterday said that she was resolved to avoiding raising rates too soon and could lead to a recession

Amanda Cooper

We're about at the end of our time so before we go, perhaps you could leave us with a question to ponder?

Mark O'Byrne

This is not the sign of a recovering economy. The U.S. government is technically insolvent. At the start of the 'credit crisis' seven years ago, U.S. Federal debt was just $8.9 trillion. Today, U.S. federal debt stands at $17.66 trillion - nearly 100% higher and increasing rapidly. This does not include the $70 trillion to $100 trillion in unfunded liabilities for social security, medicare and medicaid.

Mark O'Byrne

Who put the figs into the fig rolls?

Amanda Cooper

Oh.....a riddle wrapped in a conundrum, deep-fried in an enigma!

Mark, you’ve been a fabulous guest. Thank you so much for your time today!

Mark O'Byrne

Been a pleasure. Thanks for all the questions and hope got them all. My typing skills still leave a lot to be desired. Thanks Amanda

Amanda Cooper

Absolutely not! Plus everyone here is so used to my awful typing, yours must have looked positively glowing by comparisong. Thanks again.

See?

Mark O'Byrne

“comparisong” ... yes sounds lilting ... u sing it and I will hum it

Follow Reuters Global Markets Forum on Twitter here

Follow Mark O'Byrne on Twitter here

Follow GoldCore on Twitter here

Download The 7 Key Storage Must Haves

| Digg This Article

-- Published: Thursday, 14 August 2014 | E-Mail | Print | Source: GoldSeek.com