-- Published: Wednesday, 17 September 2014 | Print | Disqus

By Andrew Hoffman

Ah, where to start this Tuesday morning – before tomorrow’s FOMC meeting, Thursday’s ECB “TLTRO” uptake announcement and Friday’s potentially cataclysmic Scottish referendum results? Trust me, there’s many topics to choose from, but my gut tells me to discuss something extremely important to me personally; which is the “good smart guys” getting it just as wrong as the “bad foolish” ones.

In this case, the great Michael Pento failed to do his due diligence, yielding a statement that not only distorts the truth, but inadvertently furthers the propaganda of a lying, cheating establishment. Rather than citing the correct reason why fiscal policy skeptic has been “temporarily ameliorated” – i.e., MARKET MANIPULATION – he cites a “reduction of federal budget deficits starting in 2011.” For some time, we have shouted from the rooftops how this is not true; for one, because so much government debt is accounted for “off balance sheet”; and more importantly because simple math states otherwise.

As you can see, even after such accounting chicanery, the national debt increased by $670 billion in the 2013 fiscal year compared to the “$500 billion” figure Pento cites. Worse yet, the national debt has risen more than $1 trillion in FY 2014 already with another two weeks left. As a rule, don’t believe anyone claiming U.S. debts or deficits to be “shrinking” or “under control.” And now that the economy is materially weakening, things will only get worse – especially if the Fed were foolish enough to raise rates (it won’t). And by the way, even if the deficit (excluding “off balance sheet” items, of course) were in fact “just” $500 billion; pray tell, how is that positive?

First off, two pieces of anecdotal data; in both cases, “hitting home.” To start, consider Wal-Mart-like discount retailer Kohl’s, which last quarter announced alarmingly weak sales trends. For the past six months, I have been mailed “free $10 gift cards” by Kohl’s, which my wife has capitalized on by going to Kohl’s – and spending exactly $10. Frankly, I couldn’t believe they weren’t taking a bath on these cards; and thus, reading this damning article yesterday titled “Kohl’s and the rest of retailers in real trouble,” my suspicions were validated.

Next, amidst all the hype of Apple’s iphone6 release – seriously, what’s the difference from the iphone5 – it turns out Apple is deeply discounting them to the tune of no-money down layaway plans. Last year, I wrote of how Apple’s growth rate was rapidly maturing – amidst dramatically weaker economic conditions; and there’s no better way to depict this than such aggressive pricing activity. Which, just one day later, was validated with a giant exclamation point, when I got an email from my cell phone provider Verizon, telling me I could upgrade my Samsung Galaxy phone several months early with – drum roll please – a new phone purchased with no money down.

Essentially everywhere one looks, the infinite tentacles of the “Great Recession” are grabbing whatever remaining life the global economy had. As Zero Hedge noted yesterday of the recent crude oil price plunge – dovetailing what we wrote in last week’s “commodity crash” – “it’s the global economy foolish.” From China to Japan, to Europe, America and everywhere else, what we wrote in “West to East, Global Economic Collapse” is worsening. The ECB loudly admitted it with last week’s dramatic policy easing, and it’s only a matter of time before Whirlybird Janet is forced to as well.

Zero Hedge

Let’s face it, the “housing recovery” the Fed has trumpeted for so long is over, as the “echo bubble” it created through six years of unfettered money printing is clearly deflating. With mortgage rates hovering near all-time lows, mortgage applications have plunged to 14-year lows, whilst cash transactions have plunged as well – particularly in the now freefalling “99% sector” of homes under $1 million in price. Without a doubt, my neighborhood in the Denver/Boulder suburbs peaked a year ago; and with new sales prices down significantly, it doesn’t take a rocket scientist to realize that if housing is the Fed’s great “recovery hope,” they are about to have a rude awakening. Meanwhile, the post-2008 subprime auto loan bubble is popping too, as evidenced by collapsing August sales and record channel stuffing – coinciding perfectly with Americans’ cumulative credit card debt load hitting an all-time high.

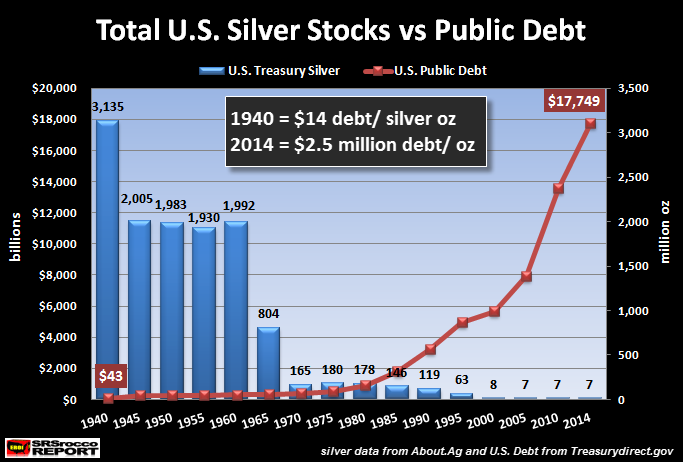

And thus, when Whirlybird Janet’s team of propagandists publish the latest version of the “most ridiculous report ever written” tomorrow afternoon, don’t for a second believe her fears of “significant underutilization of labor resources” are even mildly ameliorated, or that her committee of Ivory Tower puppets have any desire to – or intention of – tightening monetary policy in any meaningful manner. To wit, the only reason they can even pretend to consider such changes is the cushion provided by manipulating the stock, bond, currency and commodity markets to paint a picture directly contradicting reality. Which, in time, will also fall victim to the forces of “Economic Mother Nature” – as will the most “dislocated” economic relationship in modern history between suppressed precious metal prices and exploding debt.

SRSRocco Report

Andrew C. Hoffman, CFA

Marketing Director

Miles Franklin Ltd.

ahoffman@milesfranklin.com

www.milesfranklin.com

| Digg This Article

-- Published: Wednesday, 17 September 2014 | E-Mail | Print | Source: GoldSeek.com