-- Published: Tuesday, 30 September 2014 | Print | Disqus

By Steve St. Angelo, SRSrocco Report

Something is brewing in the gold market as U.S. Gold Eagle sales hit a record this month. This is a very interesting trend change as sales of Gold Eagles were sluggish for most of the year.

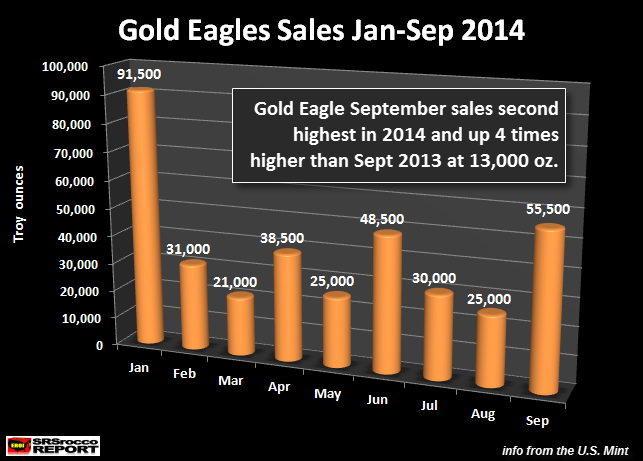

Matter-a-fact, Gold Eagle sales in September are the second highest for the year. If we look at the chart below, investors purchased 55,500 oz of Gold Eagles, more than double August sales of 25,000 oz. January usually holds the single highest sales month of the year due to high demand for the newly released official gold coin.

Not only are September Gold Eagle sales higher than June’s 48,500 (when the price of gold hit a low of $1,240), they are 4 times higher than sales during the same month last year. Gold Eagle sales in September 2013 were a paltry 13,000 oz.

Furthermore, demand for Gold Eagles are even higher than July 2013 at 50,500 oz… when gold hit a low of $1,181. There is a great deal of concern from many analysts that the broader stock markets are overdue for a correction… maybe even a crash.

If we do see a Crash in the broader stock markets beginning in October, investors fleeing the indices may start moving back in the precious metals. And why not? Precious metal sentiment is at record lows, while the stock markets are seeing signs of total EUPHORIA.

Not only have Gold Eagle sales picked up in September, so have Silver Eagles. The U.S. Mint just updated their figures for the month and Silver Eagles sales reached 3,375,000 in September. This is the highest monthly sales figure going back until May.

Silver Eagle Sales

May = 3,988,500

June = 1,975,000

July = 2,007,500

Sept = 3,375,000

If Gold and Silver Eagle sales are higher this month, I would imagine sales of other official coins are up considerably as well. It will be interesting to see how the rest of the year unfolds as the margin leverage in the NYSE is at all time HIGHS:

This chart shows a BIG ACCIDENT, just waiting to happen. Many investors believe the precious metals will head lower along with the broader stock markets, but I actually believe the opposite will occur as gold and silver decouple from the indices and shoot up much higher.

NOTE: I will be publishing the Q2 2014 Primary Silver Miners estimated break-even results shortly. I also compare Q2 2014 results to Q3 2012… what a change two years can make.

Please check back for new updates and articles at the SRSrocco Report. You can also follow us at Twitter below:

| Digg This Article

-- Published: Tuesday, 30 September 2014 | E-Mail | Print | Source: GoldSeek.com