-- Published: Wednesday, 1 October 2014 | Print | Disqus

Alan Greenspan, former Chairman of the Fed, had an article entitled “Golden Rule - Why Beijing Is Buying” published in Foreign Policy, the journal of the influential Council on Foreign Relations in which he extols the virtues of gold as “universally acceptable.”

Greenspan, former Chairman of the Federal Reserve Board of the United States from 1987 to 2006, points out that if the world’s largest gold consumer, China, used a portion of its massive $4 trillion foreign exchange reserves to buy enough gold bullion it could displace the U.S. as the world’s largest holder of gold bullion. The U.S. holdings are believed to be just over 8,500 tonnes with an estimated value of just $328 billion as of spring 2014.

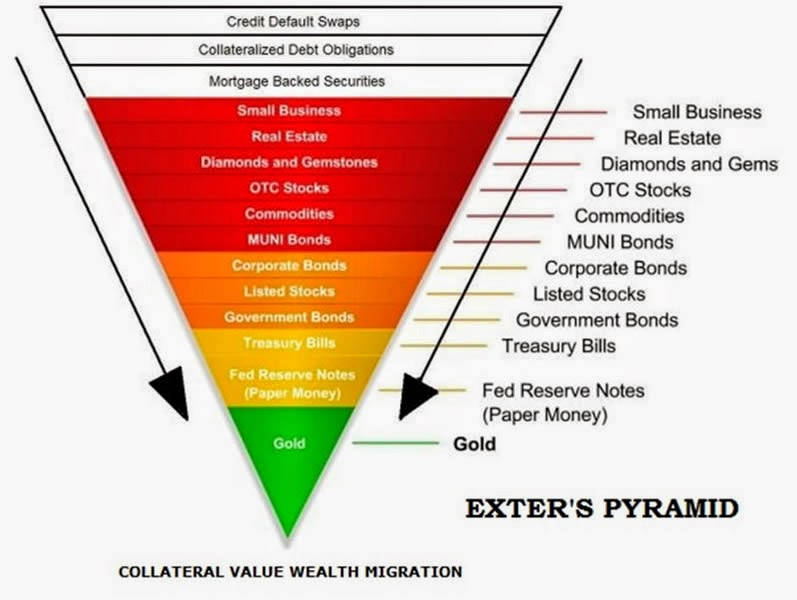

Greenspan points out how gold is the ultimate form of money in the world and is “universally acceptable”.

He concedes that “a return to the gold standard in any form is not on anybody’s horizon” right now but points out that if sovereign governments have financial crises, their fiat currencies may not be accepted as payment.

He highlights that bullion holds special properties that no currency can claim, except maybe silver. The fiat currencies and moving exchange rates that make up our monetary system of today are backed by the tax raising abilities of government’s of sovereign nations. However, gold bullion for over 2000 years has been an “unquestioned acceptance as payment”, writes Greenspan.

“No questions are raised when gold or direct claims to gold are offered in payment of an obligation; it was the only form of payment, for example, that exporters to Germany would accept as World War II was drawing to a close.”

“Today, the acceptance of fiat money -- currency not backed by an asset of intrinsic value -- rests on the credit guarantee of sovereign nations endowed with effective taxing power, a guarantee that in crisis conditions has not always matched the universal acceptability of gold.”

“If the dollar or any other fiat currency were universally acceptable at all times, central banks would see no need to hold any gold. The fact that they do indicates that such currencies are not a universal substitute. Of the 30 advanced countries that report to the International Monetary Fund, only four hold no gold as part of their reserve balances. Indeed, at market prices, the gold held by the central banks of developed economies was worth $762 billion as of December 31, 2013, comprising 10.3 percent of their overall reserve balances. (The IMF held an additional $117 billion.) “

“If, in the words of the British economist John Maynard Keynes, gold were a “barbarous relic,” central banks around the world would not have so much of an asset whose rate of return, including storage costs, is negative.”

In the article, he also suggests that China will find it hard to compete with the U.S. in the long term as China is an authoritarian, one party state and does not have free markets.

This comparison is questionable given that many are concerned that the U.S. markets are no longer free. Markets see daily interventions and manipulations and are increasingly influenced by corporate and banking monopolies including the Federal Reserve itself and its continuing massive intervention in financial markets and the monetary system.

There are also concerns that the U.S. is jettisoning many of the civil liberties, civil rights and freedoms that the Founding Fathers fought for and achieved and the emerging surveillance state has the hallmarks of a potentially authoritarian one or two party, corporate state.

The article shows that senior monetary officials and policy makers continue to see gold as an important part of our modern financial and monetary system and as an important strategic assset. Influential global policy makers do not see gold as a “barbarous relic” as many of Keynes ardent disciples of today, including Paul Krugman, would have people believe.

While he says that gold is important and the Chinese are right to accumulate it, he appears be warning the Chinese government that accumulating too much gold might lead to a very strong yuan on international markets which could lead to deflation and a recession in China’s export dependent economy.

The Council on Foreign Relations may be concerned about the ramifications of China accumulating larger gold reserves than those that the U.S. has and the People’s Bank of China (PBOC) giving the yuan some form of gold backing. This would pose serious challenges to the dollar as global reserve currency and thus to U.S. hegemony.

Greenspan has on a few occasions warned that the U.S. needs to be careful not to debase the dollar and engage in fiat money ‘extremis.’ If that happens fiat dollars would no longer be accepted on global markets with attendant difficult financial and economic consequences.

MARKET UPDATE

Today’s AM fix was USD 1,208.50, EUR 958.75 and GBP 746.17 per ounce.

Yesterday’s AM fix was USD 1,210.00, EUR 959.94 and GBP 746.55 per ounce.

Gold in US Dollars - 2 Years (Thomson Reuters)

Gold in Singapore stayed around the $1,206 an ounce level in lack lustre trade. In late morning trade in London prices have crept marginally higher.

Gold fell $7.50 or 0.62% to $1,209.00 per ounce and silver slipped $0.44 or 2.52% to $17.05 per ounce yesterday. It is interesting to note that gold’s falls continue to be primarily in dollar terms and that gold in euros and pounds has seen only minor falls.

Gold fell to a nine-month low yesterday as the dollar rose again and commodities led by crude oil tumbled on concerns about the U.S. economy. Gold touched its lowest since January 1st at $1,204.40 an ounce.

U.S. consumer confidence fell in September, the first time in five months that this has happened and July home prices rose less than expected from a year earlier, underscoring the fragility of the U.S. economy. Another report yesterday showed business activity growth in the U.S. Midwest decelerated slightly in September.

Gold is down 6% in dollar terms for the month erasing the gains for the year. The quarterly drop is around 9%, marking the sharpest monthly loss since June 2013 and first quarterly loss this year.

The dollar surged to a four-year high against a basket of currencies and a two-year high against the euro on Tuesday despite weak U.S. economic data.

Earlier this month, the U.S. Federal Reserve indicated it could raise borrowing costs faster than expected. Something it has suggested for more than 5 years now.

The peculiar phenomenon of gold falling sharply into quarter end continues and has all the hallmarks of certain entities attempting to ‘paint the tape’ and curtail ‘animal spirits’ and hence demand in the gold market.

Previous quarter end sell offs have proved good buying opportunities for those accumulating bullion on the dip (see chart above).

7 KEY STORAGE MUST HAVES

RECEIVE OUR IMPORTANT MARKET UPDATES HERE

| Digg This Article

-- Published: Wednesday, 1 October 2014 | E-Mail | Print | Source: GoldSeek.com