-- Published: Friday, 10 October 2014 | Print | Disqus

This week has seen some market volatility (see VIX Chart) reminiscent of the functioning market from days of old. The markets are spooked, bad news is overtaking good news and bearish views are becoming vogue. We are seeing a titanic battle taking place between the various bull and bear camps and they are starting to unleash some serious firepower.

The sleepy volumes of late have ticked up appreciably, and small investors are shifting in their seats nervously. The secret that no one really wants to admit (especially while they are making money) is that the recent stock market rally is a gargantous fraud. It has very shaky foundations indeed, propped up on pillars of monetary jelly. At its core is a massive money creation machine which is utterly unaccountable and unelected and a very select credit distribution system.

Market Volatility Index - 1989 to October 9, 2014 (Thomson Reuters)

You have heard the arguments regarding growing mountains of debt, the risk of inflation and stagflation, overvalued stock markets, property markets, massive derivative positions etc etc etc.

Perhaps you have become a little desensitized to these risks, because the party still seems to be going on, and no one is panicking. Yes we have had a few bumps in the economic road to date but they have been explained away. But far more has happened on your watch then you may be aware and it might all becoming to a head very, very shortly.

What has happened is that the entire capital market complex has become "managed" and captured by a few very powerful institutions. What this means is that we have moved from a market based global economy - which matches buyer against seller in an efficient price discovery mechanism, to a planned global economy, where intervention is the norm and the views of those in leveraged command matter more.

The markets are, and have been for the past 10 to 15 years, transfixed on the policy decisions of the U.S. Federal Reserve Bank, and all other global central banks are transfixed on the policy decisions of the Federal Reserve too. The power that this one institution has been given is staggering. They can, without any recourse, to elected officials, initiate policy that can send the global economy into a tailspin. Their policies can push millions if not billions of Emerging Economy citizens into destitution or transform them from impoverished to empowered.

The market gyrations we are seeing this week are multi-faceted. At their heart is a game of chicken between what the markets say they need and what the Federal Reserve is willing to give them. It all comes down to the terms by which credit is released and managed and how productive those in receipt of money can be with the credit.

There is also another battle being waged, those that wish to print money to stimulate and those that wish to manage government expenditures in order to balance the fiscal books. The market assumptions regarding Germany and its economy are being found to be false, the growth assumptions for the global economy are being found to be false, these falsehoods are now being priced into expected returns, and as such current valuations are being seen as being shaky.

Many commentators believe that the central banks and regulators have become captive to political and specific industry interests, we would agree. What is even more troubling is the degree to which the markets themselves have become centralised in their outlook. For example, In the last number of years an enormous amount of the world's capital market asset basis is increasingly be managed by ONE single company and or directed by the services provided by Blackrock’s “Alladin” system. Indeed The Economist magazine believes that “Alladin” monitors and supports upwards of 30,000 investment portfolios and assists in the direction of over 17 Trillion dollars in assets. That is 7% of the worlds total. This is sheer lunacy.

What if the Federal Reserve makes a bad call, what if the Alladin misses it, what then?

Too much power vested in two few is a recipe for disaster. Truly we have put a fox in charge of our hen house.

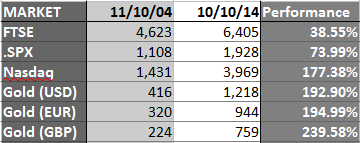

Gold has started to grab attention as concerned money seeks a safe haven. Interestingly over the last 10 years gold has risen in most currencies and far outperformed the equity markets.

See GoldCore’s ‘Gold Important Diversification As Living In One Greatest Financial Bubbles Ever’ Webinar Here

RECEIVE BREAKING NEWS AND UPDATES HERE

9TH OF OCTOBER - THOMSON REUTERS INTERVIEW GOLDCORE’S MARK O’BYRNE FOR THOMSON REUTERS GLOBAL GOLD FORUM

Jan Harvey thomsonreuters.com I'm joined in the Forum now by Mark O'Byrne, research director at GoldCore, who's agreed to talk us through his view of the market. Welcome, Mark!

Mark O’Byrne goldcore.com Thanks Jan. Thanks for having me on !

Jan Harvey thomsonreuters.com Glad to have you. So -- gold's had a bit of a rollercoaster time of it recently, with prices falling back below $1,200/oz earlier this week. What sort of reaction did you see to that decline from consumers?

Mark O’Byrne goldcore.com We saw a tentative increase in demand from existing clients but retail investors remain out of the gold market with sentiment as bad as we have seen it for many years.

Jan Harvey thomsonreuters.com Are potential buyers still attracted to gold at lower price levels? Or are there some concerns that it could have further to fall?

Mark O’Byrne goldcore.com So repeat business is key with clients either reallocating to gold if they previously had liquidated - we advised caution when gold prices surged over $1600 back in 2011 - or clients increasing allocations due to concerns about various risks. Some good HNW and family office business too and a desire for storage in Singapore and Zurich.

Mark O’Byrne goldcore.com Bit of both really. Think majority concerned about further falls but quite a large percentage of our clients see the price weakness as a buying opportunity. Think retail investors as a whole would be very concerned of further price falls as there is still a lot of risk appetite in the world and investors are favouring stocks and property over gold ... for now

Jan Harvey thomsonreuters.com What do you think we would need to see before we saw a stronger return to buying among retail investors?

Mark O’Byrne goldcore.com I believe we need a period of rising gold prices and retail investors tend to be trend followers. We also probably need heightened concern about markets and about the financial system and global economy. A resumption of the Eurozone debt crisis, a U.S. recession, a global recession and major War in the Middle East and other risks of today...

Mark O’Byrne goldcore.com have the potential to lead to a period of risk aversion which may see stocks, bonds and property come under pressure. This would greatly benefit gold and should see higher prices and retail investors allocate to gold again. Unfortunately for investors they tend to forget the most important rule in investing which is ...

Mark O’Byrne goldcore.com ... DIVERSIFICATION. Irrational exuberance and complacency is rife again today --- but for how long and how sustainable - are important questions

Mark O’Byrne goldcore.com We advise dollar, pound or euro cost averaging into gold. This protects from volatility and short term price risk.

Jan Harvey thomsonreuters.com Has there been a change in the kind of volumes, or products, favoured by retail investors this year over last?

Mark O’Byrne goldcore.com Not for us. We tend to deal with investors who wish to accumulate physical gold in the cheapest ways possible. Therefore, we always offer cost effective bullion formats. If we are offering American eagles at very low premiums they will buy them, if we have Gold bars (1 oz) they will go for them.

Mark O’Byrne goldcore.com We are offering kilo bars in volume at near 1% premiums currently, if the client buys a minumim of 4 kilo bars for storage in London, Zurich, Singapore or Hong Kong. Because we are so competitive on the premium, we are attracting some flows from the gold ETFs and some flows from banks unallocated gold accounts.

Jan Harvey thomsonreuters.com What has interest been like in silver, compared to gold?

Mark O’Byrne goldcore.com Thus, much of our business is not new gold buyers but rather from existing gold buyers who are looking to own segreated and allocated coins and bars

Mark O’Byrne goldcore.com Quite similar. Although there is the silver stacker phenomenon of those who believe silver will either outperform gold or will be a better protection from a systemic or currency collapse or both ...

Mark O’Byrne goldcore.com ... they buy silver consistently whenever they have disposable income and have been a constant for years. Their demand can be seen in the data as well. The VAT on silver in the UK and Europe can lead to less demand for silver for delivery but for our Secure Storage we see similar demand for silver as we see for gold - everything from 1,000 oz bars to silver eagles and maples and a combination thereof

Jan Harvey thomsonreuters.com Do you think demand for silver has been affected by the hefty price swings of recent years (which have been even more pronounced for silver than for gold)?

Mark O’Byrne goldcore.com Silver looks unvervalued when compared to stocks and many assets today and there is some merit to their line of thought

Mark O’Byrne goldcore.com Yes the volatility has put off most of the retail investment marketplace. This means that silver remains the preserve of a minority of hard money types and those who are concerned about the financial and monetary system ...

Mark O’Byrne goldcore.com Although silver has been volatile - it is important to put that volatility into context. Silver is less volatile than many "blue chip" shares and many of the tech share darlings of today. Yet you rarely hear experts caution people from buying individual shares ...

Mark O’Byrne goldcore.com It is interesting there is a cross over of bitcoin advocates and early adopters and both share similar concerns about the monetary system ...

Mark O’Byrne goldcore.com Our positon on silver is similar to that on gold. It has a place in a diversifed portfolio. Somewhere between 5% to 10% for gold and 5% to 10% for silver. This means that an investor would have some 10% to 20% in precious metals ...

Mark O’Byrne goldcore.com This would be considered high but we believe that the financial, economic, monetary and indeed geopolitical backdrop merits higher allocations to precious metals today - especially due to their undervaluation versus stocks, bonds and property - all of which are at record highs.

Jan Harvey thomsonreuters.com Thanks Mark. And thanks for joining us today!

Mark Obyrne goldcore.com Pleasure Jan. Sorry for the dreaded blue boxes ! and thanks again for having me on

GOLDCORE MARKET UPDATE

Today’s AM fix was USD 1,222.25, EUR 964.38 and GBP 761.01 per ounce.

Yesterday’s AM fix was USD 1,227.50, EUR 961.99 and GBP 757.67 per ounce.

Gold climbed $1.20 or 0.1% to $1,223.70 per ounce and silver fell $0.05 or 0.29% to $17.35 per ounce yesterday.

Gold in Singapore remained firm at $1,224.06 an ounce by 0035 GMT, after climbing for four straight sessions.

The yellow metal is up 2.8% for the week, its best since the third week of June, after bouncing back from a 15-month-low hit earlier this week.

Other precious metals, silver, platinum and palladium all look set to end their five weeks of losses.

Gold’s safe haven status has been ignited on poor economic news from the eurozone’s biggest economy, Germany, a weaker dollar, and IMF’s weaker growth expectations for Japan and Brazil.

In London, gold pulled back on Friday, ending four days of gains as the dollar climbed against a basket of currencies.

| Digg This Article

-- Published: Friday, 10 October 2014 | E-Mail | Print | Source: GoldSeek.com