-- Published: Wednesday, 15 October 2014 | Print | Disqus

The lawsuits against banks that alleges they engaged in a secret scheme to manipulate the price of silver bullion is proceeding.

Gold fixing in London at NM Rothschild and Sons began in September 1919

Litigation alleging that Deutsche Bank, Bank of Nova Scotia and HSBC Plc illegally fixed the price of silver were centralised in a Manhattan federal court yesterday. The banks have been accused of rigging the price of billions of dollars in silver to the detriment of investors globally.

Lawsuits filed by investors since July over the allegations were consolidated yesterday in the U.S. District Court for the Southern District of New York, following an order issued last Thursday by the U.S. Judicial Panel on Multidistrict Litigation, a special body of federal judges that decides when and where to consolidate related lawsuits.

The banks abused their position of controlling the daily silver fix to reap illegitimate profit from trading, hurting other investors in the silver market who use the benchmark in billions of dollars of transactions, according to the suit.

Investors claim, the banks unlawfully manipulated silver and silver futures.

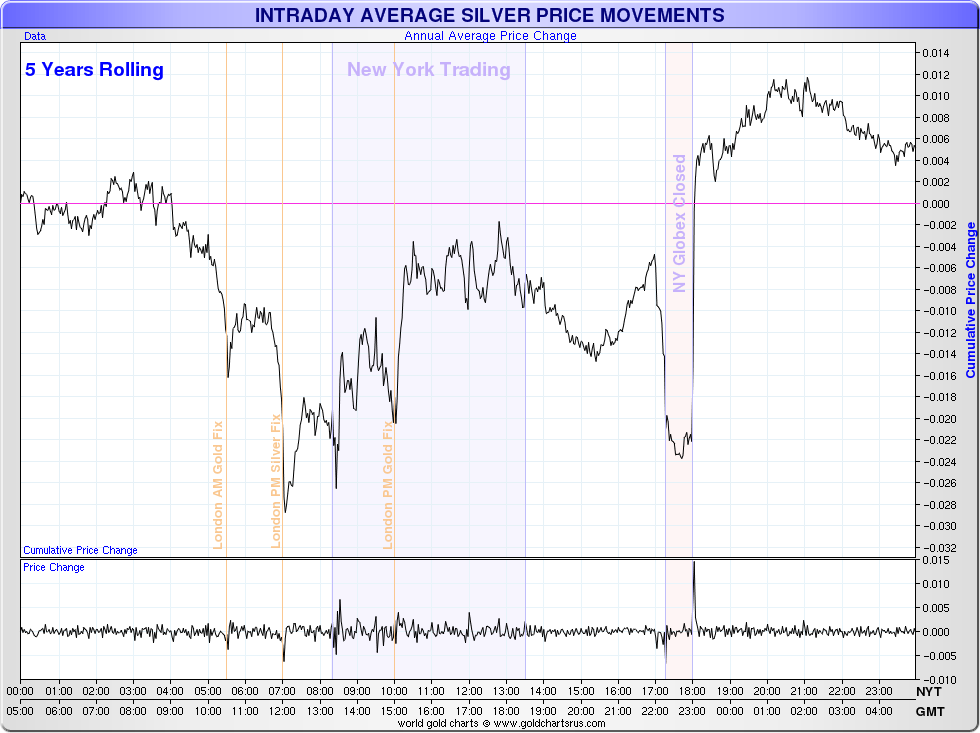

Sharelynx

The U.S. Judicial Panel on Multidistrict Litigation ruled that the cases should be handled by U.S. District Judge Valerie Caproni in Manhattan, who is already overseeing similar litigation over alleged gold price fixing.

Three lawsuits were originally filed in Manhattan, and two were filed in Brooklyn. The plaintiffs in the Brooklyn lawsuits had sought to have the litigation consolidated there.

The banks had also asked that the litigation be consolidated in Brooklyn, in the Eastern District of New York. However, the multidistrict litigation panel said Manhattan made more sense because the defendants all had corporate offices there and also because the cases involved issues similar to the gold litigation.

The plaintiffs allege that the banks abused their power as participants in the silver fix, a London based benchmark pricing method dating back to the Victorian era, in which banks fixed silver prices once a day by phone.

In August, the system was replaced by a new benchmark system administered by the CME (Chicago Mercantile Exchange) and Thomson Reuters.

HSBC spokesman Neil Brazil declined to comment and representatives of the other banks did not immediately respond to requests for comment.

This follows the initiation of similar actions against some bullion banks for alleged gold price manipulation earlier this year. The three named banks, Deutsche Bank, Bank of Nova Scotia, and HSBC are alleged to have abused their position at the LBMA to profit from inside knowledge.

The fixing of the price of silver is a daily operation where banks on the panel of the LBMA agree on a price for the precious metals which are then used throughout the financial, jewellery and mining industries throughout the day.

It is alleged that some of the banks who fix the price, position themselves advantageously in the silver market before the price is made public.

"Defendants have a strong financial incentive to establish positions in both physical silver and silver derivatives prior to the public release of silver fixing results, allowing them to reap large illegitimate profits," plaintiff Scott Nicholson told the AFP.

Separately, Bullion Desk reported yesterday that JPMorgan Chase Bank is now the fifth accredited member of the silver pricing benchmark, the LBMA has confirmed, with others parties “in the pipeline”, a spokesman said.

The American multinational bank which has been the subject of silver manipulation allegations by Max Keiser and others, took part in its first silver benchmarking session yesterday.

A spokesperson said they had completed “strict regulatory controls” for accredited members..

JP Morgan becomes the fifth member, alongside HSBC Bank USA, Mitsui & Co Precious Metals, the Bank of Nova Scotia – ScotiaMocatta and UBS AG.

Furthermore, the LBMA has confirmed that several other parties are also in the process of joining the list, subject to passing regulatory requirements.

Several Chinese banks have expressed interest in participating in the new global price setting mechanism for silver, according to the head of the LBMA.

The LBMA ushered in a new era of electronic benchmarking for London’s precious metals market in August when an algorithm was used for the first time to set the benchmark price for silver after recent scandals regarding price fixing and concerns about the nature of the gold and silver fix.

It will be interesting to see if Chinese banks partake in the new fix process as the concern is that the fixes remain the play things of certain western banks and are not representative of global physical demand and supply of actual gold and silver bullion.

Manipulation of the silver market was covered in a recently released ‘Get REAL’ Special on Silver presented by Jan Skoyles. Mark O'Byrne of Goldcore.com was interviewed and the interview was an in depth look at this silver market today.

See Video here

GOLDCORE MARKET UPDATE

Today’s AM fix was USD 1,223.50, EUR 967.58 and GBP 768.63 per ounce.

Yesterday’s AM fix was USD 1,233.00, EUR 974.55 and GBP 772.41 per ounce.

Gold climbed $0.70 or 0.06% to $1,233.40 per ounce and silver slipped $0.05 or 0.29% to $17.40 per ounce yesterday.

Silver in U.S. Dollars - 1984 to October 14, 2014 (Thomson Reuters)

Gold in Singapore fell 0.3% to $1,222.10 an ounce. The metal hit a four week high of $1,237.90 on Tuesday, before pulling back to close 0.4% lower.

Silver for immediate delivery or Swiss storage fell 1.4% to $17.19 an ounce in London. Palladium dropped 1.6% to $782.10 an ounce. Platinum lost 1% to $1,254 an ounce.

Gold fell on low volume again and futures trading volume was 40% below the average for the past 100 days for this time of day, data compiled by Bloomberg show.

Volumes for the benchmark spot contract on the Shanghai Gold Exchange are about 33% lower than in late September, the latest data show however physical deliveries remain very high and are headed for 2,000 tonnes again in 2014.

Yesterday, Germany’s Economy Ministry cut its economic growth forecasts for 2014 and 2015, before the Federal Reserve releases its Beige Book on economic conditions.

See Essential Guide To Gold and Silver Storage In Switzerland

| Digg This Article

-- Published: Wednesday, 15 October 2014 | E-Mail | Print | Source: GoldSeek.com