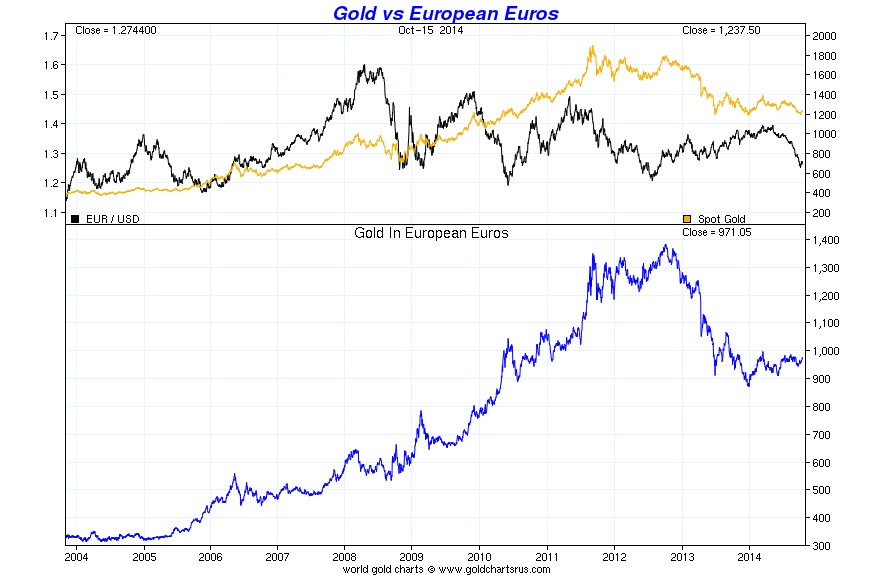

Today’s AM fix was USD 1,241.00, EUR 969.38 and GBP 775.87 per ounce.

Yesterday’s AM fix was USD 1,223.50, EUR 967.58 and GBP 768.63 per ounce.

Gold climbed $4.40 or 0.36% to $1,237.80 per ounce and silver slipped $0.03 or 0.17% to $17.43 per ounce yesterday. Gold is now nearly 5% above its recent lows and is again acting as a hedging instrument in investment portfolios after sharp falls in stock and many bond markets.

Gold in U.S. Dollars - 2 Years (Thomson Reuters)

Gold retained sharp overnight gains today to trade near its highest in over a month as investors sought safety amid increasing concerns over a slump in the global economy. Gold rose to its highest since September 11 at $1,249.30 yesterday.

This morning gold for Swiss storage or for immediate delivery rose 0.2% to $1,244 an ounce by 12:00 in London, according to Bloomberg generic pricing. Futures trading volume was 64% above the average for the past 100 days for this time of day.

Global stocks plummeted yesterday and again today, on investor concern that U.S. and Chinese inflation data are signalling a global slowdown in economic activity. U.S. retail sales fell in September and producer prices declined for the first time in a year.

S&P 500 Stock Index - 10 Years (Thomson Reuters)

The MSCI All-Country World Index of equities slumped to an eight month low yesterday and the Bloomberg Commodity Index has retreated to the lowest level since July 2009.

The risks of a stock market crash are quite high and the complacency of recent months has inevitably come to a shuddering halt.

Weak U.S. data and global growth concerns will likely prompt the Federal Reserve to delay a hike in interest rates, a potential boost for non-interest-bearing gold - as we have warned of for some time.

Europe and the debt laden world risks falling into a downward spiral of falling wages, prices and deflation.

Investors fled into safe haven gold bullion, bonds and Japanese yen as the dollar and oil declined.

Yesterday’s, stampede into non risky assets resulted in a massive rally in U.S. Treasury bonds, moving the benchmark 10-year note's yield as low as 1.865%, its lowest since May 2013.

Today, markets are in a panic. Greek stocks, which collapsed yesterday, are down another 2% today.

Italian stocks are down 3.6% right now, on top of the 4% decline yesterday.

The FTSE and DAX are down nearly 2% and France is down nearly 3%.

Irish 10 Year Bonds (Thomson Reuters)

There is huge volatility in stock markets and European bonds have seen sharp selling again, with Greek 10-year interest rates surging to nearly 9% and Irish bonds rising over 20 basis points to over 1.9%.

Spanish 10-year government bond yields rose 26 basis points to 2.37 percent, while equivalent Italian yields were 28 bps up at 2.68 percent. Portuguese yields rose 27 bps to 3.57 percent.

As we have warned for many months now, the Eurozone and indeed global financial crisis is far from over. We had a brief interlude after the starter but the main course is soon to commence.

Get Breaking News and Updates On Gold and Markets Here

See Essential Guide To Gold and Silver Storage In Switzerland