-- Published: Tuesday, 28 October 2014 | Print | Disqus

Excerpted from this week’s Notes From the Rabbit Hole, NFTRH 314:

Our view has been that a stronger US dollar would eventually start to eat away at corporate results, especially in the manufacturing sector and at US based companies with a global customer base. The decline in revenues thus far is something to be watched because where revenues go, earnings eventually follow.

[edit: the segment previous to this one reviewed a contrast between strong earnings and sagging revenues with companies that have reported earnings thus far]

An article by Doug Short published at Business Insider on Friday illustrates how the Economic Cycle Research Institute (ECRI) called for a recession in 2011 and was promptly made to eat that call first by Operation Twist and then by balls out QE3. All the while as ZIRP has quietly whirred along in the background for 6 years.

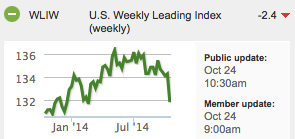

ECRI’s weekly Leading Index is flashing warnings again…

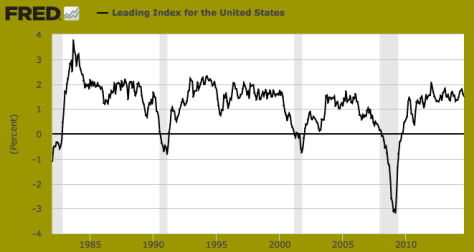

…while the St. Louis Fed’s Leading Index (incl. ISM data, Treasury spreads and State level housing permits and unemployment data) continues to slog around its 30 year average after the big recovery out of 2009.

Reference again the ‘*’ note at the end of page 1 [this is in reference to.. *Orthodoxy and mechanical thinking are everywhere in the markets. That is why herds are herds. Just one example: “The Fed will not let markets go down.”]

The Fed may not let the market go down as long as policy and probably 1000 other moving parts throughout the interconnected global financial network are in sync for the desired outcome, but still we should avoid the automatic thinking like “the Fed will not dare alter ZIRP and is even making sounds about extending QE, therefore everything will remain ‘as is’, and bullish.”

What we should do is watch the data and watch the currency. Of course all it took was a noisy PR out of the Semiconductor industry and a couple days of impulsive looking market decline to jerk supposed Fed Hawk James Bullard out in front of a microphone to talk about extending QE. Now the market is acting once again like it is safe in Mommy’s arms, with nothing to fear but fear itself.

Well, that remains to be seen as the technicals we track will tell the story in real time. The Fed had multiple jawbones working against the strong dollar story because they know that their ability to keep the economy inflated is dependent upon the USD remaining under wraps. Policy makers will not remain beyond reproach forever. By 2005 Greenspan had become known (to those who were paying attention) as the instigator of a massive commercial credit bubble, in 2011 Bernanke was reviled (with gold bugs, inflationists and even Bill Gross out front bull horning) as ‘Helicopter Ben’.

Today, Janet Yellen’s Fed seems to very much want the inflation to take because they know that if a lack of inflation expectations morphs into increasing deflation expectations, the asset pumping game – the macro game in play since 2008 – is up.

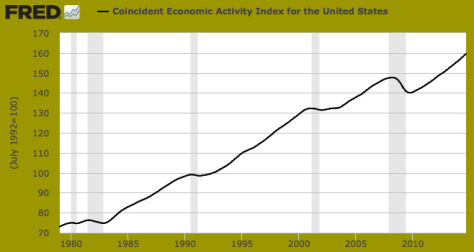

Thus far the post-2008 inflation has worked to desired effects, per the US Coincident Economic Activity Index, which is composed of Non-Farm Payrolls, Unemployment Rate, Average Hours Worked in Manufacturing and Wages/Salaries.

Graphs like this one show the reason that people who claim the economy is weak simply because they think or want it to be so should be disregarded. The inflation has worked so far, with the questions being how long will it continue to work?

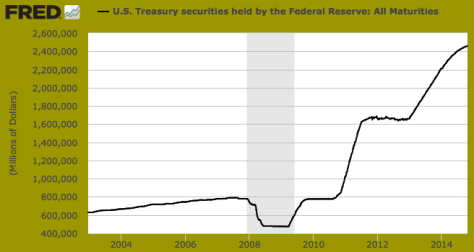

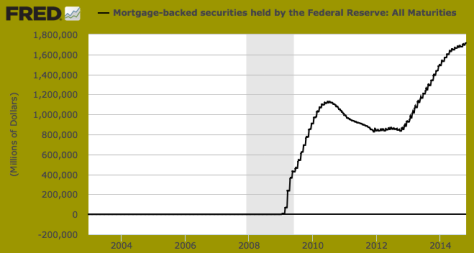

QE along with ZIRP has completely underpinned a non-organic economic recovery. Here are the two faces of QE to this point, US Treasury and MBS securities held by the Fed. Through QE’s 1, 2 and now 3 the Fed’s balance sheet has become bloated with securities that if not sucked up, would have imploded the economy long ago.

Not even considering the toxic nature of many MBS that were taken off the open (and free) market, the effects on interest rates would have been market moving had not policy makers taken active meddling in financial markets to new heights.

Along with our theme that the economy is strong goes our theme that it is built on a foundation dependent upon policy makers’ will and/or ability to keep the racket (i.e. the accumulation and/or manipulation of debt) going.

ECRI tries to make its bones by forecasting the economy. It has thus far been foiled by the Fed’s machinations. So too have many notable and respected asset managers and economists been thrown for a loop during the current inflation operation that does not even show any signs of inflation’s effects other than in the stock market.

It’s all the more reason we should proceed with eyes on incoming data, especially with regard to US dollar strength, deflationary forces and corporate signals like the sagging top line revenue performance noted in the previous segment.

Biiwii.com

| Digg This Article

-- Published: Tuesday, 28 October 2014 | E-Mail | Print | Source: GoldSeek.com