-- Published: Thursday, 6 November 2014 | Print | Disqus

By Steve St. Angelo, SRSrocco Report

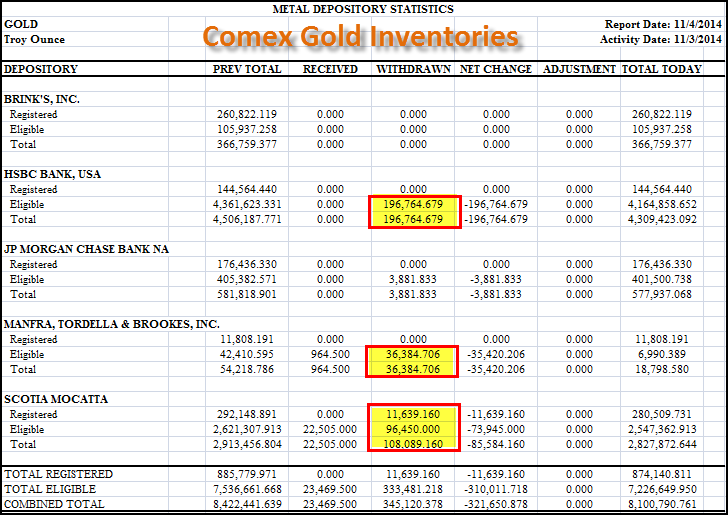

As the Banking Cartel continues to push the paper price of gold lower, the Comex experienced another large withdrawal of gold from its inventories. The largest withdrawals came from the vaults at HSBC and Scotia Mocatta.

In just one day, 321,650 ounces of gold were removed from the Comex:

As we can see from table, 196,764 oz of gold were removed from the HSBC’s vault and a total of 85,584 oz were taken off Scotia Mocatta. The total 321,650 oz removed represents 36% of the total gold in the Registered Category. The Registered category is gold that is available for delivery into the market.

Furthermore, JP Morgan only has 577,937 oz of gold remaining in its vaults. A few weeks ago, JP Morgan experienced a ONE DAY removal of 321,500 oz from its warehouse stocks. This is not a trend JP Morgan can afford to continue.

Furthermore, total Comex gold inventories fell nearly 2 million oz since its high of 10 million ounces at the end of August. This is a 20% decline of total gold warehouse stocks in just three months.

Gold Paper Price Smash During the Swiss Gold-Backed Franc Referendum

Right now the Swiss are voting on whether to back their Swiss Franc with gold. The voting takes place throughout the month and will be tallied on November 30th. It’s no coincidence that the paper price of gold is being smashed during this important Swiss vote, that if passed, could be a huge LOSS for the BANKING CARTEL.

Of course, there are no REAL MARKETS anymore as every thing is being rigged by the Fed and Central Banks. Before the Fed took control of the markets in 2008, the Stock markets and the precious metals all declined in the same fashion. However, today we see a totally disconnect.

The Dow Jones hits another high today, while gold and silver hit new lows. Furthermore, the king base metal, COPPER is down 8% from its high of $3.27 in July to $3.02 today. However, SILVER is down 28% from $21.5 in July to $15.5 today. Thus, silver is down more than three times than copper in percentage terms.

The world will wake up one day to realize the BIGGEST PAPER PONZI SCHEME in history will go the same way as BERNIE MADOFF. Right now, the Banking Cartel has the world convinced that the only way to survive is to continue investing in the largest ponzi scheme in history.

Unfortunately, all PONZI SCHEMES BURST. And, when this one finally goes MADOFF, it will end a way of life for most of those who thought DIGITS in an account were wealth.

Please check back for new articles and updates at the SRSrocco Report. You can also follow us at Twitter below:

| Digg This Article

-- Published: Thursday, 6 November 2014 | E-Mail | Print | Source: GoldSeek.com